* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Lecture note

Survey

Document related concepts

Transcript

Econometrics in Practice

Donggyu Sul

2015

Abstract

1

1

Introduction: Types of Data

There are three types of data: Cross sectional data, Time series data, Panel data.

1.0.1

Cross sectional data (i = 1; :::; n)

- True cross sectional data: Time invariant. Example; personality, preference, I.Q., blood

type.

- Pseudo cross sectional data: Time varying. Example; personal income, real estate

prices,

1.0.2

Time series data (t = 1; ::; T )

- Stationary data: The variance is not time varying. Example; interest rate, Texas state

income growth rates

- Nonstationary data: The variance is time varying, and sometimes, the variance is

increasing over time. Example; US income level, stock prices, exchange rates.

1.0.3

Panel data

Combining with cross and time.

- short panel: large n but small T

- long panel: small n but large T

Depending on a type of the data, the statistics of interest are in general di¤erent.

2

Part I

Cross Section Data

Parameters of interest: central tendency and shape of distribution.

Learn the di¤erence between the true and pseudo cross sectional data

Learn how to compare two samples. (independent and dependent)

Learn how to model a linear regression

Learn the role of missing variables on the regression results

3

2

Central Tendency

Mean, Median, Quantile Mean.

Example: Female and male income comparison.

2.1

Mean: Statistics

Sample mean:

1X

^=

yi

n i=1

n

Weighted mean:

^ we =

n

X

! i yi ;

where

i=1

Trimmed mean: Discard a small

calculating the mean. Let y1

y2

^ trim

ym

n:

! i = 1:

i=1

percentage of the largest and smallest values before

yn : Then

n

m

X

1

yi ;

=

n 2m i=m+1

Winsorized mean: Set y1 = ym+1 ;

n

X

= m=n:

; ym = ym+1 and yn = ym

n;

yn

1

= ym

n;

; ym

n+1

Then take the mean.

Example: n = 50:

= 2%: The 2% winsorized mean is

original sample: from smallest to largest y1 ; y2 ; y3 ; y4 ; y5 ;

Trimmed mean 2%:

0; y2 ; y3 ; y4 ; y5 ;

Winsorized mean 2%

y 2 ; y2 ; y3 ; y4 ; y5 ;

; y46 ; y47 ; y48 ; y49 ; y50

; y46 ; y47 ; y48 ; y49 ; 0

; y46 ; y47 ; y48 ; y49 ; y49

Googling: Trimmed Mean PCE In‡ation Rate http://www.dallasfed.org/research/pce/

2.2

Mean: Statistical Inference

How to evaluate whether or not the sample mean is meaningful. Or test if the estimated

sample mean is di¤erent from a referenced value (for example, zero or unity)

Basic idea: Use central limit theorem which is a nice statistical device.

4

=

Central limit theorem (CLT)

P

1 n

yi : As n ! 1; (^ n

) !d N

Let ^ n =

n i=1

2.2.1

2

0;

n

:

Interpretation:

1. !d the distribution (d) approaches to

2. N (0; v) : Normal distribution with the variance of v:

3. Normal distribution: probability density function or Pr(x = c) :

(a) Example: (Probability of x = 0)

1

p exp

2

(b) If

= 0 and

(c) If

= 0 and

4. Why

"

)2

(x

2

2

#

2

= 1 (standard normal distribution), then Pr(x = 0) becomes

#

"

1

1

(0 0)2

1

p exp

= p exp (0) = p = 0:39894

2

2

2

2

2

= 0:5; then Pr(x = 0) becomes

"

#

(0 0)2

1

1

1

p exp

p exp (0) = p

p = 0:5642

p

=p

2 0:5

0:5

2

0:5

2

0:5

2

2

=n ? As n ! 1; the variance goes to zero. As the variance approaches to

zero, the probability of (^ = ) becomes unity.

5.

: unknown mean.

6. ^ n : the sample mean with the sample size of n:

7. n ! 1 : as the sample size becomes in…nitely large.

2.2.2

Statistical Testing

Central limit theorem (CLT): If yi is i.i.d.

p

n (^ n

) d

q

As n ! 1; t ^ =

! N (0; 1)

2

^

5

What is i.i.d?

independently identical distribution.

independent: yi is not correlated with yj

identical: The variance of yi is the same as that of yj

T-statistics

1. Calculate the sample mean ^ n

2. Calculate the sample variance ^ 2 =

Why (n

1

n

1

Pn

i=1

(yi

^ n )2

1) rather than n? You will learn (sure?) it later.

Want to know now? Do the following.

(a)

(b)

(c)

(d)

!

!

2

2

Pn 2

1 Pn

1 Pn

yi

yi

=E

Show that E

i=1 yi

i=1 yi

n i=1

n i=1

P

P

Assume that Eyi2 = 2 : Then E ni=1 yi2 = ni=1 Eyi2 =?

