Annual Report - San Francisco Employees` Retirement System

... Private Equity, $979 million in the Real Assets portfolio and $1.68 billion in fixed income (see the Investment Section for a detailed schedule of these investments). Beginning in fiscal year 201415 the Retirement Board approved a significant step up in resources. Over the past two years, the manage ...

... Private Equity, $979 million in the Real Assets portfolio and $1.68 billion in fixed income (see the Investment Section for a detailed schedule of these investments). Beginning in fiscal year 201415 the Retirement Board approved a significant step up in resources. Over the past two years, the manage ...

Where Did All The Borrowing Go? Philip R. Lane

... positions. In addition to its central role in the current global configuration of external imbalances, the United States is a natural candidate for a case study due to the high quality of its balance of payments statistics. The BEA provides a more detailed breakdown of the IIP than is available for ...

... positions. In addition to its central role in the current global configuration of external imbalances, the United States is a natural candidate for a case study due to the high quality of its balance of payments statistics. The BEA provides a more detailed breakdown of the IIP than is available for ...

Alternative investment sectors

... The motor retail industry operates on a franchising model with vehicle manufacturers (VMs) themselves seldom involved in the business of car retailing and servicing. Despite this some manufacturers have utilised their blue-chip covenants through head-lease and under-lease arrangements to recoup thei ...

... The motor retail industry operates on a franchising model with vehicle manufacturers (VMs) themselves seldom involved in the business of car retailing and servicing. Despite this some manufacturers have utilised their blue-chip covenants through head-lease and under-lease arrangements to recoup thei ...

India - CUTS International

... banks in India over the 1990s. Over the 1980s, interest rates were regulated, the PLR of State Bank of India [the largest scheduled commercial bank] being pegged at about 16percent and that of Industrial Development Bank of India [IDBI, which is a term lending institution; also called a financial in ...

... banks in India over the 1990s. Over the 1980s, interest rates were regulated, the PLR of State Bank of India [the largest scheduled commercial bank] being pegged at about 16percent and that of Industrial Development Bank of India [IDBI, which is a term lending institution; also called a financial in ...

Xetra-Gold Precious. Always. And forever.

... but instead merely provides a summarised description of the securities’ key features. The full details of the securitiy, including risk factors may be noted from the prospectus. The prospectus constitutes the only binding basis for the purchase of the securities. Investors can obtain these documents ...

... but instead merely provides a summarised description of the securities’ key features. The full details of the securitiy, including risk factors may be noted from the prospectus. The prospectus constitutes the only binding basis for the purchase of the securities. Investors can obtain these documents ...

Balance of Payments Accounts Balance of Payments

... ¾ When CA < 0, there is a current account deficit. • For some countries, net unilateral transfers are a substantial (positive) part of the current account; for the U.S., net unilateral transfers have been increasingly ...

... ¾ When CA < 0, there is a current account deficit. • For some countries, net unilateral transfers are a substantial (positive) part of the current account; for the U.S., net unilateral transfers have been increasingly ...

Transformation of Micro-finance Operations from NGO to Regulated

... Wider range of financial services: As NGOs, most microfinance institutions are not allowed to provide clients with financial services other than credit. In most countries, regulation prevents unregulated, non-profit microfinance institutions to mobilize savings. By transforming into a regulated fina ...

... Wider range of financial services: As NGOs, most microfinance institutions are not allowed to provide clients with financial services other than credit. In most countries, regulation prevents unregulated, non-profit microfinance institutions to mobilize savings. By transforming into a regulated fina ...

Dimension of Budgetary Control

... budget. There is a continuum of responses, some of which may be more appropriate than others in meeting the budget. The more closely an individual identifies himself with the budget goals, the more appropriate will be his budget response. The degree of identification with budget goals is, therefore, ...

... budget. There is a continuum of responses, some of which may be more appropriate than others in meeting the budget. The more closely an individual identifies himself with the budget goals, the more appropriate will be his budget response. The degree of identification with budget goals is, therefore, ...

PORTFOLIO CHOICE, LIQUIDITY CONSTRAINTS AND STOCK

... the stock market (even in the presence of stock market predictability) is small. A positive demand for the riskless asset can therefore arise from agents who face high stock market entry costs. Can demand for stocks always be generated as well? To answer this question, the welfare gain from using th ...

... the stock market (even in the presence of stock market predictability) is small. A positive demand for the riskless asset can therefore arise from agents who face high stock market entry costs. Can demand for stocks always be generated as well? To answer this question, the welfare gain from using th ...

Mission accomplished... In Focus: Markets as we see them

... Underneath all of this, but central to investment portfolio performance, remains the ongoing progress made by the world economy. The continuing interaction of the learning curve with new technology remains a powerful and durable driving force, one which the last few hundred years of history tell us ...

... Underneath all of this, but central to investment portfolio performance, remains the ongoing progress made by the world economy. The continuing interaction of the learning curve with new technology remains a powerful and durable driving force, one which the last few hundred years of history tell us ...

KDE Capital Asset Guide

... direct expense or function of the asset. Consequently, districts must establish policies and procedures to identify the KDE Fixed Asset Department code (Appendix A). The Fixed Asset Department code should reflect the direct expense or functionality of the assets at the time of purchased and whenever ...

... direct expense or function of the asset. Consequently, districts must establish policies and procedures to identify the KDE Fixed Asset Department code (Appendix A). The Fixed Asset Department code should reflect the direct expense or functionality of the assets at the time of purchased and whenever ...

