financial services - Xavier Institute of Management

... services produced across space and time. • Over time, these markets multiply and become more complex in response to greater variety of demand for goods and services. ...

... services produced across space and time. • Over time, these markets multiply and become more complex in response to greater variety of demand for goods and services. ...

ch.11

... capital market market in which financial capital is loaned and/or borrowed for more than one year ...

... capital market market in which financial capital is loaned and/or borrowed for more than one year ...

The balance sheet: Telling a balanced story

... resources. At first blush, 50% profit growth sounds good. But what if a company funds that growth by doubling the number of shares outstanding? ROI would decline. ROI measures profitability relative to the capital invested in the business, a useful way to assess companies with a capitalization struc ...

... resources. At first blush, 50% profit growth sounds good. But what if a company funds that growth by doubling the number of shares outstanding? ROI would decline. ROI measures profitability relative to the capital invested in the business, a useful way to assess companies with a capitalization struc ...

Research Projects in Financial Economics

... structured), and investors observe neither opaque funds’ nor assets’ payoffs. The model shows that opaque funds take on excessive leverage, causing overpricing of opaque assets. Over-the-Counter Financial Markets Project leader: Prof. Norman Schürhoff (University of Lausanne and SFI) – In view of r ...

... structured), and investors observe neither opaque funds’ nor assets’ payoffs. The model shows that opaque funds take on excessive leverage, causing overpricing of opaque assets. Over-the-Counter Financial Markets Project leader: Prof. Norman Schürhoff (University of Lausanne and SFI) – In view of r ...

If Markets Are Efficient, Why Do Crises Occur?

... The Efficient Market Hypothesis is defined as a theory which states that asset prices reflect all publicly available information about the asset’s value. It was first developed by Fama in the early 1960s and by 1970, he had combined his ideas with Samuelson’s work on the random walk behaviour of pri ...

... The Efficient Market Hypothesis is defined as a theory which states that asset prices reflect all publicly available information about the asset’s value. It was first developed by Fama in the early 1960s and by 1970, he had combined his ideas with Samuelson’s work on the random walk behaviour of pri ...

numbering template.indd

... Value is determined by a proper assessment of the relationship between the future returns generated on an investment and the risk of attaining those returns ...

... Value is determined by a proper assessment of the relationship between the future returns generated on an investment and the risk of attaining those returns ...

serie documentos de trabajo ownership structure and risk at

... reported by each banking institution to Superfinanciera3. As dependent variable, we computed an ex-post measure of credit risk (RISK) that is explained by the ratio of non-performing loans to total Loans. We recognize that other measures of risk based on the Market risk approach could allow the iden ...

... reported by each banking institution to Superfinanciera3. As dependent variable, we computed an ex-post measure of credit risk (RISK) that is explained by the ratio of non-performing loans to total Loans. We recognize that other measures of risk based on the Market risk approach could allow the iden ...

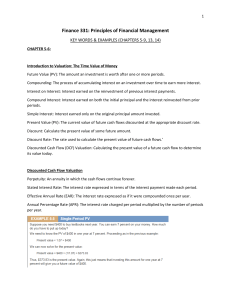

Finance Slides 051915

... • Equity Financing -- The funds raised from within the firm from operations or through the sale of ownership in the firm (such as stock). ...

... • Equity Financing -- The funds raised from within the firm from operations or through the sale of ownership in the firm (such as stock). ...

Kazimierz Dolny konferencja

... construction and mortgage lending such as Northern Rock, as they could no longer obtain financing through the credit markets. ...

... construction and mortgage lending such as Northern Rock, as they could no longer obtain financing through the credit markets. ...

20-Year Portfolio Performance Examining the past 20 years

... As illustrated in this image, portfolios with a greater allocation to stocks generally produced greater returns and higher ending wealth values than portfolios allocated more heavily to bonds. However, the higher returns of portfolios with large allocations to stocks are associated with much greater ...

... As illustrated in this image, portfolios with a greater allocation to stocks generally produced greater returns and higher ending wealth values than portfolios allocated more heavily to bonds. However, the higher returns of portfolios with large allocations to stocks are associated with much greater ...

Day 1 — Wednesday, 10 April 2013 - Asia Pacific Financial Market

... It will also discuss the current state of cross-border trade in financial products and services in the Asia-Pacific region, compared with financial markets in Europe and the US. ...

... It will also discuss the current state of cross-border trade in financial products and services in the Asia-Pacific region, compared with financial markets in Europe and the US. ...

