Due Diligence - Risk Profiling Tool

... Where we have used a multi-manger fund for a risk targeted / managed solution, additional due diligence will be completed. See Annex 2. Where we identify monies to be managed by an external discretionary manager, research and due diligence is carried out as contained in Annex 3. Where we identify fu ...

... Where we have used a multi-manger fund for a risk targeted / managed solution, additional due diligence will be completed. See Annex 2. Where we identify monies to be managed by an external discretionary manager, research and due diligence is carried out as contained in Annex 3. Where we identify fu ...

Untitled

... In order to strengthen our earning capacity, we have taken positive action including focusing on corporate loans, strengthening personal loans, and promoting sales of financial instruments such as investment trusts and personal pension insurance. At the same time we have attempted to introduce great ...

... In order to strengthen our earning capacity, we have taken positive action including focusing on corporate loans, strengthening personal loans, and promoting sales of financial instruments such as investment trusts and personal pension insurance. At the same time we have attempted to introduce great ...

Clarification on Government Debt Investment Limits

... This circular shall come into effect immediately. This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992. A copy of this circular is available at the web page “Circulars” on our website www.sebi.gov.in. Custodians are requ ...

... This circular shall come into effect immediately. This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992. A copy of this circular is available at the web page “Circulars” on our website www.sebi.gov.in. Custodians are requ ...

ASB Investment Funds World Fixed Interest Fund Update

... See the Product Disclosure Statement (PDS) for more information about the risks associated with investing in this fund. The risk indicator may not be a reliable indicator of the risk or returns that a fund is likely to experience in the future. For example, the risk indicator may be different if it ...

... See the Product Disclosure Statement (PDS) for more information about the risks associated with investing in this fund. The risk indicator may not be a reliable indicator of the risk or returns that a fund is likely to experience in the future. For example, the risk indicator may be different if it ...

Chapter 1

... 2. A property has a potential gross rent of $1,500,000; operating expenses of $765,750; a vacancy allowance of $45,000, and other income of $9,000. What is its effective gross income? a. b. c. d. ...

... 2. A property has a potential gross rent of $1,500,000; operating expenses of $765,750; a vacancy allowance of $45,000, and other income of $9,000. What is its effective gross income? a. b. c. d. ...

Payment of Dividends out of Capital

... “target dividend income funds”. In response to these trends, many fund promoters are likely to explore launching such funds. The Central Bank is now satisfied that the concerns highlighted at (1) and (2) above can be addressed by means of enhanced disclosure rather than an outright prohibition. This ...

... “target dividend income funds”. In response to these trends, many fund promoters are likely to explore launching such funds. The Central Bank is now satisfied that the concerns highlighted at (1) and (2) above can be addressed by means of enhanced disclosure rather than an outright prohibition. This ...

assessment of investment portfolios of jordanian banks

... Traditional commercial banks, especially small community banks invest mostly in loans, including mortgage loans, commercial loans, student loans, credit card loans, small business loans, lines of credit etc.yet not all bank funds can be allocated to loans. For one reason, many loans are illiquid as ...

... Traditional commercial banks, especially small community banks invest mostly in loans, including mortgage loans, commercial loans, student loans, credit card loans, small business loans, lines of credit etc.yet not all bank funds can be allocated to loans. For one reason, many loans are illiquid as ...

Risk Allocation, Debt Fueled Expansion and Financial Crisis Paul Beaudry Amartya Lahiri

... If so, the mechanism needs to be able explain both the expansion between 2001-07 and the collapse ...

... If so, the mechanism needs to be able explain both the expansion between 2001-07 and the collapse ...

Japan`s Cross-Shareholding Legacy: the Financial Impact on Banks

... Liquidating shareholdings through sales is the most direct way for Japanese banks to minimize the risk posed by exposure to equity markets, and banks have used this approach to reduce net equity investments since the mid1990s. But liquidation through sales can be somewhat problematic for a number of ...

... Liquidating shareholdings through sales is the most direct way for Japanese banks to minimize the risk posed by exposure to equity markets, and banks have used this approach to reduce net equity investments since the mid1990s. But liquidation through sales can be somewhat problematic for a number of ...

exercises_1_soln

... Problem 2) A rare genetic disease is discovered. Although only one in a million people carry it, you consider getting screened. You are told that the genetic test is extremely good; it is 100% sensitive (it is always correct if you have the disease) and 99.99% specific (it gives a false positive re ...

... Problem 2) A rare genetic disease is discovered. Although only one in a million people carry it, you consider getting screened. You are told that the genetic test is extremely good; it is 100% sensitive (it is always correct if you have the disease) and 99.99% specific (it gives a false positive re ...

CEAP RB FORM NO - CEAP Retirement Plan Office

... peso-denominated, US$-denominated, or other major foreign currency-denominated common and preferred stocks, securities issued or guaranteed by the Philippine government or any of its subdivisions and instrumentalities, notes, bonds, deposits, money market placements, and any and all forms of securit ...

... peso-denominated, US$-denominated, or other major foreign currency-denominated common and preferred stocks, securities issued or guaranteed by the Philippine government or any of its subdivisions and instrumentalities, notes, bonds, deposits, money market placements, and any and all forms of securit ...

