* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Credit Unions and Caisses Populaires SECTOR OUTLOOK 4Q16

Survey

Document related concepts

Payday loan wikipedia , lookup

Negative gearing wikipedia , lookup

Moral hazard wikipedia , lookup

Household debt wikipedia , lookup

Yield spread premium wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Global saving glut wikipedia , lookup

United States housing bubble wikipedia , lookup

Financialization wikipedia , lookup

Interbank lending market wikipedia , lookup

Credit rationing wikipedia , lookup

Transcript

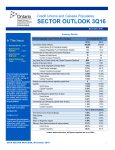

Credit Unions and Caisses Populaires SECTOR OUTLOOK 4Q16 April 2017 Summary Results In This Issue Summary Results….Page 1 Sector Financial Highlights… ……….Page 6 Sector Financial Statements…… …..Page 7 Selected Performance Trends …… ……...Page 9 The information presented in this report has been prepared using a variety of sources, including unaudited reports submitted to DICO by credit unions and caisses populaires. While DICO believes that the information contained in this report would be useful to readers, and considers the financial statements to be reliable, their accuracy and completeness cannot be guaranteed. Ce document est également disponible en français. Contact Us: [email protected] Throughout this document, unless specifically indicated otherwise, credit union refers to both credit unions and caisses populaires. Selected Aggregate Sector Performance Indicators Total Sector Assets (millions) Credit Unions (% of Total Sector Assets) Caisses Populaires (% of Total Sector Assets) Total Number of Credit Unions and Caisses Populaires Number of Credit Unions Number of Caisses Populaires Avg. Asset Size of Credit Unions and Caisses Populaires ($millions) Number of Members (000’s) Regulatory Capital (Aggregate Leverage Ratio) Credit Unions (Leverage) Caisses Populaires (Leverage) Regulatory Risk Weighted Capital Ratio (Class 2 only) Credit Unions Caisses Populaires Number not meeting minimum regulatory capital level Liquidity Credit Unions Caisses Populaires Asset Growth Total Loan Delinquency (greater than 30 days) Credit Unions Caisses Populaires Commercial Loan Delinquency (greater than 30 days) Credit Unions Caisses Populaires As at December 31 2016 $51,852 86.86 13.14 99 74 25 $524 1,610 6.97% 6.66% 9.00% 13.60% 13.04% 17.18% 0 11.26% 11.83% 7.44% 11.2% 0.68% 0.66% 0.80% 1.07% 1.06% 1.13% 2015 $46,621 86.0 14.0 110 85 26 $420 1,594 7.34% 7.10% 8.80% 14.25% 13.85% 16.63% 0 11.20% 11.74% 7.79% 9.88% 0.91% 0.91% 0.91% 1.50% 1.56% 1.12% Year to Date (annualized) Net Interest Income (Financial Margin) Other Income ROAA Return on Regulatory Capital Efficiency Ratio (before dividends & interest rebates) Credit Unions Caisses Populaires 1.98% 0.58% 0.33% 4.59% 81.0% 2.05% 0.58% 0.27% 3.73% 84.1% 83.4% 67.8% 86.8% 69.7% Unless stated otherwise, all figures reported are as at 4Q16. 4Q16 SECTOR OUTLOOK, April 2017 1 Economic Overview ELECTRONIC PUBLICATION: The Sector Outlook is available in PDF format (readable using Adobe Acrobat Reader) and can be downloaded from the Publications section on DICO’s website at www.dico.com. The Bank of Canada’s January Monetary Policy Report expects Canada’s economy to grow at 2.1% in 2017. After the downturn in oil and commodity prices, the economy in Alberta struggled to recover. The BOC expects the US President’s election promises to cancel or renegotiate NAFTA, cut taxes, and boost infrastructure spending, could have a negative impact on Canadian exports. In 2016, the Canadian housing market set new records in terms of prices and sales especially in the Greater Toronto Area. With house prices rising faster than incomes, Canadians have increased borrowing to purchase homes resulting in a rapid increase in household debt. CMHC issued a red flag in the fall due to evidence of problematic