Revision 1 – Financial Management, Financial Objectives and

... Question 7 – Efficient market hypothesis, effect of interest rate increase and comparison of objectives of not-for-profit organization and private company. Tagna is a medium-sized company that manufactures luxury goods for several well-known chain stores. In real terms, the company has experienced o ...

... Question 7 – Efficient market hypothesis, effect of interest rate increase and comparison of objectives of not-for-profit organization and private company. Tagna is a medium-sized company that manufactures luxury goods for several well-known chain stores. In real terms, the company has experienced o ...

BGF European Value Fund

... price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Investment involves risk. Past performance is not necessarily a guide to future performance. Th ...

... price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Investment involves risk. Past performance is not necessarily a guide to future performance. Th ...

JAMES M. SANFORD, CFA 107 STONEY HILL ROAD SAG

... Director, Equity Derivative and Convertible Group: Convertible Bond Sales ( Mar 1999-Apr 2004) Top 2 producer on top 3 U.S. Convertible Desk ranked by McGlogan and Greenwich Survey. Covered arbitrage, high yield/distressed and outright/mutual fund customers by pr ...

... Director, Equity Derivative and Convertible Group: Convertible Bond Sales ( Mar 1999-Apr 2004) Top 2 producer on top 3 U.S. Convertible Desk ranked by McGlogan and Greenwich Survey. Covered arbitrage, high yield/distressed and outright/mutual fund customers by pr ...

Accounting degree

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

Financial Self Reliance: It's Not As Hard As You Think

... Your $5,000 automatically comes out of your salary each month and goes—at your direction—into whatever mutual funds are available through the plan. You leave it there until you retire. ...

... Your $5,000 automatically comes out of your salary each month and goes—at your direction—into whatever mutual funds are available through the plan. You leave it there until you retire. ...

The Role of Short Selling in Equity Markets

... Securities lending is a long-standing practice that allows broker-dealers to avoid delivery failures associated with trade settlement. Prior to the adoption of electronic settlement in the 1970s through the Depository Trust & Clearing Corporation (DTC), broker-dealers had to physically deliver secur ...

... Securities lending is a long-standing practice that allows broker-dealers to avoid delivery failures associated with trade settlement. Prior to the adoption of electronic settlement in the 1970s through the Depository Trust & Clearing Corporation (DTC), broker-dealers had to physically deliver secur ...

Birla Sun Life Focused Equity Fund - Series 4.cdr

... the portfolio construction process. The risk control process involves reducing risks through portfolio diversification, taking care however not to dilute returns in the process. The AMC believes that this diversification would help achieve the desired level of consistency in returns. The AMC may als ...

... the portfolio construction process. The risk control process involves reducing risks through portfolio diversification, taking care however not to dilute returns in the process. The AMC believes that this diversification would help achieve the desired level of consistency in returns. The AMC may als ...

entrada - Bolsa de Madrid

... multilateral trading facilities that have sprung up under MiFID. What is key here is that MTFs themselves or their participants trust stock exchanges for price discovery and in fact use the prices set at regulated markets as their reference prices. 4) Fragmentation is introducing serious risk for th ...

... multilateral trading facilities that have sprung up under MiFID. What is key here is that MTFs themselves or their participants trust stock exchanges for price discovery and in fact use the prices set at regulated markets as their reference prices. 4) Fragmentation is introducing serious risk for th ...

Hiding in Plain Sight

... into an existing slice of a large firm’s asset allocation. Some are as unskilled at marketing as they are skilled at security selection, while others don’t believe in paying the platform fees that are required to gain distribution access with most of the well-known Wall Street firms. Alas, nothing i ...

... into an existing slice of a large firm’s asset allocation. Some are as unskilled at marketing as they are skilled at security selection, while others don’t believe in paying the platform fees that are required to gain distribution access with most of the well-known Wall Street firms. Alas, nothing i ...

Text of Howard Davies lecture: Financial Reform in the Middle Kingdom

... the architects of their own misfortunes. This political problem bedevilled attempts to resolve the Japanese financial crisis for more than a decade. While in China political pressures do not present themselves in quite the same way as they do in a parliamentary democracy, they are real, nonetheless. ...

... the architects of their own misfortunes. This political problem bedevilled attempts to resolve the Japanese financial crisis for more than a decade. While in China political pressures do not present themselves in quite the same way as they do in a parliamentary democracy, they are real, nonetheless. ...

The Financial Instability Hypothesis

... hypothesis is that over periods of prolonged prosperity, the economy transits from financial relations that make for a stable system to financial relations that make for an unstable system. In particular, over a protracted period of good times, capitalist economies tend to move from a financial stru ...

... hypothesis is that over periods of prolonged prosperity, the economy transits from financial relations that make for a stable system to financial relations that make for an unstable system. In particular, over a protracted period of good times, capitalist economies tend to move from a financial stru ...

