Current - Insurance Gateway

... Overview of changes to the ASISA fund classification structure – Effective 1 January 2013 ...

... Overview of changes to the ASISA fund classification structure – Effective 1 January 2013 ...

Variable Insurance and Investment Products

... in the gains of your contract every several years. This death benefit “step-up” can protect your beneficiary during periods of market decline. ...

... in the gains of your contract every several years. This death benefit “step-up” can protect your beneficiary during periods of market decline. ...

Monthly Review Global Real Estate Securities

... publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients. No legal or tax advice is provided. Recipients should independently evaluate specific investments and trading strategies. By accepting receipt of this publicatio ...

... publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients. No legal or tax advice is provided. Recipients should independently evaluate specific investments and trading strategies. By accepting receipt of this publicatio ...

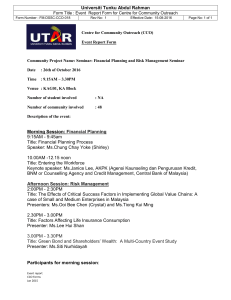

Financial Planning and Risk Management Seminar

... non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in short term (saving account, fixed deposits) or long term (stocks, bonds, mutual ...

... non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in short term (saving account, fixed deposits) or long term (stocks, bonds, mutual ...

Jerry Skees

... Model had ability to forecast national yields with insample and out-of-sample data When regional weather 10 day forecast were added, the model improved the forecasting ability and the ability to make the early call on national crop yield (late June) Air World-wide has such modelling services to U.S ...

... Model had ability to forecast national yields with insample and out-of-sample data When regional weather 10 day forecast were added, the model improved the forecasting ability and the ability to make the early call on national crop yield (late June) Air World-wide has such modelling services to U.S ...

Look inside a PRE-study booklet

... The IPS establishes “RR TTLLU” --> Risk, Return, Taxes, Timeline, Liquidity, Legal, and Unique circumstances Assessing a client’s risk tolerance is a critical step in developing the Investment Policy Statement. The primary goal is to understand an investor’s attitude toward risk so that an appropria ...

... The IPS establishes “RR TTLLU” --> Risk, Return, Taxes, Timeline, Liquidity, Legal, and Unique circumstances Assessing a client’s risk tolerance is a critical step in developing the Investment Policy Statement. The primary goal is to understand an investor’s attitude toward risk so that an appropria ...

PML_Paper3_Financial Risk

... Another class of financial instruments that is generally considered to involve low risks contains equity securities, more commonly called shares or stocks. The stock market is very similar to the bond market, in that its main function is to supply capital, albeit in this case only to corporations a ...

... Another class of financial instruments that is generally considered to involve low risks contains equity securities, more commonly called shares or stocks. The stock market is very similar to the bond market, in that its main function is to supply capital, albeit in this case only to corporations a ...

UK FUNDS MARKET PRACTICE GROUP INVESTMENT

... June 2012 - Version 1.0 – The original portfolio transfer market practice based on the 2007 ISO messages covering ISAs and funds. This will be deprecated in November 2013. October 2012 – Version 2.0 – An extension of the original market practice, based on the 2007 ISO messages and extended for pensi ...

... June 2012 - Version 1.0 – The original portfolio transfer market practice based on the 2007 ISO messages covering ISAs and funds. This will be deprecated in November 2013. October 2012 – Version 2.0 – An extension of the original market practice, based on the 2007 ISO messages and extended for pensi ...

GLOBAL MARKETING MANAGEMENT

... According to Standard & Poor’s Global Insight, world exports of goods and services will reach $11.4 trillion by 2005 (24% of world GDP). The net result of these factors has been the increased interdependence of countries/economies and increased competitiveness. Consumers and companies in the U.S. an ...

... According to Standard & Poor’s Global Insight, world exports of goods and services will reach $11.4 trillion by 2005 (24% of world GDP). The net result of these factors has been the increased interdependence of countries/economies and increased competitiveness. Consumers and companies in the U.S. an ...

U.S. Small Caps: Outperformers during Rising Rate Environments

... Well-diversified portfolios allocate across asset types, capitalisation ranges, and industry sectors. This paper does not advocate allocating to one asset class over any other. Instead, it provides insight into considerations important to allocation decisions regarding U.S. small-cap stocks. While t ...

