Alfred M. Pollard, General Counsel Attention: Comments/RIN 2590

... institutions. Community banks worked hard to have the Congress exempt institutions under $500 million in assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That numbe ...

... institutions. Community banks worked hard to have the Congress exempt institutions under $500 million in assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That numbe ...

Investors and Markets

... “... (in 1716, John Law) introduced the practice of dealing in “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzl ...

... “... (in 1716, John Law) introduced the practice of dealing in “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzl ...

Presentation by Mr. Christopher Towe, Deputy Director, Monetary

... critical vehicle for disseminating our analysis and pressing our policy advice to a wide audience We will work closely with the Financial Stability Forum to help forge the consensus on specific policy responses We will be actively engaged with the key standard setters (e.g., Basel Committee) and key ...

... critical vehicle for disseminating our analysis and pressing our policy advice to a wide audience We will work closely with the Financial Stability Forum to help forge the consensus on specific policy responses We will be actively engaged with the key standard setters (e.g., Basel Committee) and key ...

A Framework to Monitor Systemic Risk Sep. 27-28, 2012

... o Measures may be hard to construct in real time (credit-to-GDP gap) o Measurement may change behavior (stress tests) ...

... o Measures may be hard to construct in real time (credit-to-GDP gap) o Measurement may change behavior (stress tests) ...

IFM_Ch16_country risk

... B. Identify the common factors used by MNCs to measure a country’s financial risk C. Explain the techniques used to measure country risk D. Explain how MNCs use the assessment of country risk when making financial decisions ...

... B. Identify the common factors used by MNCs to measure a country’s financial risk C. Explain the techniques used to measure country risk D. Explain how MNCs use the assessment of country risk when making financial decisions ...

PDF - Bankrate.com

... If there is a loss of investor confidence arising from any catastrophic financial event in Europe, the impact upon American banks, investors, and the overall domestic economy will likely be swift and significant. Source: John Moore, associate professor at Walsh College; Richard S. Grossman and Chris ...

... If there is a loss of investor confidence arising from any catastrophic financial event in Europe, the impact upon American banks, investors, and the overall domestic economy will likely be swift and significant. Source: John Moore, associate professor at Walsh College; Richard S. Grossman and Chris ...

risk management

... information and act on it? How to extract & handle risk tolerance toward uncertainty and investor ability to change behavior? How to measure correlations across risky assets? (human wealth, housing equity, and pension wealth from both public and private sources) In other words: how to incorporat ...

... information and act on it? How to extract & handle risk tolerance toward uncertainty and investor ability to change behavior? How to measure correlations across risky assets? (human wealth, housing equity, and pension wealth from both public and private sources) In other words: how to incorporat ...

Measure of Market Risk

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...

Risk-spreading tools for healthcare financing

... capital markets. There are a variety of portion of its accident and health insurinnovative ways in which risk spreading ance exposure to the capital market tools enable both large and small com- (Vitality Re Series bonds, inception panies to become more competitive in 2010). In short, the cat bonds ...

... capital markets. There are a variety of portion of its accident and health insurinnovative ways in which risk spreading ance exposure to the capital market tools enable both large and small com- (Vitality Re Series bonds, inception panies to become more competitive in 2010). In short, the cat bonds ...

Systemic Risk and Sentiment

... 2011) emphasizes the importance of systemic risk and sentiment. These two concepts, and the relationship between them, are important for regulatory bodies. • The FCIC describes systemic risk as “a precipitous drop in asset prices, resulting in collateral calls and reduced liquidity.” In its report, ...

... 2011) emphasizes the importance of systemic risk and sentiment. These two concepts, and the relationship between them, are important for regulatory bodies. • The FCIC describes systemic risk as “a precipitous drop in asset prices, resulting in collateral calls and reduced liquidity.” In its report, ...

Saving and Investment in China

... What happened in the US and global financial markets? What may be the impact on the global economy and financial system? Possible impact on China ...

... What happened in the US and global financial markets? What may be the impact on the global economy and financial system? Possible impact on China ...

After the banking crisis: what now? Monetary, fiscal and

... The liquidity crisis and QE • The liquidity crisis was really a risk crisis. It was caused by a failure of risk management: either a failure to measure risk correctly, or a moral hazard problem due to asymmetric incentives to take on risk. • And due to bad risk assessment of one bank by another the ...

... The liquidity crisis and QE • The liquidity crisis was really a risk crisis. It was caused by a failure of risk management: either a failure to measure risk correctly, or a moral hazard problem due to asymmetric incentives to take on risk. • And due to bad risk assessment of one bank by another the ...

New Financial Intermediaries: Private Equity and the Corporation

... Argues low‐growth, mature firms should return free cash flow to shareholders (dividends, stock repurchases) ...

... Argues low‐growth, mature firms should return free cash flow to shareholders (dividends, stock repurchases) ...

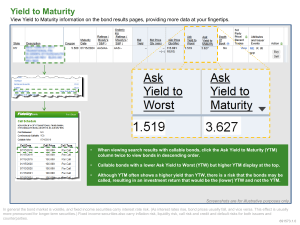

Yield to Maturity

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

Document

... • Oldest way to handle “risk” and understand how markets operate • If a stock is rising or falling seek the cause in a study of the company or the economy behind it. • Postulate: the price of a stock , bond, derivative or currency moves because of some endogenous (or most of the time exogenous) even ...

... • Oldest way to handle “risk” and understand how markets operate • If a stock is rising or falling seek the cause in a study of the company or the economy behind it. • Postulate: the price of a stock , bond, derivative or currency moves because of some endogenous (or most of the time exogenous) even ...

questions in real estate finance

... Understand how the supply and demand for money and credit affect (and are affected by) the economy and the general level of interest rates Understand how yields on individual debt instruments are determined Understand why securities of different maturities may have different yields ...

... Understand how the supply and demand for money and credit affect (and are affected by) the economy and the general level of interest rates Understand how yields on individual debt instruments are determined Understand why securities of different maturities may have different yields ...