* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download UK ECONOMIC FORECAST Q4 2012 BUSINESS WITH coNfIdENcE icaew.com/ukeconomicforecast

Survey

Document related concepts

Transcript

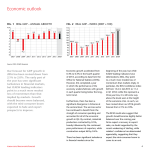

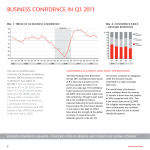

UK ECONOMIC FORECAST Q4 2012 BUSINESS WITH confidence icaew.com/ukeconomicforecast 2 icaew.com/ukeconomicforecast Introduction Welcome to the second edition of the ICAEW Economic Forecast. The report considers the outlook for the UK economy based on the views of ICAEW Chartered Accountants running all types of businesses across the UK, surveyed through the quarterly ICAEW/Grant Thornton UK Business Confidence Monitor (BCM). Since its launch in 2004, BCM has provided a strong steer on the overall direction of travel in the economy. It pointed to the weakening real economic environment at the end of 2007 and into 2008 and indicated the return to growth in the third quarter of 2009. It also correctly predicted the UK entering a double-dip recession at the end of 2011. BCM data includes a range of business performance and planning indicators that build up a picture of how different aspects of the economy are faring and how the economy is likely to evolve in the coming months. This was demonstrated by analysis published in 2011 by Cebr, ICAEW’s economic consultants, which concluded that the BCM dataset has tracked a wide range of key economic indicators remarkably well in recent years. icaew.com 3 ECONOMIC OUTLOOK 2007 2008 2009 2010 2011 2012f 96 95 94 93 92 2013f 2007 2008 95.1 2009 96.8 2010 2011 97.7 2012f ................................................. 97 97.7 ................................................. 98 99 ................................................. -4.0 99 0.8 ................................................. -5 100 ................................................. -3 -4 -1.0 101 100 ................................................. -1 -2 0.0 Fig. 2 Real GDP – index (2007 = 100) ................................................. 0 0.9 ................................................. 1 1.8 ................................................. 2 ................................................. 3.6 3 ................................................. % 4 ................................................. Fig. 1 Real GDP – annual growth 98.4 2013f Source: ONS, ICAEW forecasts Despite an Olympic bounce in the latest growth figures, the economy is set to show zero growth in 2012 and very modest growth in 2013. While the labour market has fared better than expected to date, the cost of lower unemployment is likely to be weak earnings growth. The economy is set to record zero growth for 2012 as a whole and looks likely to show only very weak growth next year – we are forecasting growth of just 0.8% in 2013. This leaves GDP still some 1.6% below its pre-crisis peak. 4 The latest data on UK economic growth was better than expected – the Office for National Statistics’ (ONS) second estimate of economic activity in Q3 2012 showed that the economy grew by 1.0% compared with the previous quarter. This is the strongest growth seen since Q3 2007 – the quarter in which the Northern Rock bank crisis occurred. However, these seemingly robust growth figures come with a couple of significant caveats. Firstly, the Olympic Games, particularly ticket sales, provided a boost to the economy in the third quarter of the year. Secondly, the presence of an extra Bank Holiday in Q2 2012 means that the Q3 figures are compared against a quarter in which economic output was unusually suppressed. Consequently, underlying economic growth, driven by fundamentals, is likely to be much less than 1.0%. BCM leading indicators support this assessment of a weaker, more tentative recovery. The BCM Confidence Index stands at +4.2 this quarter, slightly up from +1.1 last quarter. This increase in business confidence is not statistically significant, and points to modest quarter-on-quarter growth of 0.2% in Q4 2012. This would imply zero growth for 2012 as a whole. icaew.com/ukeconomicforecast Business Investment -10 -15 -20 2007 2008 -14.4 2009 -0.4 2010 2011 2.8 2012f ................................................. -5 -0.2 2.9 ................................................. 0 ................................................. 5 ................................................. 10.9 10 ................................................. % 15 ................................................. Fig. 3 Business investment – annual growth 0.4 2013f Source: ONS, ICAEW forecasts An investment-led recovery remains a remote possibility in the short term, with the Office for Budget Responsibility (OBR)’s December forecasts looking very optimistic. In this quarter’s BCM, businesses report capital investment rising by 1.8% compared with the same quarter a year ago, broadly unchanged from growth rates seen in previous quarters of 2012. However, capital investment is expected to be just 1.0% higher than a year ago in Q4 2013. Our latest forecast is for total real business investment growth to slow from 2.8% this year to 0.4% for 2013 as a whole. This is much weaker than the 4.9% growth predicted in the OBR’s December Economic and Fiscal Outlook publication but up from our previous forecast of a 0.9% contraction, reflecting a slight improvement in business confidence this quarter. icaew.com/ukeconomicforecast Growth in company research and development budgets is expected to remain very modest. This quarter, businesses report that their research and development budgets are 2.3% higher than 12 months ago, but they expect an expansion of just 1.2% over the next 12 months. Overall, this suggests that businesses remain concerned about the medium-term economic outlook for the UK and are thus reluctant to expand investment on a large scale. 