CHAPTER 1

... To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. ...

... To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. ...

Sortino:A `Sharper` Ratio

... Harry Markowitz, when he developed Modern Portfolio Theory in 1959, recognized that since only downside deviation is relevant to investors, using downside deviation to measure risk would be more appropriate than using standard deviation. However, he used variance (the square of standard deviation) i ...

... Harry Markowitz, when he developed Modern Portfolio Theory in 1959, recognized that since only downside deviation is relevant to investors, using downside deviation to measure risk would be more appropriate than using standard deviation. However, he used variance (the square of standard deviation) i ...

Development Economics

... - if too large for individual private investors - if positive externalities (public goods: no exclusion from consumption possible and marginal costs near zero (non-rivalry); example lighthouse) - if generation of economic resources > costs - if greater return than all of the other available options ...

... - if too large for individual private investors - if positive externalities (public goods: no exclusion from consumption possible and marginal costs near zero (non-rivalry); example lighthouse) - if generation of economic resources > costs - if greater return than all of the other available options ...

intermediate-financial-management-10th-edition

... Stand-alone risk is measured by the standard deviation (SD) of expected returns or the coefficient of variation (CV) of returns = SD/expected return. A portfolio’s risk is measured by the SD of its returns, and the risk of the individual stocks in the portfolio is measured by their beta coefficients ...

... Stand-alone risk is measured by the standard deviation (SD) of expected returns or the coefficient of variation (CV) of returns = SD/expected return. A portfolio’s risk is measured by the SD of its returns, and the risk of the individual stocks in the portfolio is measured by their beta coefficients ...

Are pension funds good for sustainable development?

... can be promoted. Sustainability means that later generations enjoy a level of welfare which equals or exceeds the welfare of the currently living generation. The quantity and the direction of long-term investments decide on issues which are crucial for welfare such as changes in natural resource abu ...

... can be promoted. Sustainability means that later generations enjoy a level of welfare which equals or exceeds the welfare of the currently living generation. The quantity and the direction of long-term investments decide on issues which are crucial for welfare such as changes in natural resource abu ...

CAPITAL BUDGET CARRY FORWARD

... progress. Projects can continue across financial years. However the portfolio owners must operate within the funding envelope allocated for the current financial year ( i.e. the total amount spent on Group One projects in the current financial year must not exceed the annual budget). This includes c ...

... progress. Projects can continue across financial years. However the portfolio owners must operate within the funding envelope allocated for the current financial year ( i.e. the total amount spent on Group One projects in the current financial year must not exceed the annual budget). This includes c ...

Lisbon Office Market Overview

... 2016 reached 75,000 sq m. Demand figures are considered good when compared to crisis period average data. 2011-2013 average fell under 90,000 sq m/year and 2014-2015 average already reached 135,000 sq m/year representing a major retake in gross take-up figures although far from pre financial crisis ...

... 2016 reached 75,000 sq m. Demand figures are considered good when compared to crisis period average data. 2011-2013 average fell under 90,000 sq m/year and 2014-2015 average already reached 135,000 sq m/year representing a major retake in gross take-up figures although far from pre financial crisis ...

TO THE COMISIÓN NACIONAL DEL MERCADO DE

... agreement signed on 8 June 2015 by Sacyr S.A. and MERLIN Properties Socimi S.A. ("MERLIN Properties") by which the latter will acquire a majority shareholding in the share capital of Testa Inmuebles en Renta, S.A. ("Testa") orchestrated in several phases, the 34,810,520 remaining shares of Testa own ...

... agreement signed on 8 June 2015 by Sacyr S.A. and MERLIN Properties Socimi S.A. ("MERLIN Properties") by which the latter will acquire a majority shareholding in the share capital of Testa Inmuebles en Renta, S.A. ("Testa") orchestrated in several phases, the 34,810,520 remaining shares of Testa own ...

C15.0021 Money, Banking, and Financial Markets

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 237. The KMV model uses the OPM to extract the impli ...

... On the last equation variance and leverage ratio would affect the risk premium. But NOTICE that the key variables are A, market value of assets, and asset risk 2 Neither of which are directly observable. An Option Model Example is given on page 237. The KMV model uses the OPM to extract the impli ...

Sample chapter - McGraw Hill Higher Education

... Investors generally dislike risk, but they are also unable to avoid it. The valuation formulae for shares and debt securities outlined in Chapter 4 showed that the price of a risky asset depends on its expected future cash flows, the time value of money, and risk. However, little attention was paid ...

... Investors generally dislike risk, but they are also unable to avoid it. The valuation formulae for shares and debt securities outlined in Chapter 4 showed that the price of a risky asset depends on its expected future cash flows, the time value of money, and risk. However, little attention was paid ...

