Exploring the Dynamics of Global Liquidity

... made clear that traditional monetary aggregates on a national level may not capture the full range of liquidity-creating instruments nor the full impact of the activities of large cross border financial intermediaries, which play an increasingly important role in globally integrated capital markets. ...

... made clear that traditional monetary aggregates on a national level may not capture the full range of liquidity-creating instruments nor the full impact of the activities of large cross border financial intermediaries, which play an increasingly important role in globally integrated capital markets. ...

The long history of financial boom-bust cycles in Iceland1 Part I

... latest episode saw major financial and macroeconomic imbalances combine to make it the most serious crisis of them all. We therefore find no single financial variable consistently providing an early-warning signal of an upcoming financial crisis across all the six episodes. However, we find that mac ...

... latest episode saw major financial and macroeconomic imbalances combine to make it the most serious crisis of them all. We therefore find no single financial variable consistently providing an early-warning signal of an upcoming financial crisis across all the six episodes. However, we find that mac ...

Optimal Reserves in Financially Closed Economies

... rates is reminiscent of the way that the cost of holding reserves is measured in the existing literature on international reserves but there are important differences. In particular, the carry cost is not the same as two measures that are often used by practitioners, the quasi-fiscal cost of holdin ...

... rates is reminiscent of the way that the cost of holding reserves is measured in the existing literature on international reserves but there are important differences. In particular, the carry cost is not the same as two measures that are often used by practitioners, the quasi-fiscal cost of holdin ...

Chapter 02 Money and the Payments System

... http://testbankhero.eu/Solution-manual-for-Money-Banking-and-FinancialMarkets-3rd-edition-by-Stephen-G-Cecchetti 46. Checks and currency function similarly, however: A. Currency is a more effective means of payment B. Carrying currency entails greater risk, because it cannot be replaced if lost or s ...

... http://testbankhero.eu/Solution-manual-for-Money-Banking-and-FinancialMarkets-3rd-edition-by-Stephen-G-Cecchetti 46. Checks and currency function similarly, however: A. Currency is a more effective means of payment B. Carrying currency entails greater risk, because it cannot be replaced if lost or s ...

xcthe development of latvia`s economy (1990–2004)

... the country's foreign trade system underwent the most profound changes. The republics of the former USSR had mainly traded with each other. According to the World Bank data, Latvia's exports to former USSR republics accounted for 95.7% of the total in 1990, while its imports from them constituted 83 ...

... the country's foreign trade system underwent the most profound changes. The republics of the former USSR had mainly traded with each other. According to the World Bank data, Latvia's exports to former USSR republics accounted for 95.7% of the total in 1990, while its imports from them constituted 83 ...

DP2012/05 The macroeconomic effects of a stable funding requirement

... richness of the nonlinear finance models, they benefit from more tractable solution methods and the general equilibrium environment. Such an approach is useful for examining the first-order macroeconomic effects of prudential policies, but less so for examining the underlying externalities and insta ...

... richness of the nonlinear finance models, they benefit from more tractable solution methods and the general equilibrium environment. Such an approach is useful for examining the first-order macroeconomic effects of prudential policies, but less so for examining the underlying externalities and insta ...

chapter 11

... 4) Which of the following statements is true? A) One of the limitations of using money is that it does not allow for the transfer of purchasing power into the future. B) The necessary condition required for money to function as a medium of exchange is that it also needs to be a store of value. C) H ...

... 4) Which of the following statements is true? A) One of the limitations of using money is that it does not allow for the transfer of purchasing power into the future. B) The necessary condition required for money to function as a medium of exchange is that it also needs to be a store of value. C) H ...

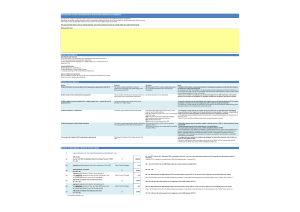

CA DISCLOSURE.xls - ECB Banking Supervision

... - Figures presented should not be interpreted as accounting figures - The asset quality indicators are based on EBA’s simplified definition of NPE - While the application of this definition constitutes an important step forward in terms of harmonisation across the euro area banking sector, the degre ...

... - Figures presented should not be interpreted as accounting figures - The asset quality indicators are based on EBA’s simplified definition of NPE - While the application of this definition constitutes an important step forward in terms of harmonisation across the euro area banking sector, the degre ...

Download attachment

... Under the trust certificate issuance programme described in this Base Prospectus (the Programme), EIB Sukuk Company Ltd. (in its capacity as issuer, the Issuer and, in its capacity as trustee, the Trustee), subject to compliance with all relevant laws, regulations and directives, may from time to ti ...

... Under the trust certificate issuance programme described in this Base Prospectus (the Programme), EIB Sukuk Company Ltd. (in its capacity as issuer, the Issuer and, in its capacity as trustee, the Trustee), subject to compliance with all relevant laws, regulations and directives, may from time to ti ...

Monetary Policy - Macmillan Learning

... holding money fell. The last two rows of Table 15-2 summarize this comparison: they give the differences between the interest rates on demand deposits and on currency and the interest rate on CDs. These differences—the opportunity cost of holding money rather than interest-bearing assets—declined sh ...

... holding money fell. The last two rows of Table 15-2 summarize this comparison: they give the differences between the interest rates on demand deposits and on currency and the interest rate on CDs. These differences—the opportunity cost of holding money rather than interest-bearing assets—declined sh ...

Analysis of Bank Efficiency of Chinese Commercial Banks and the

... intervention and NPL problem, can not be dealt with properly in the near future, the chance of success is very small. Thus, our policy recommendations include consolidating up-to-date reform achievements, improving bank's managerial and operational skills, and reducing state's share in banks to less ...