Study on Industry Risk Assessment of Decision-making Model

... Production of the above Industrial risks is with the local government decision-making related to non-industrial risk assessment. Industry Risk The first is risk assessment, risk assessment model is an advanced concepts and techniques and methods in the embodiment of the macro level risk assessment o ...

... Production of the above Industrial risks is with the local government decision-making related to non-industrial risk assessment. Industry Risk The first is risk assessment, risk assessment model is an advanced concepts and techniques and methods in the embodiment of the macro level risk assessment o ...

Impact of financial and debt crisis on local and regional authorities

... Impact of financial and debt crisis on local and regional authorities The financial and debt crisis. Investments in danger. How to restore the self-financing capacities ? Limited financing capabilities of banks. Alternatives for financing public facilities. ...

... Impact of financial and debt crisis on local and regional authorities The financial and debt crisis. Investments in danger. How to restore the self-financing capacities ? Limited financing capabilities of banks. Alternatives for financing public facilities. ...

FINANCE - power point presentation

... 1. Statements of changes in financial position can be prepared using either a source and uses format or an activity format, with both providing essentially equivalent information. 2. A statement of sources and uses of funds is derived by comparing the balance sheet of a firm at two different points ...

... 1. Statements of changes in financial position can be prepared using either a source and uses format or an activity format, with both providing essentially equivalent information. 2. A statement of sources and uses of funds is derived by comparing the balance sheet of a firm at two different points ...

Document

... difference between the actual value and the optimal forecast will on average be zero. In other words, sometimes the actual value will be greater than the optimal forecast and sometimes less, but on average, the differences will cancel each other out. In a given period, it is impossible to know what ...

... difference between the actual value and the optimal forecast will on average be zero. In other words, sometimes the actual value will be greater than the optimal forecast and sometimes less, but on average, the differences will cancel each other out. In a given period, it is impossible to know what ...

Assets = Liabilities + Shareholders` Equity

... sources that support these assets. • Owner or shareholder equity is the amount of money initially invested into the company plus any retained earnings and it represents a source of funding for the business. ...

... sources that support these assets. • Owner or shareholder equity is the amount of money initially invested into the company plus any retained earnings and it represents a source of funding for the business. ...

Networks of Economic Market Interdependence and Systemic Risk

... In summary, complex systems science focuses on the role of interdependence, a key aspect of the dynamical behavior of economic crises as well as the evaluation of risks in both “normal” and rare conditions. We have analyzed the dynamics of correlational dependencies in rising and falling markets. Th ...

... In summary, complex systems science focuses on the role of interdependence, a key aspect of the dynamical behavior of economic crises as well as the evaluation of risks in both “normal” and rare conditions. We have analyzed the dynamics of correlational dependencies in rising and falling markets. Th ...

How to assess a manager recovery skill - ORBi

... In this section, we compare the ranking of all the risk measures we have selected with each others. We compute the risk measures for the 4,136 mutual funds in our data set over the entire period (January 2000 to March 2010). We then rank the mutual funds according to their level of risk for each ris ...

... In this section, we compare the ranking of all the risk measures we have selected with each others. We compute the risk measures for the 4,136 mutual funds in our data set over the entire period (January 2000 to March 2010). We then rank the mutual funds according to their level of risk for each ris ...

12[Insert Product Name shift return for second line if needed]

... Advice for Other Bankers: “Practice, practice, practice. As with any change, it is important to give employees enough time to practice using the new solution to boost not only their comfort level, but their confidence as well.” ...

... Advice for Other Bankers: “Practice, practice, practice. As with any change, it is important to give employees enough time to practice using the new solution to boost not only their comfort level, but their confidence as well.” ...

Personal Finance - Bemidji Area Schools

... • Differentiate among the main types of auto insurance coverage and factors that can increase or reduce auto importance of property insurance premiums. and liability insurance • Determine the legal minimum amounts of auto insurance coverage required in one’s state of residence. protection. • Calcula ...

... • Differentiate among the main types of auto insurance coverage and factors that can increase or reduce auto importance of property insurance premiums. and liability insurance • Determine the legal minimum amounts of auto insurance coverage required in one’s state of residence. protection. • Calcula ...

![12[Insert Product Name shift return for second line if needed]](http://s1.studyres.com/store/data/022634580_1-11cb652bc759a67d74cb1246b7b4041d-300x300.png)