UK consumer credit

... Other is estimated as total consumer credit lending minus dealership car finance and credit card lending. ...

... Other is estimated as total consumer credit lending minus dealership car finance and credit card lending. ...

Transmission of Monetary Policy.

... Supply and Demand for Money - Equilibrium Supply of money is determined by the central bank monetary policy, and therefore the supply curve is vertical. Demand for money is inversely related to the money rate of interest, because higher interest rates ...

... Supply and Demand for Money - Equilibrium Supply of money is determined by the central bank monetary policy, and therefore the supply curve is vertical. Demand for money is inversely related to the money rate of interest, because higher interest rates ...

Macro Chapter 13 study guide questions 15e

... the money supply and the national debt? a. The money supply will increase; the national debt will decrease. b. The money supply will decrease; the national debt will increase. c. The money supply will increase; the national debt will be unaffected. d. The money supply will decrease; the national deb ...

... the money supply and the national debt? a. The money supply will increase; the national debt will decrease. b. The money supply will decrease; the national debt will increase. c. The money supply will increase; the national debt will be unaffected. d. The money supply will decrease; the national deb ...

Lecture 7 Money Commercial Banking and Monetary Policy

... Now, Bank 3 makes a €51.20 loan and deposits it in the checking account of a borrower, Neithan, who uses the loan to buy a good and pays by a check. The seller, Jennifer, deposits the check in her account in Bank 4: ...

... Now, Bank 3 makes a €51.20 loan and deposits it in the checking account of a borrower, Neithan, who uses the loan to buy a good and pays by a check. The seller, Jennifer, deposits the check in her account in Bank 4: ...

Chapter 15 Monetary Policy

... banks, banks give up some of their securities and the Fed pays money for those securities. Thus they increase the excess reserves of the commercial banks by the amount of the purchase. Commercial banks are then able to loan out more money from their excess reserves. This increases Ig, which stimulat ...

... banks, banks give up some of their securities and the Fed pays money for those securities. Thus they increase the excess reserves of the commercial banks by the amount of the purchase. Commercial banks are then able to loan out more money from their excess reserves. This increases Ig, which stimulat ...

Handout 7 - Jason Lee

... 2. Changing the Reserve Requirement Ratio: A tool that is rarely used to change the money supply is to change the reserve requirement ratio. Think about how changing the ratio will affect money supply. Suppose that the Fed decides to increase the reserve requirement ratio. The result would be that t ...

... 2. Changing the Reserve Requirement Ratio: A tool that is rarely used to change the money supply is to change the reserve requirement ratio. Think about how changing the ratio will affect money supply. Suppose that the Fed decides to increase the reserve requirement ratio. The result would be that t ...

Lecture8a

... – Open market operations -- purchase securities -increase bank excess reserves and the monetary base. – Reserve requirements -- reduce reserve requirements -- increase excess reserves and increase the deposit expansion multiplier. – Discount rate -- reduce the rate -- reduce the cost of borrowing re ...

... – Open market operations -- purchase securities -increase bank excess reserves and the monetary base. – Reserve requirements -- reduce reserve requirements -- increase excess reserves and increase the deposit expansion multiplier. – Discount rate -- reduce the rate -- reduce the cost of borrowing re ...

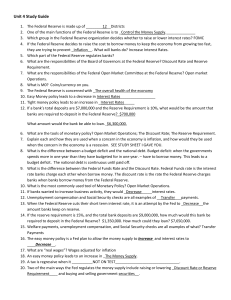

Unit 4 Study Guide

... rate banks charge each other when borrow money. The discount rate is the rate the Federal Reserve charges banks when banks borrow money from the Federal Reserve. 10. What is the most commonly used tool of Monetary Policy? Open Market Operations. 11. If banks wanted to increase business activity, the ...

... rate banks charge each other when borrow money. The discount rate is the rate the Federal Reserve charges banks when banks borrow money from the Federal Reserve. 10. What is the most commonly used tool of Monetary Policy? Open Market Operations. 11. If banks wanted to increase business activity, the ...

Education Technology Service

... value of their Local Authority funding paid, by monthly instalments, directly into their bank account. All schools in Bradford have their own bank accounts and schools have the option to receive either a full or a part budget share. Part Budget Share – a school has the cost of their salaries, cateri ...

... value of their Local Authority funding paid, by monthly instalments, directly into their bank account. All schools in Bradford have their own bank accounts and schools have the option to receive either a full or a part budget share. Part Budget Share – a school has the cost of their salaries, cateri ...

Two banks can borrow from the corporate sector on the following terms

... The bank borrows on a low fixed rates, and enters a swap so that it pays a floating rate and receives a fixed rate.Therefore it can achieve sub-LIBOR borrowing. A money market investor has made a deposit that is due to mature but is concerned that interest rates are falling and the returns on re-inv ...

