Global outlook - the United Nations

... the imposition of global consistency rules (especially for trade flows measured both in volumes and values) set by the WEFM. The main global assumptions are discussed below. The baseline forecast does not include any specific assumption about international coordination of macroeconomic policies. It ...

... the imposition of global consistency rules (especially for trade flows measured both in volumes and values) set by the WEFM. The main global assumptions are discussed below. The baseline forecast does not include any specific assumption about international coordination of macroeconomic policies. It ...

from global collapse to recovery

... The resulting widening of the interest rate differential will further boost capital flows to LAC, intensifying policy tensions vis-à-vis the risks of an overshooting in the appreciation of LAC currencies (with potentially permanent adverse effects on export competitiveness) and excessive credit expa ...

... The resulting widening of the interest rate differential will further boost capital flows to LAC, intensifying policy tensions vis-à-vis the risks of an overshooting in the appreciation of LAC currencies (with potentially permanent adverse effects on export competitiveness) and excessive credit expa ...

International aspects of the Great Depression and the crisis of 2007

... institutions may have made it easier for government, central bank, and other authorities to exert informal supervision over the banking system. Because bank branching, size, and concentration are typically highly correlated, it is difficult to determine which of these attributes was most responsible ...

... institutions may have made it easier for government, central bank, and other authorities to exert informal supervision over the banking system. Because bank branching, size, and concentration are typically highly correlated, it is difficult to determine which of these attributes was most responsible ...

increase

... b. It is more important to reduce world inflation than to reduce U.S. unemployment. c. Workers are not affected; only business suffer. d. The long-run gains to consumers & some producers exceed the losses to other producers. e. Government can protect U.S. industries while encouraging free trade. ...

... b. It is more important to reduce world inflation than to reduce U.S. unemployment. c. Workers are not affected; only business suffer. d. The long-run gains to consumers & some producers exceed the losses to other producers. e. Government can protect U.S. industries while encouraging free trade. ...

Fiscal Reaction Function: Evidences from CESEE countries 4

... states and countries out of EU. As some of CESEE countries became Eurozone members in recent years, their decisions on primary and budget balance levels were influenced by Maastricht criteria for Eurozone admission (Mencinger and Aristovnik, 2013). In addition, NMS are generally considered to be mor ...

... states and countries out of EU. As some of CESEE countries became Eurozone members in recent years, their decisions on primary and budget balance levels were influenced by Maastricht criteria for Eurozone admission (Mencinger and Aristovnik, 2013). In addition, NMS are generally considered to be mor ...

Who Gains and Who Loses from the Exchange Rate System in

... approach. It is often involved determining the equilibrium exchange rate and shadow exchange rate in the presence of trade and foreign exchange restrictions. One of the very first works, to our knowledge, is Tarr (1990) dealing with the second-best foreign exchange policy in Poland. A partial equili ...

... approach. It is often involved determining the equilibrium exchange rate and shadow exchange rate in the presence of trade and foreign exchange restrictions. One of the very first works, to our knowledge, is Tarr (1990) dealing with the second-best foreign exchange policy in Poland. A partial equili ...

Exhibit 15 Foreign exchange market for US dollars and British pounds

... a. Correct. This account records payments for financial capital, such as real estate, stock, bonds, and government securities. b. Incorrect. Expenditures for services such as tourism, income for foreign investment, and foreign gifts are tabulated in the current account. c. Incorrect. This is the dif ...

... a. Correct. This account records payments for financial capital, such as real estate, stock, bonds, and government securities. b. Incorrect. Expenditures for services such as tourism, income for foreign investment, and foreign gifts are tabulated in the current account. c. Incorrect. This is the dif ...

MACROECONOMICS Section I

... (A) keep part of their demand deposits as reserves (B) expand the money supply when requested by the central bank (C) insure their deposits against losses and bank runs (D) pay a fraction of their interest income in taxes (E) charge the same interest rate on all their loans ...

... (A) keep part of their demand deposits as reserves (B) expand the money supply when requested by the central bank (C) insure their deposits against losses and bank runs (D) pay a fraction of their interest income in taxes (E) charge the same interest rate on all their loans ...

