* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 2009 - Homex

Survey

Document related concepts

Security interest wikipedia , lookup

Securitization wikipedia , lookup

Household debt wikipedia , lookup

Financialization wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

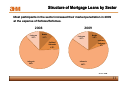

Moral hazard wikipedia , lookup

Syndicated loan wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Yield spread premium wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Interbank lending market wikipedia , lookup

Transcript

Asociación Hipotecaria Mexicana Mexican Housing Day 2010 José Manuel Rivero Andreu President Mexican Mortgage Association February 2010 Associates and Affiliates Associates Associates Associates Banco del Bajío GE Money Santander Banorte GMAC Hipotecaria Scotiabank Banamex Hip. Su Casita SHF Bancomer Hip. Casa Mexicana Hipotecaria Nacional Hip. Independiente Banregio Hip. Vértice ANNM Corporación Hipotecaria HSBC Cibergestion Crédito Inmobiliario Inbursa Concord Servicing Crédito y Casa Infonavit Hito Fincasa ING Hipotecaria Tinsa Ixe Metrofinanciera Fovissste Genworth Financial Patrimonio Affiliates Content • Housing Investment • Mortgage Loans Performance • Construction Lending • 2010 Forecast and Conclusions 3 Housing Investment Housing Industry in Mexico has been an important growth factor in the economy economy.. (Billion Pesos at 2009 Prices) Annual Growth rate of investment in real terms during last decade, decade, has been 15.2% versus a 2.5% of GDP. Source: BBVA Bancomer with Presidencia de la República data 4 Housing Investment Such outstanding growth rate during last decade was mainly due to to:: Macroeconomic Stability (Low rate of inflation) inflation) Ample availability of funding and debt in the markets markets.. Low interest rate and peso fixed rate mortgages mortgages.. Diversification of financial intermediaries and products. Role of Housing agencies (Infonavit (Infonavit,, Fovissste) Fovissste) Active Participation of Home Builders Demographic Bonus 5 Demographic Bonus Housing needs of the population in Mexico, Mexico, the so called “Bono Demografico”, Demografico ”, will increase substantially in the next decades. decades. Mexico Demographics 1950-2050 Number of family members for each 100 persons Total Young Population “Bono Demografico” Older Population Source: Estimates of the Consejo Nacional de Población 6 Content • Housing Investment • Mortgage Loans Performance • Construction Lending • 2010 Forecast and Conclusions 7 Mortgage Loans Performance In spite of world economic recession and a 7% fall of GDP in our country mortgage activity in Mexico had a better performance than expected. expected. 771,974 677,594 640,846 566,810 NUMBER OF MORTGAGE LOANS NUMBER OF HOUSES 2008 Only includes Acquisition 2009 Source: AHM with data of Infonavit, Fovissste, Banks, Sofoles/Sofomes 8 Mortgage Loans Performance Fovissste,, Banks and Infonavit led the market Fovissste 494,073 447,481 187,761 90,140 130,031 100,082 FOVISSSTE PRIVATE SECTOR 2008 Private Sector: Banks and Sofoles/Sofomes Only includes Acquisition INFONAVIT 2009 Source: AHM 9 Mortgage Loans Performance Amount of mortgage loans in mexican pesos was lower due to reduced levels of demand and a shift to low income housing housing.. Amount of Mortgage Loans (Millions of Pesos) 231,569 2008 Only includes Acquisition 217,784 2009 Source: AHM 10 Structure of Mortgage Loans by Sector Most participants in the sector increased their market penetration in 2009 at the expense of Sofoles/ Sofoles/Sofomes Sofomes.. 2009 2008 Fovissste 12% Banks 11% Fovissste 15% Banks 14% Sofoles/ Sofomes 5% Sofoles/ Sofomes 13% Infonavit Infonavit 64% 66% Source: AHM 11 Mortgage Loan Delinquencies Delinquencies.. In spite of higher unemployment in the country, loan delinquencies do not represent an undo risk risk.. Banks 4.40% Sofoles/Sofomes 7.25% Infonavit 4.81% Weighted Average 4.74% Units Source: AHM •Agressive restructuring programs have mitigated delinquencies delinquencies.. •Unemployment insurance and mortgage insurance have played a relevant role in reducing severity severity.. •Loan provisions are in general adequate to cover delinquencies and potential write write--offs. offs. 12 Loan