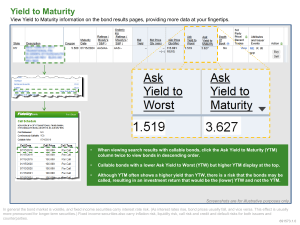

It is not appropriate to discount the cash flows of a bond by the yield

... different assumptions concerning market participant’s interest rate risk tolerance. Pure expectations theory; Liquidity theory; Preferred Habitat theory; Segmented Markets theory; Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of o ...

... different assumptions concerning market participant’s interest rate risk tolerance. Pure expectations theory; Liquidity theory; Preferred Habitat theory; Segmented Markets theory; Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of o ...

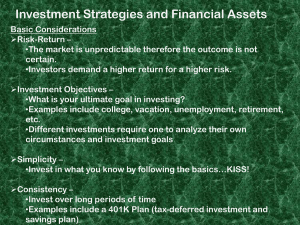

Investment Strategies and Financial Assets

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...

Downlaod File

... How are the risks of the capital market securities measured and evaluated? The technical, statistical and behavioral characteristics of the models used by major derivatives intermediaries are, in principle, well-equipped to provide estimates of "risk of loss" or "capital at risk" associated with a g ...

... How are the risks of the capital market securities measured and evaluated? The technical, statistical and behavioral characteristics of the models used by major derivatives intermediaries are, in principle, well-equipped to provide estimates of "risk of loss" or "capital at risk" associated with a g ...

Finance 301 Chapter 6: Problems 10/16/08 30 day T

... 13. Describe the concept of a call provision A call provision is a provision in a bond contract that gives the issuer the right to redeem the bonds unders specified terms prior to the maturity date. Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond hold ...

... 13. Describe the concept of a call provision A call provision is a provision in a bond contract that gives the issuer the right to redeem the bonds unders specified terms prior to the maturity date. Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond hold ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

901KB - Australian Government Bonds

... Close of business eight calendar days prior to the Coupon Payment Date. If this day is not a Business Day, the preceding Business Day is the Record Date. ...

... Close of business eight calendar days prior to the Coupon Payment Date. If this day is not a Business Day, the preceding Business Day is the Record Date. ...

The Debt Ceiling and the Road Ahead

... Congress would be able to vote against those increases but would not be able to effectively prevent them. One proposal that seems to have a chance of winning at least some bipartisan support is based on months of negotiations by the "Gang of Six" senators from both parties. The proposal is designed ...

... Congress would be able to vote against those increases but would not be able to effectively prevent them. One proposal that seems to have a chance of winning at least some bipartisan support is based on months of negotiations by the "Gang of Six" senators from both parties. The proposal is designed ...

Government Securities

... Government securities are debt instruments issued by a national government as means of borrowing money. Bond holders receive interest payments based on the specified coupon rate, and principal payment, which is a repayment of the face value of the bond at maturity. n Uses: Government bonds offer: • ...

... Government securities are debt instruments issued by a national government as means of borrowing money. Bond holders receive interest payments based on the specified coupon rate, and principal payment, which is a repayment of the face value of the bond at maturity. n Uses: Government bonds offer: • ...

bworld12050603 - Bureau of the Treasury

... T-bills are debt papers issued by the government to borrow funds from the local debt market on a regular basis.; These debt papers mature in three months, six months and one year. The rates fetched by T-bills are also used by banks as reference in setting loan rates. Mr. Edeza also said the Treasury ...

... T-bills are debt papers issued by the government to borrow funds from the local debt market on a regular basis.; These debt papers mature in three months, six months and one year. The rates fetched by T-bills are also used by banks as reference in setting loan rates. Mr. Edeza also said the Treasury ...