AP Macro Economics 2005 Section I MACROECONOMICS Section I

... B. the Internal Revenue Service spends more than it collects in taxes in a given year C. the federal government spends more than it collects in taxes in a given year D. high levels of unemployment use up tax collections E. interest payments on the national debt increase from one year to the next 6 U ...

... B. the Internal Revenue Service spends more than it collects in taxes in a given year C. the federal government spends more than it collects in taxes in a given year D. high levels of unemployment use up tax collections E. interest payments on the national debt increase from one year to the next 6 U ...

CHAPTER 7

... 3. The total of the accounts payable column in the cash payments journal is overstated by $300 because of an addition error. 4. $160 owed by a debtor was written off as uncollectable. The write-off was recorded in the general journal, but the entry was never posted. 5. The total payment of $2875 mad ...

... 3. The total of the accounts payable column in the cash payments journal is overstated by $300 because of an addition error. 4. $160 owed by a debtor was written off as uncollectable. The write-off was recorded in the general journal, but the entry was never posted. 5. The total payment of $2875 mad ...

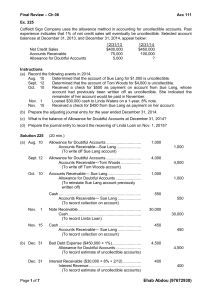

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... Kosko Furniture Store has credit sales of $400,000 in 2014 and a debit balance of $600 in the Allowance for Doubtful Accounts at year end. As of December 31, 2014, $130,000 of accounts receivable remain uncollected. The credit manager prepared an aging schedule of accounts receivable and estimates t ...

... Kosko Furniture Store has credit sales of $400,000 in 2014 and a debit balance of $600 in the Allowance for Doubtful Accounts at year end. As of December 31, 2014, $130,000 of accounts receivable remain uncollected. The credit manager prepared an aging schedule of accounts receivable and estimates t ...

DRAFT: Not for citation

... Harrod-Domar and Solow-Swan clearly in mind.4 Yet unlike some contemporaries, Lewis was concerned with the incremental capital: output ratio that linked investment to growth, realizing that this ratio was in fact anything but stable, as simple growth presentations assumed. Nonetheless, with the adva ...

... Harrod-Domar and Solow-Swan clearly in mind.4 Yet unlike some contemporaries, Lewis was concerned with the incremental capital: output ratio that linked investment to growth, realizing that this ratio was in fact anything but stable, as simple growth presentations assumed. Nonetheless, with the adva ...

Small open economies in the vast ocean of global high finance

... 1. The table shows the development of each variable compared to its long‐term trend for the five years in the run‐up to and in the aftermath of a financial crisis (starting in 2008). The long‐term trend is estimated for 1870‐2013 using the Hodrick‐Prescott filter with a smoothing parameter equal to ...

... 1. The table shows the development of each variable compared to its long‐term trend for the five years in the run‐up to and in the aftermath of a financial crisis (starting in 2008). The long‐term trend is estimated for 1870‐2013 using the Hodrick‐Prescott filter with a smoothing parameter equal to ...

(Textbook) Behavior in Organizations, 8ed (AB Shani)

... • Brings jobs that otherwise would not be created - Direct: Hiring host-country citizens - Indirect: • Jobs created by local suppliers • Jobs created by increased spending by employees of the multi-national enterprise ...

... • Brings jobs that otherwise would not be created - Direct: Hiring host-country citizens - Indirect: • Jobs created by local suppliers • Jobs created by increased spending by employees of the multi-national enterprise ...

Beggar Thy Neighbour: British Imports During the Inter

... particularly in terms of trade policy. From being the world‟s leading exponent of free trade, as befitting an imperial power with a dominant hegemonic position in the global trading order of the 19th century, Britain became increasingly concerned about open trade and free market policies, which were ...

... particularly in terms of trade policy. From being the world‟s leading exponent of free trade, as befitting an imperial power with a dominant hegemonic position in the global trading order of the 19th century, Britain became increasingly concerned about open trade and free market policies, which were ...

