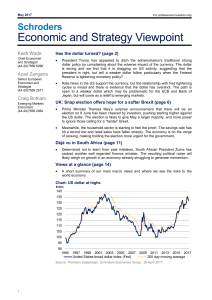

Economic and Strategy Viewpoint

... Currencies tend to move ahead of rates as investors adjust their expected returns. When interest rates move against a currency its value must fall to the point where it offers sufficient potential for appreciation so as to restore equilibrium. This is the basis for overshooting where a currency will ...

... Currencies tend to move ahead of rates as investors adjust their expected returns. When interest rates move against a currency its value must fall to the point where it offers sufficient potential for appreciation so as to restore equilibrium. This is the basis for overshooting where a currency will ...

4Q16 Firm Overview.ind.indd

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

financial prudential norms

... together with affiliated persons are made by the general assembly of members or by the board of the association, if this function is attributed to the board by law and/or by by-laws. If the board is invested with this function, the respective administrator will leave the meeting for the period of ti ...

... together with affiliated persons are made by the general assembly of members or by the board of the association, if this function is attributed to the board by law and/or by by-laws. If the board is invested with this function, the respective administrator will leave the meeting for the period of ti ...

Measuring systemic risk: the role of macro

... decisions. Macro-prudential indicators (MPIs) play an important role in the identification of financial system risk; the assessment of the banking system’s capacity to weather periods of financial stress; and in signalling periods of financial stress. The indicators inform decisions to both deploy a ...

... decisions. Macro-prudential indicators (MPIs) play an important role in the identification of financial system risk; the assessment of the banking system’s capacity to weather periods of financial stress; and in signalling periods of financial stress. The indicators inform decisions to both deploy a ...

chapter - three concept and significance of cd ratio

... commercial banks in Bihar has been a subject of intense debate during the present time period. Periodically, the state government has raised the issue; lash out at the ‘negative attitude’ of the banks for the lack of development of the state. Bihar reports one of the lowest ratio, the credit amount ...

... commercial banks in Bihar has been a subject of intense debate during the present time period. Periodically, the state government has raised the issue; lash out at the ‘negative attitude’ of the banks for the lack of development of the state. Bihar reports one of the lowest ratio, the credit amount ...

econ stor www.econstor.eu

... central banks should lend freely in a crisis on good collateral at a high rate of interest. But as more and more banks were affected by the Global Financial Crisis (GFC), central banks developed new approaches and took untraditional measures to contain the crisis. As policy rates approached the lowe ...

... central banks should lend freely in a crisis on good collateral at a high rate of interest. But as more and more banks were affected by the Global Financial Crisis (GFC), central banks developed new approaches and took untraditional measures to contain the crisis. As policy rates approached the lowe ...

Market Penetration and Investment Pattern: A Study

... Funds or by the objective of their investment: Growth Funds, Income Funds, Balanced Funds or Money Market Funds. Hence, there is large scope for penetration. However, one of the ironies of having a large and established mutual fund industry is that this variation serves to intimidate rather than inf ...

... Funds or by the objective of their investment: Growth Funds, Income Funds, Balanced Funds or Money Market Funds. Hence, there is large scope for penetration. However, one of the ironies of having a large and established mutual fund industry is that this variation serves to intimidate rather than inf ...

Global Economics View

... borrow funds at -10%, but rather than lending out the funds at -10% plus a reasonable spread, one attractive alternative would be for it to invest the funds in euro currency. The relevant effective interest rate that should determine whether households or businesses decide to spend or save today wou ...

... borrow funds at -10%, but rather than lending out the funds at -10% plus a reasonable spread, one attractive alternative would be for it to invest the funds in euro currency. The relevant effective interest rate that should determine whether households or businesses decide to spend or save today wou ...

NBER WORKING PAPER SERIES US AFTER 2001 Lawrence Christiano

... It is sometimes tempting to establish comparisons across central banks’ policies over the cycle on the basis of the extent to which they move their instruments in a fraction of time. A central bank that moves its policy rate around abruptly would under this measure be viewed as very responsive to th ...

