Risk Analysis - Purdue Agriculture

... expenditures to be higher than “expected” when investment was made. • Measured by variation in these factors • Causes – Physical risk – physical loss of growing stock due to acts of God or uncontrollable acts of man – Market risk – changes in markets that cause variation in revenues and costs – Fina ...

... expenditures to be higher than “expected” when investment was made. • Measured by variation in these factors • Causes – Physical risk – physical loss of growing stock due to acts of God or uncontrollable acts of man – Market risk – changes in markets that cause variation in revenues and costs – Fina ...

Written exam 2008 spring

... present 5 situations. You should decide how each situation affects the DCF value of your company. It doesn’t matter what kind of company we are talking about. a) The company takes on more debt but also give out dividends in the same amount, meaning the capital structure has not changed? The question ...

... present 5 situations. You should decide how each situation affects the DCF value of your company. It doesn’t matter what kind of company we are talking about. a) The company takes on more debt but also give out dividends in the same amount, meaning the capital structure has not changed? The question ...

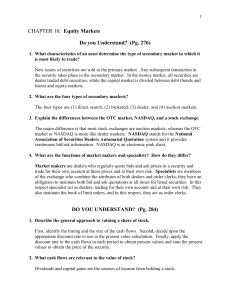

CHAPTER 10: Equity Markets

... 2. What are the four types of secondary markets? The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas th ...

... 2. What are the four types of secondary markets? The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas th ...

Download: The way forward: building a sustainable recovery and driving growth (pdf)

... business, and also encouraging a savings culture in the UK through investment in UK Plc. • Let me be clear, debt finance is not bad. • But debt, lent to unreliable customers, secured against volatile assets, securitised and priced using dubious methodology, leveraged again and again, and funded usin ...

... business, and also encouraging a savings culture in the UK through investment in UK Plc. • Let me be clear, debt finance is not bad. • But debt, lent to unreliable customers, secured against volatile assets, securitised and priced using dubious methodology, leveraged again and again, and funded usin ...

Chapter 11

... • A currency can only graduate to an international role if there exists monetary and financial stability at home • The foremost indicator of monetary stability is the rate of inflation (which measures the stability of the purchasing power of money) • In both Europe and the USA, price stability has b ...

... • A currency can only graduate to an international role if there exists monetary and financial stability at home • The foremost indicator of monetary stability is the rate of inflation (which measures the stability of the purchasing power of money) • In both Europe and the USA, price stability has b ...

ENTERPRISE RISK MANAGEMENT

... Managed numbers can convey more, or less information Examples where signaling is important - Outside investors rely on accounting numbers to value the firm. Do “hedged” numbers convey more or less information - The profit or share price of a firm depends both on factors under the control of the ...

... Managed numbers can convey more, or less information Examples where signaling is important - Outside investors rely on accounting numbers to value the firm. Do “hedged” numbers convey more or less information - The profit or share price of a firm depends both on factors under the control of the ...

Diapositive 1 - University of Ottawa

... corporations is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial ...

... corporations is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial ...

Ch.1 - 13ed Overview of Fin Mgmt

... Objective of the firm: Maximize wealth Determinants of fundamental value Financial securities, markets and ...

... Objective of the firm: Maximize wealth Determinants of fundamental value Financial securities, markets and ...

FREE Sample Here - We can offer most test bank and

... converting an asset into cash with little risk of loss of principal. "Liquidity" in the professional investment community is generally used to mean the ease with which an asset may be sold at the current market price. With this definition, liquidity refers to the depth of the market. Which definitio ...

... converting an asset into cash with little risk of loss of principal. "Liquidity" in the professional investment community is generally used to mean the ease with which an asset may be sold at the current market price. With this definition, liquidity refers to the depth of the market. Which definitio ...

Dealing With Systemic Crisis

... c. Cost of the Financial Crisis • Total cost 1.4 trillion Baht = About 25% of GDP (Gross basis, recovery not yet deducted) • All costs fiscalised by law • 800 billion Baht worth of government bonds issued. • The remaining 600 billion Baht to be issued when obligations fall due. ...

... c. Cost of the Financial Crisis • Total cost 1.4 trillion Baht = About 25% of GDP (Gross basis, recovery not yet deducted) • All costs fiscalised by law • 800 billion Baht worth of government bonds issued. • The remaining 600 billion Baht to be issued when obligations fall due. ...

macroprudential regulation – the missing policy pillar

... expressing net worth as proportion of asset price volatility – mainly institution level • Value at risk – flawed due to assumptions such as normality, correlations • Stress tests at institution, banking system and economy wide level • Bubble detection ...

