Money, Banking, and the Financial System (Hubbard/O`Brien)

... B) the chance that the value of financial assets will change from what you expect. C) the ease with which an asset can be exchanged for other assets or for goods and services. D) the difference between the return on common stock and the return on corporate bonds. Answer: B Diff: 1 Page Ref: 12 Topic ...

... B) the chance that the value of financial assets will change from what you expect. C) the ease with which an asset can be exchanged for other assets or for goods and services. D) the difference between the return on common stock and the return on corporate bonds. Answer: B Diff: 1 Page Ref: 12 Topic ...

Who are the Value and Growth Investors?

... tilt and characteristics, even though the portfolios of new entrants are formed for the first time and cannot be impacted by past stock market investment decisions. The baseline results are also robust to controlling for the length of risky asset market participation and other measures of financial ...

... tilt and characteristics, even though the portfolios of new entrants are formed for the first time and cannot be impacted by past stock market investment decisions. The baseline results are also robust to controlling for the length of risky asset market participation and other measures of financial ...

Optimal Consumption and Portfolio Choices with Risky

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

Download Full Article

... (ii) As the data are only secondary, i.e., they are collected from the published annual reports. (iii) Only profitability ratio is taken for the study. VIII. A BRIEF ACCOUNT OF PROFITABILITY Every firm is most concerned with its profitability. One of the most frequently used tools of financial ratio ...

... (ii) As the data are only secondary, i.e., they are collected from the published annual reports. (iii) Only profitability ratio is taken for the study. VIII. A BRIEF ACCOUNT OF PROFITABILITY Every firm is most concerned with its profitability. One of the most frequently used tools of financial ratio ...

Current Yield of Commercial Real Estate as an Indicator of

... Political and legal factors which reflect the attitude of regional authorities towards development of certain industries of economy that can range from restrictive to supportive. ...

... Political and legal factors which reflect the attitude of regional authorities towards development of certain industries of economy that can range from restrictive to supportive. ...

No Slide Title

... Aggregate carrier spending could be flat to down for next 1-4 years, due to recent capex/revenue imbalance Aggregate long-haul spending will be flat to down given over-investment and capacity glut No catalyst (killer application or economic recovery) on near term horizon to re-accelerate spending ...

... Aggregate carrier spending could be flat to down for next 1-4 years, due to recent capex/revenue imbalance Aggregate long-haul spending will be flat to down given over-investment and capacity glut No catalyst (killer application or economic recovery) on near term horizon to re-accelerate spending ...

Efficiency and Distortions in a Production Economy with

... EIS is greater than one, disagreement generates overinvestment. The intuition behind the result is straightforward. Disagreement and trading, together generate a speculative wealth effect, where all agents believe that they are better off in the economy with disagreement than in one without it, becaus ...

... EIS is greater than one, disagreement generates overinvestment. The intuition behind the result is straightforward. Disagreement and trading, together generate a speculative wealth effect, where all agents believe that they are better off in the economy with disagreement than in one without it, becaus ...

The effect of working capital management on

... Working capital management involves the management of the most liquid resources of the firm which includes cash and cash equivalents, Inventories and trade and other receivables. Most firms do not hold the correct amount of working capital and this has been a major obstacle to their overall profitab ...

... Working capital management involves the management of the most liquid resources of the firm which includes cash and cash equivalents, Inventories and trade and other receivables. Most firms do not hold the correct amount of working capital and this has been a major obstacle to their overall profitab ...

Trust Owned Life Insurance (TOLI) A Case Study on Variable Life

... • 17% were in imminent danger of lapsing because of under funding • 10% had a significant chance of lapsing before a client reached life expectancy ...

... • 17% were in imminent danger of lapsing because of under funding • 10% had a significant chance of lapsing before a client reached life expectancy ...

Management & Engineering Study on Non-financial Value of Tourism Listed Companies

... welfare, changed the regional image, provided more jobs, protected the culture and environment. Investment value of listed company refers to the intrinsic value of listed companies, reflects the size of the company's future profitability, and is listed company's future cash flows of present value. I ...

... welfare, changed the regional image, provided more jobs, protected the culture and environment. Investment value of listed company refers to the intrinsic value of listed companies, reflects the size of the company's future profitability, and is listed company's future cash flows of present value. I ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... Placement Agents may be added or removed from time to time. As to each investor referred by a Placement Agent to date, such additional compensation may be up to 0.85% of the value of the Shares held by the investor per annum (but in the aggregate across all investors will not exceed 1% of the Compan ...

... Placement Agents may be added or removed from time to time. As to each investor referred by a Placement Agent to date, such additional compensation may be up to 0.85% of the value of the Shares held by the investor per annum (but in the aggregate across all investors will not exceed 1% of the Compan ...