Glossary of Local Government Financial Terms

... It is the limit on the total value of a local authority’s outstanding liabilities resulting from borrowing or other credit arrangements. The statutory basis for the ACL can be found in s.62 of the Local Government & Housing Act 1989. Aggregate external finance (AEF) The total level of support the Go ...

... It is the limit on the total value of a local authority’s outstanding liabilities resulting from borrowing or other credit arrangements. The statutory basis for the ACL can be found in s.62 of the Local Government & Housing Act 1989. Aggregate external finance (AEF) The total level of support the Go ...

Paper delivered at the Conference “Ragnar Nurkse (1907–2007): Classical Development

... the basis of eliminating barriers to trade and liberalizing financial markets was based on a theoretical contradiction. As Nurkse pointed out in the earlier debates, in classical Ricardian trade theory the benefits from comparative advantage specialization that result from the static comparison of ...

... the basis of eliminating barriers to trade and liberalizing financial markets was based on a theoretical contradiction. As Nurkse pointed out in the earlier debates, in classical Ricardian trade theory the benefits from comparative advantage specialization that result from the static comparison of ...

budget 2015 economic and fiscal outlook

... cent next year, closer in line with trading partner growth. Domestic demand Private consumption is set to grow by 1.7 per cent this year. Although purchases of durable goods has been healthy, continued weakness in consumption of services is in evidence. Private consumption is set to pick up to 2.7 p ...

... cent next year, closer in line with trading partner growth. Domestic demand Private consumption is set to grow by 1.7 per cent this year. Although purchases of durable goods has been healthy, continued weakness in consumption of services is in evidence. Private consumption is set to pick up to 2.7 p ...

References - ACS - United Nations Economic Commission for Africa

... AfDB and UNDESA while EIU forecasts were pessimistic, i.e predicting lower values than actual values. Regarding the inflation rate four institutions (EIU, HCP, AfDB and UNDESA) were pessimistic (i.e. predicting higher inflation rates than the actual rate) while IMF was optimistic .With regard to the ...

... AfDB and UNDESA while EIU forecasts were pessimistic, i.e predicting lower values than actual values. Regarding the inflation rate four institutions (EIU, HCP, AfDB and UNDESA) were pessimistic (i.e. predicting higher inflation rates than the actual rate) while IMF was optimistic .With regard to the ...

File

... Even though the secular trend is downward, the ARP starts rising from the mid1980s. This does not contradict the Law, provided it is understood as in Marx, i.e. as a tendential movement. The whole secular trend in downwards, and that includes the period of rising profitability starting around the mi ...

... Even though the secular trend is downward, the ARP starts rising from the mid1980s. This does not contradict the Law, provided it is understood as in Marx, i.e. as a tendential movement. The whole secular trend in downwards, and that includes the period of rising profitability starting around the mi ...

Changes to CIBC Business Bank Accounts and Fees (effective April

... By continuing to use your business bank account or safety deposit box after the changes take effect, you are accepting these changes. Of course, you have the option to cancel your account or safety deposit box without cost within 30 days of the changes taking effect by contacting your CIBC business ...

... By continuing to use your business bank account or safety deposit box after the changes take effect, you are accepting these changes. Of course, you have the option to cancel your account or safety deposit box without cost within 30 days of the changes taking effect by contacting your CIBC business ...

Migrant Remittances, Financial Globalization, and Exchange Rate

... relative to the recipient country’s economy (World Bank 2006). Migrants send more money to their families when their home countries experience economic downturns, financial crises, or natural disasters. Moreover, adverse circumstances often trigger more migration, which then results in greater remit ...

... relative to the recipient country’s economy (World Bank 2006). Migrants send more money to their families when their home countries experience economic downturns, financial crises, or natural disasters. Moreover, adverse circumstances often trigger more migration, which then results in greater remit ...

Document

... adopt the single currency. Therefore, this convergence assessment covers the following ten Member States with a derogation: Bulgaria, the Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Romania, Slovakia and Sweden. Having joined the EU on 1 January 2007, Bulgaria and Romania are examin ...

... adopt the single currency. Therefore, this convergence assessment covers the following ten Member States with a derogation: Bulgaria, the Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Romania, Slovakia and Sweden. Having joined the EU on 1 January 2007, Bulgaria and Romania are examin ...