Financial Institutions

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

Trade Log - Portfolio Strategies Investment Managers

... any parent organization. Cougar Global is registered with the Ontario Securities Commission and is an independent, nonresident registered investment adviser with the Securities and Exchange Commission. Prior to 01/02/2013, the firm was named Cougar Global Investments LP. Principal Risk: An investmen ...

... any parent organization. Cougar Global is registered with the Ontario Securities Commission and is an independent, nonresident registered investment adviser with the Securities and Exchange Commission. Prior to 01/02/2013, the firm was named Cougar Global Investments LP. Principal Risk: An investmen ...

Introduction to Financial Markets, Institutions, and Systems Learning

... the domestic (internal) value of goods and services and foreign (external) value of goods and services. You can search for more information about foreign exchange market on the Internet. Institutions There are many different types of financial institutions that assist with financial markets, includi ...

... the domestic (internal) value of goods and services and foreign (external) value of goods and services. You can search for more information about foreign exchange market on the Internet. Institutions There are many different types of financial institutions that assist with financial markets, includi ...

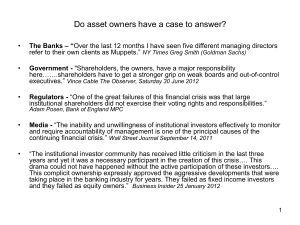

Causes of the Financial Crisis

... •Extremely complex system of pipes. •Lag times •Interdependent flows, dependencies. •Not even sure where the water will come out ...

... •Extremely complex system of pipes. •Lag times •Interdependent flows, dependencies. •Not even sure where the water will come out ...

2010-09-10 MFR interview with Vince Reinhart_1

... risk discipline on risk takers. Abuses. People taking risks were not looking out for the longer term health of the firm. ...

... risk discipline on risk takers. Abuses. People taking risks were not looking out for the longer term health of the firm. ...

Characteristics of Catastrophe Risk

... The catastrophe work program to date includes the Bank’s involvement in the design of the Turkish Catastrophe Insurance Pool, preparation of the Regional R/I Pool in the Caribbean and risk management studies of natural hazards in Honduras, India, Bangladesh, Pakistan and Sri Lanka. Feasibility stud ...

... The catastrophe work program to date includes the Bank’s involvement in the design of the Turkish Catastrophe Insurance Pool, preparation of the Regional R/I Pool in the Caribbean and risk management studies of natural hazards in Honduras, India, Bangladesh, Pakistan and Sri Lanka. Feasibility stud ...

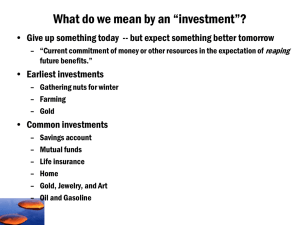

Investments

... Performance Attribution with International Extension to consider additional factors ...

... Performance Attribution with International Extension to consider additional factors ...

Investing Against the Grain

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

Financial Markets

... Other Futures Markets • The history of commodity futures • The evolution since 1980 of financial ...

... Other Futures Markets • The history of commodity futures • The evolution since 1980 of financial ...

Download pdf | 1374 KB |

... Risks remain on the downside • The shift towards fiscal and monetary tightening represents a major risk of a prolonged period of mediocre growth in developed economies – if not of an outright contraction. • Given the economic weakness in developed economies and the lack of significant reforms in in ...

... Risks remain on the downside • The shift towards fiscal and monetary tightening represents a major risk of a prolonged period of mediocre growth in developed economies – if not of an outright contraction. • Given the economic weakness in developed economies and the lack of significant reforms in in ...

9.2. International Financial Management

... How professional you are, and how much care and attention you give to what you do. To answer a question effectively, address the question directly, bring important related issues into the discussion, refer to sources, and indicate how principles from the course materials apply. You must also be able ...

... How professional you are, and how much care and attention you give to what you do. To answer a question effectively, address the question directly, bring important related issues into the discussion, refer to sources, and indicate how principles from the course materials apply. You must also be able ...

Derivatives and Risk Management

... Property risks: Those associated with loss of a firm’s productive assets. Personnel risk: Risks that result from human actions. Environmental risk: Risk associated with polluting the environment. Liability risks: Connected with product, service, or ...

... Property risks: Those associated with loss of a firm’s productive assets. Personnel risk: Risks that result from human actions. Environmental risk: Risk associated with polluting the environment. Liability risks: Connected with product, service, or ...

Systemic Risk, Systematic Risk, and the Identification of

... In contrast to the reasoning of MES and ΔCoVaR, numerous crises have demonstrated that distress events do not necessarily materialize instantaneously. Instead, they may cause persistent market distress, which in turn may lead to an impairment of the financial sector with possible severe ...

... In contrast to the reasoning of MES and ΔCoVaR, numerous crises have demonstrated that distress events do not necessarily materialize instantaneously. Instead, they may cause persistent market distress, which in turn may lead to an impairment of the financial sector with possible severe ...

Junior Sophisters Monetary and Welfare Economics

... (a) Only unsystematic risk, while standard deviation measures total risk (b) Only systematic risk, while standard deviation measures total risk (c) Both systematic and unsystematic risk, while standard deviation measures only unsystematic risk (d) Both systematic and unsystematic risk, while standar ...

... (a) Only unsystematic risk, while standard deviation measures total risk (b) Only systematic risk, while standard deviation measures total risk (c) Both systematic and unsystematic risk, while standard deviation measures only unsystematic risk (d) Both systematic and unsystematic risk, while standar ...

Investment Management Process p2ch1

... Suppose you invested $1,000 in a stock at $25 per share. After one year, the price increases to $35. For each share, you also received $2 in dividends. ...

... Suppose you invested $1,000 in a stock at $25 per share. After one year, the price increases to $35. For each share, you also received $2 in dividends. ...

Presentation

... time spent on studying usually means lost time for leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savin ...

... time spent on studying usually means lost time for leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savin ...

Chap001_overview

... o Security selection & analysis Choosing specific securities w/in an asset class ...

... o Security selection & analysis Choosing specific securities w/in an asset class ...

Figure 3

... financial obligation. Level is driven by the predictability of the firm’s operating cash flows and its fixed-cost financial obligation. The chance that changes in interest rates will adversely affect the value of an investment. The chance that an investment cannot be easily liquidated at a reasonabl ...

... financial obligation. Level is driven by the predictability of the firm’s operating cash flows and its fixed-cost financial obligation. The chance that changes in interest rates will adversely affect the value of an investment. The chance that an investment cannot be easily liquidated at a reasonabl ...