... intervention and NPL problem, can not be dealt with properly in the near future, the chance of success is very small. Thus, our policy recommendations include consolidating up-to-date reform achievements, improving bank's managerial and operational skills, and reducing state's share in banks to less ...

Monetary Policy - Central Bank of Nigeria

... everyday language as synonymous, in Economics, wealth is created in an economy through the production and exchange of goods and services. Here, money performs two roles. It facilitates the exchange of goods and services and expresses in a single unit of measurement, the value of the goods and servic ...

... everyday language as synonymous, in Economics, wealth is created in an economy through the production and exchange of goods and services. Here, money performs two roles. It facilitates the exchange of goods and services and expresses in a single unit of measurement, the value of the goods and servic ...

Technical Note on Stress Testing for IIFS

... The IFSB is an international standard-setting organisation which was officially inaugurated on 3 November 2002 and started operations on 10 March 2003. The organisation promotes and enhances the soundness and stability of the Islamic financial services industry by issuing global prudential standards ...

... The IFSB is an international standard-setting organisation which was officially inaugurated on 3 November 2002 and started operations on 10 March 2003. The organisation promotes and enhances the soundness and stability of the Islamic financial services industry by issuing global prudential standards ...

Economic Report - Central Bank of Bahrain

... List of Tables Table 1-1: Summary of World Output (% change) ............................................................ 3 Table 1-2: Exchange Rates of Major Currencies against the SDR .................................... 6 Table 1-3: Commodity Prices ............................................ ...

... List of Tables Table 1-1: Summary of World Output (% change) ............................................................ 3 Table 1-2: Exchange Rates of Major Currencies against the SDR .................................... 6 Table 1-3: Commodity Prices ............................................ ...

The Quality of Money

... Austrian economists such as Mises (1953, chap. 1) and Rothbard (2004, pp. 189–93) have followed Carl Menger in their analysis of the origins of money. While Mises does not list the specific qualities that help a commodity to become money, Rothbard (2008, p. 6) mentions the “proper qualities of money ...

... Austrian economists such as Mises (1953, chap. 1) and Rothbard (2004, pp. 189–93) have followed Carl Menger in their analysis of the origins of money. While Mises does not list the specific qualities that help a commodity to become money, Rothbard (2008, p. 6) mentions the “proper qualities of money ...

Money, Banking, and the Financial System

... medium of exchange? A) The good must be of standardized quality. B) The good must be valuable relative to its weight. C) The good must have value even if it were not being used as money. D) The good must be durable so that value is not lost through product spoilage. Answer: C Diff: 2 Page Ref: 29-30 ...

... medium of exchange? A) The good must be of standardized quality. B) The good must be valuable relative to its weight. C) The good must have value even if it were not being used as money. D) The good must be durable so that value is not lost through product spoilage. Answer: C Diff: 2 Page Ref: 29-30 ...

Sample

... medium of exchange? A) The good must be of standardized quality. B) The good must be valuable relative to its weight. C) The good must have value even if it were not being used as money. D) The good must be durable so that value is not lost through product spoilage. Answer: C Diff: 2 Page Ref: 29-30 ...

... medium of exchange? A) The good must be of standardized quality. B) The good must be valuable relative to its weight. C) The good must have value even if it were not being used as money. D) The good must be durable so that value is not lost through product spoilage. Answer: C Diff: 2 Page Ref: 29-30 ...

Money-Income Causality-- A Critical Review of the Literature Since

... produce a lead over income, even for the special case here in which the supply is entirely passive to the demand. Tobin goes on to point out, as had Walters (1967) earlier, that if money demand depends only on permanent income, exogenous changes in the money supply will produce large immediate chang ...

... produce a lead over income, even for the special case here in which the supply is entirely passive to the demand. Tobin goes on to point out, as had Walters (1967) earlier, that if money demand depends only on permanent income, exogenous changes in the money supply will produce large immediate chang ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... produce a lead over income, even for the special case here in which the supply is entirely passive to the demand. Tobin goes on to point out, as had Walters (1967) earlier, that if money demand depends only on permanent income, exogenous changes in the money supply will produce large immediate chang ...

... produce a lead over income, even for the special case here in which the supply is entirely passive to the demand. Tobin goes on to point out, as had Walters (1967) earlier, that if money demand depends only on permanent income, exogenous changes in the money supply will produce large immediate chang ...

the use of reserve requirements in an optimal monetary policy

... Some inflation targeting countries like Brazil, Colombia and Peru, have used reserve requirements on domestic deposits as a macro-prudential policy tool aimed at increasing lending interest rates, reducing credit growth and curbing excessive private sector leverage during the expansionary phase of t ...

... Some inflation targeting countries like Brazil, Colombia and Peru, have used reserve requirements on domestic deposits as a macro-prudential policy tool aimed at increasing lending interest rates, reducing credit growth and curbing excessive private sector leverage during the expansionary phase of t ...

Economics of Money, Banking, and Financial Markets, 8e

... 27) Explain the Keynesian theory of money demand. What motives did Keynes think determined money demand? What are the two reasons why Keynes thought velocity could not be treated as a constant? Answer: Keynes believed the demand for money depended on income and interest rates. Money was held to faci ...

... 27) Explain the Keynesian theory of money demand. What motives did Keynes think determined money demand? What are the two reasons why Keynes thought velocity could not be treated as a constant? Answer: Keynes believed the demand for money depended on income and interest rates. Money was held to faci ...