conditions in the housing market. The federal government was concerned that the continued sharp increases in house prices in the large urban centres like Toronto could increase the risk of default in the future should the mortgage rates rise. In an attempt to curb this activity, the federal government announced changes in October 2016 to tighten eligibility rules on prospective mortgage borrowers with the following potential impacts: NOTE : Income Statement results are based on aggregate year to date annualized information for each credit union. Comparative results may not always agree with previously reported information for the same period as a result of additional information received after the reporting date. Results are based on the latest available information as at February 1, 2017. Higher eligibility standards may cause a major constraint to mortgage lending and restrain the ability to sell these loans into securitization vehicles. Credit unions may experience a decline in residential mortgage loans being issued because home buyers will qualify for less than their desired amount. The proposed income tax measures may reduce the demand for houses from foreign and domestic real estate speculators, which may stabilize house prices. The proposed concept of “Lender Risk Sharing”, where lenders take on additional risk for insured mortgages, could be detrimental to borrowers as lenders may increase interest rates to pass on this risk as an additional cost to the borrowers, which will reduce the amount the prospective home buyer can borrow. These changes may force borrowers to postpone their purchase, buy a less expensive home or make a larger down payment. As a result of these restrictions and the potential increased risk, lenders have responded by beginning to raise mortgage rates. Although the Bank of Canada seems content to keep its bank rate at 0.5%, all of Canada’s largest banks increased mortgage rates in late 2016. The Canadian Real Estate Association is predicting a general decline in sales activity in 2017 which should prompt a decline in prices. Despite this prediction, the prices for the homes located in the Greater Toronto Area and in the Golden Horseshoe will likely not experience price declines because of the lack of supply and continued demand in this area. Capital Aggregate regulatory capital for the sector increased to $3.57 billion (6.97% of assets) from $3.38 billion (7.34%) year over year and consisted of: 1. Retained earnings $2.23 B (62.3%); 2. Investment and patronage shares $1.29 B (36.08%); and 3. Membership shares $65 million (1.8%). Credit unions should continue to stress test their regulatory capital requirements to assess the potential impacts of a change in interest rates and/or a downturn in other economic factors. Growth Sector consolidation continued over the last twelve months with the number of credit unions decreasing by 11 to 99, resulting in an increase in average asset size to $524 million. The number of credit unions declined by 10 to 74 with an average asset size of $609 million compared to caisses populaires which decreased by one to 25 with an average asset size of $273 million. Total assets grew by 11.2% to $51.9 billion, largely due to growth in residential mortgage loans and (12.1%) and commercial loans (13.2%). Personal loans continue to represent a declining proportion of the total loan portfolio. Over the past five years, as a percentage of the total loan portfolio, residential mortgages have increased from 58.4% to 60.0% and commercial loans from 27.8% to 29.7%. 