2

1 Pn

1 Pn 2 1 Pn Pn

Show that

y +

y

yi yj :

=

i

n i=1

n2 i=1 i n i=1 i6=j

2

1 Pn

y

Show that E

= 2 =n if Eyi yj = 0 for i 6= j:

i

n i=1

Pn

3. Calculate the t-statistics

4. Compare the critical value. (?) what is this?

Testing (Size of the Test)

Plot a bell shape standard normal density here

5% and 95% values: -1.65, 1.65 => Meaning: if a t-value is inside this range, ^ is the

same as :

– Any mistake? Yes, we allow 5% mistakes (both sides) => total 10%. Too large?

2.5% and 97.5%: -1.96, 1.96

6

– 5% total mistake. Still huge? Think about this. You are a MD. Mistake you can’t

…nd a cancer. 5%: Huge. Actual: 50%?

– What if you are a judge? Is -1.96 a good number to reject that ^ is ?

We call 5% or 2.5% as the size of the test: Probability of the rejection when the null

is true.

In Physics, the mistake rate should be less than 0.0001%. In Statistics, usually 5%.

What if yi is not independent?

No solution in cross sectional data if we don’t know how to order yi

Spatial analysis: order yi by using location. And assume that the dependence increases

as yi is near by yj

What else? Nothing much.

What if yi is not identical

Basically, it is okay. De…ne

Statistically ^ 2 !

2

2

= limn!1

:

Standard Deviation and Standard Error

r

q

2

Standard deviation (SD) ^ = ^ =

1 Pn

n i=1

1

2

i:

Pn

i=1

(yi

n 1

p

Standard error (SE) s^ = ^ = n: So usually t ^ = ^ =^

s if

How to estimate the variance of weighted Mean

P

^ 2 ;we = ni=1 ! 2i (yi ^ we )2 or alternatively,

!

Pn

2

Pn

!

i

^ 2 ;we = 1

^ we )2 :

Pni=1 2

i=1 ! i (yi

( i=1 ! i )

CLT works with ^ we and ^

;we

also.

7

^ n )2

= 0:

2.3

Median

The median is the number separating the higher half of a data sample from the lower half.

When median is used (Example)

house price. Why?

household income. Why not mean?

Median is a better measure of the central tendency when a distribution is asymmetric or

skewed.

Example: {1,2,2,3,4,5,20}. Sample mean: 1 + 2 + 2 + 3 + 4 + 5 + 20 = 37:0. 37=7 = 5:2857:

Median: 3.

Is median e¢ cient than mean?

What is e¢ cient? => smaller variance.

Answer is "No" in general.

2.4

Quantile Mean

Calculate 25% of the quantile and 75% of the quantile. And then take their average.

Example: {1,2,3,4,5,6,7,8,9,100,200}.

25% quantile = 3, 75% quantile = 9. (3+9)/2 = 6. Median = 6. Mean = ?

8

3

Distribution

Learn how to plot a probability density function (pdf) or distribution, and cumulative density

function.

Learn how to interpret a pdf and how to use a cdf.

Basic: Histogram

1. Select bandwidth or interval size. Smaller interval size makes more fuzziness. Large

interval size makes too roughness.

2. Count the total number of observations for each interval.

3. Plot histogram.

Advance: Kernel Estimation

Nonparametric estimation (based on parametric assumption).

The formula is given by

1 X

f (x) =

K

nh i=1

n

x

xi

h

Basically, one assume a particular kernel function (normal, uniform, epanechnikov for

example), and for each point, one calculate its pseudo density, and then sum up all

densities.

Among many kernel function, epanechnikov kernel is known as the most e¢ cient one.

Do you need to plot one? Use histogram.

In many cases, you don’t need to plot a pdf by yourself. The most important matter is

whether or not the distribution is skewed. If a distribution becomes really skewed, then the

better central tendency becomes median or quantile mean rather than the sample mean.

Next, we will learn how to plot an empirical cumulative function.

9

Empirical Cumulative Density Function

1. Sort from the smallest to the largest.

2. Set the smallest as 1=n; the second smallest as 2=n; :::; and the largest as n=n:

3. Plot the data over the sequence (1=n; 2=n;

; 1):

How to use Empirical CDF

Testing whether or not observed samples follow a particular distribution. We call one

sample distribution test.

– Kolmogorov-Smirnov (KS) test

– Anderson-Darling test

– Watson test

– Cramer-von Mises test etc..

Suppose that yi

N( ;

2

) ; then you can plot the theoretical cdf. Compare the

theoretical cdf with the empirical one. And then test whether or not yi is actually

distributed as a normal.

Also you can test whether or not two samples share the same distribution. We call this

two-sample distribution test. Still you can use KS test by comparing the maximum

di¤erence between two empirical cdfs.

10

3.1

Exercise 1

Use PCE_Inf_90item.xls. Check the assignment sheet. Find which years you need to use

for this exercise.

