`Open Access` in Electricity - Central Electricity Regulatory Commission

... – Moreover, credit profile of the borrower would also determine the debtequity ratio being offered to him. For a majority of SEBs with poor financial health and a track-record of defaults on debt obligations, lenders may definitely like to insist on better equity cushion. • Having determined these n ...

... – Moreover, credit profile of the borrower would also determine the debtequity ratio being offered to him. For a majority of SEBs with poor financial health and a track-record of defaults on debt obligations, lenders may definitely like to insist on better equity cushion. • Having determined these n ...

Capital Investment Governance White Paper

... Governance committees are routinely used by attendees to update themselves on the project’s progress. Quite often they are used as a mechanism for stakeholder management – one need only consider the size of the meeting. Very large meetings are usually indicative of a committee functioning more as a ...

... Governance committees are routinely used by attendees to update themselves on the project’s progress. Quite often they are used as a mechanism for stakeholder management – one need only consider the size of the meeting. Very large meetings are usually indicative of a committee functioning more as a ...

Causes of Financial Distress - This Webs.com site has not yet been

... from companies that operated in different macro – economic contexts. In addition, the researcher decided not to include any financial information from companies during the years 2007 and 2008 because that period there was an economic crisis which was as a result of political crashes that affected th ...

... from companies that operated in different macro – economic contexts. In addition, the researcher decided not to include any financial information from companies during the years 2007 and 2008 because that period there was an economic crisis which was as a result of political crashes that affected th ...

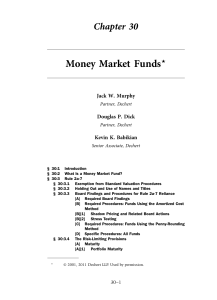

#32842_30_Mutual Fund Regulation_P1 1..72

... market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current market factors, and (ii) calculate its price per share to an accuracy of within 0.10% (that is, $0.01 based on a share price of $10). The ...

... market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current market factors, and (ii) calculate its price per share to an accuracy of within 0.10% (that is, $0.01 based on a share price of $10). The ...

Financing the Capital Development of the Economy: A Keynes

... Hence, from Schumpeter we borrow two insights: (1) it is critical to understand the innovation process in order to begin to analyze the dynamics of the capitalist economy, and (2) part of this understanding concerns the fact that innovation needs appropriate types of finance. In Schumpeter’s view t ...

... Hence, from Schumpeter we borrow two insights: (1) it is critical to understand the innovation process in order to begin to analyze the dynamics of the capitalist economy, and (2) part of this understanding concerns the fact that innovation needs appropriate types of finance. In Schumpeter’s view t ...

Call for expression of Interest

... “Medium” or higher score for this indicator will be awarded if, at and following a closing where EIF is expected to participate under the Programme, at least 50% of the Fund’s commitments are envisaged to come from Independent Private Investors, not taking into account EIF, EIB, and NPBs investing t ...

... “Medium” or higher score for this indicator will be awarded if, at and following a closing where EIF is expected to participate under the Programme, at least 50% of the Fund’s commitments are envisaged to come from Independent Private Investors, not taking into account EIF, EIB, and NPBs investing t ...

Effect Type Strategy, Investment Opportunity Set In

... Agency theory is the basis of the theory underlying the company's current business practices. Agency theory is a theory that arise because of a conflict of interest between principal and agent. Principal shareholder while the agent as a manager. Principal agent contracted to perform resource managem ...

... Agency theory is the basis of the theory underlying the company's current business practices. Agency theory is a theory that arise because of a conflict of interest between principal and agent. Principal shareholder while the agent as a manager. Principal agent contracted to perform resource managem ...

Excerpted from the Charity Commission guidance document: Charity

... give voluntary funders, such as grant-makers, an understanding of why funding is needed to undertake a particular project or activity give assurance to lenders and creditors that the charity can meet its financial commitments manage the risk to a charity’s reputation from holding substantial unspent ...

... give voluntary funders, such as grant-makers, an understanding of why funding is needed to undertake a particular project or activity give assurance to lenders and creditors that the charity can meet its financial commitments manage the risk to a charity’s reputation from holding substantial unspent ...