4Q16 SECTOR OUTLOOK, April 2017 2 The following table provides additional detail on lending activity in the sector. Sector Lending Activity 4Q 2016 Percent of $ Billions Total Loans Residential Mortgage Loans $ 26.82 60.0% Commercial Loans $ 13.29 29.7% Agricultural Loans $ 1.74 3.9% Personal Loans $ 2.71 6.1% Other Loans $ 0.14 0.3% $ 44.70 100% 4Q 2015 Percent of $ Billions Total Loans $ 23.91 59.5% $ 11.74 29.2% $ 1.64 4.1% $ 2.76 6.9% $ 0.12 0.3% $ 40.17 100% 4Q 2011 Percent of $ Billions Total Loans $ 17.95 58.3% $ 8.56 27.8% $ 1.24 4.0% $ 2.95 9.6% $ 0.10 0.3% $ 30.80 100% Total deposits grew by 10.1%, the highest year over year growth rate in the last 10 years and materially higher than the five-year average deposit growth trend of 7.0%. Demand deposit growth led the way with an increase by 12.1% while term deposits increased by 10.0% and registered deposits increased by 7.1% year over year. The funding gap (difference between total loans and total deposits) continues to grow and has increased to 8% in 4Q16 from 6.9% in 4Q15 as credit unions aggressively grow their loan portfolios to increase revenue. There are currently 7 credit unions with a funding gap greater than 10%, including 11 credit unions with funding gaps greater than 20%. Insured deposits are estimated to be $28.6 billion or 69.2% of total deposits in contrast to the banking sector with insured deposits of 27% (source: CDIC, Sept. 2016). The level of insured deposits at credit unions has decreased steadily at an average of 1% per year over the last decade from 81% in 2006. Efficiency Ratio Credit Unions 83.4% Caisses Populaires 67.8% Banks 63.7% The overall efficiency ratio (before dividends and interest rebates) strengthened slightly to 83.4% from 86.4% in 4Q15 however, it remains significantly higher than large Canadian banks at 63.7% (3Q16). Collectively, caisses populaires continue to report an efficiency ratio (67.8%) that is closer to bank results. Caisses populaires benefit from increased economies of scale through an integrated model where most back office functions (including credit underwriting and adjudication) are shared. Profitability: Decreasing Over Time Return on average assets (ROAA) increased to 33 bps in 4Q16 from 27 bps in 4Q15. The following table provides the income and expense breakdown for the sector over the last 4 years. Breakdown of Income and Expenses for Sector As a percentage of Avg. Assets Interest and Investment Income Other Income Total Income Interest Expense Dividend Expense Loan Costs Total Expenses Net Income 4Q 2016 3.40% 0.58% 3.98% 1.09% 0.33% 0.06% 3.65% 0.33% 4Q 2015 3.52% 0.58% 4.10% 1.17% 0.31% 0.09% 3.83% 0.27% 4Q 2014 3.75% 0.55% 4.30% 1.27% 0.29% 0.09% 3.94% 0.36% 4Q 2013 3.77% 0.59% 4.36% 1.31% 0.18% 0.09% 3.92% 0.44% 4Q 2012 3.88% 0.61% 4.49% 1.38% 0.18% 0.14% 4.15% 0.34% There has been a 48 bps decrease in interest and investment income (12.4%) over the last four years as a result of low interest rates driving down rates charged on loans. “Other income” has decreased by 3 bps over the same period to 58 bps. Credit unions continue to seek alternative sources to increase income from non-interest earning related sources to increase revenues. 4Q16 SECTOR OUTLOOK, April 2017 3 Total expenses decreased by 50 bps over the period (12% decrease) led by lower interest expenses - down 29 bps (or 21%) and non-interest expenses - down 21 bps (or 4.7%). All categories of noninterest expenses decreased over the last five years, led by salaries and benefits that dropped by 14 bps (10.8%). Credit unions have focused efforts on lowering expenses, which they have been able to substantially offset the decrease in gross income. Credit unions are beginning to explore new avenues to drive operating expenses down further through economies of scale achieved by pooling resources through shared services. Credit Risk Gross loan delinquency greater than 30 days was 0.68% of total loans, down 23 bps from 0.91% in 4Q15. This was due mainly to lower delinquencies in commercial loans (1.07% vs. 1.50%), and residential mortgages (0.44% vs. 0.62%). In dollar terms, total commercial loan delinquencies decreased to $135 million in 4Q16 from $176.0 million in 4Q15 due