Euro area government securities markets: recent developments and

... Government securities markets have traditionally played an important role for both central banks and private agents. From the standpoint of central banks, certain indicators for assessing the inflation and output outlook have normally been derived from pricing data collected in these markets. From t ...

... Government securities markets have traditionally played an important role for both central banks and private agents. From the standpoint of central banks, certain indicators for assessing the inflation and output outlook have normally been derived from pricing data collected in these markets. From t ...

Yield Curve Basics

... maturities of the securities are highly concentrated at one point on the yield curve. For example, most of the bonds in a portfolio may mature in 10 years. In a barbell strategy, the maturities of the securities in a portfolio are concentrated at two extremes, such as five years and 20 years. In a ...

... maturities of the securities are highly concentrated at one point on the yield curve. For example, most of the bonds in a portfolio may mature in 10 years. In a barbell strategy, the maturities of the securities in a portfolio are concentrated at two extremes, such as five years and 20 years. In a ...

Long-duration Bonds and Sovereign Defaults

... accompanied by a large decline in foreign credit to domestic private firms. This may be the case because a sovereign default may indicate to investors a higher risk of expropriation or bad economic conditions, and therefore, it may reduce firms’ net worth and their ability to borrow (see Sandleris ( ...

... accompanied by a large decline in foreign credit to domestic private firms. This may be the case because a sovereign default may indicate to investors a higher risk of expropriation or bad economic conditions, and therefore, it may reduce firms’ net worth and their ability to borrow (see Sandleris ( ...

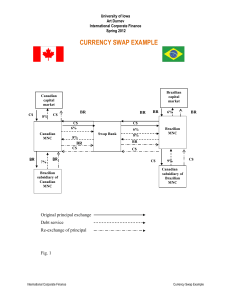

E4 - Art Durnev

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

the growing bond market of china

... international financial institutions within the boundaries of China. In terms of interest pattern, zero-coupon bonds, interest-bearing bonds and repayment upon maturity bonds are been separated, and the interest-bearing bonds can also be divided into floating rate bonds and fixed rate bonds. bonds a ...

... international financial institutions within the boundaries of China. In terms of interest pattern, zero-coupon bonds, interest-bearing bonds and repayment upon maturity bonds are been separated, and the interest-bearing bonds can also be divided into floating rate bonds and fixed rate bonds. bonds a ...

Changes in Equilibrium Interest Rates

... For bonds with maturities of greater than one year, the expected return may differ from the interest rate. For example, we saw in Chapter 4, Table 2, that a rise in the interest rate on a long-term bond from 10 to 20% would lead to a sharp decline in price and a very negative return. Hence if people ...

... For bonds with maturities of greater than one year, the expected return may differ from the interest rate. For example, we saw in Chapter 4, Table 2, that a rise in the interest rate on a long-term bond from 10 to 20% would lead to a sharp decline in price and a very negative return. Hence if people ...

Chapter 6: Bond Primer

... The Liquidity Premium Theory holds that forward rates are upwardly biased estimators of expected future spot rates. The theory asserts that the estimates are too high and that forward rates exceed expected future spot rates. This theory rejects the claim that there are numerous investors who are ind ...

... The Liquidity Premium Theory holds that forward rates are upwardly biased estimators of expected future spot rates. The theory asserts that the estimates are too high and that forward rates exceed expected future spot rates. This theory rejects the claim that there are numerous investors who are ind ...

Bonds Payable

... The price of a bond when it is issued is calculated by the bond market and is stated in Bonds that sell for more than 100 are issued terms of a percentage of the face value. The for more than the face value. They are called cash the company receives when issuing a bond bonds issued at a premium. is ...

... The price of a bond when it is issued is calculated by the bond market and is stated in Bonds that sell for more than 100 are issued terms of a percentage of the face value. The for more than the face value. They are called cash the company receives when issuing a bond bonds issued at a premium. is ...

Copyright © 2001 by Harcourt, Inc. All rights reserved.

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

Comments of the Municipal Bonds for America Coalition to the U.S.

... pay, but rather by state and local residents forced to pay billions more every year in additional financing costs. 14 Effectively, a new tax on bonds would result in a locally imposed federal tax. State and Local Government Spending As discussed above, the tax exemption for municipal bonds was inclu ...

... pay, but rather by state and local residents forced to pay billions more every year in additional financing costs. 14 Effectively, a new tax on bonds would result in a locally imposed federal tax. State and Local Government Spending As discussed above, the tax exemption for municipal bonds was inclu ...

THE CAPITAL ASSET PRICING MODEL`S RISK

... U.S. and five other large stock markets. These studies indicate that researchers have measured the equity premium relative to both T. Bills and long-term government bonds, with varying results. Some studies have indicated that the return interval used in the regression has a significant impact on th ...

