* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Comparative Statics: Analysis of Individual Demand and Labor Supply

Survey

Document related concepts

Transcript

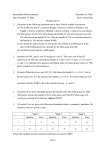

Comparative Statics: Analysis of Individual Demand and Labor Supply Chapter 4 Slides by Pamela L. Hall Western Washington University ©2005, Southwestern Introduction Rational households are never quite able to find local bliss Ever-changing prices and income require households to continuously adjust their commodity bundle Can study these changes by comparing one equilibrium position to another Comparative statics analysis Investigates a change in some parameters holding everything else constant • Called ceteris paribus With preferences held constant, individual indifference curves remain fixed Comparative statics is concerned with sensitivity of a solution to changes in parameters Will derive a household’s demand curve for each commodity 2 Introduction Will investigate a change in income, holding all prices constant Develop Engel curves and Engel’s Law associated with income changes Based on shapes (slopes) of demand and Engel curves Commodities are generally classified as normal, luxury, or inferior goods in terms of income change • Ordinary or Giffen goods for price change Discuss how Slutsky equation considers total effect of a price change as shown to be sum of substitution effect and income effect Illustrate theoretical possibility of a positively sloping demand curve • Giffen’s Paradox Discuss use of Slutsky equation to measure compensated price changes and Laspeyres Index to measure Consumer Price Index (CPI) Extend Slutsky equation to changes in price of another commodity Develop concepts of gross and net substitutes and gross and net complements 3 Chapter Objective To derive a household’s demand functions for commodities it purchases and its labor supply function Quantity demanded should generally decline as price of a commodity increases Demand should generally increase with a rise in income We investigate underlying determinants for this response of quantity demanded 4 Introduction Determinants of a household’s supply of labor given a rise in wages may result in supply increasing, declining, or remaining unchanged Can develop aggregate (market) demand and supply Market supply and demand functions will provide a foundation for investigating efficient allocation of society’s resources Applied economists estimate consumer demand and labor supply functions To determine how responsive consumers and labor are to changes in prices, wages, incomes, sales promotion, and various government programs Consumer demand is a very large area in economics Labor economics is also a large area Impacts of government welfare programs, working conditions, exploitation, and unions 5 Derived Household Demand With indifference curves representing preferences and budget lines as income constraints, Can derive a theoretical relationship between price and a person’s quantity demanded Consider case of a price change in one of two commodities x1 and x2 Budget line is I = p1 x 1 + p 2 x 2 • Where I, p1, and p2 represent income, per-unit price of commodity 1, and per-unit price of commodity 2, respectively Figure 4.1 is a graph of budget line With an x1-intercept of 5 units and an x2-intercept of 10 units 6 Figure 4.1 Derived demand for a decrease in p1 7 Derived Household Demand A household maximizes its utility for a given level of income At a point on budget line tangent with an indifference curve (commodity bundle A) Equilibrium bundle (at a given income level and prices) corresponds to one point on household’s demand curve (point a) Additional points on household’s demand curve for x1 are obtained By changing price of commodity x1 while holding income and price of x2 constant For example, decreasing price of x1 from 2 to 1 (p1 = 1) results in budget line tilting outward With this new price for p1, commodity bundle C represents new equilibrium level of utility maximization 8 Derived Household Demand Further changes in p1 will result in additional tangencies of a budget line With an indifference curve and a corresponding point on household’s demand curve Connecting points results in household’s demand curve for commodity x1 Each point on demand curve corresponds with a tangency point between indifference curve and budget line Household is maximizing utility for a given income level and market price of commodity x1 Illustrates how much of the commodity a household is willing and able to purchase at a given price As price of p1 declines household’s MRS(x2 for x1) declines How much it is willing to pay for an additional unit of x1 also declines A decline in price results in an increase in a household’s level of utility Household’s purchasing power has increased as a result of this price decline 9 Shift in Demand versus a Change in Quantity Demanded Convenient to graph x1 as a function of its own price With understanding that income and all other prices are being held constant As illustrated in Figure 4.1, assuming two commodities and considering a change in p1, then x1 = x1(p1|p2, I) Where p2 and I are being held constant By varying p1, price consumption curve traces out locus of tangencies Between budget line and indifference curve Negatively sloped demand curve can be derived from this price consumption curve Decrease in p1 will result in an increase in quantity demanded (a movement along demand curve) A change in p2 or I will shift demand curve 10 Shift in Demand versus A Change in Quantity Demanded Figure 4.2 illustrates difference in a change in quantity demanded versus a shift in demand At bundle A, a decrease in p2 results in a movement from bundle A to B Shifts demand curve • Shift depicted as a shift from point a on demand curve x1( p1| p2°, I) to point b on x1( p1| p'2,I ) A decrease in p1 at bundle A Results