1. Estimate the following statistics for each year: sample mean, median, quantile mean,

5% trimmed mean (low 5 and high 5), 5% winsorized mean.

2. Use the sample mean and sample variance: Test whether or not the mean of the

in‡ation rate is equal to 2% for each year.

3. Plot historgram for each year.

4. Plot distribution for each year by using at least two kernels.

5. Plot empirical CDF.

6. Test whether or not the observed series are normally distributed. (KS test)

7. Test whether or not the …rst year sample shares the same distribution with the second

year sample. Do the same test with the second and third year.

11

4

Two-Sample Comparison

Several tests available. But the point of interest is how they are di¤erent each other.

Examples: (Medical) experimental studies

Two groups: Treated v.s. Controlled. Number of subjects: small usually. (sometimes

less than 20)

Comparison: Treated sample is di¤erent from the controlled sample (how di¤er?) =>

Plot distributions if n is large enough.

Location (central tendency) or distribution:

Key assumption: Two samples are not correlated. In other words, researchers should

collect independent samples. If they can’t, they have to control the dependence. How?

we will study soon.

4.1

Nonparametric Tests (Exact Sample Theory)

Student’s t-test requires that a sample is distributed as a normal. When n is small and …xed,

we need a normal distribution assumption. Otherwise, we don’t know the critical value of

the t-statistic. Of course as n is large, we can use CLT. Nonparametric tests do not require

any distributional assumption.

Equal distribution test: Kolmogorov-Smirnov (KS) test. Compare the empirical CDF.

– KS = max jCDF (x1 )

CDF (x2 )j where CDF (xj ) is the empirical CDF of the

sample xj :

– As n ! 1; KS has Kolmogorov distribution.

– Two samples should be independent.

Rank test: Wilcoxon-Mann-Whitney Test. Comparing ranks of the two samples.

– Can be used for paired or unpaired samples.

– Combine two samples and then rank them from the smallest to the largest.

12

– If two samples share the same distribution, then both rank sum must be same.

– However it does not mean, the equal rank-sum stands for the equal distribution.

– Popularly used in practice. Wrongly interpreted (as the equal distribution)

– Two samples should be independent.

Summary: If two samples are not independent, should not use the above tests.

So if the sample size is small (less than 20) but two samples are dependent, just toss

a coin.

4.2

4.2.1

T-Test or Moments Test

Sample Moments:

1st

^

2nd ^ 2

3rd ^ 3

4.2.2

Sample Central Moments:

1st

^

2nd central ^

3rd dental

1 Pn

yi

n i=1

1 Pn 2

y

n i=1 i

1 Pn 3

y

n i=1 i

2

S^

1 Pn

yi

n i=1

1 Pn

yi

n i=1

1 Pn

yi

n i=1

1 Pn

yi

n i=1

1 Pn

yi

n i=1

2

: variance

3

: skewness

1. Variance: Risk, volatility, etc. Large variance => more risk

2. skewness: Symmetric distribution => zero skewness.

4.2.3

Method of Moments

Set a null hypothesis:

H0 : m x = m y

13

where mx and my are moments. De…ne M as M = mx

my : Further let VM be the variance

of M: Then from CLT, we have

tM

p

nM d

! N (0; 1) :

= p

VM

Example 1: Mean Let

1X

^y =

yi

n i=1

1X

xi :

n i=1

n

M = ^x

V (M ) = V (^ x ) + V ^ y

n

2Cov ^ x ; ^ y ;

where

V ^y =

1

n

1

n

X

1X

yi

n i=1

n

yi

i=1

Cov =

1

n

1

n

X

!2

; V (^ x ) =

1X

yi

n i=1

n

yi

i=1

!

1

n

1

n

X

n

xi

i=1

!

n

1X

xi :

n i=1

xi

1X

xi

n i=1

!2

Example 2: Second Moment Let

1X 2

y

n i=1 i

n

M = ^ x2

V (^ x2 ) =

1

n

1

n

X

1X 2

y

n i=1 i

n

yi2

i=1

Cov =

^ y2 =

1

n

1

n

X

i=1

yi2

!2

1X 2

x:

n i=1 i

n

; V ^ y2 =

1

n

n

X

i=1

yi2

!

1

n

1

n

X

i=1

1X 2

x

n i=1 i

n

x2i

1X 2

x

n i=1 i

n

x2i

!

!2

:

Summary: T-test or the method of moments is free from the independence assumption.

But this method requires a large sample. How large? n should be larger than at least 20.

14

4.3

Dummy Variable Approach

De…ne a dummy such that

di =

(

1 if i 2 treated group

0 if i 2 controlled group

:

Run the following regression.

yi =

+ di + u i

where yi includes all treated and controlled observations.

We didn’t learn how to run a linear regression. So we will study the statistical properties

of the linear regression in the next section.