Delinquencies Delinquencies.. Delinquency rates (180+ days) Delinquencies by type of loan • Joint programs Apoyo Infonavit and Cofinavit, show better delinquency rates than nonInfonavit related loans (mercado abierto) • This performance trend is consistently observed among commercial banks and mortgage banks (Sofols / Sofoms) Source: Fitch, “Mexican RMBS performance update”, Sept. 09 13 Loan Delinquencies Delinquencies.. Inflation linked portfolio and mortgage insurance • Cumulative defaults (180+ days) in mortgage banks (Sofols / Sofoms) Delinquency rates for inflation linked (UDI) portfolio is almost twice than that for peso denominated loans. • Mortgage insurance becomes particularly relevant for inflation linked portfolio in order to limit potential losses and increase profitability (ROE) Source: AHM estimates 14 Content • Housing Investment • Mortgage Loans Performance • Construction Lending • 2010 Forecast and Conclusions 15 Construction Lending Bank lending for construction was slightly lower than previous year however Sofoles/ Sofoles/Sofomes Sofomes were severly impacted by lack of funding in the markets markets.. 60,000 51,822 Million of Pesos 50,000 40,000 18,247 34,985 7,769 30,000 20,000 33,575 27,216 10,000 0 2008 Banks 2009 Sofoles/Sofomes Source: AHM 16 Construction Lending Number of houses financed during 2009 fell by 50,000 homes, homes, which offers aditional business opportunities for home builders this year 250,000 195,885 200,000 Homes 146,879 150,000 70,177 30,223 100,000 125,708 116,656 2008 2009 50,000 0 Banks Sofoles/Sofomes Source: AHM 17 Construction Lending Low income housing grew in 2009 at a higher rate than other sectors 35 25 15 5 -5 -15 2006 2007 2008 Low income 2009 Total Source : BBVA Bancomer with Softec Data 18 Registry of Housing Supply (RUV) AHM has signed an agreement with INFONAVIT to publicize monthly in its Web page (www. (www.ahm. ahm.org. org.mx) the statistics of new homes being built by home builders registered. registered. New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold sold.. General Purpose Purpose:: The objective is to standardize the registry of total homes being constructed in the country, so financial institutions and other interested parties could have information of the home supply that is complete, useful, reliable and on time. time. Scope:: Scope RUV reflects the total amount of new homes being built and their location, that are subject to a firm take out by individual mortgages granted by the housing agencies, mainly Infonavit and Fovissste. Fovissste. 19 Housing Supply (RUV) Home Supply by State 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 Infonavit Availability Other Entities Availability Estimated Real Home Supply Infonavit 2010 Source: Infonavit 20 Content • Housing Investment • Mortgage Loans Performance • Construction Lending • 2010 Forecast and Conclusions 21 2010 Mortgage Loans Forecast Mortgage Loans Private Sector 2009 # $ Forecast 2010 # $ Acquisition 130,031 70,011.39 157,000 74,111.68 Improvements and Liquidity 11,804 5,445.83 13,000 5,888.32 Total Private Sector 141,835 75,457.22 170,000 80,000.00 Million of Pesos 22 2010 Construction Lending Forecast New Construction Loans Private Sector Total # Projects 2009 Contract Value ($) 996 34,985.08 Forecast 2010 Contract # Homes # Projects Value # Homes ($) 146,879 1,078 38,364.39 160,392 Million of Pesos 23 Conclusions • Mortgage industry in Mexico proved its strength in this difficult times and also identified areas of opportunity, in spite of economic downturn and unemployment. • Financial Institutions have strenghthened their origination loan process and loan servicing standards, including collection policies to cope with the economic situation. • Funding has been a limitation for some sectors, like Sofoles and Sofomes,, both for the origination of mortgage loans and construction Sofomes lending. • Financing of construction of new homes represents a challenge, but also an opportunity for new business. 24 Conclusions • The most efficient financial institutions with solid capitalization will take advantage of the opportunities in the Housing Sector during this year • Home Builders with such characteristics will increase as well their market share 25