in a movement from bundle A to C • Causes a movement along demand curve x1( p1|p2°, I ) from point a to c Change in quantity demanded Change in either of the variables on axes causes a movement along a curve Whereas change in any factor not on one of the axes causes a shift in curve • For example, a change in income or preferences will shift a demand curve 11 Inverse Demand Curves Demand functions depicted in Figures 4.1 and 4.2 are sometimes called inverse demand functions Dependent variable is on vertical axis and independent variable is on horizontal axis Price as dependent variable states what level of quantity demanded for a commodity would have to be for household to be willing to pay this price per unit Inverse demand functions represent price as a function of quantity demanded As opposed to quantity demanded as a function of price 12 Figure 4.2 Shift in demand versus change in quantity demanded 13 Generalizing For K Commodities In general we can solve for optimal levels of x1*, x2*, … , xk* and * as functions of all parameters (prices and income) Quantities of x1, x2, … , xk demanded by the household will depend on Shape of utility function (consumer preferences) p1, p2, … , pk and I Demand functions state how much a household is willing and able to consume of a commodity at given prices and income Mathematically, demand functions are represented as 14 Homogeneous of Degree Zero Demand Functions In many developing countries price and income indexing occurs Due to high rates of inflation • For example, if inflation is running at 10% annually, incomes are automatically adjusted (indexed) upward by 10% Keeps households’ purchasing power the same Does not change their demands for commodities • Assuming no money illusion When all prices and income change proportionately, optimal quantities demanded would remain unchanged Slope and intercepts of budget constraint do not change • Illustrated in Figure 4.3 15 Figure 4.3 Homogeneity of demand functions 16 Homogeneous of Degree Zero Demand Functions Generally, if prices and income are multiplied by some positive constant a, same budget constraint remains Given no change in budget constraint from multiplying prices and income by > 0 Quantity demanded by a household will also not change • Called homogeneous of degree zero In this case, consumer demand functions are homogeneous of degree zero in all prices and income. Household demands are not affected by pure inflation 17 Numeraire Price Result of homogeneous of degree zero demand functions Can divide all prices and income by one of the prices Demand for a commodity depends on Price ratios (called relative prices) Ratio of money income to a price (called real income) Picking any price, say p1, and multiplying demand function by 1/p1 gives xj = xj(p1, p2,…, pk, I) = xj(1, p2/p1,…, pk/p1, I/p1) Where a is 1/p1 • Setting p1 = 1 Which is relative price to which all other prices and income are compared Called numeraire price 18 Changes in Income A college graduate’s income will generally substantially increase upon landing that first professional job Results in a change in purchasing power An increase in income results in an expected increase in purchases Represented by parallel shifts in budget lines Only I has changed, so price ratio remains constant Income consumption path, or income expansion path Curve intersecting all points where indifference curves are tangent with budget lines (locus of utility-maximizing bundles) Every point on path represents demanded bundle at that level of income 19 Engel Curves From income expansion path, can derive a function that relates income to demand for each commodity at constant prices Represented by Engel curves as illustrated in Figure 4.4 As income rises from I1 to I2 and then to I3 Demand for x1 increases from x11 to x12 and then to x13 Plotting this increased demand with rise in income yields an Engel curve Illustrate a relationship between demand for a commodity and income In Figure 4.4, Engel curve has a positive slope However Engel curves can have either positive or negative slopes • Positively sloped Engel curves are called normal goods An increase in income results in more of commodity being purchased 20 Figure 4.4 Income expansion path and Engel curve … 21 Homothetic Preferences If income expansion paths, and thus each Engel curve, are straight lines (linear) through origin Household will consume same proportion of each commodity at every level of income Assumes prices are held fixed Homothetic preferences Preferences resulting in consuming same proportion of commodities as income increases Commodities are scaled up and down in same proportion as income changes 22 Luxury and Necessary Goods Can further divide normal goods into luxury and necessary goods If income expansion path bends toward one commodity or the other Figure 4.5 illustrates income expansion path bending toward commodity x1 Making x1 a luxury good x1 is a luxury good if (x1/I)I/x1 > 1 As income increases, household spends proportionally more of its income on x1 • Examples: fine wines and silk suits Necessary good If, as income increases, household spends proportionally less of its income on a commodity • Examples are gasoline and textbooks 23 Figure 4.5 Income expansion path and Engel curve for a luxury good, x1 24 Luxury and Necessary Goods As household receives more income, it wishes to consume more of both types of commodities But proportionally more of luxury good than of necessary good For two-commodity case, if one commodity is a luxury good Other must be a necessary good 25 Inferior Goods Negatively sloped Engel curve is associated with a backward-bending income expansion path With an increase in income, a household actually wants to consume less of one of the commodities In Figure 4.6, as income increases Consumption of x1 declines • Called an inferior good and is defined as x1/I < 0 Examples