2016: The year in review

... For Australian investors, having a hedged global shares strategy (in which the value of the portfolio is protected from a strengthening AUD) was beneficial this year. In the year to 31 December, hedged global shares returned 10.7%, outperforming an unhedged global shares strategy, which returned 9.0 ...

... For Australian investors, having a hedged global shares strategy (in which the value of the portfolio is protected from a strengthening AUD) was beneficial this year. In the year to 31 December, hedged global shares returned 10.7%, outperforming an unhedged global shares strategy, which returned 9.0 ...

Download attachment

... index rigidly, even when other market information would advise against the index’s investments. This is because they make few value judgements, but blindly accept all newcomers to their benchmark. Because benchmarks choose the stock with the fastest rising price gain, index followers essentially fol ...

... index rigidly, even when other market information would advise against the index’s investments. This is because they make few value judgements, but blindly accept all newcomers to their benchmark. Because benchmarks choose the stock with the fastest rising price gain, index followers essentially fol ...

How to Make Millions in the Stock Market

... if an asset was overvalued, investors would sell the asset and, in the process, force the price down until it also was accurately priced. In summary, you should have learned that there are no easy "twenty dollar bills" just lying around waiting for you to come by and pick them up. The following les ...

... if an asset was overvalued, investors would sell the asset and, in the process, force the price down until it also was accurately priced. In summary, you should have learned that there are no easy "twenty dollar bills" just lying around waiting for you to come by and pick them up. The following les ...

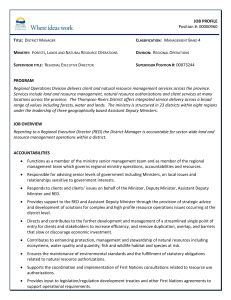

District Manager - BC Public Service

... 1. Leadership implies a desire to lead others, including diverse teams. Leadership is generally, but not always, demonstrated from a position of formal authority. The "team" here should be understood broadly as any group with which the person interacts regularly. 2. Innovation indicates an effort to ...

... 1. Leadership implies a desire to lead others, including diverse teams. Leadership is generally, but not always, demonstrated from a position of formal authority. The "team" here should be understood broadly as any group with which the person interacts regularly. 2. Innovation indicates an effort to ...

AVI Goodhart Press Announcement 30 SEP 2015

... (“British Empire”), then a £6m London listed investment company. British Empire is now capitalised at over £700m, having generated a very attractive average annual return for investors of 11.6% per annum during the period managed by AVI.1 In addition to British Empire, AVI manages a range of pooled ...

... (“British Empire”), then a £6m London listed investment company. British Empire is now capitalised at over £700m, having generated a very attractive average annual return for investors of 11.6% per annum during the period managed by AVI.1 In addition to British Empire, AVI manages a range of pooled ...

Why understanding asset allocation could improve

... have shown that it is actually asset allocation, rather than your investment ability, that is the prime determinant of portfolio performance. Different asset classes will outperform, or underperform, during different periods of time. The following chart shows annual returns for the years to 2012 and ...

... have shown that it is actually asset allocation, rather than your investment ability, that is the prime determinant of portfolio performance. Different asset classes will outperform, or underperform, during different periods of time. The following chart shows annual returns for the years to 2012 and ...

Role of financial institutions

... have an excess of income over expenditure to those who can make use of the same with view of adding to the volume of productive capital. They provide a convenient and effective link between savings and investment. In an underdeveloped economy, the role of these institutions as mobilisers of savings ...

... have an excess of income over expenditure to those who can make use of the same with view of adding to the volume of productive capital. They provide a convenient and effective link between savings and investment. In an underdeveloped economy, the role of these institutions as mobilisers of savings ...

different world - Henderson Global Investors

... top 20 economies of the developed world is steady, inflation is pretty normal, and the world recovery is broadening out. The global economy is resilient.” As a multi-asset manager, O’Connor takes a macro look at both regions and different types of assets before deciding how much to invest in equitie ...

... top 20 economies of the developed world is steady, inflation is pretty normal, and the world recovery is broadening out. The global economy is resilient.” As a multi-asset manager, O’Connor takes a macro look at both regions and different types of assets before deciding how much to invest in equitie ...

Follow this link for a full job description.

... delivered within their region, whilst ensuring delivery capability is in place to deliver against the SLA’s and KPI’s. • Service Audits are conducted and Departmental Standards are maintained and continually improved. Information is analysed and performance reports are generated in a timely and accu ...

... delivered within their region, whilst ensuring delivery capability is in place to deliver against the SLA’s and KPI’s. • Service Audits are conducted and Departmental Standards are maintained and continually improved. Information is analysed and performance reports are generated in a timely and accu ...

