NBER WORKING PAPER SERIES SOME UNPLEASANT GENERAL EQUILIBRIUM IMPLICATIONS OF EXECUTIVE

... More recently, corporate boards have expanded the range of incentive instruments to include other forms of equity based incentive pay (e.g., direct stock grants). This has gone hand-in-hand with a steady reduction in the salary component of executive pay. For March 2007, Mercer Consulting reports th ...

... More recently, corporate boards have expanded the range of incentive instruments to include other forms of equity based incentive pay (e.g., direct stock grants). This has gone hand-in-hand with a steady reduction in the salary component of executive pay. For March 2007, Mercer Consulting reports th ...

policy for nonprofit endowment funds

... modification would more effectively serve the charitable purposes of the Foundation taking into consideration the wishes of the donor. 5. Distributions - Distributions from a Nonprofit Endowment Fund shall be made only to the Nonprofit for which it was established, or its successor. Ordinary distrib ...

... modification would more effectively serve the charitable purposes of the Foundation taking into consideration the wishes of the donor. 5. Distributions - Distributions from a Nonprofit Endowment Fund shall be made only to the Nonprofit for which it was established, or its successor. Ordinary distrib ...

Quest for the Holy Grail: The Fair Value of the

... Contrarian investors, who profit from prices reverting to longer-term averages, are likely confounded by the continually increasing normalized value of the US equity market. Normalized prices, adjusted for changes in earnings or dividends, have remained above their long-term averages over the last q ...

... Contrarian investors, who profit from prices reverting to longer-term averages, are likely confounded by the continually increasing normalized value of the US equity market. Normalized prices, adjusted for changes in earnings or dividends, have remained above their long-term averages over the last q ...

Australia`s Authorised Depository Institutions The Capital–Assets Ratio

... – Fair market value of most assets and liabilities has to be disclosed. Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institutions Management 2e, by Lange, Saunders, Anderson, Thomson and Cornett Slides prepared by Maike Sundmacher ...

... – Fair market value of most assets and liabilities has to be disclosed. Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institutions Management 2e, by Lange, Saunders, Anderson, Thomson and Cornett Slides prepared by Maike Sundmacher ...

Download paper (PDF)

... More recently, corporate boards have expanded the range of incentive instruments to include other forms of equity based incentive pay (e.g., direct stock grants). This has gone hand-in-hand with a steady reduction in the salary component of executive pay. For March 2007, Mercer Consulting reports th ...

... More recently, corporate boards have expanded the range of incentive instruments to include other forms of equity based incentive pay (e.g., direct stock grants). This has gone hand-in-hand with a steady reduction in the salary component of executive pay. For March 2007, Mercer Consulting reports th ...

Weiss and Barkley - American College of Real Estate Lawyers

... A requirement that compensation committees for public companies be comprised solely of independent directors. ...

... A requirement that compensation committees for public companies be comprised solely of independent directors. ...

Market Vectors Small Cap Dividend Payers ETF (ASX Code: MVS)

... The Market Vectors Australia Small-Cap Dividend Payers Index (‘MVS Index’) is the exclusive property of Market Vectors Index Solutions GmbH (‘MVIS’), which has contracted with Solactive AG (“Solactive”) to maintain and calculate the MVS Index. MVS is not sponsored, endorsed, sold or promoted by MVIS ...

... The Market Vectors Australia Small-Cap Dividend Payers Index (‘MVS Index’) is the exclusive property of Market Vectors Index Solutions GmbH (‘MVIS’), which has contracted with Solactive AG (“Solactive”) to maintain and calculate the MVS Index. MVS is not sponsored, endorsed, sold or promoted by MVIS ...

Fear of the Unknown: Familiarity and Economic Decisions

... Furthermore, we derive implications of familiarity bias for equilibrium asset pricing. We consider stock markets in two countries, each populated by both rational and familiarity-biased investors. Given an endowed portfolio, there is an interval of prices within which the familiarity-biased investor ...

... Furthermore, we derive implications of familiarity bias for equilibrium asset pricing. We consider stock markets in two countries, each populated by both rational and familiarity-biased investors. Given an endowed portfolio, there is an interval of prices within which the familiarity-biased investor ...

Venture Capital Investment and Small Business Affiliation Rules

... capital without impacting their size status. This means companies must forgo venture capital financing or risk losing eligibility to compete for small business set aside contracts and subcontracting opportunities with prime contractors who seek to meet small business subcontracting goals. As a resul ...

... capital without impacting their size status. This means companies must forgo venture capital financing or risk losing eligibility to compete for small business set aside contracts and subcontracting opportunities with prime contractors who seek to meet small business subcontracting goals. As a resul ...

OVERVIEW OF THE CHAPTER

... Gerald Pencer, CEO of Cott Corporation, used a different strategy to achieve success in this intensely competitive market. His company manufactured and bottled a low cost cola and sold it directly to major retail establishments as a private-label “house-brand”. He initiated his strategy in Canada an ...

... Gerald Pencer, CEO of Cott Corporation, used a different strategy to achieve success in this intensely competitive market. His company manufactured and bottled a low cost cola and sold it directly to major retail establishments as a private-label “house-brand”. He initiated his strategy in Canada an ...

Alternative Finance Investment Bonds

... plural or „sakk‟ in the singular) which are intended to be regulated in an equivalent manner to conventional debt securities, where appropriate. Sukuk arrangements allow assets to be held for the benefit of investors in certificates issued by a company. The benefits may include the payment of a retu ...

