TITLE SLIDE IS IN SENTENCE CASE. GREEN BACKGROUND.

... will or may occur in the future. Factors that could cause actual business, strategy, plans and/or results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward looking statements made by the Group or on its behalf include, but are not limit ...

... will or may occur in the future. Factors that could cause actual business, strategy, plans and/or results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward looking statements made by the Group or on its behalf include, but are not limit ...

KC Industry Focus Banking in Mexico Optimistic outlook for the banking sector

... While the economy will remain sluggish, it is believed the sector’s margins are likely to be squeezed as a loan growth continues to decelerate and banks maintain substantial buffers against any increase in non-performing loans, eating into profitability. Mexican economy is expected to accelerate, in ...

... While the economy will remain sluggish, it is believed the sector’s margins are likely to be squeezed as a loan growth continues to decelerate and banks maintain substantial buffers against any increase in non-performing loans, eating into profitability. Mexican economy is expected to accelerate, in ...

The FED and Monetary Policy 1

... • When the FED increases the money supply it increases the amount of money held in bank deposits. • As banks keeps some of the money in reserve and loans out their excess reserves • The loan eventually becomes deposits for another bank that will loan out their excess reserves. ...

... • When the FED increases the money supply it increases the amount of money held in bank deposits. • As banks keeps some of the money in reserve and loans out their excess reserves • The loan eventually becomes deposits for another bank that will loan out their excess reserves. ...

The Monetary System

... • Create a brochure for the Fed. Be sure to include the following: – State the purpose of the Fed and what it is. – How the Fed is structured. – What are its regulatory responsibilities? – What are the three tools of monetary policy? ...

... • Create a brochure for the Fed. Be sure to include the following: – State the purpose of the Fed and what it is. – How the Fed is structured. – What are its regulatory responsibilities? – What are the three tools of monetary policy? ...

Econ 204 Topic 7 - University of Alberta

... Banks allow for cheque and electronic transfer clearing between institutions (through the Bank of Canada accounts when needed) 3) Banks are Profit Seekers Banks compete for investments, and make profits by lending these investments Also make profits from bank fees for a range ...

... Banks allow for cheque and electronic transfer clearing between institutions (through the Bank of Canada accounts when needed) 3) Banks are Profit Seekers Banks compete for investments, and make profits by lending these investments Also make profits from bank fees for a range ...

City of Mahnomen

... Contact Person ___________________________________ Email ____________________________ ...

... Contact Person ___________________________________ Email ____________________________ ...

What is the Federal Reserve?

... and credit available in the economy and the cost of the credit (interest rates) in order to help the economy grow, keep prices stable, and keep employment at a high level the Fed’s actions to manage the money supply to keep inflation low and stable The Fed… processes checks and provides electr ...

... and credit available in the economy and the cost of the credit (interest rates) in order to help the economy grow, keep prices stable, and keep employment at a high level the Fed’s actions to manage the money supply to keep inflation low and stable The Fed… processes checks and provides electr ...

УДК: 330:323:338 Martuniuk Ivan Volodymyrovych Kiev national

... below potential because of insufficient aggregate demand; 2) the market mechanism can not turn the national economy to full employment after shocks - depression and social disturbances; 3) Governments have real impact tools - macroeconomic policies - to return the economy to full employment; 4) if t ...

... below potential because of insufficient aggregate demand; 2) the market mechanism can not turn the national economy to full employment after shocks - depression and social disturbances; 3) Governments have real impact tools - macroeconomic policies - to return the economy to full employment; 4) if t ...

Four Monetary Terms (Part 1) - Wealthcare Securities Pvt. Ltd.

... Higher reserve requirements such as SLR make banks relatively safe (as a certain portion of their deposits are always redeemable) but at the same time restrict their capacity to lend. ...

... Higher reserve requirements such as SLR make banks relatively safe (as a certain portion of their deposits are always redeemable) but at the same time restrict their capacity to lend. ...

Comments on “What Borders are Made of: An Analysis of Banking

... consolidation of ownership (as in Italy over past 20 years or so) – Later might be followed by geographical rationalisation (selective closures in particular regions and localities) – This is the UK story. UK moved from regional banking system to national banking system from 1860s onwards – Number o ...

... consolidation of ownership (as in Italy over past 20 years or so) – Later might be followed by geographical rationalisation (selective closures in particular regions and localities) – This is the UK story. UK moved from regional banking system to national banking system from 1860s onwards – Number o ...