BYOG 3 Quick Guide to Key Ratios

... Here, G is the E/S Growth. This is a variation of Graham-Dodds valuation equation P = aE*(1 + bG) rewritten to the form + (P/E) / (a*(1 + bG )) Graham and Dodd found that the constants a and b depend upon the company’s specific industrial ...

... Here, G is the E/S Growth. This is a variation of Graham-Dodds valuation equation P = aE*(1 + bG) rewritten to the form + (P/E) / (a*(1 + bG )) Graham and Dodd found that the constants a and b depend upon the company’s specific industrial ...

An Empirical Test of the Relationship between

... see Hand, J. R. 1990. A Test of the Extended Functional Fixation Hypothesis. The Accounting Review 65 (October): ...

... see Hand, J. R. 1990. A Test of the Extended Functional Fixation Hypothesis. The Accounting Review 65 (October): ...

Empirical Analysis of Stock Returns and Volatility of the

... investors experience. Volatility is a measure of dispersion around the mean or average return of a security. One way to measure volatility is by using the standard deviation, which tells you how tightly the price of a stock is grouped around the mean or moving average (MA). When the prices are tight ...

... investors experience. Volatility is a measure of dispersion around the mean or average return of a security. One way to measure volatility is by using the standard deviation, which tells you how tightly the price of a stock is grouped around the mean or moving average (MA). When the prices are tight ...

4.1 Introduction - Managed Investments Act

... Charges.1 The report found that, for the period 1996 to 2000, there had been an overall reduction in the weighted average MER of 3.92 per cent (or 6 basis points), translating to an annual cost saving of approximately $53.3 million. From the commencement of the MIA on 1 July 1998, the report found ...

... Charges.1 The report found that, for the period 1996 to 2000, there had been an overall reduction in the weighted average MER of 3.92 per cent (or 6 basis points), translating to an annual cost saving of approximately $53.3 million. From the commencement of the MIA on 1 July 1998, the report found ...

GDB Position paper to BCBS365_9.docx

... Similarly market makers in securities or derivatives hold a position in the respective asset in order to fulfil their market maker role. In order to protect themselves they enter into hedging agreements. The current usage of CEM for leverage ratio purposes does not allow to net these positions. It i ...

... Similarly market makers in securities or derivatives hold a position in the respective asset in order to fulfil their market maker role. In order to protect themselves they enter into hedging agreements. The current usage of CEM for leverage ratio purposes does not allow to net these positions. It i ...

1 September 2006 Page 1 of 52 The SPI Fund of Scottish Provident

... differences in the way specimen asset shares are calculated for different classes of policy, both between conventional business, unitised business and deposit administration business and between classes in the conventional business category. Naturally, the size of any particular specimen asset share ...

... differences in the way specimen asset shares are calculated for different classes of policy, both between conventional business, unitised business and deposit administration business and between classes in the conventional business category. Naturally, the size of any particular specimen asset share ...

JESSICA Contribution - European Commission

... • Managing Authorities can use some of their Structural Funds allocations to invest in revolving funds ...

... • Managing Authorities can use some of their Structural Funds allocations to invest in revolving funds ...

focused on building a leading vertically integrated diamond

... different to the average value you have disclosed on regulatory new release? ...

... different to the average value you have disclosed on regulatory new release? ...

PDF

... impacts of global warming on cash flows could also be highly uncertain, which partly stems from considerable uncertainty about the magnitude of global warming, with the range of possible magnitudes involving differences of several hundred percent. This is illustrated by the IPCC’s widely-quoted esti ...

... impacts of global warming on cash flows could also be highly uncertain, which partly stems from considerable uncertainty about the magnitude of global warming, with the range of possible magnitudes involving differences of several hundred percent. This is illustrated by the IPCC’s widely-quoted esti ...

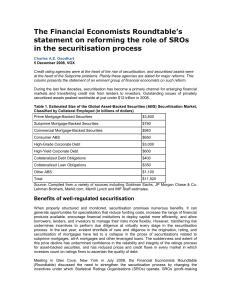

Roundtable`s Evaluation of the SEC`s Proposals for Reform

... Bond markets functioned internationally for 300 years before the first rating organisations appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for ...

... Bond markets functioned internationally for 300 years before the first rating organisations appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for ...

Russian BCS Holding International Ltd. Assigned

... damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ...

... damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ...

2017 prospectus

... minimum outstanding face value of $500 million or more, and eligible issuers must have aggregate outstanding debt of $1 billion or more to be included in the Underlying Index. All securities included in the Underlying Index must be U.S. dollar-denominated fixed rate bonds with a remaining maturity o ...

... minimum outstanding face value of $500 million or more, and eligible issuers must have aggregate outstanding debt of $1 billion or more to be included in the Underlying Index. All securities included in the Underlying Index must be U.S. dollar-denominated fixed rate bonds with a remaining maturity o ...