Large Indian bank improves fraud detection and management A reputed Indian bank

... existing patterns. The IP addresses of the computer systems used for these transactions and the account numbers to which the funds were transferred were traced. Based on the IP addresses provided by the TCS team, the client's internal IT team could identify the employees involved in the fraud. The c ...

... existing patterns. The IP addresses of the computer systems used for these transactions and the account numbers to which the funds were transferred were traced. Based on the IP addresses provided by the TCS team, the client's internal IT team could identify the employees involved in the fraud. The c ...

Discussion

... • Margin can be used to consumption and non repayment savings • Consumption depends on the saving rate of all households • How the interest rates of risky households affect the consumption of other households? ...

... • Margin can be used to consumption and non repayment savings • Consumption depends on the saving rate of all households • How the interest rates of risky households affect the consumption of other households? ...

QUESTIONS NUMBER ONE a) You are given the following

... a) Commercial banks „create‟ credit through a process known as credit creation. Credit creation is defined as a process by which commercial banks advance loans from deposits net of a statutory cash ratio requirement. This involves lending out money (from deposits) at an interest. This is because ban ...

... a) Commercial banks „create‟ credit through a process known as credit creation. Credit creation is defined as a process by which commercial banks advance loans from deposits net of a statutory cash ratio requirement. This involves lending out money (from deposits) at an interest. This is because ban ...

Lending Club Courts Small Banks as Personal

... He and Morris declined to be more specific about the financial terms of the loan-referral deal, but the arrangement is just part of Titan’s bigger relationship with Lending Club. The bank also buys loans that Lending Club has already originated through its website. Titan and other banks buy the star ...

... He and Morris declined to be more specific about the financial terms of the loan-referral deal, but the arrangement is just part of Titan’s bigger relationship with Lending Club. The bank also buys loans that Lending Club has already originated through its website. Titan and other banks buy the star ...

Monetary Policy

... all of the money received by the bank will go into reserves. The bank does not have to keep a reserve for this money as it is not a checkable deposit. When individuals deposit Fed money for bonds into the bank, the bank must hold a % of it as reserves. This means that there is slightly less monetary ...

... all of the money received by the bank will go into reserves. The bank does not have to keep a reserve for this money as it is not a checkable deposit. When individuals deposit Fed money for bonds into the bank, the bank must hold a % of it as reserves. This means that there is slightly less monetary ...

An overview of banking systems in the COMESA member states and

... strengthened financial conditions, and low dependence on external funding as banks rely on the domestic economy for their funding, in addition to the low leverage levels, and little if any, exposure to poor quality financial assets; the banking sectors in most countries were pretty much insulated fr ...

... strengthened financial conditions, and low dependence on external funding as banks rely on the domestic economy for their funding, in addition to the low leverage levels, and little if any, exposure to poor quality financial assets; the banking sectors in most countries were pretty much insulated fr ...

PDF Download

... tends to be insolvent? If so, then this must mean that even if there was a spike in the cost of financing, it should be short lived. Investors would soon bring it down after realising how favourable the risk-return profile of excessively high yielding bonds of well-capitalised banks’ was; especially ...

... tends to be insolvent? If so, then this must mean that even if there was a spike in the cost of financing, it should be short lived. Investors would soon bring it down after realising how favourable the risk-return profile of excessively high yielding bonds of well-capitalised banks’ was; especially ...

Chapter 16 Practice Problems 1. What are the Federal Reserve`s

... The argument for not releasing the FOMC directives immediately is that it keeps Congress off the Fed’s back, thus enabling the Fed to pursue an independent monetary policy that is less subject to inflation and political business cycles. The argument for releasing the directive immediately is that it ...

... The argument for not releasing the FOMC directives immediately is that it keeps Congress off the Fed’s back, thus enabling the Fed to pursue an independent monetary policy that is less subject to inflation and political business cycles. The argument for releasing the directive immediately is that it ...

chap016Answers

... Actual reserves of the commercial banks would fall, as would excess reserves and lending. The money supply would drop, interest rates would rise, and aggregate demand would ...

... Actual reserves of the commercial banks would fall, as would excess reserves and lending. The money supply would drop, interest rates would rise, and aggregate demand would ...

CVCFO Fund Administration

... “Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of Amer ...

... “Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of Amer ...

Monetary Policy

... economy he BUYS government bonds from banks. – Banks have more money to loan to customers. – People then have more money to consume and invest. – A way to quickly “inject” money or take it out of the economy. ...

