BALANCE OF PAYMENTS

... Direct investment: A category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise that is resident in another economy. The criterion that distinguishes between direct investment and portfolio inve ...

... Direct investment: A category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise that is resident in another economy. The criterion that distinguishes between direct investment and portfolio inve ...

Boston Partners Global Equity Fund (BPGIX)

... The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.boston-partners.com. The investment return and principal value of an investment will ...

... The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.boston-partners.com. The investment return and principal value of an investment will ...

Media Contact: Ellen Seaver / / (201) 796-7788

... stocks and bonds staying relatively low, according to the investment and origination principals of Case Real Estate Capital, LLC (Case). A northern New Jersey-based situational lender and commercial real estate investment company, Case is active in high-yield, sub- and non-performing debt. On the he ...

... stocks and bonds staying relatively low, according to the investment and origination principals of Case Real Estate Capital, LLC (Case). A northern New Jersey-based situational lender and commercial real estate investment company, Case is active in high-yield, sub- and non-performing debt. On the he ...

Markets

... Importance of Financial Markets • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

... Importance of Financial Markets • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

Earnings Ratio - KV Institute of Management and Information Studies

... Graham and Dodd Method of Investing Definition Fundamental investment tactics founded by Benjamin Graham and David Dodd in the 1930s. ...

... Graham and Dodd Method of Investing Definition Fundamental investment tactics founded by Benjamin Graham and David Dodd in the 1930s. ...

ppt

... – by recombination of parts • Eliminates Multiple Container Types – differences are between parts selected • Requires Combinatorial Constraints – terms come in sets that must be consistent ...

... – by recombination of parts • Eliminates Multiple Container Types – differences are between parts selected • Requires Combinatorial Constraints – terms come in sets that must be consistent ...

The Indian Private Equity Opportunity

... Limited use of leverage – Most Indian banks unwilling to provide “cash flow based” financing – Ability to achieve attractive returns without gearing ...

... Limited use of leverage – Most Indian banks unwilling to provide “cash flow based” financing – Ability to achieve attractive returns without gearing ...

2008+ GLOBAL CRISIS

... • May 7: FED releases the results of the stress test of 19 largest US bank holding companies. It finds that losses at the firms in 2009 and 2010 could be US$ 600 billion and ten firms would need to add, US$ 185 billion to their capital to maintain adequate buffers if the economy were to record the m ...

... • May 7: FED releases the results of the stress test of 19 largest US bank holding companies. It finds that losses at the firms in 2009 and 2010 could be US$ 600 billion and ten firms would need to add, US$ 185 billion to their capital to maintain adequate buffers if the economy were to record the m ...

lecture 11: government debt

... • Overall no change in citizen’s wealth because the value of the bond is offset by the value of the future tax liability General Principal (Ricardian equivalence) • Government Debt is equivalent to future taxes • If consumers are forward looking, future taxes are equivalent to current taxes • So, fi ...

... • Overall no change in citizen’s wealth because the value of the bond is offset by the value of the future tax liability General Principal (Ricardian equivalence) • Government Debt is equivalent to future taxes • If consumers are forward looking, future taxes are equivalent to current taxes • So, fi ...

- Access to Finance Portal for Africa

... SSA focused PE funds raised US$922 million5. In contrast, Private Equity Africa puts the figure at over US$2 billion; whilst KPMG notes, from reviewing publicly available information that over US$16.8 billion was raised for PE ventures in Africa in the same year. Of this, approximately one third wen ...

... SSA focused PE funds raised US$922 million5. In contrast, Private Equity Africa puts the figure at over US$2 billion; whilst KPMG notes, from reviewing publicly available information that over US$16.8 billion was raised for PE ventures in Africa in the same year. Of this, approximately one third wen ...

Chapter 9 Sources of Capital

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

Investing as a zero-sum game

... Index funds typically carry lower charges than their active counterparts. At the same time, the distribution of returns from index funds tends to be narrower, with fewer instances of significant out- or underperformance. Considering all of these factors, we believe that setting a long-term asset all ...

... Index funds typically carry lower charges than their active counterparts. At the same time, the distribution of returns from index funds tends to be narrower, with fewer instances of significant out- or underperformance. Considering all of these factors, we believe that setting a long-term asset all ...

Sales Aid

... the UK Financial Services Conduct of Business Sourcebook. All or most of the protection provided by the UK regulatory system does not apply to investments in the Company and compensation will not be available under the UK Financial Services Compensation Scheme. An investment in the Company entails r ...

... the UK Financial Services Conduct of Business Sourcebook. All or most of the protection provided by the UK regulatory system does not apply to investments in the Company and compensation will not be available under the UK Financial Services Compensation Scheme. An investment in the Company entails r ...

PPT - IAEA Publications

... – Usually around 50/50 in energy projects possible to mitigate with a positive risk sharing ...