Economist Intelligence Unit

... • The currency should show signs of relative stability once the IMF deal (which is necessary) is in place • If the government decides to go without the IMF, there will be more currency weakness and on-going problems to finance the large payments in 2009 and 2010 ...

... • The currency should show signs of relative stability once the IMF deal (which is necessary) is in place • If the government decides to go without the IMF, there will be more currency weakness and on-going problems to finance the large payments in 2009 and 2010 ...

Suresh M. Sundaresan Office: (212) 854

... Visiting Associate Professor of Finance, September 1984 - December 1984. Graduate School of Business, University of Chicago. On leave from Columbia University. Assistant Professor of Business, July 1980 - June 1983, Graduate School of Business, Columbia University. ---------------------------------- ...

... Visiting Associate Professor of Finance, September 1984 - December 1984. Graduate School of Business, University of Chicago. On leave from Columbia University. Assistant Professor of Business, July 1980 - June 1983, Graduate School of Business, Columbia University. ---------------------------------- ...

Sizing up active small-cap - Charles Schwab Investment Management

... right questions to investing is well-suited for small-caps, please read our white paper: The Evolution of Integrated Management ...

... right questions to investing is well-suited for small-caps, please read our white paper: The Evolution of Integrated Management ...

Smartfund 80% Protected Growth Fund (USD)

... The investments of the fund are managed by experts at Smart Investment Management (Smart ). The portfolio strategy consists predominantly of equities but does use a multi-asset approach and may include funds to provide exposure to a wide range of asset classes which can include bonds, property, comm ...

... The investments of the fund are managed by experts at Smart Investment Management (Smart ). The portfolio strategy consists predominantly of equities but does use a multi-asset approach and may include funds to provide exposure to a wide range of asset classes which can include bonds, property, comm ...

Glossary - Investment 2020

... The beneficial owners of trust property, or those who inherit under a will. ...

... The beneficial owners of trust property, or those who inherit under a will. ...

we have made progress

... The great geographical distances made it complicated and tiresome to gather the managers and professionals of the related companies, so that they could share better practices or design and implement ad-hoc solutions to common problems that they faced. Transportation and travel expenses and increase ...

... The great geographical distances made it complicated and tiresome to gather the managers and professionals of the related companies, so that they could share better practices or design and implement ad-hoc solutions to common problems that they faced. Transportation and travel expenses and increase ...

Proceedings of 10th Asia - Pacific Business and Humanities Conference

... ISBN: 978-1-925488-00-5 ...

... ISBN: 978-1-925488-00-5 ...

View item 6c as RTF 564 KB

... Non-investment targets – the investments to date have leveraged an average 4.9 co-investment multiple from the private sector, which is ahead of the LEP’s target of 2.9x. It is in the process of completing eight more investments, which are expected to be finalised by the end of January 2016. In addi ...

... Non-investment targets – the investments to date have leveraged an average 4.9 co-investment multiple from the private sector, which is ahead of the LEP’s target of 2.9x. It is in the process of completing eight more investments, which are expected to be finalised by the end of January 2016. In addi ...

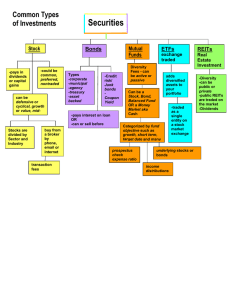

Securities

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

Real Assets and Inflation Hedging Strategies

... other financial products. Offers will only be made through a private placement memorandum to qualified investors and only in those jurisdictions where permitted by law. No assurances can be made that any expectations, strategies and/or goals expressed or implied will be realized or successful or tha ...

... other financial products. Offers will only be made through a private placement memorandum to qualified investors and only in those jurisdictions where permitted by law. No assurances can be made that any expectations, strategies and/or goals expressed or implied will be realized or successful or tha ...

Associate Portfolio Manager Job Description (00291244).PDF

... Maintain a working knowledge of current events in global investment markets, estate planning and tax policy Assist in data management and maintain best practices within the group Monitor and coordinate with Operations team on cash flows and wire transfers Participate in daily market research ...

... Maintain a working knowledge of current events in global investment markets, estate planning and tax policy Assist in data management and maintain best practices within the group Monitor and coordinate with Operations team on cash flows and wire transfers Participate in daily market research ...

We put a price tag on just how much money the finance sector has

... taxpayers, and businesses been "overcharged" as a result of these questionable financial activities? The following findings —with all figures in inflation adjusted dollars—are from “Overcharged: The High Cost of High Finance,” by Gerald A. Epstein and Juan Antonio Montecino, a Roosevelt Institute re ...

... taxpayers, and businesses been "overcharged" as a result of these questionable financial activities? The following findings —with all figures in inflation adjusted dollars—are from “Overcharged: The High Cost of High Finance,” by Gerald A. Epstein and Juan Antonio Montecino, a Roosevelt Institute re ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.