... economy he BUYS government bonds from banks. – Banks have more money to loan to customers. – People then have more money to consume and invest. – A way to quickly “inject” money or take it out of the economy. ...

Segmentation in the US Financial Services Industry

... demand deposits and made commercial and industrial loans. By acquiring banks and subsequently divesting off either their deposits or their loans, nonbanks and commercial firms gained control over banking institutions, essentially exploiting a loophole. The 1987 Competitive Equality Banking Act redef ...

... demand deposits and made commercial and industrial loans. By acquiring banks and subsequently divesting off either their deposits or their loans, nonbanks and commercial firms gained control over banking institutions, essentially exploiting a loophole. The 1987 Competitive Equality Banking Act redef ...

Should banks be allowed to go into bankruptcy

... Icelandic economy were too small in comparison with the debt of the banks. Therefore, the Icelandic banks were forced into bankruptcy leaving the country in turmoil. The domestic stock market 2009 was 95% lower than it had been in 2007, and Iceland’s GDP fell by 14% during the same period. (MoneyWee ...

... Icelandic economy were too small in comparison with the debt of the banks. Therefore, the Icelandic banks were forced into bankruptcy leaving the country in turmoil. The domestic stock market 2009 was 95% lower than it had been in 2007, and Iceland’s GDP fell by 14% during the same period. (MoneyWee ...

the real lessons of “black thursday”

... account with anybody. This institutional set-up impeded the proper working of the CBA. To illustrate, suppose the Hong Kong dollar came under pressure, and the authorities were obliged to sell US dollars. The monetary base would not shrink, and the money market would not tighten, as required by the ...

... account with anybody. This institutional set-up impeded the proper working of the CBA. To illustrate, suppose the Hong Kong dollar came under pressure, and the authorities were obliged to sell US dollars. The monetary base would not shrink, and the money market would not tighten, as required by the ...

SBP Conference on Branchless Banking Keynote Address by 17

... 4. It is also my desire that we should work towards achieving a system in which our farmers also receive their payments particularly for rice, sugarcane and cotton electronically through branchless banking. The same should apply to BISP beneficiaries as well as any future disaster affectees. Likewis ...

... 4. It is also my desire that we should work towards achieving a system in which our farmers also receive their payments particularly for rice, sugarcane and cotton electronically through branchless banking. The same should apply to BISP beneficiaries as well as any future disaster affectees. Likewis ...

MONEY SETTLEMENT SYSTEM

... a secure Fed wire, allowing firms to “net” dollars across product lines and providing easier reconciliation of your business transactions at the end of every day. ...

... a secure Fed wire, allowing firms to “net” dollars across product lines and providing easier reconciliation of your business transactions at the end of every day. ...

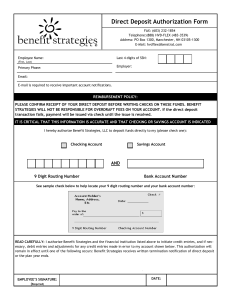

Direct Deposit Authorization Form

... IT IS CRITICAL THAT THIS INFORMATION IS ACCURATE AND THAT CHECKING OR SAVINGS ACCOUNT IS INDICATED I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

... IT IS CRITICAL THAT THIS INFORMATION IS ACCURATE AND THAT CHECKING OR SAVINGS ACCOUNT IS INDICATED I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

Chapter 10 Federal Reserve System

... After the purchase of securities by the Fed, if all banks makes loans until excess reserves equal 0 and there are no cash leakage, checkable deposits can expand by a maximum of _________. ...

... After the purchase of securities by the Fed, if all banks makes loans until excess reserves equal 0 and there are no cash leakage, checkable deposits can expand by a maximum of _________. ...

krugman ir macro module 36(72).indd

... 2. The Federal Reserve’s assets include government debt, mainly in the form of U.S. Treasury bills. 3. The Federal Reserve’s liabilities include the currency in circulation plus bank reserves, which together constitute the monetary base. 4. Monetary policy is most often conducted using open-marke ...

... 2. The Federal Reserve’s assets include government debt, mainly in the form of U.S. Treasury bills. 3. The Federal Reserve’s liabilities include the currency in circulation plus bank reserves, which together constitute the monetary base. 4. Monetary policy is most often conducted using open-marke ...

Ch 29 The Monetary System

... what the bank could earn by lending those funds out to a consumer or business. So what if the bank managers choose to lend some of the bank’s money out, in an effort to increase the interest ...

... what the bank could earn by lending those funds out to a consumer or business. So what if the bank managers choose to lend some of the bank’s money out, in an effort to increase the interest ...