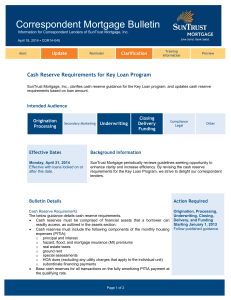

Bulletin COR 14-045: Cash Reserve Requirements

... This information is for use by mortgage professionals only and should not be distributed to or used by consumers or other third parties. This is not for solicitation of sales. Information is accurate as of date of posting and is subject to change without current product details and lending procedure ...

... This information is for use by mortgage professionals only and should not be distributed to or used by consumers or other third parties. This is not for solicitation of sales. Information is accurate as of date of posting and is subject to change without current product details and lending procedure ...

Greece: Taking Stock Powerpoint

... deleveraging – credit to the private sector contracted by 14% between June 2010 - July 2014 (-31% deposits). But deleveraging itself contributed to economic contraction and created negative feedback loops between the financial and real sectors. What started out as liquidity problems very soon turned ...

... deleveraging – credit to the private sector contracted by 14% between June 2010 - July 2014 (-31% deposits). But deleveraging itself contributed to economic contraction and created negative feedback loops between the financial and real sectors. What started out as liquidity problems very soon turned ...

A Study in Risk Analysis - Lahore School of Economics

... faster pace than the rate of growth of their costs. For Pakistani banks, the difference in the growth rates is extremely narrow, if not negative. Bank deposits have grown significantly in recent years primarily because of the rapid growth of money supply, which increased by around 18 per cent and 20 ...

... faster pace than the rate of growth of their costs. For Pakistani banks, the difference in the growth rates is extremely narrow, if not negative. Bank deposits have grown significantly in recent years primarily because of the rapid growth of money supply, which increased by around 18 per cent and 20 ...

SP125: Can Central Banking Survive the IT Revolution?

... System has decided against the issue of $500 bills precisely in order to restrain criminality. ...

... System has decided against the issue of $500 bills precisely in order to restrain criminality. ...

UAE Banking Sector Chart Book: Q3 2016 Review

... that inflation is moving closer to long-run objective of the FED. ECB and FED are diverging in policy directions (Easing & Tightening) which is raising market uncertainty. With the recent data indicating weak growth and low inflation ECB is focusing on medium term targets and started bond purchase p ...

... that inflation is moving closer to long-run objective of the FED. ECB and FED are diverging in policy directions (Easing & Tightening) which is raising market uncertainty. With the recent data indicating weak growth and low inflation ECB is focusing on medium term targets and started bond purchase p ...

The Money Market & Monetary Policy Part I

... http://www.economicnoise.com/2010/08/09/close-the-federal-reserve/ ...

... http://www.economicnoise.com/2010/08/09/close-the-federal-reserve/ ...

Avoiding the Next Crisis: Can Central Banks Learn? Robert L. Hetzel

... nominal anchor) and that respects the working of the price system (allows market forces to determine real variables like the real interest rate and the unemployment rate). In order to give fiat money value given its intrinsic worthlessness, the central bank must limit its quantity. Given that centra ...

... nominal anchor) and that respects the working of the price system (allows market forces to determine real variables like the real interest rate and the unemployment rate). In order to give fiat money value given its intrinsic worthlessness, the central bank must limit its quantity. Given that centra ...

Krugman Unit 5 modules 22-29

... then the value of the deposits (usually at least 7% more). If they don’t have enough in excess reserves they will go to the FED or other banks to borrow funds. • Reserve Requirements: Reserve ratio is presently 10% of all checkable deposits • Discount Window/Discount Rate: Ability to borrow from the ...

... then the value of the deposits (usually at least 7% more). If they don’t have enough in excess reserves they will go to the FED or other banks to borrow funds. • Reserve Requirements: Reserve ratio is presently 10% of all checkable deposits • Discount Window/Discount Rate: Ability to borrow from the ...

Topic 4: Monetary Policy

... Conducted by legislative and executive branches of government Government spending and taxes to stimulate or slow down the ...

... Conducted by legislative and executive branches of government Government spending and taxes to stimulate or slow down the ...

Economic Notes

... customer since they are 24 hour operations, you can do many things at the ATM – check balance, withdraw money and sometimes deposit money Debit Cards – very much like a credit card [but not as protected] to help protect customer, PIN numbers may be used – this allows the bank to directly take $$ fro ...

... customer since they are 24 hour operations, you can do many things at the ATM – check balance, withdraw money and sometimes deposit money Debit Cards – very much like a credit card [but not as protected] to help protect customer, PIN numbers may be used – this allows the bank to directly take $$ fro ...

Chapter 4

... implement policy directives each business day operations may be permanent or temporary may use repurchase agreements for temporary increases or decreases in excess reserves ...

... implement policy directives each business day operations may be permanent or temporary may use repurchase agreements for temporary increases or decreases in excess reserves ...