T-Fit: Financially Fit Taking Control of your Retirement

... you need to take at least a little control of your portfolio. – Analyze where you are at with your retirement. What return do you need to earn and how much do you need to invest to be able to be comfortable in the future. – Make sure your portfolio has an expected return high enough to get you there ...

... you need to take at least a little control of your portfolio. – Analyze where you are at with your retirement. What return do you need to earn and how much do you need to invest to be able to be comfortable in the future. – Make sure your portfolio has an expected return high enough to get you there ...

Chapter 2--Classical Approaches

... 25. Fayol suggests that employees should be rewarded for their work with appropriate salaries and benefits. This is the principle of ____________________. remuneration of personnel ...

... 25. Fayol suggests that employees should be rewarded for their work with appropriate salaries and benefits. This is the principle of ____________________. remuneration of personnel ...

explanatory statement

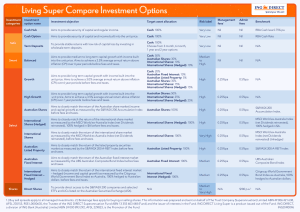

... 1 July 2007, depending on the product and particular situation. This timetable aligns ‘common fund’ disclosure with the commencement dates for the ‘enhanced fee disclosure regulations’. Specifically, items 3 and 4 of the table provide relief to all financial products other than superannuation produc ...

... 1 July 2007, depending on the product and particular situation. This timetable aligns ‘common fund’ disclosure with the commencement dates for the ‘enhanced fee disclosure regulations’. Specifically, items 3 and 4 of the table provide relief to all financial products other than superannuation produc ...

NBER WORKING PAPER SERIES FINANCIAL FRICTIONS, INVESTMENT AND TOBIN'S Q Guido Lorenzoni

... returns and market power help to generate realistic correlations, while financial frictions do not.6 In this paper we show that the second conclusion is unwarranted, and depends on the way one models the financial constraint. On the other hand, there are some parallels between our approach and these ...

... returns and market power help to generate realistic correlations, while financial frictions do not.6 In this paper we show that the second conclusion is unwarranted, and depends on the way one models the financial constraint. On the other hand, there are some parallels between our approach and these ...

Interpreting the facts - Principal Global Investors

... Sharing economy enterprises such as Airbnb and Uber are one part of the story, but comparable system development makes usage of the capital stock elsewhere in industry more intensive. Accordingly, the economy becomes less capital intensive. If my assertion turns out to be true, it would seem likely ...

... Sharing economy enterprises such as Airbnb and Uber are one part of the story, but comparable system development makes usage of the capital stock elsewhere in industry more intensive. Accordingly, the economy becomes less capital intensive. If my assertion turns out to be true, it would seem likely ...

Notes on Finite State Approach to Modern Portfolio

... Underlying all of modern finance is the idea of diversification. Holding a diversified collection of assets permits an investor to better control risk and, for a given level of risk, achieve better investment performance. But what, in theory and in practice, is diversification? How does one diversif ...

... Underlying all of modern finance is the idea of diversification. Holding a diversified collection of assets permits an investor to better control risk and, for a given level of risk, achieve better investment performance. But what, in theory and in practice, is diversification? How does one diversif ...

Topic Note-3

... infinity. It is important to remember that (5) is true only if the underlying assumption of a constant growth rate in dividends is true (which is often not the case). The above formula assumes that we know r and g, and want to find the price P 0. If we do not know g, we have to make additional assum ...

... infinity. It is important to remember that (5) is true only if the underlying assumption of a constant growth rate in dividends is true (which is often not the case). The above formula assumes that we know r and g, and want to find the price P 0. If we do not know g, we have to make additional assum ...

Corporate Finance II Course for the Master`s Level Course

... Master Program in Economics Department of NSU in order to equip them with a framework and basic tools and techniques necessary to understand and make financial and investment decisions. This course examines important issues in corporate finance from the perspective of financial managers who are resp ...

... Master Program in Economics Department of NSU in order to equip them with a framework and basic tools and techniques necessary to understand and make financial and investment decisions. This course examines important issues in corporate finance from the perspective of financial managers who are resp ...

report to the board of governors subject endowment funds

... Gift, including the continuing eligibility of a person to hold an award or to obtain a renewal thereof, as well as any matters relating to the investment, management, use or administration of the Fund will be made in accordance with the Policies. If, as a result of the Donor’s wishes or other circum ...

... Gift, including the continuing eligibility of a person to hold an award or to obtain a renewal thereof, as well as any matters relating to the investment, management, use or administration of the Fund will be made in accordance with the Policies. If, as a result of the Donor’s wishes or other circum ...

A new architecture for public investment in Europe

... time after the trough of the crisis, whereas in the US it recouped and has now overtaken its precrisis level. The poor dynamics of European investment in recent years are even more striking when expressed in terms of GDP (see Figure 2). In stark contrast with the US, private investment in Europe fel ...

... time after the trough of the crisis, whereas in the US it recouped and has now overtaken its precrisis level. The poor dynamics of European investment in recent years are even more striking when expressed in terms of GDP (see Figure 2). In stark contrast with the US, private investment in Europe fel ...

MARKET AND ECONOMIC OUTLOOK 2016 Ends Mostly Strong

... Financial information is from third party sources. Such information is believed to be reliable but is not verified or guaranteed. Performances from any indices in this report are presented without factoring fees or charges, and are provided for reference and competitive purposes only. Any fees, char ...