... It is sometimes tempting to establish comparisons across central banks’ policies over the cycle on the basis of the extent to which they move their instruments in a fraction of time. A central bank that moves its policy rate around abruptly would under this measure be viewed as very responsive to th ...

REITs - Bivio

... total investment assets in real estate. Must receive at least 75% of their gross income from rents or mortgage interest Have no more than 20% of assets consist of stocks in taxable REIT subsidiaries. ...

... total investment assets in real estate. Must receive at least 75% of their gross income from rents or mortgage interest Have no more than 20% of assets consist of stocks in taxable REIT subsidiaries. ...

Money Market instruments

... The unit price of a REIT or business trust depends on many factors and may go down if underlying assets drop in value ...

... The unit price of a REIT or business trust depends on many factors and may go down if underlying assets drop in value ...

Good First--and Maybe Only--Funds

... indexed, also called actively managed funds, might not own the same types of stocks day in and day out. It all depends on the manager's style. He or she may like large companies one day and then see value in smaller firms the next. Finally, index-fund investors don't have to worry about manager turn ...

... indexed, also called actively managed funds, might not own the same types of stocks day in and day out. It all depends on the manager's style. He or she may like large companies one day and then see value in smaller firms the next. Finally, index-fund investors don't have to worry about manager turn ...

Shadow Banking: Economics and Policy

... After describing these two main functions, the paper reviews their economic values, highlighting how they cater to various demands. The securitization function, operating through the prime money funds complex, serves the needs of large institutional cash pools that seek safe, short-term investments ...

... After describing these two main functions, the paper reviews their economic values, highlighting how they cater to various demands. The securitization function, operating through the prime money funds complex, serves the needs of large institutional cash pools that seek safe, short-term investments ...

Luminis Credit Assessment Information

... If a hedge is entered into, please note that the credit assessment must be updated annually for as long as the hedge is active. Please also note that all credit assessment reports – Counterparty Risk Reports (initial) and Surveillance Reports (annual updates) – are confidential documents and only ...

... If a hedge is entered into, please note that the credit assessment must be updated annually for as long as the hedge is active. Please also note that all credit assessment reports – Counterparty Risk Reports (initial) and Surveillance Reports (annual updates) – are confidential documents and only ...

Hedge funds - Bank for International Settlements

... requirements for most hedge funds means that there are no comprehensive data on the size of the industry. Estimates by the main commercial suppliers of hedge fund information range between 2,500 and 5,000 funds with between $200 and $300 billion in assets under management.64 According to one of thes ...

... requirements for most hedge funds means that there are no comprehensive data on the size of the industry. Estimates by the main commercial suppliers of hedge fund information range between 2,500 and 5,000 funds with between $200 and $300 billion in assets under management.64 According to one of thes ...

Bank performance in the US and Europe

... the 22 largest banks on the continent, unless mentioned otherwise. Speaking of “European” banks in the following thus refers to this largely representative set rather than all of the about 9,000 banks in Europe. Despite our sample covering every major institution and all of the bigger geographic mar ...

... the 22 largest banks on the continent, unless mentioned otherwise. Speaking of “European” banks in the following thus refers to this largely representative set rather than all of the about 9,000 banks in Europe. Despite our sample covering every major institution and all of the bigger geographic mar ...

Exercise: The New Economy

... funds rate and maintains that target interest rate by buying and selling U.S. Treasury securities. When the Fed buys securities, bank reserves rise, and the fed funds rate tends to fall. When the Fed sells securities, bank reserves fall, and the fed funds rate tends to rise. Buying and selling secur ...

... funds rate and maintains that target interest rate by buying and selling U.S. Treasury securities. When the Fed buys securities, bank reserves rise, and the fed funds rate tends to fall. When the Fed sells securities, bank reserves fall, and the fed funds rate tends to rise. Buying and selling secur ...