mainly to the resolution of two large delinquent loans at one credit union. Residential Mortgage delinquencies decreased to $118.3 million from $147.7 million year over year with $29.4 million of the change due to accounts moving from 30 - 89 days delinquent to 0 - 30 days delinquent. Total agricultural delinquencies increased to $17.3 million from $13.3 million year over year. The following chart shows fluctuations in delinquencies greater than 30 days over the past five years for different loan types. Commercial loan and residential mortgage delinquencies continue to trend down from the highs experienced in 2009 and are now at the lowest level seen in over 10 years. Similarly, loan costs decreased from 0.06% to 0.09% year over year. The decrease in delinquencies coincides with the findings from the Examinations group that, overall, credit unions have improved their loan management processes. Loan Delinquencies 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Personal Mortgages Commercial Total Loan Mix and Yields Total loans grew by 11.3% due to growth in all loan categories with the exception of personal loans. Personal loans decreased by $44 million (1.6%) year over year to $2.71 billion and continue to represent a declining portion of the total loan portfolio mix at 6.1% from 6.7% in 2015. Competition in the residential mortgage market and low yields in the bond markets have resulted in floating and fixed rates that are near historical lows leading to continued strong demand for new mortgages. Mortgage loan rates are beginning to increase which should begin to have a positive impact on loan interest income in the near future. 4Q16 SECTOR OUTLOOK, April 2017 4 The following chart illustrates the current loan portfolio mix and yields versus the values from 4Q15 and their notional impacts on gross interest revenues. Loan Product % of portfolio 2016 2015 Personal Mortgage Commercial Agricultural/Other 6.1% 60.0% 29.7% 4.2% 6.7% 59.5% 29.2% 4.6% Total 100% 100% Change ($M) $ $ $ $ (44) 2,902 1,547 102 % Change Yield 4Q 2016 -1.6% 12.1% 13.2% 6.2% Yield 4Q 2015 6.40% 3.07% 4.53% 3.39% Notional impact (in Millions) on portfolio mix interest rates 6.32% 3.19% 4.56% 3.75% (15.9) 6.6 10.5 (5.9) 1.9 (27.7) (3.4) (5.8) (4.8) (35.1) Liquidity and Borrowings Year over year borrowings increased 34.5% due largely to securitization of residential mortgages in order to make up the funding gap between the growth in assets and deposits. Securitization programs have increased by 31.5% in 4Q16 while all other borrowings decreased. There are currently 17 independent credit unions and 13 caisses populaires affiliated with La Fédération involved in securitization programs. DICO is monitoring the use of securitization programs due to the heavy reliance of this as a liquidity funding source by a few credit unions. As at end of quarter 4Q13 Total Deposts Total Loans Securitization Borrowings Total Securitizations ($millions) ($millions) of Residential from other Securitizations and Mortgages sources & Borrowings Borrowings as ($millions) ($millions) ($millions) a % of Total Liabilites $ 32,591 $ 33,400 $ 2,123 $ 554 $ 2,677 7.39% 4Q14 $ 35,052 $ 36,838 $ 2,646 $ 1,065 $ 3,711 9.40% 4Q15 $ 37,591 $ 40,167 $ 3,947 $ 1,294 $ 5,241 12.12% 4Q16 $ 41,375 $ 44,699 $ 5,192 $ 1,155 $ 6,347 13.14% Liquid asset holdings increased by $569 million to $5.32 billion improving the liquidity ratio to 11.26% from 11.20% in 4Q16. This is mostly attributable to increases in deposits at the leagues/centrals held for liquidity, commercial paper, banker’s acceptances and similar instruments. Liquidity at caisses populaires affiliated with Desjardins (5.13%) remains much lower than at credit unions (11.83%) and the caisses populaires affiliated with L’Alliance (15.65%). The following chart provides a breakdown of liquidity sources. The bulk of liquidity is held in “Deposits