Overview - Bank of England

... Sources: Bank of England Systemic Risk Survey (May 2009 and November 2009) and Bank calculations. (a) Per cent of respondents citing each risk. Market participants were asked to list (in free format) the five risks they believed would have the greatest impact on the UK financial system if they were ...

... Sources: Bank of England Systemic Risk Survey (May 2009 and November 2009) and Bank calculations. (a) Per cent of respondents citing each risk. Market participants were asked to list (in free format) the five risks they believed would have the greatest impact on the UK financial system if they were ...

Basel III: The Changing World of Banking

... In order to address all these complexities, banks must first look internally. One approach is to appoint a chief data officer (CDO) who is responsible for ensuring that accurate and reliable data can be gathered from all parts of the business, and stored in a constructive format that allows senior e ...

... In order to address all these complexities, banks must first look internally. One approach is to appoint a chief data officer (CDO) who is responsible for ensuring that accurate and reliable data can be gathered from all parts of the business, and stored in a constructive format that allows senior e ...

Willem_H.Buiter - Bank of Greece

... No common policy towards recapitalising banks No common policy towards guaranteeing assets or liabilities, new lending or new borrowing No common fiscal stabilisation measures, modulated according to ‘fiscal spare capacity’ Strong protectionism in financial and ‘posted workers’ ...

... No common policy towards recapitalising banks No common policy towards guaranteeing assets or liabilities, new lending or new borrowing No common fiscal stabilisation measures, modulated according to ‘fiscal spare capacity’ Strong protectionism in financial and ‘posted workers’ ...

POLS 306

... Federal Reserve purchases and sales of financial instruments, usually securities issued by the U.S. Treasury, Federal agencies and government-sponsored enterprises. Open market operations are carried out by the Domestic Trading Desk of the Federal Reserve Bank of New York under direction from the FO ...

... Federal Reserve purchases and sales of financial instruments, usually securities issued by the U.S. Treasury, Federal agencies and government-sponsored enterprises. Open market operations are carried out by the Domestic Trading Desk of the Federal Reserve Bank of New York under direction from the FO ...

Document

... money – in the society Monetary policy: policy about money supply and interest rate. Money supply in the short-run affects interest rate and in the long-run affect macro-econ variables such as GDP, price level, etc. The Fed has some ability to manipulate and control the money supply, but the fir ...

... money – in the society Monetary policy: policy about money supply and interest rate. Money supply in the short-run affects interest rate and in the long-run affect macro-econ variables such as GDP, price level, etc. The Fed has some ability to manipulate and control the money supply, but the fir ...

It Takes a Woman to Do a Man`s Job - Asia

... triple what they were before 2007. They have become front line intermediaries in areas such as the mortgage market and money markets. Indeed, governments with debt over 100 per cent of GDP are completely reliant on low interest rates to sustain their budget debt servicing at a reasonable level. Even ...

... triple what they were before 2007. They have become front line intermediaries in areas such as the mortgage market and money markets. Indeed, governments with debt over 100 per cent of GDP are completely reliant on low interest rates to sustain their budget debt servicing at a reasonable level. Even ...

o Why was the Federal Reserve created

... Open-Market Operations: the Fed conducts open market operations when it buys or sells government bonds. To increase the money supply, the Fed instructs its bond traders at the New York Fed to buy bonds from the public in the nation’s bond markets. Reserve Requirements: The Fed also influences the mo ...

... Open-Market Operations: the Fed conducts open market operations when it buys or sells government bonds. To increase the money supply, the Fed instructs its bond traders at the New York Fed to buy bonds from the public in the nation’s bond markets. Reserve Requirements: The Fed also influences the mo ...

Japan

... Postwar Financial System • Bank-based system with underdeveloped stock and bond market. • Stable system – no threat of new entry • Safe but inefficient system • Postwar system could not last forever • Banks grew too large but restricted by many restrictions ...

... Postwar Financial System • Bank-based system with underdeveloped stock and bond market. • Stable system – no threat of new entry • Safe but inefficient system • Postwar system could not last forever • Banks grew too large but restricted by many restrictions ...

Public Investment Programme of BiH

... The most important function of CBBH The CBBH operates monetary policy through a Currency Board arrangement Choice of a Currency Board: It Provides a firm nominal anchor in the form of a fixed exchange rate. It removed discretion in a situation where there was considerable difficulty in est ...

... The most important function of CBBH The CBBH operates monetary policy through a Currency Board arrangement Choice of a Currency Board: It Provides a firm nominal anchor in the form of a fixed exchange rate. It removed discretion in a situation where there was considerable difficulty in est ...

Chapter 19

... The Fed was to hold a stock of government bonds. The interest income from the bonds finances the work of the Fed. This gives the Fed a source of income independent of the federal budget, and reduces the influence of politics on Fed behavior. If Congress is upset over some action of, say, the Federal ...

... The Fed was to hold a stock of government bonds. The interest income from the bonds finances the work of the Fed. This gives the Fed a source of income independent of the federal budget, and reduces the influence of politics on Fed behavior. If Congress is upset over some action of, say, the Federal ...

Fiscal policy is carried out primarily by:

... 13. In which of the following situations is it certain that the quantity of money demanded by the public will decrease? A) nominal GDP decreases and the interest rate decreases B) nominal GDP increases and the interest rate decreases C) nominal GDP decreases and the interest rate increases D) nomina ...

... 13. In which of the following situations is it certain that the quantity of money demanded by the public will decrease? A) nominal GDP decreases and the interest rate decreases B) nominal GDP increases and the interest rate decreases C) nominal GDP decreases and the interest rate increases D) nomina ...

3 - GCC

... b. Assuming the Fed injects $1000 into the economy and that the reserve requirement is 4%, lay out a table that shows how the banking system creates money through its intermediation (accepting deposits and making loans). c. Assuming a 2.5% reserve ratio, calculate the deposit multiplier. (Show your ...

... b. Assuming the Fed injects $1000 into the economy and that the reserve requirement is 4%, lay out a table that shows how the banking system creates money through its intermediation (accepting deposits and making loans). c. Assuming a 2.5% reserve ratio, calculate the deposit multiplier. (Show your ...

here - mrrobinson.org

... 1. To regulate bank holding companies and state chartered banks. 2. To supply money and credit to the economy to maintain stable prices and full employment. 3. To ensure the smooth functioning of the ...

... 1. To regulate bank holding companies and state chartered banks. 2. To supply money and credit to the economy to maintain stable prices and full employment. 3. To ensure the smooth functioning of the ...

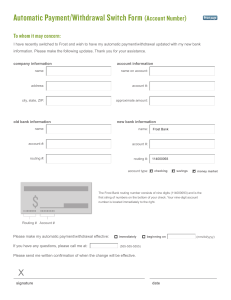

Automatic Payment/Withdrawal Switch Form (Account Number)

... To whom it may concern: I have recently switched to Frost and wish to have my automatic payment/withdrawal updated with my new bank information. Please make the following updates. Thank you for your assistance. company information ...

... To whom it may concern: I have recently switched to Frost and wish to have my automatic payment/withdrawal updated with my new bank information. Please make the following updates. Thank you for your assistance. company information ...

![Statement on Monetary Policy (Announced at 12:00 p.m.) [PDF 32KB]](http://s1.studyres.com/store/data/007821207_1-f2f5fedca75232ebc78fc301f8df1ffe-300x300.png)