IJER v4i5 so (3)

... (Norton, 1990). In this context, we infer that corruption can raise transaction costs for economic agents, for example, due to payment of bribes. Shleifer and Vishny (1993) show that for invest in a Russian company (post-communist) the foreigner must bribe all departments involved in foreign investm ...

... (Norton, 1990). In this context, we infer that corruption can raise transaction costs for economic agents, for example, due to payment of bribes. Shleifer and Vishny (1993) show that for invest in a Russian company (post-communist) the foreigner must bribe all departments involved in foreign investm ...

Home | National Commercial Bank

... provision expenses. • 153% increase over prior year • 8% contribution to segment operating profit for the 2015 financial year • Increased operating income of $712 million as a result of higher interest income from loans and net fee and commission income. • 26% increase over prior year • 27% contribu ...

... provision expenses. • 153% increase over prior year • 8% contribution to segment operating profit for the 2015 financial year • Increased operating income of $712 million as a result of higher interest income from loans and net fee and commission income. • 26% increase over prior year • 27% contribu ...

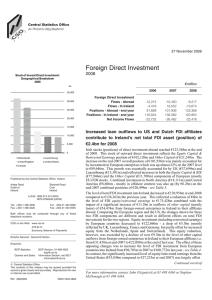

Foreign Direct Investment Annual (PDF 239KB)

... The contents of this release may be quoted provided the source is given clearly and accurately. Reproduction for own or internal use is permitted. Ref 208/2009 ...

... The contents of this release may be quoted provided the source is given clearly and accurately. Reproduction for own or internal use is permitted. Ref 208/2009 ...

Concept of Accounting And Review Of Balance Sheet

... business to out side parties ( called creditors ). This includes amount owed to suppliers for goods or services purchased amount borrowed from banks or other lenders, salaries and taxes due but not paid. Net worth : the term net worth, proprietorship, owner’s investment, or capital– all have the sam ...

... business to out side parties ( called creditors ). This includes amount owed to suppliers for goods or services purchased amount borrowed from banks or other lenders, salaries and taxes due but not paid. Net worth : the term net worth, proprietorship, owner’s investment, or capital– all have the sam ...

An_Efficiency_of_Financial_Markets_11

... Early results from both tests generally confirmed the efficient market view that stock prices are not predictable and follow a ...

... Early results from both tests generally confirmed the efficient market view that stock prices are not predictable and follow a ...

Q1 2017 Summary Slides

... These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news. Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all right ...

... These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news. Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all right ...

Select Risk Profile Portfolios – quarterly investment report

... National Party demanded a second Scottish independence referendum. Meanwhile, the economy continued to perform robustly and Chancellor Phillip Hammond delivered a budget aimed at stabilising growth in the run up to Brexit. Equities in the US continued to rise as President Donald Trump took office an ...

... National Party demanded a second Scottish independence referendum. Meanwhile, the economy continued to perform robustly and Chancellor Phillip Hammond delivered a budget aimed at stabilising growth in the run up to Brexit. Equities in the US continued to rise as President Donald Trump took office an ...

Shadow Banking and Financial Stability

... including the Financial Stability Board (FSB) and the European Commission (EC) as: The risks of the shadow banking system became apparent during the financial crisis, making it clear that this segment of the financial system requires greater attention. ...

... including the Financial Stability Board (FSB) and the European Commission (EC) as: The risks of the shadow banking system became apparent during the financial crisis, making it clear that this segment of the financial system requires greater attention. ...

New Employee Welcome Guide

... Under Michigan State law, the 401(k) and 457 Plans must be self-supporting. This means that the Plan participants must pay all costs. The investment expense fees charged by each investment fund cover most of these costs. The only other fees are for optional services such as the Self-Managed Accounts ...

... Under Michigan State law, the 401(k) and 457 Plans must be self-supporting. This means that the Plan participants must pay all costs. The investment expense fees charged by each investment fund cover most of these costs. The only other fees are for optional services such as the Self-Managed Accounts ...

Solactive US Quality Dividend Low Volatility Index

... Companies in the US currently have net cash flows of around USD 1,960 billion. This corresponds to more than 12% of US gross domestic product (GDP) and is close to the record set in 1980. ...

... Companies in the US currently have net cash flows of around USD 1,960 billion. This corresponds to more than 12% of US gross domestic product (GDP) and is close to the record set in 1980. ...

US marinas set to become `asset class`

... foremost to a healthy economy and increased interest in boating. Loanto-value ratios are typically in the 65% range, with the Small Business Administration in the 80% range. There has been a strong upswing in investment groups entering the investor demand for marinas here in the marketplace and acqu ...

... foremost to a healthy economy and increased interest in boating. Loanto-value ratios are typically in the 65% range, with the Small Business Administration in the 80% range. There has been a strong upswing in investment groups entering the investor demand for marinas here in the marketplace and acqu ...