... Financial information is from third party sources. Such information is believed to be reliable but is not verified or guaranteed. Performances from any indices in this report are presented without factoring fees or charges, and are provided for reference and competitive purposes only. Any fees, char ...

Risk Management and Your Retirement Savings Plan

... Know your personal risk tolerance How much risk are you willing to take to pursue your savings goal? Gauging your personal risk tolerance--or your ability to endure losses in your account due to swings in the market--is an important step in your risk management strategy. Because all investments invo ...

... Know your personal risk tolerance How much risk are you willing to take to pursue your savings goal? Gauging your personal risk tolerance--or your ability to endure losses in your account due to swings in the market--is an important step in your risk management strategy. Because all investments invo ...

Sample Endowment Fund policy

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

product differentiation

... exploitable advantage over the firm. Opportunities: environmental factors that favor the firm, include a growing market for the form’s products; the exit of a competitor; identification of a new market or product segment. Threats: are environmental factors that can hinder the firm in achieving its g ...

... exploitable advantage over the firm. Opportunities: environmental factors that favor the firm, include a growing market for the form’s products; the exit of a competitor; identification of a new market or product segment. Threats: are environmental factors that can hinder the firm in achieving its g ...

Why Hedge Funds? - CFA Institute Publications

... assets under management. Even under a very conservative estimate, only a small minority of funds could possibly afford this necessary expense given the fees they charge. There are important economies of scale in the business of managing funds of hedge funds. This fact alone might explain the disappo ...

... assets under management. Even under a very conservative estimate, only a small minority of funds could possibly afford this necessary expense given the fees they charge. There are important economies of scale in the business of managing funds of hedge funds. This fact alone might explain the disappo ...

can the earning-price ratio explain the cross

... into account that the CAPM is untestable per se– the mean-variance efficiency of the valueweighted stock market index for the period 1963–1982. Moreover, he finds size effect which is especially pronounced in January. Marhuenda (1997) also concludes that there is size effect in Spain using 1963-1991 ...

... into account that the CAPM is untestable per se– the mean-variance efficiency of the valueweighted stock market index for the period 1963–1982. Moreover, he finds size effect which is especially pronounced in January. Marhuenda (1997) also concludes that there is size effect in Spain using 1963-1991 ...

You Can See Where This is Going

... Life was abjectly miserable for almost everyone 300 years ago. And misery in your own life limits how much mental bandwidth you have for sympathy toward others. Animal welfare barely registered as relevant when the health of your own children was so tenuous, and famine and plague lurked around every ...

... Life was abjectly miserable for almost everyone 300 years ago. And misery in your own life limits how much mental bandwidth you have for sympathy toward others. Animal welfare barely registered as relevant when the health of your own children was so tenuous, and famine and plague lurked around every ...

Answers to Workshop 9

... curves get less and less steep). Eventually all the new investment is taken up with replacing worn-out capital (it all goes on depreciation) and national income stops rising. A steady state has been reached at Y1 and K1. (e) ...

... curves get less and less steep). Eventually all the new investment is taken up with replacing worn-out capital (it all goes on depreciation) and national income stops rising. A steady state has been reached at Y1 and K1. (e) ...

Chapter 2: The Data of Macroeconomics

... If q > 1, firms buy more capital to raise the market value of their firms ...

... If q > 1, firms buy more capital to raise the market value of their firms ...

The case of Lithuania

... • Lithuania: small country, therefore its economy is comparatively more dependent on export; • Thus, the economic situation is highly dependent on the demand in export markets; • At the same time, import is rather inflexible: Lithuania imports almost 90% of primary energy; ...

... • Lithuania: small country, therefore its economy is comparatively more dependent on export; • Thus, the economic situation is highly dependent on the demand in export markets; • At the same time, import is rather inflexible: Lithuania imports almost 90% of primary energy; ...

FREE Sample Here - We can offer most test bank and

... What are some of the external and internal factors that affect a firm’s stock price? What is the difference between these two types of factors? External factors that affect the firm’s stock price are: (1) economic shocks, such as natural disasters or wars, (2) the state of the economy, such as the l ...

... What are some of the external and internal factors that affect a firm’s stock price? What is the difference between these two types of factors? External factors that affect the firm’s stock price are: (1) economic shocks, such as natural disasters or wars, (2) the state of the economy, such as the l ...

Planview Enterprise for Application Portfolio Management

... requirements, IT organizations have become the stewards of large and complex application environments. According to top industry analysts, costs to maintain corporate applications have skyrocketed and are consuming the IT budget. The overwhelming recommendation is that organizations need to become m ...

... requirements, IT organizations have become the stewards of large and complex application environments. According to top industry analysts, costs to maintain corporate applications have skyrocketed and are consuming the IT budget. The overwhelming recommendation is that organizations need to become m ...

Memo - Amendments to Banking Law

... of all principal shareholders (and, when such shareholders are corporations, also the qualifications of directors, statutory auditors and officers thereof) of securities firms. While this change will increase the regulatory burden for principal shareholders, it is anticipated that it will also enhan ...

... of all principal shareholders (and, when such shareholders are corporations, also the qualifications of directors, statutory auditors and officers thereof) of securities firms. While this change will increase the regulatory burden for principal shareholders, it is anticipated that it will also enhan ...