Against this background GUE/NGL rejects the so called Juncker

... candy to big finance, insurers and pension funds which lack adequate returns in the real economy due to austerity. The fatal privatization of pension systems and the austerity inflicted lack of investment and hence credit demand should be no excuse to satisfy yield via taxpayers’ money. Project se ...

... candy to big finance, insurers and pension funds which lack adequate returns in the real economy due to austerity. The fatal privatization of pension systems and the austerity inflicted lack of investment and hence credit demand should be no excuse to satisfy yield via taxpayers’ money. Project se ...

August 29 - Pontiac General Employees` Retirement System

... Minister Koizumi has guided Japan through this very rough period. He does not follow many of the old Japanese traditions; bail-outs were a cultural phenomenon. They are no longer bailing out failures. Japan is beginning to look more attractive to investors than it has in recent years. Europe is a ma ...

... Minister Koizumi has guided Japan through this very rough period. He does not follow many of the old Japanese traditions; bail-outs were a cultural phenomenon. They are no longer bailing out failures. Japan is beginning to look more attractive to investors than it has in recent years. Europe is a ma ...

Trading Mandate Catalogue

... or to seek increased liquidity or higher returns from other markets. ...

... or to seek increased liquidity or higher returns from other markets. ...

inflationary environment

... with Round Table Advisors of Raymond James in Chattanooga, Tennessee. He is a member in good standing of the Financial Planning Association, The American Institute of Certified Public Accountants and The Tennessee Society of CPAs. Certified Financial Planner Board of Standards Inc. owns the certific ...

... with Round Table Advisors of Raymond James in Chattanooga, Tennessee. He is a member in good standing of the Financial Planning Association, The American Institute of Certified Public Accountants and The Tennessee Society of CPAs. Certified Financial Planner Board of Standards Inc. owns the certific ...

Supervisor title - BC Public Service

... Analytical Thinking is the ability to comprehend a situation by breaking it down into its components and identifying key or underlying complex issues. It implies the ability to systematically organize and compare the various aspects of a problem or situation, and determine cause-and-effect relations ...

... Analytical Thinking is the ability to comprehend a situation by breaking it down into its components and identifying key or underlying complex issues. It implies the ability to systematically organize and compare the various aspects of a problem or situation, and determine cause-and-effect relations ...

Open PDF of Monika Beck`s presentation at

... either in full or in part, nor may it be passed on to another party. It constitutes neither an offer nor an invitation to subscribe or to purchase securities, nor is this document or the information contained herein meant to serve as a basis for any kind of obligation, contractual or otherwise. In a ...

... either in full or in part, nor may it be passed on to another party. It constitutes neither an offer nor an invitation to subscribe or to purchase securities, nor is this document or the information contained herein meant to serve as a basis for any kind of obligation, contractual or otherwise. In a ...

Direct Leverage - Treasury.gov.au

... Higher governance requirements have been imposed on superannuation funds regarding derivative use and APRA has increased its monitoring of this area. Both are positive steps. But, exposures created by derivatives are still largely opaque, particularly where the exposures are used to enhance investme ...

... Higher governance requirements have been imposed on superannuation funds regarding derivative use and APRA has increased its monitoring of this area. Both are positive steps. But, exposures created by derivatives are still largely opaque, particularly where the exposures are used to enhance investme ...

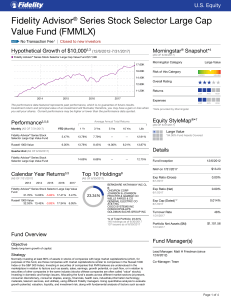

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... an index. Past performance is no guarantee of future results. This chart is not intended to imply any future performance of the investment product. 3. The Morningstar Category Average is the average return for the peer group based on the returns of each individual fund within the group, for the peri ...

... an index. Past performance is no guarantee of future results. This chart is not intended to imply any future performance of the investment product. 3. The Morningstar Category Average is the average return for the peer group based on the returns of each individual fund within the group, for the peri ...

Rajiv Gandhi Equity Savings Scheme

... associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the perspective of it being a primer on financial c ...

... associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the perspective of it being a primer on financial c ...

Insurance-Linked Securities: A Primer

... Given the nature of catastrophe insurance, characterized by low frequency and high severity events, ILS can offer higher coupon payments relative to comparably rated corporate bonds. As such, investors may expect relatively high annual returns potentially. However, given the randomness and severity ...

... Given the nature of catastrophe insurance, characterized by low frequency and high severity events, ILS can offer higher coupon payments relative to comparably rated corporate bonds. As such, investors may expect relatively high annual returns potentially. However, given the randomness and severity ...

Product Brochure - Pramerica Mutual Fund

... *As per the present tax laws, eligible investors (individual/ HUF) are entitled to deduction from their gross total income, of the amount invested in equity linked saving scheme (ELSS) upto `1,50,000/- (along with other prescribed investments) under Section 80C of the Income Tax Act, 1961. Tax savin ...

... *As per the present tax laws, eligible investors (individual/ HUF) are entitled to deduction from their gross total income, of the amount invested in equity linked saving scheme (ELSS) upto `1,50,000/- (along with other prescribed investments) under Section 80C of the Income Tax Act, 1961. Tax savin ...