... – Usually around 50/50 in energy projects possible to mitigate with a positive risk sharing ...

Lecture10 Balance of payments and debt dynamics

... • The debt/GDP ratio this year is equal to the ratio last year, plus the primary deficit, plus bank costs, plus interest charged on last year’s debt less growth rate of GDP • Why the primary deficit? Because interest rates are not ...

... • The debt/GDP ratio this year is equal to the ratio last year, plus the primary deficit, plus bank costs, plus interest charged on last year’s debt less growth rate of GDP • Why the primary deficit? Because interest rates are not ...

In his 1936 book entitled The General Theory of Employment

... on U.S. productivity generally, because companies have lacked the confidence to invest in new productivity-enhancing technology and equipment. This poor productivity growth has not only weighed very heavily on corporate profit growth, but has also made it difficult for companies to afford and/or jus ...

... on U.S. productivity generally, because companies have lacked the confidence to invest in new productivity-enhancing technology and equipment. This poor productivity growth has not only weighed very heavily on corporate profit growth, but has also made it difficult for companies to afford and/or jus ...

PDF Download

... Direct Investment to bottom out this year Although direct investment is likely to fall to $103 billion this year, the lowest level since 1996, these flows still represent nearly two-thirds of total net private capital flows to emerging markets. The trough expected in FDI this year is attributable in ...

... Direct Investment to bottom out this year Although direct investment is likely to fall to $103 billion this year, the lowest level since 1996, these flows still represent nearly two-thirds of total net private capital flows to emerging markets. The trough expected in FDI this year is attributable in ...

Europees recht en mededingingsrecht

... Red Eurobonds • Sovereign debt up to 60% theshold covered by European bonds jontly-and-several guaranteed by the participating Member States (blue bonds) • Independent new Stability Council charged with allocating blue bonds • Member States are allowed to issue own debt instruments beyond the 60% th ...

... Red Eurobonds • Sovereign debt up to 60% theshold covered by European bonds jontly-and-several guaranteed by the participating Member States (blue bonds) • Independent new Stability Council charged with allocating blue bonds • Member States are allowed to issue own debt instruments beyond the 60% th ...

Chapter 3 Financial Instruments, Financial Markets, and Financial

... Financial Instruments • A financial instrument is the written legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

... Financial Instruments • A financial instrument is the written legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

Coping with Asia`s Large Capital Inflows in a Multi

... In Asia since 2008, India, followed by Indonesia, have had the greatest tendency to float, given EMP; Hong Kong & Singapore the least, followed by Malaysia & China. ...

... In Asia since 2008, India, followed by Indonesia, have had the greatest tendency to float, given EMP; Hong Kong & Singapore the least, followed by Malaysia & China. ...

Institutional Investor magazine`s 2015 US Investment Management

... with eVestment’s research team. Subsequently investment strategy analysis was based on factors such as one-, three- and 5-year performance, Sharpe ratio, information ratio, standard deviation and upside market capture. Each category is analyzed based on the factors used by institutional investors in ...

... with eVestment’s research team. Subsequently investment strategy analysis was based on factors such as one-, three- and 5-year performance, Sharpe ratio, information ratio, standard deviation and upside market capture. Each category is analyzed based on the factors used by institutional investors in ...

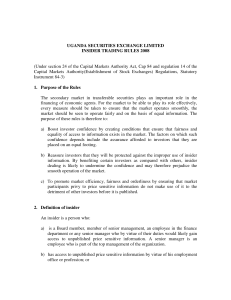

USE Insider Trading Rules-2009

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

THREADNEEDLE LAUNCHES NEW EMERGING MARKET CORPORATE BONDS STRATEGY

... The fund aims to achieve a total return from income and capital appreciation from/by investing principally in debt issued by emerging market companies as well as companies that conduct a significant part of their business in emerging markets. Threadneedle, known for its expertise in managing emergin ...

... The fund aims to achieve a total return from income and capital appreciation from/by investing principally in debt issued by emerging market companies as well as companies that conduct a significant part of their business in emerging markets. Threadneedle, known for its expertise in managing emergin ...

List of terms and expressions for the exam(2015)

... Scope of Financial Management CFO Treasurer Controller Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer an ...

... Scope of Financial Management CFO Treasurer Controller Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer an ...

Pakistan`s Investment Scenario and Capital Markets

... intensive the flip side of this diversion from public sector credit to private sector would be increase in employment and rural incomes in the short to medium term. Second, the value chain of the financial sector ranging from capital markets at one end and micro-credit at the other, with the bankin ...

... intensive the flip side of this diversion from public sector credit to private sector would be increase in employment and rural incomes in the short to medium term. Second, the value chain of the financial sector ranging from capital markets at one end and micro-credit at the other, with the bankin ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.