... plural or „sakk‟ in the singular) which are intended to be regulated in an equivalent manner to conventional debt securities, where appropriate. Sukuk arrangements allow assets to be held for the benefit of investors in certificates issued by a company. The benefits may include the payment of a retu ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... the “OEM Solutions Projections.” The following disclosures supplement the existing disclosures contained under the caption “Opinion of Financial Advisor to SMI” beginning on page 50 of the proxy statement/prospectus: Discounted Cash Flow Analysis. Stifel used the OEM Solutions Projections for the ...

... the “OEM Solutions Projections.” The following disclosures supplement the existing disclosures contained under the caption “Opinion of Financial Advisor to SMI” beginning on page 50 of the proxy statement/prospectus: Discounted Cash Flow Analysis. Stifel used the OEM Solutions Projections for the ...

financial prudential norms

... together with affiliated persons are made by the general assembly of members or by the board of the association, if this function is attributed to the board by law and/or by by-laws. If the board is invested with this function, the respective administrator will leave the meeting for the period of ti ...

... together with affiliated persons are made by the general assembly of members or by the board of the association, if this function is attributed to the board by law and/or by by-laws. If the board is invested with this function, the respective administrator will leave the meeting for the period of ti ...

September __, 2016 The Honorable Richard C. Shelby Chairman

... recommendations and most elements of the research informing their reports, (2) give companies an opportunity to review and lobby the firms to change their recommendations, and (3) establish a heavy-handed “ombudsman” construct to address issues that companies raise. This right of pre-review would gi ...

... recommendations and most elements of the research informing their reports, (2) give companies an opportunity to review and lobby the firms to change their recommendations, and (3) establish a heavy-handed “ombudsman” construct to address issues that companies raise. This right of pre-review would gi ...

Cash, Cash Equivalents, and Investments

... The reclassification entry needs to be reversed in the following year. In order to determine the amount to reclassify from short-term investments, a calculation must be performed to derive the net cash balance at year-end. The net cash balance per books equals the balance per bank in the Bank of CSU ...

... The reclassification entry needs to be reversed in the following year. In order to determine the amount to reclassify from short-term investments, a calculation must be performed to derive the net cash balance at year-end. The net cash balance per books equals the balance per bank in the Bank of CSU ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... (Former name or former address, if changed since last report) ...

... (Former name or former address, if changed since last report) ...

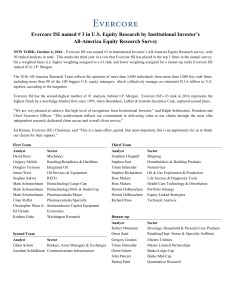

Evercore ISI named # 3 in US Equity Research by

... Evercore ISI named # 3 in U.S. Equity Research by Institutional Investor’s All-America Equity Research Survey NEW YORK, October 6, 2016 – Evercore ISI was named #3 in Institutional Investor’s All-America Equity Research survey, with 30 ranked analysts in total. This marks the third year in a row tha ...

... Evercore ISI named # 3 in U.S. Equity Research by Institutional Investor’s All-America Equity Research Survey NEW YORK, October 6, 2016 – Evercore ISI was named #3 in Institutional Investor’s All-America Equity Research survey, with 30 ranked analysts in total. This marks the third year in a row tha ...

Homework 10 solution

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

Global timber investments, wood costs, regulation, and risk

... common criteria and indicators (C&I) of SFM to compare the rigor of forestry laws and policies, and then classifying them by degree of regulation e mandatory or voluntary e and by type of approach e process, prescriptive, or outcome based. We simplified the McGinley schema for this analysis by simpl ...

... common criteria and indicators (C&I) of SFM to compare the rigor of forestry laws and policies, and then classifying them by degree of regulation e mandatory or voluntary e and by type of approach e process, prescriptive, or outcome based. We simplified the McGinley schema for this analysis by simpl ...

NBER WORKING PAPER SERIES EXPLAINING ANOMALY PERFORMANCE WITH POLITICS,

... independence. Predictive regressions do not, however, test for a relation between the predictive variable and returns. They test for a relation between the predictive variable and the expected returns (a level), which may be far more persistent. Ferson, Sarkissian and Simin (2003) show in simulation ...

... independence. Predictive regressions do not, however, test for a relation between the predictive variable and returns. They test for a relation between the predictive variable and the expected returns (a level), which may be far more persistent. Ferson, Sarkissian and Simin (2003) show in simulation ...

Chapter 5 The Time Value of Money

... Credit rating services use financial ratios, among other information, to evaluate the creditworthiness of companies and the default risk of debt obligations. Moody’s, one of the major rating services, periodically provides data on the most commonly used credit ratios and how they are correlated with ...

... Credit rating services use financial ratios, among other information, to evaluate the creditworthiness of companies and the default risk of debt obligations. Moody’s, one of the major rating services, periodically provides data on the most commonly used credit ratios and how they are correlated with ...

Solutions For Financial Professionals | Russell Investments

... It’s been a rough start to the year. Global developed equities, as measured by the FTSE Developed Index, lost nearly 20% from their 2015 peak by mid-February of 2016, before rebounding by around 10% by mid-March. The volatility has been driven by a combination of China fears, Fed tightening, U.S. re ...

... It’s been a rough start to the year. Global developed equities, as measured by the FTSE Developed Index, lost nearly 20% from their 2015 peak by mid-February of 2016, before rebounding by around 10% by mid-March. The volatility has been driven by a combination of China fears, Fed tightening, U.S. re ...

Collateral Valuation for Extreme Market Events

... learing and settlement systems are critical to the infrastructure of financial markets because of the large values of funds and securities that settle through them. For instance, in 2005, $49.9 trillion was settled through the Canadian securities clearing and settlement system (CDSX). Given the larg ...

... learing and settlement systems are critical to the infrastructure of financial markets because of the large values of funds and securities that settle through them. For instance, in 2005, $49.9 trillion was settled through the Canadian securities clearing and settlement system (CDSX). Given the larg ...