This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: Quantifying Systemic Risk

... There are two approaches to understanding the issue of systemic risk and macroprudential regulation—one is empirical macroeconomics based, and the other is financial market based. These two approaches have different methodologies, emphases, and purposes. De Nicolò and Lucchetta’s chapter belongs to t ...

... There are two approaches to understanding the issue of systemic risk and macroprudential regulation—one is empirical macroeconomics based, and the other is financial market based. These two approaches have different methodologies, emphases, and purposes. De Nicolò and Lucchetta’s chapter belongs to t ...

Human Capital and the Theory of Life-Cycle

... and financial capital, with the former usually being the most important. [The theory of life-cycle investing discussed here should not be confused with the target-date or age-based life cycle asset allocation process, adopted by many mutual funds and that is a common investment choice in many 401(k) ...

... and financial capital, with the former usually being the most important. [The theory of life-cycle investing discussed here should not be confused with the target-date or age-based life cycle asset allocation process, adopted by many mutual funds and that is a common investment choice in many 401(k) ...

Strategic Value Dividend (MA) Select UMA

... include all fee-paying portfolios with no investment restrictions. New accounts are included beginning with the second full calendar month of performance. Terminated accounts are removed in the month in which they terminate (but prior performance of terminated accounts is retained). Performance is c ...

... include all fee-paying portfolios with no investment restrictions. New accounts are included beginning with the second full calendar month of performance. Terminated accounts are removed in the month in which they terminate (but prior performance of terminated accounts is retained). Performance is c ...

Shipping Industry Profile and Competitive Landscape

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

Navigating 5 years of emerging market corporate debt

... The emerging market (EM) corporate debt universe has diversified exponentially in geography and sector over the past 5 years. To keep up with the expanding size of the asset class we have: ...

... The emerging market (EM) corporate debt universe has diversified exponentially in geography and sector over the past 5 years. To keep up with the expanding size of the asset class we have: ...

Reasons Young Americans Won`t Be Ready For Retirement

... Relatively small amounts, saved regularly in investments that have a higher return potential, can result in massive long-term accumulations, but starting early is imperative. Assuming an 8 percent return, if people save $100 per month beginning at age 25, they could accumulate $351,000 by age 65. If ...

... Relatively small amounts, saved regularly in investments that have a higher return potential, can result in massive long-term accumulations, but starting early is imperative. Assuming an 8 percent return, if people save $100 per month beginning at age 25, they could accumulate $351,000 by age 65. If ...

Notice of change of interests of substantial holder

... This notice is given by IOOF Holdings Limited on behalf of itself and its subsidiaries. There was a change in the interest of the substantial holder on: ...

... This notice is given by IOOF Holdings Limited on behalf of itself and its subsidiaries. There was a change in the interest of the substantial holder on: ...

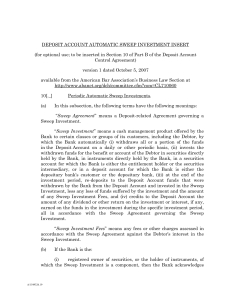

draft - American Bar Association

... available from the American Bar Association’s Business Law Section at http://www.abanet.org/dch/committee.cfm?com=CL710060 10[._] (a) ...

... available from the American Bar Association’s Business Law Section at http://www.abanet.org/dch/committee.cfm?com=CL710060 10[._] (a) ...

February 2004 - McCarthy Asset Management, Inc.

... diversify portfolios. Another is Hussman Strategic Growth. The manager of this three-year old fund, John Hussman, is willing to hedge up to 100% of the fund’s equity exposure when both valuations and market sentiment are negative. Conversely, he will add leverage when his outlook is especially brigh ...

... diversify portfolios. Another is Hussman Strategic Growth. The manager of this three-year old fund, John Hussman, is willing to hedge up to 100% of the fund’s equity exposure when both valuations and market sentiment are negative. Conversely, he will add leverage when his outlook is especially brigh ...

Real estate investment has provided many investors with positive

... rates of return run rampant in real estate investment. Don’t get caught up in the excitement check everything: rents, payment history, taxes, expenses, deposits, future modifications... everything. Make sure you have the right agent. It’s like having a good insurance policy against overlooking all t ...

... rates of return run rampant in real estate investment. Don’t get caught up in the excitement check everything: rents, payment history, taxes, expenses, deposits, future modifications... everything. Make sure you have the right agent. It’s like having a good insurance policy against overlooking all t ...

Resource mobilization - Indian School Al Wadi Al Kabir

... 1 It proposed to the existing shareholders and in case they are not willing to subscribe, they can renounce the same in favour of another person. This method of issuing securities is considered to be inexpensive as it does not require any brokers, agents, underwriters, prospectus or enlistment, etc. ...

... 1 It proposed to the existing shareholders and in case they are not willing to subscribe, they can renounce the same in favour of another person. This method of issuing securities is considered to be inexpensive as it does not require any brokers, agents, underwriters, prospectus or enlistment, etc. ...

INVESTMENT POLICY The Kitsap Community Foundation (“the

... Public equity securities shall generally be restricted to a broadly diversified portfolio of readily marketable securities of corporations that are traded on the major stock exchanges, including NASDAQ. Equity holdings must generally represent companies meeting a minimum market capitalization requir ...

