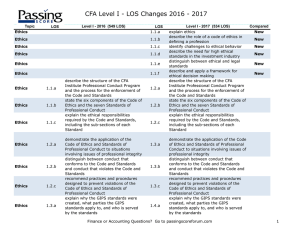

CFA Level I - LOS Changes 2016 - 2017

... compliance describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS stan ...

... compliance describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS stan ...

Refinancing Pressure and Earnings Management

... violations have been explored. Additionally, there is evidence that firms manage earnings prior to seasoned equity issues (e.g., Kim and Park 2005, Cohen and Zarowin 2010, Teoh et al. 1998) and public debt issues (Liu et al. 2010). We attempt to bring together these different strands of literature ...

... violations have been explored. Additionally, there is evidence that firms manage earnings prior to seasoned equity issues (e.g., Kim and Park 2005, Cohen and Zarowin 2010, Teoh et al. 1998) and public debt issues (Liu et al. 2010). We attempt to bring together these different strands of literature ...

CHAPTER I Global Investment Trends

... global macroeconomic environment, which was dominated by slowing growth in emerging markets and a sharp decline in commodity prices. The principal explanation for this seeming inconsistency was a surge in cross-border M&As, especially in developed economies. Although FDI through cross-border M&As ca ...

... global macroeconomic environment, which was dominated by slowing growth in emerging markets and a sharp decline in commodity prices. The principal explanation for this seeming inconsistency was a surge in cross-border M&As, especially in developed economies. Although FDI through cross-border M&As ca ...

Focus Point_focus point

... The Malaysian Gross Domestic Products (GDP) grew 4.7% in 2013 compared with 5.6% in 2012. Malaysia’s growth was driven by domestic demand, through public spending supported by private consumption and investment. The national economy is expected to remain resilient at above 5% mark in 2014, backed by ...

... The Malaysian Gross Domestic Products (GDP) grew 4.7% in 2013 compared with 5.6% in 2012. Malaysia’s growth was driven by domestic demand, through public spending supported by private consumption and investment. The national economy is expected to remain resilient at above 5% mark in 2014, backed by ...

Optimal Asset Location and Allocation with Taxable and Tax

... the taxable account allocated to equity can exceed 100% (i.e., a levered equity position) at high levels of tax-deferred wealth. When investors are prohibited from borrowing, the holding of equity in the taxable account is capped at 100%. In this case, we find that equity can spill over into the tax ...

... the taxable account allocated to equity can exceed 100% (i.e., a levered equity position) at high levels of tax-deferred wealth. When investors are prohibited from borrowing, the holding of equity in the taxable account is capped at 100%. In this case, we find that equity can spill over into the tax ...

THE OUTSOURCING OF FINANCIAL REGULATION TO RISK

... Abstract: The widespread use of computer-based risk models in the financial industry during the last two decades enabled the marketing of more complex financial products to consumers, the growth of securitization and derivatives, and the development of sophisticated risk-management strategies by fin ...

... Abstract: The widespread use of computer-based risk models in the financial industry during the last two decades enabled the marketing of more complex financial products to consumers, the growth of securitization and derivatives, and the development of sophisticated risk-management strategies by fin ...

Relative Wealth Concerns and Financial Bubbles

... equilibrium for the above setting: the risky security is not traded, and has a price equal to the price of the risk-free bond. Indeed, in a standard complete markets model this price is the only price consistent with the absence of aggregate risk in this economy, and we therefore refer to it as the ...

... equilibrium for the above setting: the risky security is not traded, and has a price equal to the price of the risk-free bond. Indeed, in a standard complete markets model this price is the only price consistent with the absence of aggregate risk in this economy, and we therefore refer to it as the ...

Presentation GMO Low Volatility Fundamentals

... Three routes to the permanent impairment of capital: ...

... Three routes to the permanent impairment of capital: ...

Differences in profitability between European dairy processing firms

... (operating in niche markets). The European dairy sector has changed towards a more concentrated market structure because of changes in the European Union. There is a decrease in the number of dairy firms, an increase in the number of cows per firm and an increase in the productivity of a cow. In the ...

... (operating in niche markets). The European dairy sector has changed towards a more concentrated market structure because of changes in the European Union. There is a decrease in the number of dairy firms, an increase in the number of cows per firm and an increase in the productivity of a cow. In the ...

Banking Industry Private Banking Specification of

... The industry has made significant steps forward. In view of the distinct nature of the clientele and operations of private banking businesses, the Hong Kong Monetary Authority (HKMA) issued a circular in 2012 4 to provide further clarification to private banks on the regulatory requirements governin ...

... The industry has made significant steps forward. In view of the distinct nature of the clientele and operations of private banking businesses, the Hong Kong Monetary Authority (HKMA) issued a circular in 2012 4 to provide further clarification to private banks on the regulatory requirements governin ...

Temperature, Aggregate Risk, and Expected Returns

... data on global capital markets and a cross-section of commonly used US stock portfolios, we find that the risk-exposure of these returns to temperature shocks, that is their temperature beta, is a highly significant variable in accounting for cross-sectional differences in expected returns. Second, ...

... data on global capital markets and a cross-section of commonly used US stock portfolios, we find that the risk-exposure of these returns to temperature shocks, that is their temperature beta, is a highly significant variable in accounting for cross-sectional differences in expected returns. Second, ...

EFFECT OF DIVIDENDS ON STOCK PRICES Effect of Dividends on

... question whether dividend policy affects stock prices still remains debatable among managers, policy makers and researchers for many years. Dividend policy is important for investors, managers, lenders and for other stakeholders. It is important for investors because investors consider dividends not ...