... expressing net worth as proportion of asset price volatility – mainly institution level • Value at risk – flawed due to assumptions such as normality, correlations • Stress tests at institution, banking system and economy wide level • Bubble detection ...

Beverly Hirtle (New York Fed)

... Important if these firms are to receive differentiated regulation or supervisory ...

... Important if these firms are to receive differentiated regulation or supervisory ...

MarketSavvy-Full Program

... (1) Sessions in Financial Markets will allow participants to gain the core fundamentals to be able to follow the international trading markets (2) In People in the Markets sessions focus more on the individuals who are currently in positions of power and how they may influence the business environme ...

... (1) Sessions in Financial Markets will allow participants to gain the core fundamentals to be able to follow the international trading markets (2) In People in the Markets sessions focus more on the individuals who are currently in positions of power and how they may influence the business environme ...

Understanding the Global Economic Crisis

... relatively obscure corner of the United States housing credit system means that it cannot be analysed adequately by just looking at this segment of the market while ignoring the huge asset-price bubbles that arose elsewhere seemingly independently ...

... relatively obscure corner of the United States housing credit system means that it cannot be analysed adequately by just looking at this segment of the market while ignoring the huge asset-price bubbles that arose elsewhere seemingly independently ...

Second Quarter Market Summary Dear Friends, Among the quarter`s

... In fact, one thing that stands out about the past three months amidst the record-setting highs of the S&P 500 is the very low stock market volatility. While low volatility and high stock prices reflect the market’s apparent lack of concern about risk, this seeming complacency could suggest a market ...

... In fact, one thing that stands out about the past three months amidst the record-setting highs of the S&P 500 is the very low stock market volatility. While low volatility and high stock prices reflect the market’s apparent lack of concern about risk, this seeming complacency could suggest a market ...

The Reckoning NY Times

... For more than a decade, the former Federal Reserve Chairman Alan Greenspan has fiercely objected whenever derivatives have come under scrutiny in Congress or on Wall Street. “What we have found over the years in the marketplace is that derivatives have been an extraordinarily useful vehicle to trans ...

... For more than a decade, the former Federal Reserve Chairman Alan Greenspan has fiercely objected whenever derivatives have come under scrutiny in Congress or on Wall Street. “What we have found over the years in the marketplace is that derivatives have been an extraordinarily useful vehicle to trans ...

Interrogatories

... 12. If the company has assumed reinsurance from another insurer, there should be charged a reserve equal to that which the ceding company would have been required to charge had it retained the risk. Has this been done? ___________ If not, please explain. _____________________________________________ ...

... 12. If the company has assumed reinsurance from another insurer, there should be charged a reserve equal to that which the ceding company would have been required to charge had it retained the risk. Has this been done? ___________ If not, please explain. _____________________________________________ ...

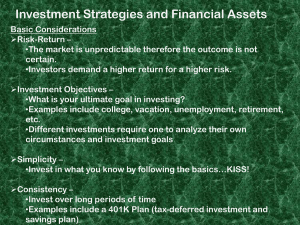

Investment Strategies and Financial Assets

... Bond prices vary depending on interest rates, risk, and supply and demand Bond Yields – annual interest divided by the purchase price •Determined by the interest paid and the purchase price •Bonds are NOT insured and the risk varies from company to company •Bonds are rated based on financial healt ...

... Bond prices vary depending on interest rates, risk, and supply and demand Bond Yields – annual interest divided by the purchase price •Determined by the interest paid and the purchase price •Bonds are NOT insured and the risk varies from company to company •Bonds are rated based on financial healt ...

Risk: How Much Is Too Much?

... preserve their principal – even if it means that their investments might not keep up with inflation. At the other end of the spectrum are aggressive investors who are willing to accept higher risk in exchange for potentially higher returns. Your feelings about risk can help you choose investments fo ...

... preserve their principal – even if it means that their investments might not keep up with inflation. At the other end of the spectrum are aggressive investors who are willing to accept higher risk in exchange for potentially higher returns. Your feelings about risk can help you choose investments fo ...

chapter 1

... the excess. Rather than keep these savings in his possession, the individual may consider it worthwhile to forego immediate possession of the money for a larger future amount of consumption. This trade-off of present consumption for a higher level of future consumption is the essence of investment. ...

... the excess. Rather than keep these savings in his possession, the individual may consider it worthwhile to forego immediate possession of the money for a larger future amount of consumption. This trade-off of present consumption for a higher level of future consumption is the essence of investment. ...