The U.S. Current Account Balance

... • In addition, U.S. multinational corporations sometimes over-invoice impart bills or under-report export earnings to reduce their tax obligations – worked to overstate the recorded current account deficit ...

... • In addition, U.S. multinational corporations sometimes over-invoice impart bills or under-report export earnings to reduce their tax obligations – worked to overstate the recorded current account deficit ...

Alternative Investment Fund Managers Directive

... Id. (detailing an example of how onerous the reporting may be to qualify for a passport, the author notes that Annex IV requires “at least three hundred points of reference data and other risk metrics . . . .”) ...

... Id. (detailing an example of how onerous the reporting may be to qualify for a passport, the author notes that Annex IV requires “at least three hundred points of reference data and other risk metrics . . . .”) ...

The Stock Market Game

... Unlike the Wonka Chocolate Factory most companies are public companies that sell shares of the company called stock to people called investors. Stock allows investors to share ownership in a company with others. In a publicly traded company, an investor will choose to buy stock in a particular compa ...

... Unlike the Wonka Chocolate Factory most companies are public companies that sell shares of the company called stock to people called investors. Stock allows investors to share ownership in a company with others. In a publicly traded company, an investor will choose to buy stock in a particular compa ...

The market price of mortality risk

... In practice the standard deviation of aggregate claims cost is a fraction of the average aggregate claims cost, so that the level of required reserves differs little with the probability of adequacy. Hence a suitable reserve level can be ...

... In practice the standard deviation of aggregate claims cost is a fraction of the average aggregate claims cost, so that the level of required reserves differs little with the probability of adequacy. Hence a suitable reserve level can be ...

Equity One Announces its Interest in Acquiring DIM VASTGOED NV

... drug store-anchored shopping centers, 45 retail-anchored shopping centers, eight development parcels and four commercial properties, as well as a non-controlling interest in one unconsolidated joint venture. For additional information, please visit our web site at http://www.equityone.net. Forward L ...

... drug store-anchored shopping centers, 45 retail-anchored shopping centers, eight development parcels and four commercial properties, as well as a non-controlling interest in one unconsolidated joint venture. For additional information, please visit our web site at http://www.equityone.net. Forward L ...

The Effect of Credit Risk on Stock Returns

... stocks in several industries. Examples of idiosyncratic risk are a new competitor, a management change or a product recall. In contrast, systematic risk is the risk related to the entire market, not just a particular firm or industry. Systematic risk is unpredictable and cannot be avoided completely ...

... stocks in several industries. Examples of idiosyncratic risk are a new competitor, a management change or a product recall. In contrast, systematic risk is the risk related to the entire market, not just a particular firm or industry. Systematic risk is unpredictable and cannot be avoided completely ...

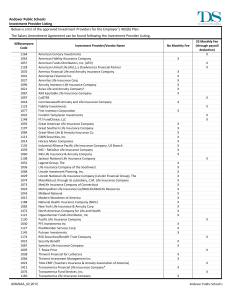

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

Multi-Factor Models of Risk for Fixed Income Portfolios

... Decoupled Macro (overall plan) vs. Micro (Portfolio) Macro: Highest risk-adjusted return via asset allocation Micro: Focus on highest return but often ignore incremental risk (stock picking) No Integrated Risk Management Static Approach Using Forecast Returns Relies on historical volatiliti ...

... Decoupled Macro (overall plan) vs. Micro (Portfolio) Macro: Highest risk-adjusted return via asset allocation Micro: Focus on highest return but often ignore incremental risk (stock picking) No Integrated Risk Management Static Approach Using Forecast Returns Relies on historical volatiliti ...

REVOLUTION

... riences phases of evolution and revolution is closely related to the market environment of its industry. For example, a company in a rapidly expanding market will have to add employees quickly; hence, the need for new organizational structures to accommodate large staff increases is accelerated. Whe ...

... riences phases of evolution and revolution is closely related to the market environment of its industry. For example, a company in a rapidly expanding market will have to add employees quickly; hence, the need for new organizational structures to accommodate large staff increases is accelerated. Whe ...

Financial Accounting: Assets Question 1 (30 marks) Multiple choice

... significant influence over the operations of the investee are called strategic investments. c. 3) A held for trading financial asset is defined as one that was acquired principally for the purpose of generating profit from short-term fluctuations in price. d. 3) A company controlled by an investor i ...

... significant influence over the operations of the investee are called strategic investments. c. 3) A held for trading financial asset is defined as one that was acquired principally for the purpose of generating profit from short-term fluctuations in price. d. 3) A company controlled by an investor i ...

