Chapter 28: Monetary Policy and the Debate about Macro Policy

... to this change, and the "ripples" will show up on its balance sheet. Paying cash to the Fed means that the bank's reserves are too low, and the bank must figure out a way to meet its reserve requirement. It may call in loans to do so, but that in turn could mean that someone paid the loan from a che ...

... to this change, and the "ripples" will show up on its balance sheet. Paying cash to the Fed means that the bank's reserves are too low, and the bank must figure out a way to meet its reserve requirement. It may call in loans to do so, but that in turn could mean that someone paid the loan from a che ...

Chapter 28: Monetary Policy and the Debate about Macro Policy

... to this change, and the "ripples" will show up on its balance sheet. Paying cash to the Fed means that the bank's reserves are too low, and the bank must figure out a way to meet its reserve requirement. It may call in loans to do so, but that in turn could mean that someone paid the loan from a che ...

... to this change, and the "ripples" will show up on its balance sheet. Paying cash to the Fed means that the bank's reserves are too low, and the bank must figure out a way to meet its reserve requirement. It may call in loans to do so, but that in turn could mean that someone paid the loan from a che ...

Monetary Policy PowerPoint

... • To contract money supply Fed sells government securities. Cash paid for securities is withdrawn from bank reserves, shrinking money supply and decreasing aggregate demand • To expand money supply Fed buys government securities. Money makes it way into individual and business accounts increasing ca ...

... • To contract money supply Fed sells government securities. Cash paid for securities is withdrawn from bank reserves, shrinking money supply and decreasing aggregate demand • To expand money supply Fed buys government securities. Money makes it way into individual and business accounts increasing ca ...

The Great Liquidity Squeeze of 2017: Cash dries up as loan

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

The Purpose of Monetary Policy - Tiemann Investment Advisors, LLC

... I allow Harper to give me what is essentially an IOU because I want to make the sale, and I know that I’ll have a better chance, or a bigger sale, if I help Harper finance it. But now I’ve created an account receivable, which I have to finance somehow until Harper pays me. To do that, I take advant ...

... I allow Harper to give me what is essentially an IOU because I want to make the sale, and I know that I’ll have a better chance, or a bigger sale, if I help Harper finance it. But now I’ve created an account receivable, which I have to finance somehow until Harper pays me. To do that, I take advant ...

here - Transforming Finance

... avoiding these cycles and crises? The East Asian Economic Miracle centred on productive credit creation Japan, Korea, Taiwan and China developed so rapidly by using ‘credit guidance’, whereby the central bank targets productive bank credit and restricts unproductive bank credit. A Bank of Engl ...

... avoiding these cycles and crises? The East Asian Economic Miracle centred on productive credit creation Japan, Korea, Taiwan and China developed so rapidly by using ‘credit guidance’, whereby the central bank targets productive bank credit and restricts unproductive bank credit. A Bank of Engl ...

Microsoft Word - TempDoc1.doc

... both primary and collateral including1 specific cash flows assigned to project wise finance/loan raised and personal/ corporate guarantee, to be furnished). VIII. Requests for facilities which are under process (The information to be given for domestic and overseas borrowings from commercial banks, ...

... both primary and collateral including1 specific cash flows assigned to project wise finance/loan raised and personal/ corporate guarantee, to be furnished). VIII. Requests for facilities which are under process (The information to be given for domestic and overseas borrowings from commercial banks, ...

Monetary Policy: Tools

... • Open market purchase federal funds rate falls • Open market sale federal funds rate rises • Impact of discount rate on federal funds rate • Impact of reserve requirement on federal funds rate ...

... • Open market purchase federal funds rate falls • Open market sale federal funds rate rises • Impact of discount rate on federal funds rate • Impact of reserve requirement on federal funds rate ...

PowerPoint

... Single supervision cannot work properly without an effective resolution authority and a credible financing mechanism. It also needs effective decisionmaking structures – all of which the SRM does not deliver at this point. Difficult political issue – Juncker: ‘We all know what to do, but don’t know ...

... Single supervision cannot work properly without an effective resolution authority and a credible financing mechanism. It also needs effective decisionmaking structures – all of which the SRM does not deliver at this point. Difficult political issue – Juncker: ‘We all know what to do, but don’t know ...

This PDF is a selection from a published volume from... Economic Research

... • The chapter argues that securitization is particularly important in Asia because it improves the transparency of the financial sector and helps lenders manage their interest rate risk and duration risk. An additional benefit of securitization is that it improves financial stability by removing ris ...

... • The chapter argues that securitization is particularly important in Asia because it improves the transparency of the financial sector and helps lenders manage their interest rate risk and duration risk. An additional benefit of securitization is that it improves financial stability by removing ris ...

The Federal Reserve The Federal Reserve

... people can use to transfer purchasing power from the present to the future. ...

... people can use to transfer purchasing power from the present to the future. ...

of a bank - Octavian JULA

... people can use to transfer purchasing power from the present to the future. ...

... people can use to transfer purchasing power from the present to the future. ...