15

5

5.1

Ordinary Least Squares (OLS) with Single Regressor

What is OLS?

Regression Model

yi =

+ x i + ui

yi : regressand

xi : regressor

ui : error (not residual). Mean is zero.

: constant or intercept

: slope coe¢ cient

How to estimate

and

:

^=

Pn

i=1

:

1 Pn

1 Pn

yi

yi

i=1 xi

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

xi

1X

^=

yi

n i=1

n

Alternatively

arg min

;

n

X

u2i

= arg min

;

i=1

^1

n

n

X

n

X

(2)

xi

i=1

(yi

xi )2

i=1

– Least squares: literary minimize the sum of the square errors.

– The solution of the least square in (3) becomes (1) and (2).

16

(1)

(3)

How to test

or

Need to calculate the variance of : Note that by de…nition,

V ^ =E ^

2

:

Observe this.

^ =

=

=

=

=

=

Hence

1 Pn

1 Pn

yi

yi

i=1 xi

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

Pn

1 Pn

1 Pn

+ x i + ui

[ + x i + ui ]

i=1 xi

i=1 xi

n

n i=1

2

Pn

1 Pn

x

x

i

i

i=1

n i=1

Pn

1 Pn

1 Pn

1 Pn

x

x

x

+

ui

+

x

+

u

+

i

i

i

i

i

i=1

n i=1

n i=1

n i=1

2

Pn

1 Pn

x

x

i

i

i=1

n i=1

Pn

1 Pn

1 Pn

1 Pn

ui

x i + ui

i=1 xi

i=1 xi

i=1 xi

n

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

Pn

Pn

1 Pn

1 Pn

1 Pn

xi

xi

ui

i=1 xi

i=1 xi

i=1 xi +

i=1 xi

n

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

Pn

1 Pn

1 Pn

x

x

u

ui

i

i

i

i=1

n i=1

n i=1

+

:

2

Pn

1 Pn

xi

i=1 xi

n i=1

Pn

i=1

xi

^

Pn

i=1

=

1 Pn

1 Pn

ui

ui

i=1 xi

n

n i=1

2

Pn

1 Pn

x

x

i

i

i=1

n i=1

xi

17

1 Pn

ui

n i=1

Next,

2

^

6

6

=6

4

Pn

It can be simpli…ed as

6

6

= E6

4

1 Pn

1 Pn

ui

ui

xi

i=1 xi

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

Pn

i=1

Pn

'

Pn

xi

i=1

Then

p

t^ = q

1 Pn

ui

n i=1

1 Pn

xi

n i=1

ui

i=1

2

E ^

1 Pn

1 Pn

xi

ui

ui

i=1 xi

n

n i=1

2

Pn

1 Pn

xi

i=1 xi

n i=1

i=1

2

2

E ^

2

n ^

(n

1)

^ 2u =^ 2x

32

7

7

7

5

32

7

7

7?

5

2

2

= (n

1) ^ 2u =^ 2x

!d N (0; 1)

Complicated, isn’t it? So what do you have to remember?

^ = (X 0 X)

– What is ?

=

"

2

#

1

X 0y

:

3

2

1 x1

y1

6 . . 7

6 .

6 .

. . 7

– what is X? X = 6

4 . . 5; y = 4 .

1 xn

yn

3

7

7:

5

– (X 0 X) =2 2 matrix.

" P

# "

#

Pn

Pn

n

1

x

n

x

i

i

i=1

i=1

X 0 X = Pni=1

Pn 2 = Pn

Pn 2

i=1 xi

i=1 xi

i=1 xi

i=1 xi

– Next,

1

V (^ ) = ^ 2u (X 0 X) : 2 2 matrix,

2

3

^

V (^ )

Cov ^ ;

5:

V (^ ) = 4

Cov ^ ; ^

V ^

18

and

^ 2u

=

1

n

1

n

X

u^2i ;

u^i = yi

^ xi :

^

i=1

– u^i is called ‘residual’.

– The t-statistics are

t^ = p

5.2

^

V (^ )

; t^ = r

^

^

V

Dummy Variable Regression

De…ne

di =

(

1 if i 2 treated group

0 if i 2 controlled group

:

The dummy variable regression is given by

yi =

+ di + ui :

Economic Meaning Let n be the total number of treated samples. Similarly nC be the

total number of controlled samples. Then we have

1X

yi = ^ =

n i2

Hence if

+

+

1X

yi = ^ C =

n i2C

+

1X

ui =

n i2

1X

ui =

n i2C

+ :

= 0; then there is no mean di¤erence between the two samples.

19

6

Problem Set 2

Use PCE_Inf_90item.xls. Choose the …rst two years. Check the assignment sheet. Find

which years you need to use for this exercise.