in a League or Central” (73.8%), followed by “Deposits in deposit taking institutions” (11.9%). Sources of Liquidity Deposits in a League or Central Deposits in a deposit taking institution in Canada Securities secured by mortgages and guaranteed by CMHC held for liquidity Commercial paper, banker's acceptances and similar instruments Cash held for liquidity Other Sources of Liquidity Total Sources of Liquidity 4Q 2016 4Q 2015 4Q 2014 % of Total % of Total % of Total $ millions $ millions $ millions Liquidity Liquidity Liquidity $ 3,924.7 73.8% $ 3,641.4 76.7% $ 3,056.9 76.0% $ 626.7 11.8% $ 384.4 8.1% $ 269.9 6.7% $ 194.4 3.7% $ 191.4 4.0% $ 202.5 5.0% $ 242.8 4.6% $ 210.4 4.4% $ 129.0 3.2% $ $ $ 234.2 94.4 5,317.2 4.4% $ 1.8% $ 100.0% $ 239.2 81.4 4,748.2 5.0% $ 1.7% $ 100.0% $ 236.9 126.8 4,022.0 5.9% 3.2% 100.0% Credit unions are encouraged to stress test their liquidity requirements sufficiently to challenge the level of liquidity to which they have access and develop alternative contingency strategies to rectify potential liquidity shortages. Credit unions are also encouraged to monitor and stress test their dependence on a single source of liquidity such as securitization in their models. 4Q16 SECTOR OUTLOOK, April 2017 5 Sector Financial Highlights 4Q 2016 Selected Bank Information ONTARIO SECTOR % average assets*, Year to date at . . . 4Q 2016 4Q 2015 3Q 2016 PROFITABILITY Net Interest and Investment Income Loan Costs Other (non-interest) Income Total Income Total Non-Interest Expenses (Operating Expenses) Net Income/(Loss) before Taxes and Non-recurring Extraordinary Items 1.98% 0.06% 0.58% 2.50% 2.10% 0.40% 2.05% 0.09% 0.58% 2.53% 2.20% 0.33% 1.98% 0.34% 1.35% 2.73% 1.74% 0.99% Efficiency Ratio (% Operating Expenses to Total Income) Efficiency Ratio (% Operating Expenses, before dividends & interest rebates Return on Average Assets (ROA) before dividends etc. Return on Average Assets (ROA) Return on Regulatory Capital before dividends etc. Return on Regulatory Capital 83.83% 81.03% 0.41% 0.33% 5.80% 4.59% 86.87% 84.09% 0.35% 0.27% 4.83% 3.73% 63.71% 0.68% 0.38% 0.91% 0.50% 12,567 8,722 24.35% 21.30% 99 110 Total Assets ($ millions) Average Assets per Credit Union ($ millions) 51,852 523.8 46,621 420.0 Median Assets ($ millions) Regulatory Capital 157.9 6.97% 118.2 7.34% 0 0 11.26% 11.20% to Total Income) 0.79% 9.94% CREDIT RISK, as at the quarter-end Gross Delinquency greater than 30 days (% Gross Delinquency greater than 90 days (% of total loans) of total loans) OFF BALANCE SHEET ACTIVITY Off balance Sheet Assets ($millions) (Includes mutual fund sales and administered loans etc.) Income on Off Balance Sheet Activity ( % Other Income) OTHER INDICATORS, as at the quarter-end Total Number of Credit Unions 5,071,070 (as a percentage of net assets) Number of Credit Unions below Regulatory Minimum Liquidity * Year to date annualized unless otherwise stated. Totals may not agree due to rounding 4Q16 SECTOR OUTLOOK, April 2017 6 Sector Financial Statements 4Q 2016 Balance Sheet 4Q 2016 4Q 2015 ($000) ($000) ASSETS Cash and Investments Personal Loans Residential Mortgage Loans Commercial Loans Institutional Loans Unincorporated Association Loans Agricultural Loans Total Loans Total Loan Allowances Capital (Fixed) Assets Intangible & Other Assets Total Assets 6,399,511 2,711,551 26,816,066 13,290,579 102,307 37,336 1,740,761 44,698,601 136,118 494,828 394,837 51,851,659 5,736,571 2,755,592 23,913,390 11,742,736 66,359 50,811 1,638,542 40,167,430 133,886 466,010 384,551 46,620,676 12.3% 5.2% 51.7% 25.6% 0.2% 0.1% 3.4% 86.2% 0.3% 1.0% 0.8% 100.0% 12.3% 5.9% 51.3% 25.2% 0.1% 0.1% 3.5% 86.2% 0.3% 1.0% 0.8% 100.0% LIABILITIES Demand Deposits Term Deposits Registered Deposits Other Deposits Total Deposits Borrowings Securitization Other Liabilities Total Liabilities 17,385,524 13,460,453 10,285,998 242,967 41,374,942 676,155 5,192,058 