... Public equity securities shall generally be restricted to a broadly diversified portfolio of readily marketable securities of corporations that are traded on the major stock exchanges, including NASDAQ. Equity holdings must generally represent companies meeting a minimum market capitalization requir ...

Bernard L. Madoff Investment and Securities: Broker

... the staff of the SEC on May 19, 2006, that I executed trades of common stock on behalf of my investment advisory clients and that I purchased and sold the equities that were part of my investment strategy in European markets. In that session with the SEC . . . I also knowingly gave false testimony u ...

... the staff of the SEC on May 19, 2006, that I executed trades of common stock on behalf of my investment advisory clients and that I purchased and sold the equities that were part of my investment strategy in European markets. In that session with the SEC . . . I also knowingly gave false testimony u ...

MSF-CHP25

... DCs are defined as developed (high income) countries with per capital exceeding $9,300 (in year 2000). EMs; Active portfolios will include many stocks and indexes of EMs. 20 EMs made up of 16% of the world GDP, together with 25 DCs make 95% of GDP.China, Brazil and Korea are the largest EMs in the w ...

... DCs are defined as developed (high income) countries with per capital exceeding $9,300 (in year 2000). EMs; Active portfolios will include many stocks and indexes of EMs. 20 EMs made up of 16% of the world GDP, together with 25 DCs make 95% of GDP.China, Brazil and Korea are the largest EMs in the w ...

read more

... alternatives, as well as in comparison with other commercial real estate categories. While we maintain a positive outlook for multifamily development and, as such, remain very active in this space, I instill in my team at Resmark to always expect the unexpected. On patrol or on a mission, my militar ...

... alternatives, as well as in comparison with other commercial real estate categories. While we maintain a positive outlook for multifamily development and, as such, remain very active in this space, I instill in my team at Resmark to always expect the unexpected. On patrol or on a mission, my militar ...

With new “Vaccine Bonds” Japanese Investors will have the

... commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the commission for each transaction. In some cases, our company also may charge a maximum of ¥3,150 (i ...

... commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the commission for each transaction. In some cases, our company also may charge a maximum of ¥3,150 (i ...

DAILY UPDATE September 11, 2014

... on the performance of the company(ies). The information and/or opinions contained in this report has been assembled by Panin Asset Management from sources which we deem to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, completeness ...

... on the performance of the company(ies). The information and/or opinions contained in this report has been assembled by Panin Asset Management from sources which we deem to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, completeness ...

Transamerica ONE and Transamerica ALPHA Digital

... TFA is dedicated to serving people from all walks of life by helping them create an individualized investment strategy. Meet with a TFA Investment Advisor Representative to determine if the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program is an approp ...

... TFA is dedicated to serving people from all walks of life by helping them create an individualized investment strategy. Meet with a TFA Investment Advisor Representative to determine if the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program is an approp ...

150528 ISDS CAMs final

... (xiv) to ensure the applicability of international agreements, to bring an end to the unequal treatment of European investors in the US on account of existing agreements of Member States; to ensure that foreign investors are treated in a non-discriminatory fashion and have a fair opportunity to seek ...

... (xiv) to ensure the applicability of international agreements, to bring an end to the unequal treatment of European investors in the US on account of existing agreements of Member States; to ensure that foreign investors are treated in a non-discriminatory fashion and have a fair opportunity to seek ...

total alternative debt holdings at 31 december 2016

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

Junior Sophisters Monetary and Welfare Economics

... (a) Only unsystematic risk, while standard deviation measures total risk (b) Only systematic risk, while standard deviation measures total risk (c) Both systematic and unsystematic risk, while standard deviation measures only unsystematic risk (d) Both systematic and unsystematic risk, while standar ...

... (a) Only unsystematic risk, while standard deviation measures total risk (b) Only systematic risk, while standard deviation measures total risk (c) Both systematic and unsystematic risk, while standard deviation measures only unsystematic risk (d) Both systematic and unsystematic risk, while standar ...

Class D Shares - Accumulating - USD

... profitability of the companies the Sub-Fund invests in and also the value of the Sub-Fund's investments. Exchange derivatives risk: Some commodity exchanges place limits on how much prices are allowed to fluctuate in the course of a day. There is therefore a risk that the Sub-Fund might not be able ...

... profitability of the companies the Sub-Fund invests in and also the value of the Sub-Fund's investments. Exchange derivatives risk: Some commodity exchanges place limits on how much prices are allowed to fluctuate in the course of a day. There is therefore a risk that the Sub-Fund might not be able ...

Introduction to Course

... Hedging some risks while also taking advantage of upside potential through strategic risk taking ...

... Hedging some risks while also taking advantage of upside potential through strategic risk taking ...

QSI Press Release Here

... chemical plants globally, representing billions of dollars in annual output. QSI common stock is quoted on the OTCQB under the ticker symbol QSIM. For more information, please visit www.qsinano.com. About National Investment Banking Association (NIBA) National Investment Banking Association (NIBA) i ...

... chemical plants globally, representing billions of dollars in annual output. QSI common stock is quoted on the OTCQB under the ticker symbol QSIM. For more information, please visit www.qsinano.com. About National Investment Banking Association (NIBA) National Investment Banking Association (NIBA) i ...