What is money? Primarily, anything widely accepted and used as a

... The term Banking reserves refers to the stock of state fiat money held by ADIs as assets. Banking institutions are obliged for several reasons to maintain a minimal level of regulatory capital in relation to their financial assets (loans, investments and reserves), and a minimal level of banking res ...

... The term Banking reserves refers to the stock of state fiat money held by ADIs as assets. Banking institutions are obliged for several reasons to maintain a minimal level of regulatory capital in relation to their financial assets (loans, investments and reserves), and a minimal level of banking res ...

Download attachment

... Capital requirements Crisis prevention policies u Coordination and exchange of information u Improve incentive structures u Minimization of moral hazard u Transparency and disclosure u Liquidity backstop facilities Reforms ...

... Capital requirements Crisis prevention policies u Coordination and exchange of information u Improve incentive structures u Minimization of moral hazard u Transparency and disclosure u Liquidity backstop facilities Reforms ...

Why the Fed`s rate cuts won`t help you

... dark forces in the global financing system that they now admit they scarcely understood. How could this happen? Albert Wojnilower, who was chief economist at Credit Suisse First Boston for a quarter of a century, observes that the history of finance is rife with examples of financiers who successful ...

... dark forces in the global financing system that they now admit they scarcely understood. How could this happen? Albert Wojnilower, who was chief economist at Credit Suisse First Boston for a quarter of a century, observes that the history of finance is rife with examples of financiers who successful ...

Ch. 14 Handout

... The different from others in that they are not ____________________________and _____________________________after they have first been issued. Holders of these who want their funds back before the bonds have matured must “_______________________” the bonds with the Bank of Canada at a __________ ...

... The different from others in that they are not ____________________________and _____________________________after they have first been issued. Holders of these who want their funds back before the bonds have matured must “_______________________” the bonds with the Bank of Canada at a __________ ...

Money, Banking and the Federal Reserve

... Reserves: Deposits that a bank keeps as cash in its vault or on deposit with the Federal Reserve. Required reserves: Reserves that a bank is legally required to hold, based on its checking account deposits. Required reserve ratio: The minimum fraction of deposits banks are required by law to keep a ...

... Reserves: Deposits that a bank keeps as cash in its vault or on deposit with the Federal Reserve. Required reserves: Reserves that a bank is legally required to hold, based on its checking account deposits. Required reserve ratio: The minimum fraction of deposits banks are required by law to keep a ...

Home Economics - Green Economist

... Euro as a Political Project • Compare Polanyi’s critique of the gold standard • For countries who control their national curencies the decision not to pay is a political one ...

... Euro as a Political Project • Compare Polanyi’s critique of the gold standard • For countries who control their national curencies the decision not to pay is a political one ...

Guaranty Trust Bank plc AUDITED HALF

... Commenting on the financial results, Segun Agbaje, the Managing Director/CEO of Guaranty Trust Bank plc, said that “Going into the year, we knew it would be a challenging year and we prepared for it by focusing on effective management of the balance sheet and adapting our business model to changing ...

... Commenting on the financial results, Segun Agbaje, the Managing Director/CEO of Guaranty Trust Bank plc, said that “Going into the year, we knew it would be a challenging year and we prepared for it by focusing on effective management of the balance sheet and adapting our business model to changing ...

2013 Spring Sample Final Solutions

... 11) Suppose the Bank of Canada were to implement an expansionary monetary policy by buying government securities on the open market, thereby increasing cash reserves in the banking system. If the commercial banks do not expand their lending in response, then 1) there would be no change in the money ...

... 11) Suppose the Bank of Canada were to implement an expansionary monetary policy by buying government securities on the open market, thereby increasing cash reserves in the banking system. If the commercial banks do not expand their lending in response, then 1) there would be no change in the money ...

2013 Spring Sample Final

... 11) Suppose the Bank of Canada were to implement an expansionary monetary policy by buying government securities on the open market, thereby increasing cash reserves in the banking system. If the commercial banks do not expand their lending in response, then 1) there would be no change in the money ...

... 11) Suppose the Bank of Canada were to implement an expansionary monetary policy by buying government securities on the open market, thereby increasing cash reserves in the banking system. If the commercial banks do not expand their lending in response, then 1) there would be no change in the money ...

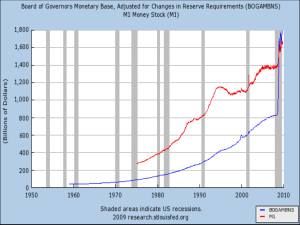

Monetary Policy Monetary Policy Money Supply How Banks Make

... o If you can’t lower the interest rate (the price of money) any further, the Bank can try to increase the supply. o The central bank buys financial assets (bonds (government or private), other securities) from financial institutions. o By purchasing these instruments (increasing demand), this increa ...

... o If you can’t lower the interest rate (the price of money) any further, the Bank can try to increase the supply. o The central bank buys financial assets (bonds (government or private), other securities) from financial institutions. o By purchasing these instruments (increasing demand), this increa ...