1,034,013 48,277,168 15,513,517 12,231,823 9,607,326 239,149 37,591,814 869,174 3,947,859 835,147 43,243,994 33.5% 26.0% 19.8% 0.5% 79.8% 1.3% 10.0% 2.0% 93.1% 33.3% 26.2% 20.6% 0.5% 80.6% 1.9% 8.5% 1.8% 92.8% 65,161 2,227,412 1,289,965 (8,047) 3,574,491 70,678 2,065,764 1,245,129 (4,890) 3,376,681 0.1% 4.3% 2.5% 0.0% 6.9% 0.2% 4.4% 2.7% 0.0% 7.2% 51,851,659 46,620,676 100.0% 100.0% MEMBERS' EQUITY & CAPITAL Membership Shares Retained Earnings Other Tier 1 & 2 Capital Accumulated Other Comprehensive Income Total Members' Equity & Capital Total Liabilities, & Members' Equity & Capital 4Q 2016 4Q 2015 (Percentage of Total Assets) Totals may not agree due to rounding 4Q16 SECTOR OUTLOOK, March 2017 7 Sector Financial Statements 4Q 2016 Income Statement ONTARIO SECTOR Canadian Chartered Banks ** Percentage of Average Assets * 4Q 2016 4Q 2015 3Q 2016 3.21% 3.32% 1.98% 0.19% 0.21% 0.34% 3.40% 3.52% 2.32% 1.09% 1.17% 0.53% 0.33% 1.42% 0.31% 1.48% 0.20% 0.73% Net Interest & Investment Income 1.98% 2.05% 1.79% Loan Costs Net Interest & Investment Income after Loan Costs Other (non-interest) Income Net Interest, Investment & Other Income 0.06% 1.92% 0.58% 2.50% 0.09% 1.95% 0.58% 2.53% 0.21% 1.58% 1.35% 2.93% 1.15% 0.21% 0.20% 0.14% 0.08% 0.19% 0.13% 2.10% 1.20% 0.21% 0.22% 0.14% 0.08% 0.20% 0.15% 2.20% 0.93% 0.14% 0.15% 0.07% Net Income/(Loss) Before Taxes and Non-recurring & Extraordinary items 0.40% 0.33% 1.18% Non-recurring & Extraordinary gains/(losses) Taxes Minority Interests Net Income/(Loss) 0.00% 0.08% 0.00% 0.33% 0.00% 0.06% 0.00% 0.27% 0.00% 0.20% 0.00% 0.98% 49,269,689 44,637,738 4,903,408,264 Interest and Investment Income Loan Interest Income Investment Income Interest Expense Interest Expense on Deposits Interest Rebates & Dividends on Share Capital Dividends on Investment Capital & Other Capital Other Interest Expense Total Rebates, Dividends & Other Interest Expense Non-interest Expenses Salaries and Benefits Occupancy Computer, office & other equipment Advertising & Communications Member Security Administration Other Average Assets ($000) 4Q16 SECTOR OUTLOOK, March 2017 0.00% 0.08% 0.24% 0.00% 0.10% 0.21% 0.46% 1.75% 8 Selected Financial Trends Selected Performance Trends Selected Growth Trends 12.00% 3.75% 0.80% 3.50% 0.70% 3.25% 0.60% 8.00% 3.00% 0.50% 6.00% 2.75% 0.40% 2.50% 0.30% 2.25% 0.20% 2.00% 0.10% 10.00% 4.00% 2.00% 1.75% 0.00% Assets Loans 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Financial Margin (L) Gross Margin (L) Operating Expenses (L) ROA (R) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Deposits Loan Growth Loan Yields 7.50% 20.0% 7.00% 6.50% 15.0% 6.00% 10.0% 5.50% 5.00% 5.0% 4.50% 4.00% 0.0% 3.50% 3.00% -5.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Personal Mortgages Commercial Total Personal Mortgages Commerical Total Sources of Liquidity Loan Delinquencies - Greater than 30 Days 3.00% 2.50% 2.00% 15.0% $6,000 14.0% $5,000 13.0% $4,000 12.0% $3,000 1.50% 11.0% $2,000 1.00% 10.0% $1,000 9.0% 0.50% 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Personal Mortgages Commercial Total $0 Other Sources of Liquidity ( R ) CPs, BAs and similar instruments ( R ) Mortgage securities guaranteed by CMHC ( R ) Deposits in Canadian FIs for Liquidity ( R ) Deposits in League or Central ( R ) Cash held for liquidity ( R ) Liquidity ( L ) Loan Costs and Return on Assets 0.30% 0.70% 0.25% 0.60% 0.20% 0.50% 0.15% 0.40% 0.10% 0.30% 0.05% 0.20% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% 0.00% 0.10% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Loan Costs (L) ROA (R) 4Q11 2Q12 4Q12 2Q13 4Q13 2Q14 4Q14 2Q15 4Q15 2Q16 4Q16 Demand Deposits - Yearly Growth Term Deposits - Yearly Growth Registered Deposits - Yearly Growth Total Deposits - Yearly Growth Average Total Deposit Growth Rate NOTE: L refers to the Left Axis and R refers to the Right Axis 4Q16 SECTOR OUTLOOK, March 2017 9