1. Plot two density functions jointly. (in one graph: Use red and black color)

2. Test whether or not the two samples share the same distribution. (KS test)

3. Test whether or not the two samples share the same mean.

4. Test whether or not the two samples share the same variance.

5. Run the dummy variable regression. Test whether or not the two samples share the

same mean.

6. Choose the …rst and third years. Repeat 1 through 5.

20

7

Case Study: Gender Income Gap

Data: Annual income survey. Pseudo cross sectional data

Finding: Male income has been higher than female income.

Source: BLS

The …rst …gure shows that the female earning is catching up with the male earning.

1. Two samples are correlated each other.

2. If you …x a year, and collect two cross sectional data, then two samples contain some

other informations. What are they?

3. What about future?

21

Source: For Gender Inequality Deniers, Here’s the Contrary Evidence

April 10, 2014 by Michael Morrison

The next …gure shows the two density functions jointly.

1. Looks like that two samples are somewhat di¤erent. Is it true?

2. Can you use the KS test to test the equal distribution? If not, why?

The next …gure shows that males’ SAT scores are relatively higher than female’s SAT

scores. Does it imply that the females’earning is lower than the males’earning in general?

22

SAT score distribution

1. If this claim is true, the historical SAT score di¤erence should be similar to the pattern

of the earning di¤erence. See the next …gure.

Historical SAT scores

2. Obviously, the di¤erence between the male and the female SAT scores has not been

changed much.

Conclusion

Females and males’earning di¤erence is getting smaller.

Can’t test the equal distribution because the KS test fails if the two samples are

dependent.

23

The other variable such as SAT score is not helping much to explain the gender earning

di¤erence.

There must be other reasons? What are they?

24

8

Ordinary Least Squares (OLS) with Multiple Regressors

Purpose of this section

learn the role of the missing variables.

learn how to interpret a …gure using two variables

8.1

Basic Statistic Methods

Consider the following two independent variables regression.

yi =

+

1 xi

+

2 zi

+ ui

(4)

Then

^ ols = (X 0 X)

where

1

X 0y

2

The variance of ^ is given by

3

1 x1 z1

6 . .

.. 7

.. ..

X=6

. 7

4

5:

1 xn zn

^ 2 = ^ 2u (X 0 X)

Let

(5)

2

i;j

1

:

is the element in ith column and the jth row of ^ 2 . Then the t-statistics are given

by

8.2

^

^

t ^ 1 = p 12 ; t ^ 2 = p 22 :

^ 22

^ 33

Role of the second variable

Consider the following two regressions.

yi =

1

+

1 xi

+ ei ;

(6)

yi =

2

+

2 zi

+ vi :

(7)

25

The regression in (6): you are interested in the relationship between yi and xi : The regression

in (7): you are interested in that between yi and zi : Suppose that you have

^ = 1; ^ =

2

1

1:

If and only if xi is not correlated with zi ; then

^ 1 in (4)

^ in (6),

1

^ in (4)

2

^ in (7).

2

Why? From OLS estimator formula in (5), we have

P

P

P 2P

x~i y~i

x~i z~i z~i y~i

z~i

^1 =

;

P 2P 2

P

z~i

x~i ( x~i z~i )2

P 2P

P

P

x

~

z

~

y

~

x

~

z

~

x~i y~i

i

i

i

i

i

^2 =

;

P

P 2P 2

2

z~i

x~i ( x~i z~i )

P

P

P

where x~i = xi n 1 xi ; zi = zi n 1 zi ; and yi = yi n 1 yi : That is, ‘~’ stands

for the deviation from its mean. Next, if x~i is not correlated with z~i ; then the sample cross

variance must be near to zero.

1X

x~i z~i

n

Then we have

^ =

1

P

z~i2

P

P

x~i y~i

P 2

2

z~i

x~i

0;

()

X

x~i z~i

0:

P 2P

P

P

P

x~i y~i

z~i

x~i z~i z~i y~i

x~i y~i

= P 2 P 2 = P 2 = ^ 1:

P

2

z~i

x~i

x~i

( x~i z~i )

Usually two independent variables (or regressors) are correlated each other. In other

words, xi is correlated with zi : Then in this case,

^ 1 6= ^ :

1

So what does it mean? How can we interpret ^ 1 then?

If xi is exogenous, then the inclusion of additional variables does not alter the regression result

Exogenous? What is this?

E (xi ej ) = 0 for all i and j in (6): Then xi is exogenous to ei .

26

If xi is exogenous, then E (xi vj ) = 0 in (7)? => No. xi is exogenous only to ei :

How do we know xi is exogenous?

– It is not easy to test because ei is unknown.

– So called ‘Hausman test’is used but this test is valid under very restrictive condition. We will study this later

Then what should we do?

– Including many variables. Check whether or not ^ 1 changes.

– We call them ‘control variables’.

