US marinas set to become `asset class`

... foremost to a healthy economy and increased interest in boating. Loanto-value ratios are typically in the 65% range, with the Small Business Administration in the 80% range. There has been a strong upswing in investment groups entering the investor demand for marinas here in the marketplace and acqu ...

... foremost to a healthy economy and increased interest in boating. Loanto-value ratios are typically in the 65% range, with the Small Business Administration in the 80% range. There has been a strong upswing in investment groups entering the investor demand for marinas here in the marketplace and acqu ...

What motivates entrepreneurs? - Business Economics and ICT

... You are given a lump some of money for your 18th birthday and there are numerous ways you would like to spend it. Do you buy a new i-pod? some new clothes? or put it towards a holiday with friends when you finish your examinations in the Summer? If you choose to put it towards a holiday with friends ...

... You are given a lump some of money for your 18th birthday and there are numerous ways you would like to spend it. Do you buy a new i-pod? some new clothes? or put it towards a holiday with friends when you finish your examinations in the Summer? If you choose to put it towards a holiday with friends ...

Not-for-profit organizations

... recorded as revenue in the same period as the related expense is recorded. • Under the restricted fund method, the not-for-profit organization creates, at least, a general fund and an ...

... recorded as revenue in the same period as the related expense is recorded. • Under the restricted fund method, the not-for-profit organization creates, at least, a general fund and an ...

“Strategic Valuation Applied: Real

... In order to beat the stock market, one must stay ahead of it. With all the information available to the public, where should investors look to find hidden signals for investment success? Besides the traditional stock research methods, what other strategy and models can smarter investors use? In this ...

... In order to beat the stock market, one must stay ahead of it. With all the information available to the public, where should investors look to find hidden signals for investment success? Besides the traditional stock research methods, what other strategy and models can smarter investors use? In this ...

chapter 11 powerpoint

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

L’avenir de l’Afrique et le soutien de la Banque mondiale

... the illicit diversion of funds, and capital flight ; Hiring an independent auditor to assess the oil companies’ performance vis-à-vis the stated agreements and ensuring that those agreements are in fact beneficial to Gabon; and Procuring World Bank Group advice and technical assistance to streng ...

... the illicit diversion of funds, and capital flight ; Hiring an independent auditor to assess the oil companies’ performance vis-à-vis the stated agreements and ensuring that those agreements are in fact beneficial to Gabon; and Procuring World Bank Group advice and technical assistance to streng ...

Derivatives-chapter1

... The second major event was the change in policy of the U.S. Federal Reserve Board to target its money managment operations based on money supply vs the actual level of rates U.S interest rates became much more volatile hence created interest rate risk With the prominance of U.S dollar fixed income ...

... The second major event was the change in policy of the U.S. Federal Reserve Board to target its money managment operations based on money supply vs the actual level of rates U.S interest rates became much more volatile hence created interest rate risk With the prominance of U.S dollar fixed income ...

Actuarial Methods for Valuing Illiquid Assets

... In summer 2010, the Joint Risk Management Section of the CAS/CIA/SOA and the SOA Committee on Finance Research issued a Request for Proposals – Actuarial Methods for Valuing Illiquid Assets (RFP). The RFP specified at least two components for the research, a literature review and a case study. In Ju ...

... In summer 2010, the Joint Risk Management Section of the CAS/CIA/SOA and the SOA Committee on Finance Research issued a Request for Proposals – Actuarial Methods for Valuing Illiquid Assets (RFP). The RFP specified at least two components for the research, a literature review and a case study. In Ju ...

an analysis of investor`s confidence and risk taking aptitude from the

... has in himself as compared to informal sources, control over his investments, risk taking ability, confidence of the investor as compared to formal sources such as financial analysts and advisors, expectation to perform better than the stock market, short-term investment attitude. These are some of ...

... has in himself as compared to informal sources, control over his investments, risk taking ability, confidence of the investor as compared to formal sources such as financial analysts and advisors, expectation to perform better than the stock market, short-term investment attitude. These are some of ...

Evaluating Asset Management firms by using the Divi- Ha Bui

... Some view investing in stock markets as gambling. However, there have been examples of investors who were able to beat the market by using different investment strategies. In Finland, previous studies have shown the ability of value-investing to earn higher returns compared to the market or to growt ...

... Some view investing in stock markets as gambling. However, there have been examples of investors who were able to beat the market by using different investment strategies. In Finland, previous studies have shown the ability of value-investing to earn higher returns compared to the market or to growt ...

Belgian business investment in the context of the crisis

... 0.98 ; investment was therefore highly pro-cyclical. The standard deviation of the investment growth percentage was roughly 4.3 times greater than that of GDP. This theory could therefore explain why Belgian business investment slumped from the third quarter of 2008, when business leaders saw a dete ...

... 0.98 ; investment was therefore highly pro-cyclical. The standard deviation of the investment growth percentage was roughly 4.3 times greater than that of GDP. This theory could therefore explain why Belgian business investment slumped from the third quarter of 2008, when business leaders saw a dete ...

Portfolio Budget Statement 2011-12 - Treasury

... outcome is: competition in markets that are dependent on access to nationally significant monopoly infrastructure, through recommendations and decisions promoting the efficient operation of, use of and investment in infrastructure. The Office of the Auditing and Assurance Standards Board’s mission i ...

... outcome is: competition in markets that are dependent on access to nationally significant monopoly infrastructure, through recommendations and decisions promoting the efficient operation of, use of and investment in infrastructure. The Office of the Auditing and Assurance Standards Board’s mission i ...

Asian US dollar bond market: China`s new

... of gross new supply and 72% of net new supply (new issuance minus maturing amount) (Figures 1 and 2). And while US and European investors once comprised half of the market’s investor base, Asian investors now regularly take up the bulk of new US dollar issuance in the region, with much of the absorp ...