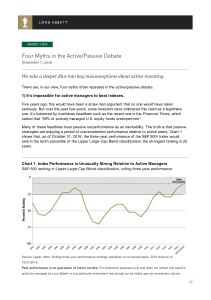

Four Myths in the Active/Passive Debate

... conditions and to changes in the prospects of particular companies and/or sectors in the economy. Historically speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spendi ...

... conditions and to changes in the prospects of particular companies and/or sectors in the economy. Historically speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spendi ...

The European investment fund dedicated to microfinance in Africa

... FEFISOL contribute to empower smallholders producers who trade in the local market (mainly organic and fair trade), contributing to food security and giving priority to family-based agriculture. The most common products are soya, shea butter, cocoa, fruits and vegetables, coffee, fresh and dried fru ...

... FEFISOL contribute to empower smallholders producers who trade in the local market (mainly organic and fair trade), contributing to food security and giving priority to family-based agriculture. The most common products are soya, shea butter, cocoa, fruits and vegetables, coffee, fresh and dried fru ...

Impact Portfolio - RSF Social Finance

... benchmarks in the short term and , with all thing equal, an over performance to benchmarks in later years. If you would like to learn more about the “J-Curve Effect” please contact Taryn Goodman at 415.561.6195. ...

... benchmarks in the short term and , with all thing equal, an over performance to benchmarks in later years. If you would like to learn more about the “J-Curve Effect” please contact Taryn Goodman at 415.561.6195. ...

Russell Continental European Equity Fund

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

Cap Value Fiduciary Services Equity Investment

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. Actual portfolio statistics ...

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. Actual portfolio statistics ...

Download attachment

... rabbiul-mal, sometimes also called sahibul-mal They deposit their money in a Mudharabah investment account at a bank (as the mudharib), with the profit ratio agreed up front (standard contracts in Islamic banks mean that there is usually no negotiation for normal account holders) The customers’ ...

... rabbiul-mal, sometimes also called sahibul-mal They deposit their money in a Mudharabah investment account at a bank (as the mudharib), with the profit ratio agreed up front (standard contracts in Islamic banks mean that there is usually no negotiation for normal account holders) The customers’ ...

press release

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

Will shares produce highest returns long-term?

... The economic model of how the investment process works, and therefore how the economy works, is reasonably straightforward. However, its operation is complex because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of econom ...

... The economic model of how the investment process works, and therefore how the economy works, is reasonably straightforward. However, its operation is complex because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of econom ...

Luminis Credit Assessment Information

... If a hedge is entered into, please note that the credit assessment must be updated annually for as long as the hedge is active. Please also note that all credit assessment reports – Counterparty Risk Reports (initial) and Surveillance Reports (annual updates) – are confidential documents and only ...

... If a hedge is entered into, please note that the credit assessment must be updated annually for as long as the hedge is active. Please also note that all credit assessment reports – Counterparty Risk Reports (initial) and Surveillance Reports (annual updates) – are confidential documents and only ...

3354:1-20-07 Investment policy

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

dpam l bonds emerging markets sustainable - f

... normalization. We do not expect the move to escalate in a disorderly way, but will keep a wary eye on what is one of the main factors determining the level of the risk premium in risky assets. On the bright side, China is staying off the bears’ radar, with economic data surprising to the upside, the ...

... normalization. We do not expect the move to escalate in a disorderly way, but will keep a wary eye on what is one of the main factors determining the level of the risk premium in risky assets. On the bright side, China is staying off the bears’ radar, with economic data surprising to the upside, the ...

everett parks foundation - Community Foundation of Snohomish

... If you wish to make a gift of securities to the Community Foundation of Snohomish County, there are several possible ways of doing so, depending upon whether the securities are registered in your own name, held in a bank custodian account, or in a brokerage account. Certain gifts of appreciated secu ...

... If you wish to make a gift of securities to the Community Foundation of Snohomish County, there are several possible ways of doing so, depending upon whether the securities are registered in your own name, held in a bank custodian account, or in a brokerage account. Certain gifts of appreciated secu ...

Chapter Twenty - Cengage Learning

... commission – Additional commission charges are based on the number of shares and the value of stock bought and sold – Generally, online transactions are less expensive when compared to trading through a full-service brokerage firm – Full-service brokerages charge a percentage of the transaction amou ...

... commission – Additional commission charges are based on the number of shares and the value of stock bought and sold – Generally, online transactions are less expensive when compared to trading through a full-service brokerage firm – Full-service brokerages charge a percentage of the transaction amou ...

One of the biggest strategic questions facing any

... are too limited; in the other case missing chances to take your time or act at a small scale because of the need to move funds out the door on a timeline. blue moon fund seeks to maximize its impact by taking from the best aspects, and avoiding the pitfalls, of both approaches. We have adopted a par ...

... are too limited; in the other case missing chances to take your time or act at a small scale because of the need to move funds out the door on a timeline. blue moon fund seeks to maximize its impact by taking from the best aspects, and avoiding the pitfalls, of both approaches. We have adopted a par ...