Risk Cannot Explain the Muni Puzzle

... of tax-exempt and taxable bonds. More specifically, long-term taxexempt bond yields appear to be too high relative to yields on taxable bonds, while short-term tax-exempt yields are generally consistent with financial theory. The following excerpt from The Wall Street Journal describes a typical com ...

... of tax-exempt and taxable bonds. More specifically, long-term taxexempt bond yields appear to be too high relative to yields on taxable bonds, while short-term tax-exempt yields are generally consistent with financial theory. The following excerpt from The Wall Street Journal describes a typical com ...

Economics of Money, Banking, and Financial Markets, 8e

... A) An increase in tax rates will increase the demand for Treasury bonds, lowering their interest rates. B) Because the tax-exempt status of municipal bonds was of little benefit to bond holders when tax rates were low, they had higher interest rates than U.S. government bonds before World War II. C) ...

... A) An increase in tax rates will increase the demand for Treasury bonds, lowering their interest rates. B) Because the tax-exempt status of municipal bonds was of little benefit to bond holders when tax rates were low, they had higher interest rates than U.S. government bonds before World War II. C) ...

Rising Interest Rates and Timberland Returns

... timberland investing became more accepted as an asset class. The point made here is that the current risk-adjusted return expectations for timberland investing are more inline on a risk/return basis with other asset classes (Figure 3). As timberland returns and risk have compressed in line with capi ...

... timberland investing became more accepted as an asset class. The point made here is that the current risk-adjusted return expectations for timberland investing are more inline on a risk/return basis with other asset classes (Figure 3). As timberland returns and risk have compressed in line with capi ...

Treasury Bill Yields: Overlooked Information

... increase in risk premium and the decrease in riskfree rate almost, but not completely, offset. Thus, the hidden factor might appear to be hidden due to its extremely short halflife in risk-neutral probability measure. One can also expect, however, that Treasury bill yields might have unique risk pre ...

... increase in risk premium and the decrease in riskfree rate almost, but not completely, offset. Thus, the hidden factor might appear to be hidden due to its extremely short halflife in risk-neutral probability measure. One can also expect, however, that Treasury bill yields might have unique risk pre ...

The Great Wall of Debt - Summer Institute of Finance

... without increasing their costs of financing. In stressed times of low land prices, debt holders may demand more collateral, which increases financing costs and generates a significant rollover risk for LGFVs. One way to meet the shortfall is to sell land, but the fire-sale in an illiquid market woul ...

... without increasing their costs of financing. In stressed times of low land prices, debt holders may demand more collateral, which increases financing costs and generates a significant rollover risk for LGFVs. One way to meet the shortfall is to sell land, but the fire-sale in an illiquid market woul ...

The Round-the-Clock Market for US Treasury Securities

... GovPX, Inc., a joint venture of the primary dealers and several interdealer brokers set up under the guidance of the Public Securities Association (an industry trade group).a GovPX was formed in 1991 to increase public access to U.S. Treasury ...

... GovPX, Inc., a joint venture of the primary dealers and several interdealer brokers set up under the guidance of the Public Securities Association (an industry trade group).a GovPX was formed in 1991 to increase public access to U.S. Treasury ...

Financial Statement Analysis and Security Valuation

... An enterprise that presents a classified statement of financial position should report all trading securities as current assets and should report individual held-to-maturity securities and individual available-for-sale securities as either current or noncurrent, as ...

... An enterprise that presents a classified statement of financial position should report all trading securities as current assets and should report individual held-to-maturity securities and individual available-for-sale securities as either current or noncurrent, as ...

The Effects of Quantitative Easing in the United States: Implications

... through the financial markets, freezing credit markets and decreasing confidence in the financial system. Figure 1, shows the drop in total consumer credit in early 2008. Throughout the global financial crisis (GFC), market participants questioned the financial strength of their counterparties and t ...

... through the financial markets, freezing credit markets and decreasing confidence in the financial system. Figure 1, shows the drop in total consumer credit in early 2008. Throughout the global financial crisis (GFC), market participants questioned the financial strength of their counterparties and t ...

Budget 2017-18 - Budget Paper No. 1

... Treasury Notes: short-term securities generally maturing within six months of issuance. The volume of Treasury Notes on issue will vary over the course of the year, depending on the size and profile of the within-year funding flows. All outstanding CGS is denominated in Australian dollars and all ne ...

... Treasury Notes: short-term securities generally maturing within six months of issuance. The volume of Treasury Notes on issue will vary over the course of the year, depending on the size and profile of the within-year funding flows. All outstanding CGS is denominated in Australian dollars and all ne ...

The Determinants of Chinese Local Government Bond Yields

... severely impaired afterwards. Naturally, one would like to ask the following questions: How do Chinese bond investors evaluate the risk of local government bonds? What factors affect their perception of the risk of these bonds? Do they respond to changes in local governments’ financial conditions? W ...

... severely impaired afterwards. Naturally, one would like to ask the following questions: How do Chinese bond investors evaluate the risk of local government bonds? What factors affect their perception of the risk of these bonds? Do they respond to changes in local governments’ financial conditions? W ...

Chapter 7

... permit the holder to buy stock for a stated price, thereby providing a capital gain if the stock’s price rises. ...

... permit the holder to buy stock for a stated price, thereby providing a capital gain if the stock’s price rises. ...

Insurance Asset Management Trends in 2014

... accounts. Rankings include assets managed by BNY Mellon Asset Management and BNY Mellon Wealth Management. Each ranking may not include the same mix of firms. This portfolio data should not be relied upon as a complete listing of the Portfolio’s holdings (or top holdings) as information on particula ...