5 Labour Market 2007 2008 0.0 2009 2010 2011 1.8 2012f 7.5 7 2.0 6.5 6 5.5 5.3 5 2013f 2007 5.7 2008 7.7 2009 7.8 2010 Source: ONS, ICAEW forecasts Source: ONS, ICAEW forecasts The labour market has defied economic gravity in recent months. But the cost of lower unemployment seems to be weak wage growth. Despite the UK economy contracting in the first half of 2012, unemployment was lower in Q3 2012 than at the start of the year. The unemployment rate fell from 8.2% in Q1 2012 to 7.8% in Q3 2012 – a decline of 96,000 in the number of individuals out of work. The number of people in employment rose by 100,000 over the three months to September, compared with the previous three months. However, part-time employment accounted for just under half (49.0%) of this increase – underemployment remains an ongoing issue. Forward-looking BCM labour market indicators remain weak, with private sector firms continuing to expect only small increases to their headcount. They expect employee numbers to grow by 0.9% on average over the next 12 months. Public sector job 6 8.1 2011 8.0 2012f ........................................... 0 2.4 8 ........................................... 1 2.3 ................................. 2 ................................. 3 3.8 ................................. 4 ................................. 4.7 ................................. 5 ................................. % 6 ........................................... 9 8.5 ........................................... % ........................................... Fig. 5 Unemployment Rate, % ........................................... Fig. 4 Average earnings – annual growth 7.8 2013f cuts will hold back the labour market over the coming years. Given this, we expect employment growth to slow from 1.1% this year to 0.8% in 2013. The unemployment rate is expected to average 7.8% next year. Compared with last quarter, we have revised down our forecast of the unemployment rate in 2013 to reflect the latest labour market data, which suggests that businesses have created jobs at a faster rate than economic fundamentals would traditionally suggest. Rather than shedding staff, businesses seem to be controlling costs by curbing employee wage growth. We expect total pay growth for the whole economy to stand at just 2.0% in 2013 – less than half the 2000–2007 average annual growth rate of 4.3%. icaew.com/ukeconomicforecast Forecasting methodology Headline economic forecasts 2007 2008 2009 2010 2011 2012f 2013f +3.6% -1.0% -4.0% +1.8% +0.9% -0.0% +0.8% +10.9% -0.2% -14.4% -0.4% +2.9% +2.8% +0.4% 2007 2008 2009 2010 2011 2012f 2013f Earnings (total pay) – annual growth +4.7% +3.8% +0.0% +2.3% +2.4% +1.8% +2.0% Employment – annual growth +0.7% +0.7% -1.6% +0.2% +0.5% +1.1% +0.8% 5.3% 5.7% 7.7% 7.8% 8.1% 8.0% 7.8% Real GDP – annual growth Business investment – annual growth Labour market forecasts Unemployment rate ICAEW’s forecasts for economic growth, business investment and the outlook for the labour market are based on the correlation between ICAEW/Grant Thornton Business Confidence Monitor (BCM) indicators and official economic data. BCM contains data – from a survey of 1,000 UK businesses – on business confidence, financial performance, challenges and expectations. BCM indicators provide a useful and unique steer on future developments in the UK economy. icaew.com/ukeconomicforecast 7 About Cebr Centre for Economics and Business Research is an independent consultancy with a reputation for sound business advice based on thorough and insightful research. Since 1992, Cebr has been at the forefront of business and public interest research. They provide analysis, forecasts and strategic advice to major UK and multinational companies, financial institutions, government departments and agencies and trade bodies. For further information about Cebr please visit cebr.com ICAEW ICAEW is a professional membership organisation, supporting over 138,000 chartered accountants around the world. Through our technical knowledge, skills and expertise, we provide insight and leadership to the global accountancy and finance profession. Our members provide financial knowledge and guidance based on the highest professional, technical and ethical standards. We develop and support individuals, organisations and communities to help them achieve long-term, sustainable economic value. Because of us, people can do business with confidence. ICAEW Chartered Accountants’ Hall Moorgate Place London EC2R 6EA UK T +44 (0)20 7920 8705 [email protected] icaew.com/ukeconomicforecast linkedin.com – find ICAEW twitter.com/icaew facebook.com/icaew © ICAEW 2012 MKTPLN11798 12/12