The Facts about Fossil Fuel Divestment

... therefore be profitable in the longterm, not just the shortterm. Responsible Investment mitigates longterm risk by identifying potential environmental, social, and governance (ESG) risks before they become portfolio risks. Consider the BP oil spill and the Fukushima nuclear disaster; these cata ...

... therefore be profitable in the longterm, not just the shortterm. Responsible Investment mitigates longterm risk by identifying potential environmental, social, and governance (ESG) risks before they become portfolio risks. Consider the BP oil spill and the Fukushima nuclear disaster; these cata ...

ijcrb.webs.com 732 FINANCIAL PERFORMANCE OF NON

... assets growth rate. Assets showed a negative growth in FY09. The reason for this negative growth rate is the mutual funds because it has an ample share in assets around 47.9 percent. Mutual funds have been showing a very good performance for last many years and its net assets had reached at a very h ...

... assets growth rate. Assets showed a negative growth in FY09. The reason for this negative growth rate is the mutual funds because it has an ample share in assets around 47.9 percent. Mutual funds have been showing a very good performance for last many years and its net assets had reached at a very h ...

Are Markets Efficient - NYU Stern School of Business

... nickel on any of these supposed market inefficiencies. An inefficiency ought to be an exploitable opportunity. If there’s nothing investors can exploit in a systematic way, time and time out, then it’s very hard to say that information is not being properly incorporated into stock prices. Real money ...

... nickel on any of these supposed market inefficiencies. An inefficiency ought to be an exploitable opportunity. If there’s nothing investors can exploit in a systematic way, time and time out, then it’s very hard to say that information is not being properly incorporated into stock prices. Real money ...

The Adequacy of Investment Choices Offered By 401(k) Plans Edwin

... the portfolios they can hold. What choices should a corporation offer to plan participants? For those participants for whom 401(k) investments are their sole financial assets, the corporation should offer a sufficient set of investment alternatives so that the investor could construct the same effic ...

... the portfolios they can hold. What choices should a corporation offer to plan participants? For those participants for whom 401(k) investments are their sole financial assets, the corporation should offer a sufficient set of investment alternatives so that the investor could construct the same effic ...

C. Mon. Sept. 30--STOCK MARKET GAME PACKET FALL 2013

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

what the fed liftoff means for the us dollar and stocks

... Brothers, Bear Stearns, and Washington Mutual were major world banks. Given that it’s been so long since the Federal Reserve last raised interest rates, we wanted to examine the historical performance of the US dollar and US equities when the Fed embarked on rising interest rate cycles in the past. ...

... Brothers, Bear Stearns, and Washington Mutual were major world banks. Given that it’s been so long since the Federal Reserve last raised interest rates, we wanted to examine the historical performance of the US dollar and US equities when the Fed embarked on rising interest rate cycles in the past. ...

Equities for Yield - Bermuda Investment Advisory Services

... At present GRA hovers slightly above the panic stage which tells us that stocks are reasonably valued (because sentiment remains only ‘somewhat’ negative) and that any deterioration in sentiment near term could result in a strong upward movement in the broad stock indices thereafter. Many stocks in ...

... At present GRA hovers slightly above the panic stage which tells us that stocks are reasonably valued (because sentiment remains only ‘somewhat’ negative) and that any deterioration in sentiment near term could result in a strong upward movement in the broad stock indices thereafter. Many stocks in ...

Theme 3

... The Bank of Italy in junction with AIFI, the Italian Association of Private Equity and Venture Capital, surveyed portfolio firms and intermediaries with the aim to collect detailed information about the structure of the operations, the characteristics of financed firms and of investment funds, the p ...

... The Bank of Italy in junction with AIFI, the Italian Association of Private Equity and Venture Capital, surveyed portfolio firms and intermediaries with the aim to collect detailed information about the structure of the operations, the characteristics of financed firms and of investment funds, the p ...

Active or Passive

... funds in this study to reduce survivorship bias: the tendency for mutual funds to be excluded from a database because they no longer exist. Mutual funds with poor performance tend to be dropped by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, wh ...

... funds in this study to reduce survivorship bias: the tendency for mutual funds to be excluded from a database because they no longer exist. Mutual funds with poor performance tend to be dropped by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, wh ...

Strategic Management Process

... means it never stops within an organization. • The term ‘iterative’ in the definiton of strategic management indicates that the process of strategic management starts with the first step, ends with the last step and then begins again with the first step. It consists of a series of steps that are rep ...

... means it never stops within an organization. • The term ‘iterative’ in the definiton of strategic management indicates that the process of strategic management starts with the first step, ends with the last step and then begins again with the first step. It consists of a series of steps that are rep ...