Graphical Approach Consider the following case.

y = a + z + u : True relationship

z = x + v : correlated variable

+ x + e : x is not exogenous.

y =

4

2

3

1.5

2

1

1

0.5

0

0

-1

-0.5

-2

-1

-3

-1.5

-4

-5

-4

-3

-2

-1

0

1

2

3

y and x

4

-2

-2.5

-2

-1.5

Mz y and Mz x

27

-1

-0.5

0

0.5

1

1.5

2

2.5

What Mz y?

Mz = I

z (z 0 z)

1

z0

Mz y = y

z (z 0 z)

1

z0y

or

What is this? The residue y after controlling out z information.

Mz x => the residue x after controlling out z information.

Then Mz y and Mz x should not have any relationship.

8.3

Case Study 2: Birth order and SAT scores

Zajonc and Bargh (1980, American Psychologist)

Figure 1 at page 667, July 1980

– They ran

SATi =

+ BOi + ui ;

where BOi stands for birth order.

– Result: Birth order explains SAT score well.

Rodgers, Cleveland, Oord and Rowe (2000, American Psychologist)

28

– They ran

SATi =

+

1 BOi

+

2 M IQi

+ ei ;

where MIQi stands for mother’s IQ.

– Low IQ mothers have bigger family size.

– Result: BO is not related with SAT score.

Conclusion

1. Do not believe any two variable regression result.

2. Check whether or not the regression of interest includes (reasonable) control variables.

3. Even when the control variables are reasonable, if the regressor of interest is time

variant, then read the next chapter.

29

9

Measurement Error

We will study the di¤erence between the true and pseudo cross sectional regressions.

Consider the following example.

SATi =

+ P Ii + u i ;

where SATi is the ith person’s SAT score and PIi is parents’income at a particular year.

P Ii can be changing over time. One parents have two kids. The age di¤erence is 10 years.

Assume the parents income increases over time. When their …rst kid took SAT, their income

was 50K. 10 years later, their income increases to 150K. If

> 0; then does it mean the

second kid’s SAT score is higher than the …rst kid?

1800

Fitted SAT Scores

1700

1600

1500

1400

1300

1200

$0

$50,000

$100,000 $150,000 $200,000 $250,000 $300,000 $350,000

Parents Income

Figure 9-1: Fitted SAT Scores and Parents Income, 2013.

Rewrite

yi =

+ xit + ui ;

where xit is chosen at a particular t:

xit =

i

|{z}

(1) target variable

+

i t

|{z}

(2) ind. in‡uence x common factor

Three components: (1) Time invariant component

and (3) pure idiosyncratic term,

xoit

Example:

30

+

xoit

|{z}

(3) pure individual speci…c term

i;

(2) common components,

i t;

–

i

=> overall your wealth.

–

t

=> economic wide condition.

–

i

=> how the economic condition in‡uences on you.

– xoit => individual speci…c income variation. transitory income.

You need to use

i:

True Regression you need to run:

yi =

+

+ ei ;

(8)

yi =

+ x i + ui ;

(9)

i

The actual regression you ran was

We will rewrite (??) as

yi =

+

i

+ ei

=

+ (

=

+ x i + ui

i

+

) + ei

where

xi =

i

+

; ui = ei

And

=

i t

+ xoit :

Then it is easy to show that

E (xi ui ) 6= 0:

We call

“measurement error”.

31

:

Conclusion

1. If the regressor is time varying, then the regressor must have a measurement error.

2. The regression result is not robust. Will change over time.’

3. In the true cross sectional regression, all variables are not (potentially) time varying

(including control variables).

32

10

Problem Set 3

1. Learn how to access to World Development Indicator.

2. Choose any two varaibles. Run cross sectional regression for each year. Report the

result. Does the result change?

3. Choose additional variable. Run a regression for a particular year. Report the result

only when the original regressor becomes insigni…cant.

33

Part II

Time Series Data

The …rst thing to do is plotting time series graphs.

We will study

Autoregressive process

Vector Autoregressive process

Unitroot Test

Cointegration Test

Error Correction Model

34

11

Autoregressive (AR) Model

11.1

AR1 Model

xt = a + xt

1

+ ut ;

where ut is i.i.d. We call this model AR1.

Features of AR1 Model

E(x2t ) =

2

u = (1

2

2

x;

E(xt xt 1 ) =

E(xt ) = a= (1

2

x

)=

E(xt xt 2 ) =

) 6= a if

2 2

x;

k 2

x:

E(xt xt k ) =

6= 0:

Estimation of Mean Assume that

xt =

+ et ; et = et

1

+ ut

Then we have

xt

1

=

+ et

1

so that

xt =

(1

) + xt

^=

1 XT

xt :

t=1

T

We want to estimate ^ : Then

The variance of ^ is given by

E (^

but since Ext xt

Note that

1

1 XT

) '

xt

t=1

T

1

+ ut :

1 XT

xt

t=1

T

2

2

for a large T;