How to Make Money with Them and Why Governments Care

... makes the whole subject exciting and interesting is working out the covariances involved. In the area of market risks,these are fairly well developed: the database is rich. Between market and credit risk, they're less well developed. And legal and systems risks are not well understood at all. But th ...

... makes the whole subject exciting and interesting is working out the covariances involved. In the area of market risks,these are fairly well developed: the database is rich. Between market and credit risk, they're less well developed. And legal and systems risks are not well understood at all. But th ...

IMPORTANT FACTORS FOR SALESPERSON EVALUATION The 7

... Performance evaluations used for the purpose of promoting a salesperson into a sales management position should focus on criteria related to successful sales managers and not just current salesperson performance. There are many procedures how we can measure salespersons. Development of system for mo ...

... Performance evaluations used for the purpose of promoting a salesperson into a sales management position should focus on criteria related to successful sales managers and not just current salesperson performance. There are many procedures how we can measure salespersons. Development of system for mo ...

The UK Current Account Deficit: Risky or Risk

... and capital gains on different international asset and liability positions can be substantial. Heightened risk and uncertainty can not only lead to challenges financing a current account deficit, but also affect the exchange rate, the relative returns that foreign and domestic investors earn, and th ...

... and capital gains on different international asset and liability positions can be substantial. Heightened risk and uncertainty can not only lead to challenges financing a current account deficit, but also affect the exchange rate, the relative returns that foreign and domestic investors earn, and th ...

1: The Effect Of International Staffing Practices On

... perceived incompatibility of employee skills (Newbury, 2001). Dealing with turnover then encompasses the need to effectively manage employees’ perceptions. In addition, the size of the local unit may have direct consequences for employees’ perceived career prospects: The limited career opportunities ...

... perceived incompatibility of employee skills (Newbury, 2001). Dealing with turnover then encompasses the need to effectively manage employees’ perceptions. In addition, the size of the local unit may have direct consequences for employees’ perceived career prospects: The limited career opportunities ...

LPL Financial Security Site

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prio ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prio ...

Outlook 2017 > Gauging Market Milestones

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prio ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prio ...

ca-ipcc (1st group) financial management (71 imp questions)

... firm‟s share represents the focal judgment of all market participants as to the value of the particular firm. It takes into account present as well as futuristic earnings per share; the timing, duration and risk of these earnings; the dividend policy of the firm; and other factors that bear upon the ...

... firm‟s share represents the focal judgment of all market participants as to the value of the particular firm. It takes into account present as well as futuristic earnings per share; the timing, duration and risk of these earnings; the dividend policy of the firm; and other factors that bear upon the ...

Effects of Business Diversification on Asset Risk-Taking

... The extant literature on the relation between diversification and corporate performance has focused on diversified companies’ overall performance by employing a variety of measures including accounting returns (e.g., Berger and Ofek, 1995), firm value (e.g., Lang and Stulz, 1994; Servaes, 1996), an ...

... The extant literature on the relation between diversification and corporate performance has focused on diversified companies’ overall performance by employing a variety of measures including accounting returns (e.g., Berger and Ofek, 1995), firm value (e.g., Lang and Stulz, 1994; Servaes, 1996), an ...

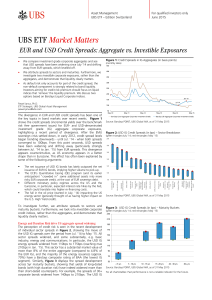

Market Matters EUR and USD Credit Spreads

... credit risk premium should therefore consider liquid indices. Investible Indices for USD and EUR IG (with limited duration risk) UBS Chief Investment Office WM overweights USD and EUR IG corporate bonds relative to the highest grade segment (Source: Chief Investment Office WM: Corporate bonds (inves ...

... credit risk premium should therefore consider liquid indices. Investible Indices for USD and EUR IG (with limited duration risk) UBS Chief Investment Office WM overweights USD and EUR IG corporate bonds relative to the highest grade segment (Source: Chief Investment Office WM: Corporate bonds (inves ...

Promoting Inward and Outward Investment Activities in Japan

... its economic ties with the overseas economies through trade and investment. This section describes the actions required for such efforts in detail. 1. Promoting of inward direct investment As explained in Chapter 2, one of the measures that Japan needs to take to become a more open and attractive pl ...

... its economic ties with the overseas economies through trade and investment. This section describes the actions required for such efforts in detail. 1. Promoting of inward direct investment As explained in Chapter 2, one of the measures that Japan needs to take to become a more open and attractive pl ...

policy for nonprofit endowment funds

... modification would more effectively serve the charitable purposes of the Foundation taking into consideration the wishes of the donor. 5. Distributions - Distributions from a Nonprofit Endowment Fund shall be made only to the Nonprofit for which it was established, or its successor. Ordinary distrib ...

... modification would more effectively serve the charitable purposes of the Foundation taking into consideration the wishes of the donor. 5. Distributions - Distributions from a Nonprofit Endowment Fund shall be made only to the Nonprofit for which it was established, or its successor. Ordinary distrib ...

Pension Discount Rates: FASB ASC 715

... equal cash outflows in timing and amount, there would be no reinvestment risk in the yields to maturity of the portfolio. However, in other than a zero coupon portfolio, such as a portfolio of long-term debt instruments that pay semiannual interest payments or whose maturities do not extend far enou ...

... equal cash outflows in timing and amount, there would be no reinvestment risk in the yields to maturity of the portfolio. However, in other than a zero coupon portfolio, such as a portfolio of long-term debt instruments that pay semiannual interest payments or whose maturities do not extend far enou ...