... accounts. Rankings include assets managed by BNY Mellon Asset Management and BNY Mellon Wealth Management. Each ranking may not include the same mix of firms. This portfolio data should not be relied upon as a complete listing of the Portfolio’s holdings (or top holdings) as information on particula ...

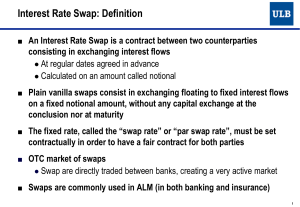

Interest Rate Swap

... ● In general this is only the case at issuance ● In this case, there is a bijection between maturity and yield to maturity ● We have seen that this is the equivalent of par swap rates Different types of rates: ● Par swap rate for a given maturity ● Zero-coupon rate for a given maturity ● Coupon ra ...

... ● In general this is only the case at issuance ● In this case, there is a bijection between maturity and yield to maturity ● We have seen that this is the equivalent of par swap rates Different types of rates: ● Par swap rate for a given maturity ● Zero-coupon rate for a given maturity ● Coupon ra ...

Australian Debt Sale Market Overview

... Developing the Australian Market Does your organisation currently have a strategy to help grow the current second tier debt buyers ...

... Developing the Australian Market Does your organisation currently have a strategy to help grow the current second tier debt buyers ...

Document

... and put options on a non-dividend paying stock. They suggest that almost all corporate liablities can be viewed as combinations of options, and hence their analysis can be used to value corporate liabilities such as shares, corporate loans and warrants. The literature on the valuation of defaultable ...

... and put options on a non-dividend paying stock. They suggest that almost all corporate liablities can be viewed as combinations of options, and hence their analysis can be used to value corporate liabilities such as shares, corporate loans and warrants. The literature on the valuation of defaultable ...

Owning Bonds - 2012 Book Archive

... A zero-coupon bond5 has a coupon rate of zero: it pays no interest and repays only the principal at maturity. A “zero” may be attractive to investors, however, because it can be purchased for much less than its face value. There are deferred coupon bonds6 (also called split-coupon bonds7 and issued ...

... A zero-coupon bond5 has a coupon rate of zero: it pays no interest and repays only the principal at maturity. A “zero” may be attractive to investors, however, because it can be purchased for much less than its face value. There are deferred coupon bonds6 (also called split-coupon bonds7 and issued ...

The Stoever Glass Municipal Bond Portfolio Planning Kit

... points from which to make comparisons. Fortunately there are such industry-wide reference points, which are used every day in the municipal bond business. _________________________________________________________________________________________ Stoever Glass & Co., Inc., 30 Wall Street, New York, NY ...

... points from which to make comparisons. Fortunately there are such industry-wide reference points, which are used every day in the municipal bond business. _________________________________________________________________________________________ Stoever Glass & Co., Inc., 30 Wall Street, New York, NY ...

Liquidity in an emerging bond market: the case of corporate bonds

... A unique feature of the Malaysian corporate bond market is the large amount of Islamic issuance. Islamic securities are structured to comply with Shariah principles, in particular the prohibition on the charging of interest. The most common structure is a sale and buyback transaction, wherein inste ...

... A unique feature of the Malaysian corporate bond market is the large amount of Islamic issuance. Islamic securities are structured to comply with Shariah principles, in particular the prohibition on the charging of interest. The most common structure is a sale and buyback transaction, wherein inste ...

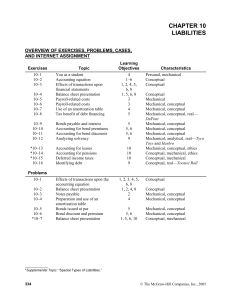

Internet Assignment

... to reducing the unpaid balance will increase. For example, let us look into the future to the time when the loan has been paid down to $10,000. At this point, a $476.17 monthly payment would be allocated as follows: interest, $91.67 ($10,000 principal 11% 112), and reduction in principal, $384. ...

... to reducing the unpaid balance will increase. For example, let us look into the future to the time when the loan has been paid down to $10,000. At this point, a $476.17 monthly payment would be allocated as follows: interest, $91.67 ($10,000 principal 11% 112), and reduction in principal, $384. ...

markets work in war

... market with shared information. In addition to possible limitations of the econometric techniques used, the reason may be attributed to differences in the amount of information available (Swiss and Swedish traders might not have received exactly the same information about the war) as well as its sub ...

... market with shared information. In addition to possible limitations of the econometric techniques used, the reason may be attributed to differences in the amount of information available (Swiss and Swedish traders might not have received exactly the same information about the war) as well as its sub ...

Chapter Three

... coupons have to be reinvested at the Err. Students may become confused over this point. For instance, if you buy a $1000, 8% coupon bond at par and receive $80 per year that appears to be an 8% annual return regardless of what the investor does with the money. It is in fact an 8% simple interest ret ...

... coupons have to be reinvested at the Err. Students may become confused over this point. For instance, if you buy a $1000, 8% coupon bond at par and receive $80 per year that appears to be an 8% annual return regardless of what the investor does with the money. It is in fact an 8% simple interest ret ...

Governed Portfolio 8 - Royal London for advisers

... Governed Portfolio 8 outperformed benchmark over 3 and 5 years to end of March 2016. The existing tactical position applied 02/06/2016 continues. No change required to benchmark asset allocation. We have reduced the exposure to equity (-1.00%), 10 year corporate bonds (-0.07%), 10 year index-linked ...

... Governed Portfolio 8 outperformed benchmark over 3 and 5 years to end of March 2016. The existing tactical position applied 02/06/2016 continues. No change required to benchmark asset allocation. We have reduced the exposure to equity (-1.00%), 10 year corporate bonds (-0.07%), 10 year index-linked ...