= Ex2t ; the above term becomes

1 XT

xt

t=1

T

1 XT

xt

t=1

T

2

1 XT

6= 2

xt

t=1

T

(A + B)2 = A2 + B 2 + 2AB:

35

1 XT

xt

t=1

T

2

:

Hence we have

1 XT

xt

t=1

T

1 XT

=

xt

t=1

T2

1 XT

=

xt

t=1

T2

1 XT

xt

t=1

T

1 XT

xt

t=1

T

1 XT

xt

t=1

T

2

1 XT

1 XT XT

x

xt

t

s6=t

t=1

t=1

T2

T

2

1 XT XT

1 XT

+2 2

xt

xt

t=1

s=2

t=1

T

T

2

+

This implies that the t-statistic given by

p

T^

6= r

t^ = p

PT

V (^ )

1

t=1

T

p

xt

Hence we need to use the ‘correct’variance.

T^

1

T

PT

t=1

2

xs

xs

1 XT

xt

t=1

T

1 XT

xt :

t=1

T

:

xt

HAC (heteroskedasticity autocorrelation consistent) Estimator There are various

HAC estimators available. Among them, Newey & West’s estimator is the most popular.

HAC estimator is a long run variance if there is no heteroskedasticity. (di¤erent variance

each time) NW’s HAC estimator is given by

V (^ )NW =

2

1 XT

1 XT

xt

xt

t=1

t=1

T

T

X

X

T

M

m

2

1

+

t=1

m=1

T

M +1

xt

1 XT

xt

t=1

T

xt

m

1 XT

xt ;

t=1

T

where M =int T 1=3 usually. Note that M is called ‘NW’s lag’.

What to do with this? We will need the concept later for general regressions. So wait..

Estimation of

The OLS estimator is given by

P

P

P

(xt T 1 xt ) (xt 1 T 1 xt 1 )

^ =

P

P

(xt T 1 xt )2

P

P

P

(xt 1 T 1 xt 1 ) (ut T 1 ut )

=

+

:

P

P

(xt T 1 xt )2

36

Properties of ^

1+3

: It’s biased. But ^ !

T

E(^) =

as T ! 1:

The distribution of ^ is asymetric if T is not large enough.

11.2

AR2

xt = a +

1 xt 1

+

2 xt 2

+ ut

Transformation: Observe this.

xt =

+ et ; et =

1 et 1

+

2 et 2

1 xt 1

=

1

+

1 et 1 ;

2 xt 2

=

2

+

2 et 2 ;

+ ut

so that

xt =

Next, let

=

1

+

2:

[1

(

We call

1

+

2 )]

+

1 xt 1

+

2 xt 2

+ ut :

‘dominant root’. Then we have

xt = a + (

1

+

2 ) xt 1

= a + xt

1

2

= a + xt

1

2

2 xt 1

(xt

1

2 xt 2

+ ut

x t 2 ) + ut

1

xt

+

+ ut

One more:

xt

xt

1

= a+(

1) xt

xt = a + xt

1

+

1

1

xt

2

xt

1

+ ut

1

+ ut

In general, AR(p) model can be written as

(

P

a + pj=1 j xt j + ut

xt =

;

Pp

a + xt 1

j=1 j xt j + ut

or

xt = a + x t

1

Xp

j=1

37

j

xt

j

+ ut :

Lag Selection There are several lag selection methods. AIC, BIC, PIC, etc. Among

them, AIC overestimates the lag length. However the under-estimation probability with

AIC is almost zero. BIC estimates the lag length consistently, but the under-estimation

probability with BIC is not always zero.

So what? Suppose that xt follows AR2. But you estimate AR1. Then what happens?

xt = a + xt

1

xt = a + xt

1

xt

2

1

+ ut : True

+ et : estimated reg.

So that

et =

xt

2

1

+ ut :

Then ^ becomes inconsistent. In other words, even when T ! 1; ^ 9 : So using AIC is

rather promising in the …nite sample.

11.3

Moving Average (MA) Process

MA(1) process is given by

xt = ut

1

+ ut ;

+ ut ) ( ut

2

+ ut 1 ) =

so that

Ext xt

1

= E ( ut

1

2

Eut

1

=

2 2

u;

but

Ext xt

2

= E ( ut

1

+ ut ) ( ut

+ ut 2 ) = 0:

3

It is useful to explain the time series variable with limited autocorrelations.

Also note that AR(1) process can be convertable to MA(1) process.

xt =

xt

1

=

( xt

=

2

=

+ ut

( xt

2

2

+ ut 1 ) + u t =

2

+ ut

+ ut =

1

X

1

ut 1 + ::: + ut 1 + ut =

3

+ ut 2 ) + ut

xt

1

j=0

38

3

j

xt

1

+ ut

3

ut j :

+

2

ut

2

+ ::: + ut

11.4

Forecasting

AR(p) process is useful to forecast the future value.

x^T +1 = a

^ + ^ xT ;

x^T +2 = a

^ + ^x^T +1 ; :::

We call this method ‘iterative forecast’.

