Banking System and Money Supply

... A. Medium of exchange: Money can be used for buying and selling goods and services. B. Unit of account: Prices are quoted in dollars and cents. C. Store of value: Money allows us to transfer purchasing power from present to future. It is the most liquid (spendable) of all assets, a convenient way to ...

... A. Medium of exchange: Money can be used for buying and selling goods and services. B. Unit of account: Prices are quoted in dollars and cents. C. Store of value: Money allows us to transfer purchasing power from present to future. It is the most liquid (spendable) of all assets, a convenient way to ...

Conventional and Unconventional Monetary Policy and FTPL Stephen Williamson

... Why? For example, include banks and “balance sheet costs,” i.e. what causes the fed funds rate to be lower than the interest rate on reserves. Implies that an increase in central bank balance sheet size is not neutral – reduces real interest rate and increases in‡ation. Why? Tightens collateral cons ...

... Why? For example, include banks and “balance sheet costs,” i.e. what causes the fed funds rate to be lower than the interest rate on reserves. Implies that an increase in central bank balance sheet size is not neutral – reduces real interest rate and increases in‡ation. Why? Tightens collateral cons ...

THE CENTRAL BANK AND INFLATION

... perpetual, high levels of inflation. It is impossible for the supply of or demand for a widely used input like labor or oil to change so much and continuously as to cause the price of the input to rise at such perpetual, very high levels to cause sustained, rapid inflation. Also, government purchase ...

... perpetual, high levels of inflation. It is impossible for the supply of or demand for a widely used input like labor or oil to change so much and continuously as to cause the price of the input to rise at such perpetual, very high levels to cause sustained, rapid inflation. Also, government purchase ...

PR-Tinkoff-Bank-Mortgage-18-May-2015-ENG

... successful online retail deposits programme. The Group’s other innovative lines of business include Tinkoff Online Insurance, which enables the Group to underwrite and sell its own innovative online insurance products, and Tinkoff Mobile Wallet, mobile payment solutions and financial services for Ru ...

... successful online retail deposits programme. The Group’s other innovative lines of business include Tinkoff Online Insurance, which enables the Group to underwrite and sell its own innovative online insurance products, and Tinkoff Mobile Wallet, mobile payment solutions and financial services for Ru ...

What is islamic banking

... What is financial system ? The processes and procedures used by an organization management to exercise financial control & accountant ability. These measures include recording , verification, and timely reporting of transactions that affect revenues, expenditures, assets and liabilities. The financ ...

... What is financial system ? The processes and procedures used by an organization management to exercise financial control & accountant ability. These measures include recording , verification, and timely reporting of transactions that affect revenues, expenditures, assets and liabilities. The financ ...

1. What are the three tools of monetary policy? Open market

... 3. If a commercial bank borrows money from the Federal Reserve, what is the rate called? Discount Rate 4. If the Fed implemented “tight money policy” what would this mean? Concern is Inflation. Give an example of how the Fed would use one of the tools to implement a tight money policy. See #2 above. ...

... 3. If a commercial bank borrows money from the Federal Reserve, what is the rate called? Discount Rate 4. If the Fed implemented “tight money policy” what would this mean? Concern is Inflation. Give an example of how the Fed would use one of the tools to implement a tight money policy. See #2 above. ...

Regulation

... than figure indicates because – There was a huge amount of unmeasured investment in the second half of the 1990s ...

... than figure indicates because – There was a huge amount of unmeasured investment in the second half of the 1990s ...

27-Evidence on Monetary Policy

... which left gold standard early, or that were not on gold standard during depression did not suffer as severe effects in terms of dropping output and prices. ...

... which left gold standard early, or that were not on gold standard during depression did not suffer as severe effects in terms of dropping output and prices. ...

... capital readily, and a stream of losses left New England’s banks with only one way to boost their capital-to-asset ratios: by shrinking their assets. And the assets most banks chose to shrink were commercial and industrial loans, which fell from a peak of $41 billion in the first quarter of 1990 to ...

Money, output and Prices in LR Macro_Module_32 money

... What you will learn in this Module: • The effects of an inappropriate monetary policy • The concept of monetary neutrality and its relationship to the long-term economic effects of monetary policy ...

... What you will learn in this Module: • The effects of an inappropriate monetary policy • The concept of monetary neutrality and its relationship to the long-term economic effects of monetary policy ...

Bank reserves - McGraw Hill Higher Education

... Receipts are deposited and this leads to a multiple expansion of the money supply ...

