* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download pl/vs curriculum framework

Survey

Document related concepts

Transcript

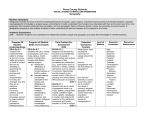

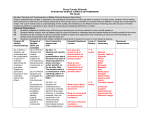

Perry County Schools PL/VS CURRICULUM FRAMEWORK 8th Grade Big Idea: Financial Literacy Financial literacy provides knowledge so that students are responsible for their personal economic well-being. As consumers, individuals need economic knowledge as a base for making financial decisions impacting short and long term goals throughout one’s lifetime. Financial literacy will empower students by providing them with the skills and awareness needed to establish a foundation for a future of financial responsibility and economic independence. Academic Expectations 2.30 Students evaluate consumer products and services and make effective consumer decisions. 2.33 Students demonstrate the skills to evaluate and use services and resources available in their community. 5.4 Students use a decision-making process to make informed decisions among options. Big Idea: Financial Literacy Program Of Program of Studies: Studies: Skills and Concepts Understandings VS-8-FL-U-1 VS-8-FL-S-1 Students will Students will understand that evaluate financial management of management financial resource practices including practices is needed budgeting, savings, to meet goals of banking services individuals and (e.g., purpose of families. checking and savings accounts, debit/credit), and investing (e.g., general types and purpose of investing) and explain why these practices are important in achieving personal financial goals by: a)describing the risks and responsibilities associated with Core Content For Assessment DOK PL-08-3.2.1 Students will identify financial management practices and the purposes of budgeting, savings, banking services, (e.g., checking and savings accounts, debit/credit, certificate of deposit), general types of investments (stocks, bonds, mutual funds) and develop a shortterm financial plan. Essential Questions/ Content Use math to project savings goals. Select a savings instrument which best meets one’s needs at a particular time. Explain why it is important to shop around for savings instruments. Calculate interest/fees of various credit card offers and compare outcome. Develop a logical argument for saving versus the opportunity Level of Mastery DOK 3 Essential Vocabulary Savings instrument Budgeting Investing Debit Credit Financial goals Checking account Savings account Financial management Resources Assessments Kentucky Learns Links (Personal Finance Management) Reality Store Understandings Skills Concepts Core Content Essential Questions Level of Mastery Essential Vocabulary Resources Assessments costs. using credit. Differentiate between various savings instruments. VS-8-FL-U-2 Students will understand that saving plans (e.g., investments, savings accounts, stocks, bonds) and budgets are economic practices in making financial decisions. VS-8-FL-S-2 Students will investigate savings plans and budgets in making financial decisions by: a)constructing and using a personal spending/savings plan and evaluate according to shortand long-term goals. b)analyzing basic components of a budget (e.g., income, fixed and flexible expenses, and savings) PL-08-3.2.1 Students will identify financial management practices and the purposes of budgeting, savings, banking services, (e.g., checking and savings accounts, debit/credit, certificate of deposit), general types of investments (stocks, bonds, mutual funds) and develop a short-term financial plan. Explain the risk associated with stock ownership. Compare and contrast an investment in stocks with an investment in savings plans. Explain two ways in which stocks provide a return to owners. Define mutual funds and cite different types. Evaluate your 2 DOK 3 Savings plan Investment Savings account Stocks Bonds Budgets Economic practices Financial Short-term goal Long-term goal Income Fixed expenses Flexible expenses Financial management practices Banking services Checking account Debit Credit Certificate of www.ecedweb.unomaha.edu www.ncee.net www.fefe.arizona.edu Understandings Skills Concepts Core Content Essential Questions current spending patterns and then develop a financial plan including the following: savings, charity, and spending. List short-term and long-term financial goals. Develop a plan to reach goals. Analyze your school’s budget. Critique the way money is being spent looking at the basic components of a budget (income, fixed and flexible expenses, and contingency monies). Make suggestions for improvement to your site-based council. 3 Level of Mastery Essential Vocabulary deposit Mutual fund Financial plan Resources Assessments Understandings VS-8-FL-U-3 Students will understand that financial institutions (e.g., banks, brokerage firms, credit unions) provide consumer services that help in achieving financial goals. Skills Concepts VS-8-FL-S-3 Students will explain how financial institutions (e.g., banks, brokerage firms, credit unions) provide consumer services that help in achieving financial goals by: analyzing the steps in opening and using a checking and savings account. Core Content Essential Questions Explain how savings plans and investments carry risk. Explain how interest is calculated. Evaluate the costs and benefits of various credit card agreements. Compare services offered by local banks. Construct a table showing comparison. Make suggestions as to which institution can better serve the consumer based on consumer financial goals. 4 Level of Mastery Essential Vocabulary Financial institution Brokerage firm Bank Credit union Financial goals Consumer services Checking account Savings account Resources Assessments www.studysphere.com www.econedlink.org www.ecedweb.unomaha.edu Understandings VS-8-FL-U-4 Students will understand that career choice and lifestyle impacts an individual’s financial future. Skills Concepts VS-8-FL-S-4 Students will develop financial goals for the future based on one’s lifestyle expectations and career choices. Core Content Essential Questions Describe the characteristics of an entrepreneur. Explain how entrepreneurs benefit the economy. Investigate various careers. Design a career fair for younger students to present knowledge you have gained. Develop a life plan and be as detailed as possible. Include what kind of home you would like, what kind of care you would like to drive, what kind of entertainment you would like to have, etc. Research prices for each area. Do a cost analysis – what will your desired lifestyle cost you. Now compare this information to your career plan – do they match? Will your career support your desired lifestyle? Investigate. 5 Level of Mastery Essential Vocabulary Entrepreneur Financial goals Expectations Career Impact Financial future Resources Assessments www.fefe.zrizona.edu www.econedlink.org