... U.S. and five other large stock markets. These studies indicate that researchers have measured the equity premium relative to both T. Bills and long-term government bonds, with varying results. Some studies have indicated that the return interval used in the regression has a significant impact on th ...

GOVERNMENT CODE TITLE 9. PUBLIC SECURITIES SUBTITLE B

... or negotiated sale if the committee determines that a private or negotiated sale will result in a more efficient and economic sale of the bonds or greater access to the bonds by investors who are residents of this state. ...

... or negotiated sale if the committee determines that a private or negotiated sale will result in a more efficient and economic sale of the bonds or greater access to the bonds by investors who are residents of this state. ...

The Kingdom of Denmark`s New Inflation

... The yield on inflation-linked bonds is often used for calculating market-based indicators of inflation expectations. A frequently used indicator, break-even inflation, can be calculated by deducting the yield to maturity on an inflationlinked bond from the yield to maturity on a nominal government b ...

... The yield on inflation-linked bonds is often used for calculating market-based indicators of inflation expectations. A frequently used indicator, break-even inflation, can be calculated by deducting the yield to maturity on an inflationlinked bond from the yield to maturity on a nominal government b ...

An Increase in Consumption Spending and the Stock Market

... interest rates. Financial markets expect shortterm rates to be higher in the future. A downward sloping yield curve means that longterm interest rates are lower than short-term interest rates. Financial markets expect shortterm rates to be lower in the future. Using the following equation, you can f ...

... interest rates. Financial markets expect shortterm rates to be higher in the future. A downward sloping yield curve means that longterm interest rates are lower than short-term interest rates. Financial markets expect shortterm rates to be lower in the future. Using the following equation, you can f ...

Fixed Income in a Rising Rate Environment

... typically respond to rising rates. To simplify the analysis, a rising rate period is when the Federal Reserve is tightening. This means that short-term rates are rising, but other factors may be impacting the intermediate and long ends of the yield curve. Since 1994, there have been three periods of ...

... typically respond to rising rates. To simplify the analysis, a rising rate period is when the Federal Reserve is tightening. This means that short-term rates are rising, but other factors may be impacting the intermediate and long ends of the yield curve. Since 1994, there have been three periods of ...

Change in the rules regarding limitations for collateral in the form of

... was appropriate, from a risk point of view, to aim at diversification in the collateral volume pledged to the Riksbank by its counterparties. One means of achieving this aim is to limit the share of the counterparty’s collateral that is issued by the same counterparty or by a group of closely-relate ...

... was appropriate, from a risk point of view, to aim at diversification in the collateral volume pledged to the Riksbank by its counterparties. One means of achieving this aim is to limit the share of the counterparty’s collateral that is issued by the same counterparty or by a group of closely-relate ...

2014 Market Outlook - KMG Private Wealth Management

... Washington will still gather some attention from investors. After all, deadlines have been set early in 2014 for hitting the debt ceiling and the funding of the federal government, coinciding with primary season for the mid-term elections. But we think there is unlikely to be a reprise of the brinkm ...

... Washington will still gather some attention from investors. After all, deadlines have been set early in 2014 for hitting the debt ceiling and the funding of the federal government, coinciding with primary season for the mid-term elections. But we think there is unlikely to be a reprise of the brinkm ...

7. Which of the following statements regarding money

... Municipal bonds are always insured; other bonds are not. Unlike other bonds, municipal bonds sell at a discount. Municipal bond interest is tax-exempt; interest on other bonds is not. There is no brokerage commission on municipal bonds unlike other bonds. ...

... Municipal bonds are always insured; other bonds are not. Unlike other bonds, municipal bonds sell at a discount. Municipal bond interest is tax-exempt; interest on other bonds is not. There is no brokerage commission on municipal bonds unlike other bonds. ...

A Primer on Bonds Bond Prices and Yields

... è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon rates of 12% (paid annually) is 4 years duration of 20-year bonds with coupon rates of 6% (paid annually) is 11 years è how much of each of these coupon bonds (in market value) should you hold to both fully fund an ...

... è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon rates of 12% (paid annually) is 4 years duration of 20-year bonds with coupon rates of 6% (paid annually) is 11 years è how much of each of these coupon bonds (in market value) should you hold to both fully fund an ...

Bond markets

... several different ways. Different investors may have different views of a bond’s duration: one of the critical numbers in the calculation, the discount rate that should be used to attach a current value to future payments, is strictly a matter of opinion; and another, the amounts that will be paid a ...

... several different ways. Different investors may have different views of a bond’s duration: one of the critical numbers in the calculation, the discount rate that should be used to attach a current value to future payments, is strictly a matter of opinion; and another, the amounts that will be paid a ...