2 Macroeconomic Variables and Term Structure of Interest

... environment to be pursued. In the analysis of the credit spread or spread short, Bernanke (1990) showed that a restrictive monetary policy by increasing the rates of fedfunds has the effect of increasing the cost of funds for banks. To avoid this increase in cost of funding, banks must choose betwee ...

... environment to be pursued. In the analysis of the credit spread or spread short, Bernanke (1990) showed that a restrictive monetary policy by increasing the rates of fedfunds has the effect of increasing the cost of funds for banks. To avoid this increase in cost of funding, banks must choose betwee ...

After Osbrown - Talk Carswell

... realised it. At the Plaza Accord meeting in New York in September 1985, finance ministers from the world’s leading industrial nations – including Lawson – agreed to take action to lower the value of the US dollar. The idea of exchange rate management – albeit in a different context – seems to have s ...

... realised it. At the Plaza Accord meeting in New York in September 1985, finance ministers from the world’s leading industrial nations – including Lawson – agreed to take action to lower the value of the US dollar. The idea of exchange rate management – albeit in a different context – seems to have s ...

Sizing up active small-cap - Charles Schwab Investment Management

... right questions to investing is well-suited for small-caps, please read our white paper: The Evolution of Integrated Management ...

... right questions to investing is well-suited for small-caps, please read our white paper: The Evolution of Integrated Management ...

Thrivent Federal Credit Union - Financial Aid Office

... Education Refinancing Loan for Students and Parents 2. Years in student loan market Our Private Student Loan programs launched in February, 2014 to a small group of colleges and universities and our loan volume exceeded our expectations in 2015. We have now expanded the offering of our programs to m ...

... Education Refinancing Loan for Students and Parents 2. Years in student loan market Our Private Student Loan programs launched in February, 2014 to a small group of colleges and universities and our loan volume exceeded our expectations in 2015. We have now expanded the offering of our programs to m ...

The Effects of the Saving and Banking Glut on the U.S. Economy

... are tied in turn to the interest rate earned by savers. In our model, this spread between borrowing and lending rates reflects the market power of financial intermediaries, which channel funds to the impatient households from both the domestic patient ones and the rest of the world. More competition ...

... are tied in turn to the interest rate earned by savers. In our model, this spread between borrowing and lending rates reflects the market power of financial intermediaries, which channel funds to the impatient households from both the domestic patient ones and the rest of the world. More competition ...

Competition and regulation in banking∗

... information on the future solvency of the bank. Therefore, the run is information-based and is efficient, as long as it leads to the liquidation of an impending insolvent bank. Panic and information-based runs can also be related, as shown by Chari and Jagannathan (1988). The analysis focuses on the ...

... information on the future solvency of the bank. Therefore, the run is information-based and is efficient, as long as it leads to the liquidation of an impending insolvent bank. Panic and information-based runs can also be related, as shown by Chari and Jagannathan (1988). The analysis focuses on the ...

The Returns and Risks From Investing

... ◦ No guarantee future will be like the past ◦ Also no reason to assume that relative relationships will be much different in the future than they are now ◦ Especially useful in the long-run ...

... ◦ No guarantee future will be like the past ◦ Also no reason to assume that relative relationships will be much different in the future than they are now ◦ Especially useful in the long-run ...

Fiche Swiss Guarantee EN _EUR

... Life and offered within the Swiss FlexInvest framework. When you choose Swiss Guarantee, the return on your investment is guaranteed by Swiss Life, irrespective of financial market fluctuations. Thanks to this guarantee, you are protected against capital loss as the investment risk is borne by Swiss ...

... Life and offered within the Swiss FlexInvest framework. When you choose Swiss Guarantee, the return on your investment is guaranteed by Swiss Life, irrespective of financial market fluctuations. Thanks to this guarantee, you are protected against capital loss as the investment risk is borne by Swiss ...