... Well-diversified portfolios allocate across asset types, capitalisation ranges, and industry sectors. This paper does not advocate allocating to one asset class over any other. Instead, it provides insight into considerations important to allocation decisions regarding U.S. small-cap stocks. While t ...

Later-Stage Growth Companies

... manufacturing capacity, and expand its distribution area and customer base. The Crowley family founded Polar Beverages in 1916 and has been the primary owner and operator of the business since its inception. Prior to the acquisition, the family had led the company through tremendous organic growth. ...

... manufacturing capacity, and expand its distribution area and customer base. The Crowley family founded Polar Beverages in 1916 and has been the primary owner and operator of the business since its inception. Prior to the acquisition, the family had led the company through tremendous organic growth. ...

1 Introduction 2 Analytical Framework

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

Accounting vs. Market-based Measures of Firm Performance

... financial statements to check whether they have materially departed from the requirements of an accounting standard. Indeed, the ASB has demanded that the financial statements include the assessment of the stewardship of the management. This conceptual exposition of accounting defines the objective ...

... financial statements to check whether they have materially departed from the requirements of an accounting standard. Indeed, the ASB has demanded that the financial statements include the assessment of the stewardship of the management. This conceptual exposition of accounting defines the objective ...

Helping CTAs Blossom in Today`s Competitive Environment (Oct

... momentum of the stock market rebound. However, today, volatility is on the rise in traditional asset classes and a stronger managed futures industry has emerged from the difficulties of the last period. In my opinion, this combination of factors can contribute to superior performance going forward. ...

... momentum of the stock market rebound. However, today, volatility is on the rise in traditional asset classes and a stronger managed futures industry has emerged from the difficulties of the last period. In my opinion, this combination of factors can contribute to superior performance going forward. ...

FA2: Module 9 Tangible and intangible capital assets

... Principle: An economic entity cannot earn a profit by selling to itself. From an economic point of view, affiliated companies are (at least partly) a single entity. Investor company cannot earn a profit simply by transferring assets to or from investee. Profits are earned only by selling to an exter ...

... Principle: An economic entity cannot earn a profit by selling to itself. From an economic point of view, affiliated companies are (at least partly) a single entity. Investor company cannot earn a profit simply by transferring assets to or from investee. Profits are earned only by selling to an exter ...

Corporate Bond Research

... regarded as a benchmark for a company’s overall economic success in a given accounting period. Unlike EBITDA, earnings after tax are not adjusted for exceptional factors. The return on equity (annual earnings/equity) in turn is used by the analyst as a gauge of the economic success of the capital em ...

... regarded as a benchmark for a company’s overall economic success in a given accounting period. Unlike EBITDA, earnings after tax are not adjusted for exceptional factors. The return on equity (annual earnings/equity) in turn is used by the analyst as a gauge of the economic success of the capital em ...

Dynamic portfolio and mortgage choice for homeowners

... Research Agenda • For many investors, house is largest asset, and mortgage largest liability • Research questions – How does optimal financial portfolio depend on housing tenure and size? – What mortgage type to finance your house? – How to hedge house price/future housing cost risk? – When to own, ...

... Research Agenda • For many investors, house is largest asset, and mortgage largest liability • Research questions – How does optimal financial portfolio depend on housing tenure and size? – What mortgage type to finance your house? – How to hedge house price/future housing cost risk? – When to own, ...

Chapt17

... news about technological progress and long-run economic growth. This implies that aggregate supply and full-employment output will be expanding more slowly than people had expected. ...

... news about technological progress and long-run economic growth. This implies that aggregate supply and full-employment output will be expanding more slowly than people had expected. ...

Tangible Capital Asset Policy - Asset Management Saskatchewan

... The municipality does not capital interest costs incurred during the construction or development of TCA. ...

... The municipality does not capital interest costs incurred during the construction or development of TCA. ...

2017 IBA Mega Conference - Indiana Bankers Association

... • More stable cashflow (less call/prepay risk) • Longer Durations • Larger percentage of assets in bonds ...

... • More stable cashflow (less call/prepay risk) • Longer Durations • Larger percentage of assets in bonds ...

State and Local Government Accounting Principles

... More complex if cash or encumbrance budgeting is required ...

... More complex if cash or encumbrance budgeting is required ...