PRIVATE MONEY: AN IDEA WHOSE TIME Introduction Richard W. Rahn HAS COME

... Since the breakdown of the Bretton Woods system in 1971, individuals making long-term international contracts and investments have had to go to considerable expense to hedge against currency losses, in addition to ordinary business risks. The increased instability of government monies is directly re ...

... Since the breakdown of the Bretton Woods system in 1971, individuals making long-term international contracts and investments have had to go to considerable expense to hedge against currency losses, in addition to ordinary business risks. The increased instability of government monies is directly re ...

Session 15: Talking Points, Cont`d Fiscal & Monetary Policy

... iii. The Fed holds government securities, as do individuals, banks, and other financial institutions, such as brokerage companies and pension funds. After FOMC participants have deliberated the options, members vote on a policy that is given to the Federal Reserve Bank of New York’s Trading Desk. Th ...

... iii. The Fed holds government securities, as do individuals, banks, and other financial institutions, such as brokerage companies and pension funds. After FOMC participants have deliberated the options, members vote on a policy that is given to the Federal Reserve Bank of New York’s Trading Desk. Th ...

Policy Implementation with a Large Central Bank Balance Sheet

... Similar to IOER in many ways, but instead of overnight, deposit is for a specified term How does it work? Banks can choose to place a fixed amount of their reserves in the TDF Used to support a floor under rates--why lend below TDF rates?--and to drain reserves--transforms one type of liabil ...

... Similar to IOER in many ways, but instead of overnight, deposit is for a specified term How does it work? Banks can choose to place a fixed amount of their reserves in the TDF Used to support a floor under rates--why lend below TDF rates?--and to drain reserves--transforms one type of liabil ...

Multiplier and the Mystery of the Magic Money

... Introduction By making changes in that reserve requirement, the Fed can “create” or “destroy” money in an attempt to prevent hyper inflation or correct serious instability in the economy. The Federal Reserve also has two other primary tools of monetary policy, the discount rate and open market op ...

... Introduction By making changes in that reserve requirement, the Fed can “create” or “destroy” money in an attempt to prevent hyper inflation or correct serious instability in the economy. The Federal Reserve also has two other primary tools of monetary policy, the discount rate and open market op ...

where does come from?

... 6.2.3. Government spending and idle balances ...................................................................................................... 123 6.3. The effect of government borrowing on the money supply: ‘crowding out’ ....... 124 6.3.1. Linking fiscal policy to increased credit creati ...

... 6.2.3. Government spending and idle balances ...................................................................................................... 123 6.3. The effect of government borrowing on the money supply: ‘crowding out’ ....... 124 6.3.1. Linking fiscal policy to increased credit creati ...

The Power to Create Money `Out of Thin Air`

... Last summer, I took up a book that had been on my reading list for some time: Cambridge sociologist Geoffrey Ingham’s Capitalism (Polity, 2011).1 Geoffrey Ingham is one of a handful of academics not blinded by the smoke and mirrors of today’s monetary ‘alchemists’. His excellent The Nature of Money ...

... Last summer, I took up a book that had been on my reading list for some time: Cambridge sociologist Geoffrey Ingham’s Capitalism (Polity, 2011).1 Geoffrey Ingham is one of a handful of academics not blinded by the smoke and mirrors of today’s monetary ‘alchemists’. His excellent The Nature of Money ...

pdf61 - Water Justice

... Partnerships, sometimes labelled as Private Sector Participation, and the DemandResponsive Approach or Community-Driven Development as the new approach for development projects in rural and peri-urban areas. Both could be considered as camouflaged variations of the privatisation move by the Bank As ...

... Partnerships, sometimes labelled as Private Sector Participation, and the DemandResponsive Approach or Community-Driven Development as the new approach for development projects in rural and peri-urban areas. Both could be considered as camouflaged variations of the privatisation move by the Bank As ...

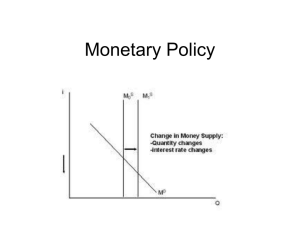

Supply and Demand Models of Financial Markets

... • Government can control the money supply and can shift the curve in or out by decreasing or increasing money supply. • What does the central bank need to do to money supply to increase the interest rate? ...

... • Government can control the money supply and can shift the curve in or out by decreasing or increasing money supply. • What does the central bank need to do to money supply to increase the interest rate? ...

492 M1, M2 and M3: (see Money Supply) Macroeconomics: is the

... Maturity Mismatch, Bank: occurs when the funding of long term loans is done with deposits or borrowings of short term maturities, thus exposing the bank to liquidity risk. If new deposits are not raised in time to replace matured deposits, or if new borrowing is not available to bridge the financial ...

... Maturity Mismatch, Bank: occurs when the funding of long term loans is done with deposits or borrowings of short term maturities, thus exposing the bank to liquidity risk. If new deposits are not raised in time to replace matured deposits, or if new borrowing is not available to bridge the financial ...

Will Guarding Against Deflation Now Lead to an Inflation

... Deposits + Savings Deposits+Time Deposits (< $100,000) Source: Federal Reserve ...

... Deposits + Savings Deposits+Time Deposits (< $100,000) Source: Federal Reserve ...

The new currency boards and discretion: empirical

... by the underlying insolvency problems, Central Bank will usually consider stepping in to provide liquidity support. 2.2. New channels The emergence of new monetary discretion channels under the new generation CBs is determined by a choice of liabilities that need be backed by reserve currency and th ...