AIF_Sponsor Based Leveraged Acquisition June 2010

... There is no risk free asset Equity risk premiums can change dramatically even in mature markets Large investment grade firms in developed markets cannot always raise new capital Diversification across asset classes does provide protection Debt is a double edge sword Cash balances are not wasting ass ...

... There is no risk free asset Equity risk premiums can change dramatically even in mature markets Large investment grade firms in developed markets cannot always raise new capital Diversification across asset classes does provide protection Debt is a double edge sword Cash balances are not wasting ass ...

PSF Floating Rate Loan - Pacific Life Annuities

... Risk is measured for up to three time periods (three, five, and 10 years). These separate measures are then weighted and averaged to produce an overall measure for the product. Products with less than three years of performance history are not rated. Morningstar Style Box™ The Morningstar Style Box ...

... Risk is measured for up to three time periods (three, five, and 10 years). These separate measures are then weighted and averaged to produce an overall measure for the product. Products with less than three years of performance history are not rated. Morningstar Style Box™ The Morningstar Style Box ...

Business Ethics

... great dissatisfaction with the status quo They are partly a response to criticisms, a recognition of underlying important social concerns, an intersection of business, civil society, and governmental functions Their activities intersect and compliment each other…and are generally aimed at similar en ...

... great dissatisfaction with the status quo They are partly a response to criticisms, a recognition of underlying important social concerns, an intersection of business, civil society, and governmental functions Their activities intersect and compliment each other…and are generally aimed at similar en ...

Our Investment Process - Horbury Financial Services

... ‘cautious’, ‘balanced’ or ‘aggressive’ can mean different things to different people. That is why we aim to make our assessment of your attitude to risk as objective as possible. The next stage of the process is a discussion about what your risk profile score means. Your resulting risk profile score ...

... ‘cautious’, ‘balanced’ or ‘aggressive’ can mean different things to different people. That is why we aim to make our assessment of your attitude to risk as objective as possible. The next stage of the process is a discussion about what your risk profile score means. Your resulting risk profile score ...

UIF Performance 2015 Q4 Alesco Market Review

... threat to the existence of the Eurozone, and (4) an increase in interest rates by the Federal Reserve in December after months of speculation and delays. These rising rates are in contrast to the European Central Bank and the Bank of Japan, which are moving monetary policy in the opposite direction ...

... threat to the existence of the Eurozone, and (4) an increase in interest rates by the Federal Reserve in December after months of speculation and delays. These rising rates are in contrast to the European Central Bank and the Bank of Japan, which are moving monetary policy in the opposite direction ...

Type of service Annual management fee, percentage of gross assets

... The fees for additional services are subject to negotiation and agreement between Skanestas Investments ltd and the Client. The Client is warned of possibility that other costs, including taxes, related to transactions in connection with the Financial Instruments and/or the investment and ancillary ...

... The fees for additional services are subject to negotiation and agreement between Skanestas Investments ltd and the Client. The Client is warned of possibility that other costs, including taxes, related to transactions in connection with the Financial Instruments and/or the investment and ancillary ...

The Swedish AP Funds` co-ordination of carbon footprint reporting

... apply different investment strategies and allocate the pension assets under their management in different ways. As long-term owners and managers of Swedish pension assets, the AP Funds have a responsibility to generate maximum possible benefit for the Swedish pension system through responsible inves ...

... apply different investment strategies and allocate the pension assets under their management in different ways. As long-term owners and managers of Swedish pension assets, the AP Funds have a responsibility to generate maximum possible benefit for the Swedish pension system through responsible inves ...

BEPS Action 6 – Discussion Draft on non-CIV examples

... We are also concerned that these examples represent a ’lowest common denominator’ view, rather than acting as a guide as to how the majority of the multilateral instrument (MLI) participating countries may wish to interpret the rules. If the goal is to provide a greater level of certainty as to how ...

... We are also concerned that these examples represent a ’lowest common denominator’ view, rather than acting as a guide as to how the majority of the multilateral instrument (MLI) participating countries may wish to interpret the rules. If the goal is to provide a greater level of certainty as to how ...

What about International stocks?

... Diversification – spreading your investments across different markets can reduce risk. Opportunity – investing in different markets can offer great profit potential should the investment perform well There is also an issue of timing. Different countries will often have stock markets that are in ...

... Diversification – spreading your investments across different markets can reduce risk. Opportunity – investing in different markets can offer great profit potential should the investment perform well There is also an issue of timing. Different countries will often have stock markets that are in ...

Regulatory Risk, Cost of Capital and Investment

... deployment of broadband technologies. Regulatory regimes that "penalize" the incumbents by setting the WACC too low may see a reduction or a delay of investment in infrastructure and the deployment of digital technologies. Both investors and telecommunications firms are seriously concerned by the ap ...

... deployment of broadband technologies. Regulatory regimes that "penalize" the incumbents by setting the WACC too low may see a reduction or a delay of investment in infrastructure and the deployment of digital technologies. Both investors and telecommunications firms are seriously concerned by the ap ...

Section 1, Mean variance analysis 1 Risk and return

... known exactly. There are costs associated with borrowing beyond paying the risk free rate. There are limits to the investor’s ability to borrow, limits that have become more severe in the past year. Even small investors are not pure price takers. For example, if the ask price for a given security is ...

... known exactly. There are costs associated with borrowing beyond paying the risk free rate. There are limits to the investor’s ability to borrow, limits that have become more severe in the past year. Even small investors are not pure price takers. For example, if the ask price for a given security is ...