Page 1 Important information This information has been provided by

... basket labelled ‘shares’. Our best defence against not knowing the unknowable is to diversify our investments as widely as possible, take enough risk in our portfolios to enable us to meet our clients’ return objectives and, to as much as possible, fully understand the risks attached to every invest ...

... basket labelled ‘shares’. Our best defence against not knowing the unknowable is to diversify our investments as widely as possible, take enough risk in our portfolios to enable us to meet our clients’ return objectives and, to as much as possible, fully understand the risks attached to every invest ...

after-tax returns: methodology for computing

... The Initial Cost-Basis and Market Value of the Shadow Benchmark At account inception, we assign the shadow benchmark the same market value and cost basis as the actual portfolio. For a portfolio incepted from cash, the shadow benchmark’s cost basis and market value will be the same, and will equal t ...

... The Initial Cost-Basis and Market Value of the Shadow Benchmark At account inception, we assign the shadow benchmark the same market value and cost basis as the actual portfolio. For a portfolio incepted from cash, the shadow benchmark’s cost basis and market value will be the same, and will equal t ...

assessing a business

... Who is interested in the accounts of a business? Profitability ratios Liquidity ratios Activity ratios Dividend policy How to structure your answer ...

... Who is interested in the accounts of a business? Profitability ratios Liquidity ratios Activity ratios Dividend policy How to structure your answer ...

Be Careful of What You Think You Know

... forcing the ECB to buy longer maturities. Additionally, national finance ministries are issuing longer dated securities in this environment, which has the effect of increasing the duration — or interest rate sensitivity — of benchmark bond indices. Investors are being pushed further out the curve, a ...

... forcing the ECB to buy longer maturities. Additionally, national finance ministries are issuing longer dated securities in this environment, which has the effect of increasing the duration — or interest rate sensitivity — of benchmark bond indices. Investors are being pushed further out the curve, a ...

PSG Global Equity Feeder Fund Class A

... Emerging markets also ended two years of underperformance and returned 18.55% year to date. (All returns quoted in US dollars.) This does not necessarily mean that all markets and all market sectors had an easy year. Value stocks, which outperformed last year on the back of higher growth, inflation ...

... Emerging markets also ended two years of underperformance and returned 18.55% year to date. (All returns quoted in US dollars.) This does not necessarily mean that all markets and all market sectors had an easy year. Value stocks, which outperformed last year on the back of higher growth, inflation ...

Advertising Management and Visual Branding

... The advertising management is an important marketing tool in the contemporary business. It is responsible for the planning and overall organization of integrated campaigns targeting the customers (existing and potential) of one company. As customers are the focus, the advertising management starts w ...

... The advertising management is an important marketing tool in the contemporary business. It is responsible for the planning and overall organization of integrated campaigns targeting the customers (existing and potential) of one company. As customers are the focus, the advertising management starts w ...

Focused on Delivering Superior Investment Advice

... determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Stock investing involves risk including loss of p ...

... determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Stock investing involves risk including loss of p ...

The case for multi asset investment

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

Rockcastle global real estate company R ockcastle Global Real

... mandate. Its investments may comprise global real estate securities, unlisted or over the counter real estate securities, other instruments derived from such real estate securities, and direct property assets (which the company will both own and manage). The latter include commercial property develo ...

... mandate. Its investments may comprise global real estate securities, unlisted or over the counter real estate securities, other instruments derived from such real estate securities, and direct property assets (which the company will both own and manage). The latter include commercial property develo ...

Northern Trust Offers Innovative Historical Corporate Actions

... London, 17 August 2016 – Northern Trust (Nasdaq: NTRS) and SCORPEO today announce that they have entered into an agreement to use SCORPEO’s services to provide an innovative historical corporate actions reporting service, designed to help investors realize the full value in corporate actions. The No ...

... London, 17 August 2016 – Northern Trust (Nasdaq: NTRS) and SCORPEO today announce that they have entered into an agreement to use SCORPEO’s services to provide an innovative historical corporate actions reporting service, designed to help investors realize the full value in corporate actions. The No ...

Think active can`t outperform? Think again

... funds resulted from this primary screen. Net-of-fee performance from the oldest share class was used to provide the longest available return history for each fund. Mutual fund sales loads were not included in the calculations for the analysis. High active share funds may potentially be more expensiv ...

... funds resulted from this primary screen. Net-of-fee performance from the oldest share class was used to provide the longest available return history for each fund. Mutual fund sales loads were not included in the calculations for the analysis. High active share funds may potentially be more expensiv ...