Fact Sheet - Pure Multi

... Group. Since 2002, the Sunstone Group has 60 years of combined experience acquiring identified, acquired, managed and disposed and managing multi-family apartment of ~$1.2 billion in revenue-producing properties. As active investors in major U.S. real estate in Canada and the United markets, we have ...

... Group. Since 2002, the Sunstone Group has 60 years of combined experience acquiring identified, acquired, managed and disposed and managing multi-family apartment of ~$1.2 billion in revenue-producing properties. As active investors in major U.S. real estate in Canada and the United markets, we have ...

2. M. Berg - Climate Finance - Kommunalkredit Public Consulting

... Innovative Use of Bond Proceeds ...

... Innovative Use of Bond Proceeds ...

Seed Equity uses LinkedIn targeting, Spotlight Ads and Sponsored

... Seed Equity’s Spotlight Ads called out targets’ interest in investing as a way to encourage them to click through and sign up for the company’s social community. “Because Spotlight Ads pull in a LinkedIn member’s profile image, they draw attention – more than you’d receive from the typical display a ...

... Seed Equity’s Spotlight Ads called out targets’ interest in investing as a way to encourage them to click through and sign up for the company’s social community. “Because Spotlight Ads pull in a LinkedIn member’s profile image, they draw attention – more than you’d receive from the typical display a ...

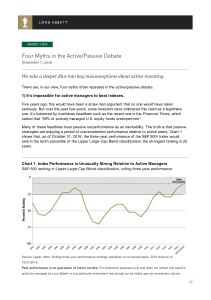

Four Myths in the Active/Passive Debate

... of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While ...

... of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While ...

Takeout financing

... January 2006, became operational in April 2006 to provide long term financial assistance to commercially viable infrastructure projects with overriding priority to PPP projects. IIFCL provides Long term debt by way of direct financing 20% of the project cost is financed Loans to have average ...

... January 2006, became operational in April 2006 to provide long term financial assistance to commercially viable infrastructure projects with overriding priority to PPP projects. IIFCL provides Long term debt by way of direct financing 20% of the project cost is financed Loans to have average ...

Fiscal Incentives for Long Term Investments

... Increasing the average rate of GDP growth is the most desirable solution to reduce public debt to GDP ratios, but it is also not easy to achieve. Countries with mature economies have had modest, if not stagnant, rates of economic growth (in the last 15 years, growth has not exceeded 2% per year, whi ...

... Increasing the average rate of GDP growth is the most desirable solution to reduce public debt to GDP ratios, but it is also not easy to achieve. Countries with mature economies have had modest, if not stagnant, rates of economic growth (in the last 15 years, growth has not exceeded 2% per year, whi ...

objective straightforward communications generating potential

... strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the portfolio strategy and for educational purposes. As such, it is n ...

... strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the portfolio strategy and for educational purposes. As such, it is n ...

SEI Added 30 New Clients in First Half Of Year

... Paul Klauder, v.p. and managing director of SEI’s Institutional Group, stated in an email. “The appeal of our business model to these types of organizations is typically the additional layer Paul Klauder of governance and oversight we provide and our ability to act quickly on asset allocation or man ...

... Paul Klauder, v.p. and managing director of SEI’s Institutional Group, stated in an email. “The appeal of our business model to these types of organizations is typically the additional layer Paul Klauder of governance and oversight we provide and our ability to act quickly on asset allocation or man ...

PIMCO VIT Income Portfolio — Advisor Class

... The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at least 65% of its total assets in a multi-sector portfolio of Fixed Income Instruments of varyi ...

... The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at least 65% of its total assets in a multi-sector portfolio of Fixed Income Instruments of varyi ...

Corporate Finance II Course for the Master`s Level Course

... The syllabus for the Corporate Finance course is prepared specifically for the students of the Master Program in Economics Department of NSU in order to equip them with a framework and basic tools and techniques necessary to understand and make financial and investment decisions. This course examine ...

... The syllabus for the Corporate Finance course is prepared specifically for the students of the Master Program in Economics Department of NSU in order to equip them with a framework and basic tools and techniques necessary to understand and make financial and investment decisions. This course examine ...

securities investment services

... launched a global securities trading platform to provide customers with a wider variety of product options. The global financial markets run 24 hours a day with no respite. The Company has provided the customers with global securities trading services that span across time zones and regions, includi ...

... launched a global securities trading platform to provide customers with a wider variety of product options. The global financial markets run 24 hours a day with no respite. The Company has provided the customers with global securities trading services that span across time zones and regions, includi ...

Weekly Commentary 04-27-15 PAA

... Investors paid as much as $97 a share during the first day of trading. By the end of 2000, the stock price was worth less than a dollar a share. Things are different this time around, according to Financial Times, largely because a lot more economic activity takes place online today. About $50 billi ...