... of gross new supply and 72% of net new supply (new issuance minus maturing amount) (Figures 1 and 2). And while US and European investors once comprised half of the market’s investor base, Asian investors now regularly take up the bulk of new US dollar issuance in the region, with much of the absorp ...

Risk, Return and Capital Budgeting

... In doing an NPV, IRR, or PI analysis, we need to have the relevant discount rate for our project. Now that we have a better understanding of the relation between expected return and risk, we can use this to develop an appropriate discount rate (cost of capital or opportunity cost of capital) for our ...

... In doing an NPV, IRR, or PI analysis, we need to have the relevant discount rate for our project. Now that we have a better understanding of the relation between expected return and risk, we can use this to develop an appropriate discount rate (cost of capital or opportunity cost of capital) for our ...

reducing costs in times of crisis: delivery forms in small and medium

... size for providing public services? (Andrews and Boyne 2009). The first major objective of the present study is to contribute to our understanding of this question. Could small and medium-sized local governments benefit more from providing waste collection services individually, or from working join ...

... size for providing public services? (Andrews and Boyne 2009). The first major objective of the present study is to contribute to our understanding of this question. Could small and medium-sized local governments benefit more from providing waste collection services individually, or from working join ...

RTF - Vornado Realty Trust

... In March 1995, the Company lent Alexander's $45 million, the subordinated tranche of a $75 million secured financing, the balance of which was funded by a bank. The Company's loan has a three-year term and bears interest at 16.43% per annum for the first two years and at a fixed rate for the third y ...

... In March 1995, the Company lent Alexander's $45 million, the subordinated tranche of a $75 million secured financing, the balance of which was funded by a bank. The Company's loan has a three-year term and bears interest at 16.43% per annum for the first two years and at a fixed rate for the third y ...

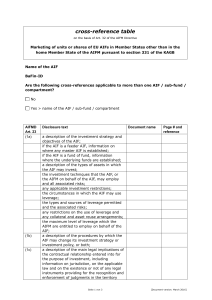

cross-reference table on the basis of Art. 32 of the AIFM Directive

... the identity of each delegate; any conflicts of interest that may arise from such delegations; a description of the AIF’s valuation procedure and of the pricing methodology for valuing assets, including the methods used in valuing hard-to-value assets in accordance with Article 19; a description of ...

... the identity of each delegate; any conflicts of interest that may arise from such delegations; a description of the AIF’s valuation procedure and of the pricing methodology for valuing assets, including the methods used in valuing hard-to-value assets in accordance with Article 19; a description of ...

Carroll, Archie B. The Pyramid of Corporate Social Responsibility

... exclusively on the notion of business obligation and motivation and that action or performance were being overlooked. The social responsiveness movement, therefore. emphasized corporate action, proaction, and implementation of a social role. This was indeed a necessary reorientation. The question st ...

... exclusively on the notion of business obligation and motivation and that action or performance were being overlooked. The social responsiveness movement, therefore. emphasized corporate action, proaction, and implementation of a social role. This was indeed a necessary reorientation. The question st ...

malta financial services authority

... clients such that they are reasonably able to understand the nature and risks of the Investment Service to be provided and of the specific type of instrument that is being offered, and consequently to take investment decisions on an informed basis. In addition, the appropriateness of the instrument ...

... clients such that they are reasonably able to understand the nature and risks of the Investment Service to be provided and of the specific type of instrument that is being offered, and consequently to take investment decisions on an informed basis. In addition, the appropriateness of the instrument ...

The Development of Collective Investment

... Collective Investment Schemes (CIS) refer to investment funds that pool together funds from a wide range of investors both retail and institutional to be invested in a number of different financial assets traded in the capital markets. Usually the CIS are managed by a regulated investment management ...

... Collective Investment Schemes (CIS) refer to investment funds that pool together funds from a wide range of investors both retail and institutional to be invested in a number of different financial assets traded in the capital markets. Usually the CIS are managed by a regulated investment management ...

Investment Promotion Manual

... The tourism-related investment laws and incentives are discussed in brief. Updating occurs together with the yearly revision of the Investment Priorities Plan (IPP) which lists the type of activities and areas extended incentives under Executive Order No. 226, otherwise known as the Omnibus Investme ...

... The tourism-related investment laws and incentives are discussed in brief. Updating occurs together with the yearly revision of the Investment Priorities Plan (IPP) which lists the type of activities and areas extended incentives under Executive Order No. 226, otherwise known as the Omnibus Investme ...

OTAS Technologies to integrate cutting

... and trader intelligence, and Portware, the first and only global provider of multi-asset trade automation solutions powered by artificial intelligence, today announced that OTAS’ sophisticated market intelligence and data analytics solutions will be available directly within Portware Enterprise. The ...

... and trader intelligence, and Portware, the first and only global provider of multi-asset trade automation solutions powered by artificial intelligence, today announced that OTAS’ sophisticated market intelligence and data analytics solutions will be available directly within Portware Enterprise. The ...

Types of Business Ownership

... owner’s personal assets can still be seized by the lending agency if he or she has put up personal collateral for a business loan ...

... owner’s personal assets can still be seized by the lending agency if he or she has put up personal collateral for a business loan ...

Inverse Indexing

... Ideal for investors seeking to profit or protect during market declines or periods of increased volatility. How an Inverse ETF Works Inverse ETFs are similar to holding short positions to hedge against, or profit from, falling prices. ...

... Ideal for investors seeking to profit or protect during market declines or periods of increased volatility. How an Inverse ETF Works Inverse ETFs are similar to holding short positions to hedge against, or profit from, falling prices. ...