Alternatively, you can forecast xT +2 value by running the following regression.

xt = a + xt

x t = a2 +

1

+ ut : to forecast xT +1 ;

2 xt 2

+ vt : to forecast xT +2

x^T +2 = a

^ 2 + ^ 2 xT :

This method is called ‘direct forecast’.

If the model is well speci…ed, the iterative forecasting method is equivalent to the direct

forecasting method.

39

12

12.1

Unitroot

What is Unitroot?

Random walk model:

yt = yt

1

+ ut : random walk without a drift

yt = a + yt

1

+ ut : random walk with a drift

Consider a simple AR(1) model given by

yt =

so if

(1

) + yt

1

+ ut ;

= 1; then

yt = yt

1

+ ut :

Note that

yt = yt 1 + ut = (yt

t

X

=

us :

2

+ ut 1 ) + ut = u1 + ::: + ut

s=1

Hence yt includes all past and current shocks. Also the past shock never go away.

Random walk model with a drift: It has a linear trending behavior. Observe this.

yt = b + yt

1

+ ut = b + (b + yt

= 2b + yt 2 + ut + ut

t

X

= tb +

us :

1

Features of Unitroot

1. Mean ( ) is not identi…ed. No mean reversion.

)2 =

40

+ ut 1 ) + ut

= 2b + yt

s=1

2. Variance increasing over time. E(yt

2

2

u t:

2

+ ut + u t

1

12.2

Unitroot Test

If yt does not have a trend, then use

yt = a + y t

1+

p

X

j

yt

j

+ ut :

j=2

Test whether or not

= 0: If

= 0; yt follows R.W without a drift. If

< 0; yt is stationary.

Note that under the null of unitroot, the t-statistic has a D.F. distribution (not a standard

normal). The critical value of DF distribution is larger than a standard normal distribution

(in absolute value)

t^ !d D:F:

If yt has a trend, then use

yt = a + bt + yt

1

+

p

X

yt

j

j

+ ut :

j=2

The critical value of t^ is di¤erent. You have to use a smaller critical value. (See Eviews)

13

Vector Autoregressive Model (VAR)

Mutivariate time series analysis. Consider yt and xt together. VAR(1) can be written as

"

# "

# "

#"

# "

#

yt

a1

y

e

t

1

1t

11

12

=

+

+

:

xt

a2

xt 1

e2t

21

22

The …rst equation becomes

y t = a1 +

11 yt 1

+

x + e1t :

}

| 12 t {z1

=ut

In other words, ut is decomposed into xt

VAR(2) is given by

"

# "

# "

yt

a1

=

+

xt

a2

11

21

12

22

#"

1

and new error e1t :

yt

1

xt

1

#

+

"

11

21

12

22

#"

yt

2

xt

2

#

+

"

e1t

e2t

and so on. This VAR model has used popularly in various areas of Economics.

41

#

;

Economic Meaning: Granger Causality Consider a VAR(1) model again. Granger

(1980) proposed a new causality de…nition based on VAR system. If

“xt granger causes yt ”. If

If

21

21

6= 0; similarly yt granger causes xt : If

12

12

6= 0; then we say,

= 0; yt is exogeneous.

= 0; xt becomes exogeneous. Past information is given. So we may treat them as

predetermined values.

When

12

6= 0 : The past information of xt

1

in‡uences on the current behavior of yt :

6= 0 : The past information of yt

1

in‡uences on the current behavior of x:

Hence yt is endogeneous.

When

21

Hence xt is endogeneous.

13.1

Granger Causality Test

1. Use AIC or BIC to choose the lag length, p.

2. Run VAR(p) and test whether or not the lagged variables are signi…cant.

42

1

2

3

4

5

6

7

8

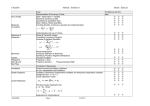

9

10

11

12

13

14

14

Alam, Ali Imran

Allen, Thomas A

Anderson, Mitch

Baird, Katherine

Burgoyne, Jason

Clounch, Brandon

Durden, Abigail

Goudeau, Nicholas

Khan, Humza

Liu, Hsien-Hui

Roberds, Kyle

Shukla, Sameer

Taylor, Evan

Woods, Britt

items

1 to 6

7 to 12

13 to 18

19 to 24

25 to 30

31 to 36

37 to 42

43 to 48

49 to 54

55 to 60

61 to 66

67 to 72

73 to 78

79 to 84

Exercise 4 (Due date: 10/09/15, 5 pm CST)

Q1: Determine the lag length of your data set by using AIC or BIC.

Q2: Run AR regression, and test whether or not ^ = 0. (dominant root)

Q3: Forcast the future in‡ation rates (up to 4 horizons) by using iterative and direct

methods.

Q4: Test unitroot for each variable.

Q5: Test Granger Causality among 6 variables.

43