... Receipts are deposited and this leads to a multiple expansion of the money supply ...

Broad money and lending in the United States during the

... base money comprises currency in circulation and deposits held in the case of the euro area, purchases will by banks and other depository institutions in their accounts with the Federal Reserve. For the euro area, base money comprises result in an initial one-to-one increase in M3 banknotes and MFls ...

... base money comprises currency in circulation and deposits held in the case of the euro area, purchases will by banks and other depository institutions in their accounts with the Federal Reserve. For the euro area, base money comprises result in an initial one-to-one increase in M3 banknotes and MFls ...

Iceland`s Financial Crisis

... • Foreign operations of the old banks will likely be sold to other parties, such as foreign financial institutions. Others may be shut down and their assets used to reimburse deposits and other outstanding liabilities – with the backup of the guarantee funds in the respective country according to EU ...

... • Foreign operations of the old banks will likely be sold to other parties, such as foreign financial institutions. Others may be shut down and their assets used to reimburse deposits and other outstanding liabilities – with the backup of the guarantee funds in the respective country according to EU ...

Does Size Matter? The Effects of Bank Mergers on Small Firm

... and New York. In these and other states there are a significant amount of loans being granted to small businesses. This is supported by economic theory according to which competition increases the quality of services offered for any given price. The opposite is also true, for example in Alaska, Neva ...

... and New York. In these and other states there are a significant amount of loans being granted to small businesses. This is supported by economic theory according to which competition increases the quality of services offered for any given price. The opposite is also true, for example in Alaska, Neva ...

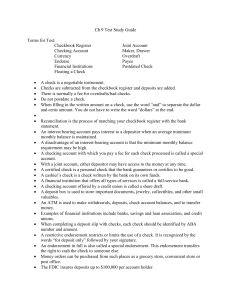

Ch 9 Test Study Guide

... A deposit box is used to store important documents, jewelry, collectibles, and other small valuables. An ATM is used to make withdrawals, deposits, check account balances, and to transfer money. Examples of financial institutions include banks, savings and loan association, and credit unions. When c ...

... A deposit box is used to store important documents, jewelry, collectibles, and other small valuables. An ATM is used to make withdrawals, deposits, check account balances, and to transfer money. Examples of financial institutions include banks, savings and loan association, and credit unions. When c ...

Practice with Money

... C. are less liquid than stocks and bonds. D. create a liability for the user of the card. E. are not considered part of the money supply as they are not paper currency. ____ 65. In order for an asset to be considered money, it must be: A. able to serve as medium of exchange, standard unit of accoun ...

... C. are less liquid than stocks and bonds. D. create a liability for the user of the card. E. are not considered part of the money supply as they are not paper currency. ____ 65. In order for an asset to be considered money, it must be: A. able to serve as medium of exchange, standard unit of accoun ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... general. When interest rates are low, banks earn less money from the loans they’ve made. At the same time, it’s hard to offset this by lowering the rate they pay on deposits. As a result, banks are worried about the gap between the return they make when they loan money and the rate they pay on depos ...

... general. When interest rates are low, banks earn less money from the loans they’ve made. At the same time, it’s hard to offset this by lowering the rate they pay on deposits. As a result, banks are worried about the gap between the return they make when they loan money and the rate they pay on depos ...

Europe`s bank loan funds – where now?

... humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activity, taking the total for the year to over $10 billion ...

... humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activity, taking the total for the year to over $10 billion ...

Ecuador

... Dollarization helps to limit currency and balance of payments crises. Without a domestic currency there is no possibility of a sharp depreciation, or of sudden capital outflows motivated by fears of devaluation. ...

... Dollarization helps to limit currency and balance of payments crises. Without a domestic currency there is no possibility of a sharp depreciation, or of sudden capital outflows motivated by fears of devaluation. ...

Date of Fund Membership: September 28, 1981 Standard Sources

... 17r). In February 1997, the European Development Fund deposited ECU 3 million in the Reserve Bank of Vanuatu on account of a STABEX grant; these funds, which were withdrawn in March (ECU 1 million) and in April 1997 (ECU 2 million), are recorded as foreign liabilities and are matched by foreign asse ...

... 17r). In February 1997, the European Development Fund deposited ECU 3 million in the Reserve Bank of Vanuatu on account of a STABEX grant; these funds, which were withdrawn in March (ECU 1 million) and in April 1997 (ECU 2 million), are recorded as foreign liabilities and are matched by foreign asse ...