... Investors paid as much as $97 a share during the first day of trading. By the end of 2000, the stock price was worth less than a dollar a share. Things are different this time around, according to Financial Times, largely because a lot more economic activity takes place online today. About $50 billi ...

Economist Insights GDP: Growth dependent payments

... fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This document is intended for limited distribution to the clients and associates of UBS Global Asset Management. Use or distribution by any other person is prohibited ...

... fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This document is intended for limited distribution to the clients and associates of UBS Global Asset Management. Use or distribution by any other person is prohibited ...

Consultation Response - Co

... certain savers for ISA investment in many types of society, and especially in those societies with a demonstrable social or ethical purpose and impact. The Community Shares Unit (CSU) conducts market analysis. Even using the most conservative estimates for the last two years based on what has been r ...

... certain savers for ISA investment in many types of society, and especially in those societies with a demonstrable social or ethical purpose and impact. The Community Shares Unit (CSU) conducts market analysis. Even using the most conservative estimates for the last two years based on what has been r ...

Selling an Idea or a Product

... Ethics in Investment Management Violators of regulations set by the Security and Exchange Commission(SEC) or the national Association of Securities Dealers(NASD) can: • Be stripped of the right to transact business on any exchange. • Be required to compensate the client for monetary damages • Be re ...

... Ethics in Investment Management Violators of regulations set by the Security and Exchange Commission(SEC) or the national Association of Securities Dealers(NASD) can: • Be stripped of the right to transact business on any exchange. • Be required to compensate the client for monetary damages • Be re ...

SECOND ANNUAL WOMEN`S ALTERNATIVE INVESTMENT

... November 4 & 5, 2010 at The Pierre Lexington, Mass., July 21, 2010 -- Falk Marques Group today announced the 2nd Annual Women’s Alternative Investment Summit will be held on November 4 & 5, 2010 at The Pierre in midtown Manhattan. At last year’s inaugural Summit, close to 250 senior women executives ...

... November 4 & 5, 2010 at The Pierre Lexington, Mass., July 21, 2010 -- Falk Marques Group today announced the 2nd Annual Women’s Alternative Investment Summit will be held on November 4 & 5, 2010 at The Pierre in midtown Manhattan. At last year’s inaugural Summit, close to 250 senior women executives ...

Emerging Derivative Markets

... OTC Gross market value 3% [1%] ; FX swaps 13% [5%] Public banks very active in D ; 85% unrelated to loans 15% institutional investors ; tax incentives for D trading Questions on legal and counterparty risk ; 14% ø netting Questions on exchange margins ; trading collars ; cushions Page 13 ...

... OTC Gross market value 3% [1%] ; FX swaps 13% [5%] Public banks very active in D ; 85% unrelated to loans 15% institutional investors ; tax incentives for D trading Questions on legal and counterparty risk ; 14% ø netting Questions on exchange margins ; trading collars ; cushions Page 13 ...

Macroeconomic Perspectives

... Though it may seem obvious that lower interest rates make assets such as homes more affordable, they also have the potential to inflate asset prices. Consider the following example, in which a house is originally purchased for $100, when the cost of money (i.e., the interest rate) was 5 percent. For ...

... Though it may seem obvious that lower interest rates make assets such as homes more affordable, they also have the potential to inflate asset prices. Consider the following example, in which a house is originally purchased for $100, when the cost of money (i.e., the interest rate) was 5 percent. For ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... As the largest holder of common stock of Accuride Corporation, owning 19% of the outstanding shares, Coliseum Capital Management, LLC is writing this letter in response to the proposed sale of Accuride to affiliates of Crestview Advisors LLC for $2.58 per share. We believe this transaction materiall ...

... As the largest holder of common stock of Accuride Corporation, owning 19% of the outstanding shares, Coliseum Capital Management, LLC is writing this letter in response to the proposed sale of Accuride to affiliates of Crestview Advisors LLC for $2.58 per share. We believe this transaction materiall ...

Capitalization - Gretchen Hurt

... intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illustrative purposes only and are not to be considered endorsed or recommended for pur ...

... intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illustrative purposes only and are not to be considered endorsed or recommended for pur ...

Debt, Growth & Politics - Robert Ricketts

... This is a perfect time for public (government) investment: Cost is relatively low; and, more importantly, Productivity of “displaced” private/corporate investment is low, increasing the probability that government investment will be more productive than private investment. ● In economic slumps ...

... This is a perfect time for public (government) investment: Cost is relatively low; and, more importantly, Productivity of “displaced” private/corporate investment is low, increasing the probability that government investment will be more productive than private investment. ● In economic slumps ...

STUDY GUIDE FOR THE EXAM ON INTRODUCTION TO THE

... Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer and holders underwriter of stock bear vs. bull market to ...

... Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer and holders underwriter of stock bear vs. bull market to ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.