... by the underlying insolvency problems, Central Bank will usually consider stepping in to provide liquidity support. 2.2. New channels The emergence of new monetary discretion channels under the new generation CBs is determined by a choice of liabilities that need be backed by reserve currency and th ...

It`s Not About Liquidity - University of Colorado Boulder

... Aug): 3.9% – ECB meets their inflation target through setting an “appropriate level of the key interest rates.” ...

... Aug): 3.9% – ECB meets their inflation target through setting an “appropriate level of the key interest rates.” ...

Semester 2 Examination – (Summer 2009)

... EuroBank is a monopoly commercial bank. The general public in Euroland holds no cash. The Central Bank requires that the banking system holds a specified proportion of its liabilities in a reserve form. €5000 of new cash is lodged to the bank, providing a foundation for credit expansion (perhaps!). ...

... EuroBank is a monopoly commercial bank. The general public in Euroland holds no cash. The Central Bank requires that the banking system holds a specified proportion of its liabilities in a reserve form. €5000 of new cash is lodged to the bank, providing a foundation for credit expansion (perhaps!). ...

fiscal & monetary policy

... government borrows money to cover it and the national debt then increases. • Current National Debt? ...

... government borrows money to cover it and the national debt then increases. • Current National Debt? ...

The Operational Framework of

... 1998 was the moment when the interbank money market knew a significant boosting, the volume of interbank deposits increased by 78.8%, the discount fee was gradually unused and since February 2002 it has become the reference interest rate. b. the liquidity control by the minimum reserve requirements ...

... 1998 was the moment when the interbank money market knew a significant boosting, the volume of interbank deposits increased by 78.8%, the discount fee was gradually unused and since February 2002 it has become the reference interest rate. b. the liquidity control by the minimum reserve requirements ...

Monetary Policy

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

note final

... buying and selling is left to the Federal Reserve Bank of New York (which is why the FRBNY president always has a vote on the FOMC). Every trading day, the FRBNY open market operations staff surveys conditions in financial markets to determine what type and how much of open market operations are nee ...

... buying and selling is left to the Federal Reserve Bank of New York (which is why the FRBNY president always has a vote on the FOMC). Every trading day, the FRBNY open market operations staff surveys conditions in financial markets to determine what type and how much of open market operations are nee ...

We analyze the business-cycle dynamics of commercial bank

... rates, but not their components; 3) they identified various factors that affect bank spreads, including the volatility of short-term interest rates, bank market power in loan and deposit markets, bank risk aversion, and default risk on bank loans. However, they typically made no attempt to link thes ...

... rates, but not their components; 3) they identified various factors that affect bank spreads, including the volatility of short-term interest rates, bank market power in loan and deposit markets, bank risk aversion, and default risk on bank loans. However, they typically made no attempt to link thes ...

Comments: “Inflation Targeting Framework for Jamaica: An

... • Could you tell us about the performance of private credit by banks as percentage of GDP? • Is there a regulatory and supervisory institution for the banking system? • What is the size and performance of the stock and bond market? • Is the financial system deep enough to absorb the placement of pub ...

... • Could you tell us about the performance of private credit by banks as percentage of GDP? • Is there a regulatory and supervisory institution for the banking system? • What is the size and performance of the stock and bond market? • Is the financial system deep enough to absorb the placement of pub ...

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 www.iosrjournals.org

... is primary work of monitory policy. In practice very few countries are able to manage moderate inflation For achieving stability, it is generally considered necessary to keep the growth of money supply in step with the demand for it, which is assumed to be uniquely related to national income. Stabil ...

... is primary work of monitory policy. In practice very few countries are able to manage moderate inflation For achieving stability, it is generally considered necessary to keep the growth of money supply in step with the demand for it, which is assumed to be uniquely related to national income. Stabil ...

CHAPTER 3 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... 2. What is likely to happen to the fed funds rate if the Fed increases the reserve requirement? Explain. Answer: An increase in reserve requirements on a given level of deposits will immediately convert more total reserves into required reserves or create a reserve deficiency if total reserves on ha ...

... 2. What is likely to happen to the fed funds rate if the Fed increases the reserve requirement? Explain. Answer: An increase in reserve requirements on a given level of deposits will immediately convert more total reserves into required reserves or create a reserve deficiency if total reserves on ha ...

3 Trillion Reasons for Concern.10.26.2012

... become inflationary given that once again the liquidity preference of commercial banks shows a heavier demand for holding these funds as reserves, versus creating loans. Reasons for this preference are varied, but the most obvious would be that many banks in the system still feel it is necessary to ...

... become inflationary given that once again the liquidity preference of commercial banks shows a heavier demand for holding these funds as reserves, versus creating loans. Reasons for this preference are varied, but the most obvious would be that many banks in the system still feel it is necessary to ...

financialization and structural imbalances in the global economy

... the economy, additional borrowers must continually be found to take out new loans to expand the money supply, in order to pay the interest collected by the bankers. However, the interest and the debt cannot possibly be paid back except by an ever expanding Ponzi scheme of lending. That scheme can l ...

... the economy, additional borrowers must continually be found to take out new loans to expand the money supply, in order to pay the interest collected by the bankers. However, the interest and the debt cannot possibly be paid back except by an ever expanding Ponzi scheme of lending. That scheme can l ...