... The bank borrows on a low fixed rates, and enters a swap so that it pays a floating rate and receives a fixed rate.Therefore it can achieve sub-LIBOR borrowing. A money market investor has made a deposit that is due to mature but is concerned that interest rates are falling and the returns on re-inv ...

Your Money and the Federal Reserve System

... will haveto be reduced to meetthe new ratioof reservesto deposits.To do so, loan volume will haveto be reduced. Second,each ReserveBank can lend funds to financial institutionsand thus increasereserves.The FederalReservedeterminesthe discount (interest)ratewhich must be paid for such loans.It usuall ...

... will haveto be reduced to meetthe new ratioof reservesto deposits.To do so, loan volume will haveto be reduced. Second,each ReserveBank can lend funds to financial institutionsand thus increasereserves.The FederalReservedeterminesthe discount (interest)ratewhich must be paid for such loans.It usuall ...

1930-1933 M1 Charts

... money makes a full circle and goes back to the original lender. In contrast, when credit is created out of "thin air" and returned on the maturity day to the bank this amounts to a withdrawal of money from the economy, i.e, to a decline in the money stock. The reason for this is because there wasn't ...

... money makes a full circle and goes back to the original lender. In contrast, when credit is created out of "thin air" and returned on the maturity day to the bank this amounts to a withdrawal of money from the economy, i.e, to a decline in the money stock. The reason for this is because there wasn't ...

The Art of Crisis Management: Auctions and Swaps

... bank as a lender of last resort. The idea is that during a crisis, solvent but illiquid banks can go to the central bank for a loan.[5] The theory is that these loans are to be made at penalty rates – higher than the target for the overnight rate set by policymakers – and on good collateral. Why are ...

... bank as a lender of last resort. The idea is that during a crisis, solvent but illiquid banks can go to the central bank for a loan.[5] The theory is that these loans are to be made at penalty rates – higher than the target for the overnight rate set by policymakers – and on good collateral. Why are ...

AP Macro Week 7 Practice Quiz: L – M, #31

... (B) signal participants in financial markets that a recession is coming. (C) signal participants in financial markets that an inflationary period is coming. (D) lower prices in the economy. (E) encourage borrowing by depository institutions so that the money supply may expand. 14. Assume that the Fe ...

... (B) signal participants in financial markets that a recession is coming. (C) signal participants in financial markets that an inflationary period is coming. (D) lower prices in the economy. (E) encourage borrowing by depository institutions so that the money supply may expand. 14. Assume that the Fe ...

Unit1

... The central bank is responsible for the trend or long-run behavior of the money supply. Banks and non-bank public also play important roles in determining the aggregate money supply. In the United States, the central bank is the Federal Reserve System (the Fed). The Fed conducts monetary pol ...

... The central bank is responsible for the trend or long-run behavior of the money supply. Banks and non-bank public also play important roles in determining the aggregate money supply. In the United States, the central bank is the Federal Reserve System (the Fed). The Fed conducts monetary pol ...

money supply

... The central bank is responsible for the trend or long-run behavior of the money supply. Banks and non-bank public also play important roles in determining the aggregate money supply. In the United States, the central bank is the Federal Reserve System (the Fed). The Fed conducts monetary pol ...

... The central bank is responsible for the trend or long-run behavior of the money supply. Banks and non-bank public also play important roles in determining the aggregate money supply. In the United States, the central bank is the Federal Reserve System (the Fed). The Fed conducts monetary pol ...

Palestine Monetary Authority: Striving for stable banks

... stability, rather than monetary stability. Thus, since its establishment in 1995, the PMA’s primary goal has been supporting a sound financial system capable of fostering the national economy through rigorous supervision and prudential regulations in line with best international practices. I believe ...

... stability, rather than monetary stability. Thus, since its establishment in 1995, the PMA’s primary goal has been supporting a sound financial system capable of fostering the national economy through rigorous supervision and prudential regulations in line with best international practices. I believe ...

Multiplier PPT

... a) Assume that a bank receives a cash deposit of $9000 from a customer. What is the immediate impact of this transaction on the money supply? Explain. ...

... a) Assume that a bank receives a cash deposit of $9000 from a customer. What is the immediate impact of this transaction on the money supply? Explain. ...

W C B ?

... stood to advocate economic management and centralized monetary policy, he too recognized the limitations of state action “but, above all, individualism, if it can be purged of its defects and abuses, is the best safeguard of personal liberty” (Keynes, 1936). what is clear is that, far from consensus ...

... stood to advocate economic management and centralized monetary policy, he too recognized the limitations of state action “but, above all, individualism, if it can be purged of its defects and abuses, is the best safeguard of personal liberty” (Keynes, 1936). what is clear is that, far from consensus ...