- Roosevelt Institute

... On top of this is the massive cost of the financial crisis itself, which most analysts agree was largely associated with the practices of speculative finance. If we add conservative Federal Reserve estimates of the cost of the crisis in terms of lost output ($6.5 trillion–$14.5 trillion), it brings ...

... On top of this is the massive cost of the financial crisis itself, which most analysts agree was largely associated with the practices of speculative finance. If we add conservative Federal Reserve estimates of the cost of the crisis in terms of lost output ($6.5 trillion–$14.5 trillion), it brings ...

Information on risk, own funds and capital requirements

... Currently all Board Members have many years’ experience not only in managing of the Bank but in specific areas they are responsible for as well. Article 435.2.d whether or not the institution has set up a separate risk committee and the number of times the risk committee has met The Bank has estab ...

... Currently all Board Members have many years’ experience not only in managing of the Bank but in specific areas they are responsible for as well. Article 435.2.d whether or not the institution has set up a separate risk committee and the number of times the risk committee has met The Bank has estab ...

Missing Numbers -- Behind Wave of Corporate Fraud: A Change in

... auditor gains assurance by examining all of the component parts of the financial statements, ensuring that the transactions recorded are complete and accurate." By comparison, under the "top down" risk-based audit methodology, auditors focus "less on the details of individual transactions" and use ...

... auditor gains assurance by examining all of the component parts of the financial statements, ensuring that the transactions recorded are complete and accurate." By comparison, under the "top down" risk-based audit methodology, auditors focus "less on the details of individual transactions" and use ...

A Stochastic Discount Factor Approach to Asset

... In this paper, we derive a novel consistent estimator of the stochastic discount factor (or pricing kernel) that takes seriously the consequences of the Pricing Equation established by Harrison and Kreps (1979), Hansen and Richard (1987), and Hansen and Jagannathan (1991), where asset prices today a ...

... In this paper, we derive a novel consistent estimator of the stochastic discount factor (or pricing kernel) that takes seriously the consequences of the Pricing Equation established by Harrison and Kreps (1979), Hansen and Richard (1987), and Hansen and Jagannathan (1991), where asset prices today a ...

MSCI Factor Indices

... Index returns do not represent the results of actual trading of investible assets/securities. MSCI maintains and calculates indexes, but does not manage actual assets. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the inde ...

... Index returns do not represent the results of actual trading of investible assets/securities. MSCI maintains and calculates indexes, but does not manage actual assets. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the inde ...

GC17/2: Treatment of politically exposed persons (PEPs) under the

... establishing source of wealth and source of funds and the true beneficiaries of long-term insurance policies. This could include information from public registers, such as beneficial ownership registers and registers maintained by the Electoral Commission under the Political Parties, Elections and R ...

... establishing source of wealth and source of funds and the true beneficiaries of long-term insurance policies. This could include information from public registers, such as beneficial ownership registers and registers maintained by the Electoral Commission under the Political Parties, Elections and R ...

NHA Mortgage-Backed Securities

... sources which we believe to be reliable, but we do not represent that they are accurate or complete, and should not be relied upon as such. All opinions expressed and data provided herein are subject to change without notice. A CIBC World Markets company or its shareholders, directors, officers and/ ...

... sources which we believe to be reliable, but we do not represent that they are accurate or complete, and should not be relied upon as such. All opinions expressed and data provided herein are subject to change without notice. A CIBC World Markets company or its shareholders, directors, officers and/ ...

Estimating the Expected Marginal Rate of Substitution

... assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-specific factor loadings {β } , coefficients that are constant across time. Estimating these factor loadings is a key objective of this research program. In practice, many empirical as ...

... assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-specific factor loadings {β } , coefficients that are constant across time. Estimating these factor loadings is a key objective of this research program. In practice, many empirical as ...

Inflation Risk and Real Return

... so over sufficiently long time periods the relatively high expected returns of equities mean investors can expect to grow assets after inflation. Over short time horizons, though, equities may suffer from inflation shocks. Over long horizons, we expect that most, but not all, of an inflation increas ...

... so over sufficiently long time periods the relatively high expected returns of equities mean investors can expect to grow assets after inflation. Over short time horizons, though, equities may suffer from inflation shocks. Over long horizons, we expect that most, but not all, of an inflation increas ...