... question whether dividend policy affects stock prices still remains debatable among managers, policy makers and researchers for many years. Dividend policy is important for investors, managers, lenders and for other stakeholders. It is important for investors because investors consider dividends not ...

2015 EUROPEAN HOTEL TRANSACTIONS

... There was a strong start to 2015, as the first and second quarters were more active than in 2014. The highest transaction activity was recorded in the fourth quarter of 2015, and this quarter represents more than a third of the year’s total transaction volume, mainly driven by the sale of the Holida ...

... There was a strong start to 2015, as the first and second quarters were more active than in 2014. The highest transaction activity was recorded in the fourth quarter of 2015, and this quarter represents more than a third of the year’s total transaction volume, mainly driven by the sale of the Holida ...

Asset Prices and Monetary Policy: Booms and Fat Tails in East Asia

... characteristics of the data and examines the empirical distributions of both real output- and price-level gaps and identifies asset boom periods. Section 3 is the heart of the study, while the conclusions of the study and possible implications for the conduct of monetary policy are presented in Sect ...

... characteristics of the data and examines the empirical distributions of both real output- and price-level gaps and identifies asset boom periods. Section 3 is the heart of the study, while the conclusions of the study and possible implications for the conduct of monetary policy are presented in Sect ...

RYDER SYSTEM INC (Form: 8-K, Received: 05/19

... forward-looking statements should be evaluated with consideration given to the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences inclu ...

... forward-looking statements should be evaluated with consideration given to the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences inclu ...

Financial Ratio Medians-2015.indd

... from turnover in both the numerator and denominator. This means figures from the Statement of Cash Flows are needed. Net turnover-related entrance fees are the cash flows associated with residents moving into previously occupied units. By comparing the results of this ratio to the NOM, the user can ...

... from turnover in both the numerator and denominator. This means figures from the Statement of Cash Flows are needed. Net turnover-related entrance fees are the cash flows associated with residents moving into previously occupied units. By comparing the results of this ratio to the NOM, the user can ...

The Joint Money Laundering Steering Group

... businesses are often, but not always, UK-based in terms of ownership, location of premises and customers. As such, the risk profile may actually be lower than that of larger businesses with a more diverse customer base or product offering, which may include international business and customers. The ...

... businesses are often, but not always, UK-based in terms of ownership, location of premises and customers. As such, the risk profile may actually be lower than that of larger businesses with a more diverse customer base or product offering, which may include international business and customers. The ...

This PDF is a selection from a published volume from the National Bureau of Economic Research

... of payments reported by the countries to the International Monetary Fund (IMF). In addition, we report results on a possible relationship between corruption and the maturity structure of foreign borrowing, and between corruption and a country’s ability to borrow internationally in its own currency. ...

... of payments reported by the countries to the International Monetary Fund (IMF). In addition, we report results on a possible relationship between corruption and the maturity structure of foreign borrowing, and between corruption and a country’s ability to borrow internationally in its own currency. ...

Pillar 3 Disclosures Quantitative Disclosures As at 31

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

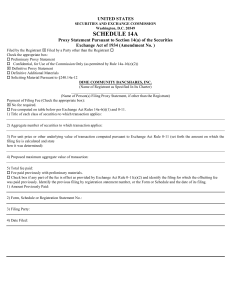

DIME COMMUNITY BANCSHARES INC

... The Company's Board of Directors has fixed the close of business on March 30, 2015 as the record date for the determination o f shareholders entitled to notice of, and to vote at, the Annual Meeting (the "Record Date"). Accordingly, only holders of record of shares of Common Stock at the close of bu ...

... The Company's Board of Directors has fixed the close of business on March 30, 2015 as the record date for the determination o f shareholders entitled to notice of, and to vote at, the Annual Meeting (the "Record Date"). Accordingly, only holders of record of shares of Common Stock at the close of bu ...

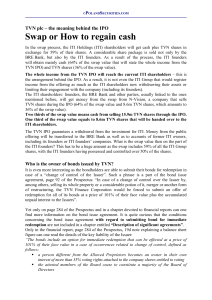

TVN plc – the meaning behind the IPO

... the creditor and the issuer, such as the former being an important shareholder of the latter. The nonexistent liquidity of bonds at the Luxembourg stock exchange once again draws attention to the commission assigned for “acquisition of financing”. Drawing up the Prospectus could not have cost 75m PL ...

... the creditor and the issuer, such as the former being an important shareholder of the latter. The nonexistent liquidity of bonds at the Luxembourg stock exchange once again draws attention to the commission assigned for “acquisition of financing”. Drawing up the Prospectus could not have cost 75m PL ...

The Declining Equity Premium: What Role Does Macroeconomic

... were not a¤ected by this fundamental change in the structure of macroeconomic volatility. Consistent with this, we …nd that volatility in consumption is highly correlated with ‡uctuations in the aggregate dividend-price ratio over longer horizons. This phenomenon is not merely a feature of postwar U ...

... were not a¤ected by this fundamental change in the structure of macroeconomic volatility. Consistent with this, we …nd that volatility in consumption is highly correlated with ‡uctuations in the aggregate dividend-price ratio over longer horizons. This phenomenon is not merely a feature of postwar U ...

Firm-specific attributes and the cross-section of

... second drug therefore contributes little to the overall value of the firm and news about potential future demand for the second drug has little effect on the firm’s value. If the second drug makes it to advanced stages of development, the value of the overall firm increases because cash flows from marke ...

... second drug therefore contributes little to the overall value of the firm and news about potential future demand for the second drug has little effect on the firm’s value. If the second drug makes it to advanced stages of development, the value of the overall firm increases because cash flows from marke ...