The Financial Industry as a Catalyst for

... – The levels of banking development and stock market liquidity each exerts a positive influence on economic growth – Better-functioning financial systems ease the external financing constraints that impede firm and industrial expansion ...

... – The levels of banking development and stock market liquidity each exerts a positive influence on economic growth – Better-functioning financial systems ease the external financing constraints that impede firm and industrial expansion ...

Better portfolio evaluations – quantitative analysis to improve

... Our experienced teams, assisted by financial engineers and quantitative analysts, can provide support on a range of challenges related to the valuation, classification and analysis of financial instruments – from straightforward derivatives, through to highly complex hybrid products. We have develo ...

... Our experienced teams, assisted by financial engineers and quantitative analysts, can provide support on a range of challenges related to the valuation, classification and analysis of financial instruments – from straightforward derivatives, through to highly complex hybrid products. We have develo ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

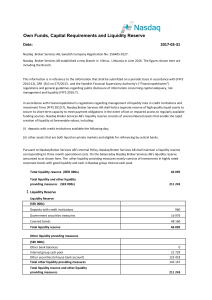

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

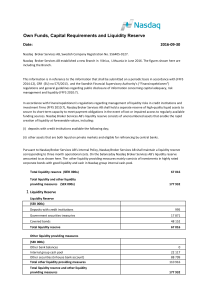

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

Risk and Return Analysis

... supposed to include all risky assets in their relative proportion, of which only a fraction are traded and quoted with up-to-date prices. Proxies may of course be used but it is not clear what the scope of the proxy should be, whether the portfolio can be taken as domestic-only for a US-based invest ...

... supposed to include all risky assets in their relative proportion, of which only a fraction are traded and quoted with up-to-date prices. Proxies may of course be used but it is not clear what the scope of the proxy should be, whether the portfolio can be taken as domestic-only for a US-based invest ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... asymmetric information problem takes the market illiquid. Comments BL ...

... asymmetric information problem takes the market illiquid. Comments BL ...

**** 1

... profits shall be reserved in full. ② In case where any losses are incurred in the closing, they shall be covered by the reserve under Paragragh ①, and if the reserves are insufficient, the Government may cover them. ...

... profits shall be reserved in full. ② In case where any losses are incurred in the closing, they shall be covered by the reserve under Paragragh ①, and if the reserves are insufficient, the Government may cover them. ...

New Century Financial - San Francisco State University

... 1. Ambiguity in Accounting and Auditing. Bias thrives wherever there is the possibility of interpreting information in different ways. 2. Attachment. KPMG have strong business reasons to remain in its clients’ (New Century) good graces and are thus highly motivated to approve their accounts. 3. Fami ...

... 1. Ambiguity in Accounting and Auditing. Bias thrives wherever there is the possibility of interpreting information in different ways. 2. Attachment. KPMG have strong business reasons to remain in its clients’ (New Century) good graces and are thus highly motivated to approve their accounts. 3. Fami ...

MPIs Macro-prudential analysis Qualitative information

... • Extend the current TFIs for the non-financial sectors and ICPFs to seven sectors • Improve the timeliness (90 days) • Complete the instrument coverage and the link between stocks and flows • Sectoral accounts • Quarterly who-to-whom system ...

... • Extend the current TFIs for the non-financial sectors and ICPFs to seven sectors • Improve the timeliness (90 days) • Complete the instrument coverage and the link between stocks and flows • Sectoral accounts • Quarterly who-to-whom system ...

Chapter 13 - Carlin Business

... – Hope to capture the upside of rising stock prices while avoiding most of the downside ...

... – Hope to capture the upside of rising stock prices while avoiding most of the downside ...

Financial literacy - Fairfield Public Schools

... FINANCIAL LITERACY Description Financial literacy is defined as the ability to read, analyze, manage and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss money and financial issues without (or despite) ...

... FINANCIAL LITERACY Description Financial literacy is defined as the ability to read, analyze, manage and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss money and financial issues without (or despite) ...

Engelsk PPT-mal

... If the liabilities' duration is 15, then a 2 percentage points fall in interest rates alters the present value of liabilities with 30% if this change is simply carried through for the purpose of liability valuation Which assets (apart from too few long dated bonds) yield 30% with certainty over 4 mo ...

... If the liabilities' duration is 15, then a 2 percentage points fall in interest rates alters the present value of liabilities with 30% if this change is simply carried through for the purpose of liability valuation Which assets (apart from too few long dated bonds) yield 30% with certainty over 4 mo ...

IFM7 Chapter 27

... What problems do not-for-profit businesses encounter when they attempt to implement the trade-off theory? The major problem is their lack of flexibility in raising equity capital. Not-for-profit firms do not have access to the typical equity markets. It’s harder for them to raise fund capital. ...

... What problems do not-for-profit businesses encounter when they attempt to implement the trade-off theory? The major problem is their lack of flexibility in raising equity capital. Not-for-profit firms do not have access to the typical equity markets. It’s harder for them to raise fund capital. ...

FINANCING WORKING CAPITAL The financing of working capital is

... only long-term financing. The financing mix of the working capital depends upon the risk preferences of the management. Cost of different type of funds, the long-term and short-term, the return on different type of current assets, risk-bearing ability of the concern, liquidity, levels etc., have to ...

... only long-term financing. The financing mix of the working capital depends upon the risk preferences of the management. Cost of different type of funds, the long-term and short-term, the return on different type of current assets, risk-bearing ability of the concern, liquidity, levels etc., have to ...

CAPITAL MOBILITY

... allowed them to borrow from international investors by selling domestic currency-denominated financial assets, which does not entail the currency risk incurred by emerging market borrowers.. It is not a surprising evidence that capital account liberalisation boosts growth in high income countries, b ...

... allowed them to borrow from international investors by selling domestic currency-denominated financial assets, which does not entail the currency risk incurred by emerging market borrowers.. It is not a surprising evidence that capital account liberalisation boosts growth in high income countries, b ...

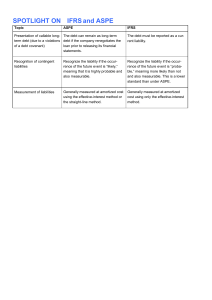

SPOTLIGHT ON*IFRS and ASPE

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

vce02-frankel 222027 en

... attention to the actual and potential changes in financial intermediation and to the incentive structures built into markets and systems. In recent years, the Committee has touched on a number of issues that came to be grouped under the title of issues relating to the financing of the new economy. T ...

... attention to the actual and potential changes in financial intermediation and to the incentive structures built into markets and systems. In recent years, the Committee has touched on a number of issues that came to be grouped under the title of issues relating to the financing of the new economy. T ...