include cheap wine and used books 26 Figure 4.6 Income expansion path and Engel curve for an inferior good x1 27 Engel’s Law Relationship between income and consumption of specific items has been studied since 18th century Engel was first to conduct such studies Developed generalization about consumer behavior • Proportion of total expenditure devoted to food declines as income rises Has been verified in numerous subsequent studies Engel’s Law appears to be such a consistent empirical finding that some economists have suggested proportion of income spent on food might be used as an indicator of poverty Families that spend more than say 40% of their income on food might be regarded as poor 28 Changes in Price If p1 is allowed to vary holding p2 and I fixed, budget line will tilt Illustrated in Figure 4.7 Locus of tangencies will sweep out a price consumption curve Curve connecting all tangencies between indifference curves and budget lines for alternative price levels 29 Figure 4.7 Price consumption curve and demand curve … 30 Ordinary Goods Price consumption curve for an ordinary good is illustrated in Figure 4.7 Where xj ÷ pj < 0 defines an ordinary good Demand curve derived from price consumption curve has a negative slope Indicates inverse relationship between a commodity’s own price and quantity consumed 31 Giffen Goods Slope of a demand curve could be positive xj ÷ pj > 0 • Defines a Giffen good Decrease in p1 results in a decrease in demand for x1 Shown in Figure 4.8 32 Figure 4.8 Price consumption curve for a Giffen good 33 Substitution and Income Effects Determinants of whether a commodity is ordinary good or Giffen good Depend on direction and magnitude of substitution and income effects Figure 4.9 shows effects for case of an own price change where p1 decreases Initial budget constraint I = p1x1 + p2x2 New budget constraint I = p‘1x1 + p2x2 • Where p'1 < p°1 Price decrease in p1 results in increased quantity demanded of x1 Shown in Figure 4.9 • Increase in quantity demanded is total effect of price decline Total effect = x1/p1 < 0 Can be decomposed into substitution and income effects 34 Figure 4.9 Substitution and income effects … 35 Substitution Effect In 2002, automobiles in Canada generally cost from 20% to 35% less than in US With fall of trade barriers and harmonizing of environmental and safety regulations Only major differences between new cars made for sale in Canada and those made for sale in U.S. • Speedometers and odometers 36 Substitution Effect U.S. automobile buyers attempt to substitute Canadian cars for U.S. ones Illustrates substitution effect (also called Hicksian substitution) • As an incentive for consumers to purchase more of a lower-priced commodity (Canadian cars) and less of a higher-priced commodity (U.S. cars) Given a change in price of one commodity relative to another To determine substitution effect Hold level of utility constant at initial utility level, U° • Consider price change for x1 If a household were to stay on same indifference curve • Consumption patterns would be allocated to equate MRS to new price ratio 37 Substitution Effect Represented in Figure 4.9 by a budget line parallel to new budget line But tangent to initial indifference curve • Point B, illustrates a household’s equilibrium for a level of utility U° with p1' as the price of x1 Bundle A represents consumer equilibrium for the same level of utility as bundle B Decrease in p1 results in consumer purchasing more of x1 and less of x2 with level of utility unchanged Movement from bundle A to bundle B is substitution effect 38 Compensated Law of Demand In Figure 4.9, Strict Convexity Axiom makes it impossible for a tangency point representing the new price ratio (bundle B) to occur left of bundle A If p1 decreases, implying p1/p2 decreasing • MRS also decreases Only way for MRS to decrease is for x1 to increase and x2 to decrease Thus, decreasing x1’s own price holding utility constant results in • Consumption of x1 increasing Own substitution effect is always negative Implying x1/p1|dU=0 < 0 Known as Compensated Law of Demand Where price and quantity always move in opposite directions for a constant level of utility 39 Income Effect In general, a change in the price of a commodity a household purchases changes purchasing power of household’s income Called income effect For example, an increase in price of prescription drugs decreases ability to purchase both drugs and food Decreased ability to purchase same level of commodities represents a decline in purchasing power • Has same effect as if household experienced a change in income A price decline has effect of increasing a household’s purchasing power or real income 40 Income Effect Figure 4.9 illustrates a price decline of p1 with utility remaining constant Results in an increase in real income or purchasing power Represented by a parallel outward shift in budget line associated with the new price Equilibrium tangency shifts from point B to C, which is the measurement of the income effect Mathematically, given the budget constraint I = p1x1 + p2x2 Change in income from a change in p1, holding consumption of commodities x1 and x2 constant, is • I/p1 = x1 Substitution effect will equal total effect if, given a decline in p1, income also falls by x1 • If income is not reduced, then this decline in p1 represents an increase in real income Specifically, a decline in p1 results in an increase in IR of x1 • I/p1 = -x1 Minus sign results from condition that a change in price and a change in real income move in opposite directions 41 Income Effect Change in real income depends on how much x1 a household is consuming If purchases of x1 are small, impact of a price change will be minor Partial derivative x1/I may be either positive (normal good) or negative (inferior good) Sign of income effect is indeterminate 42 Slutsky Equation Combining equations for substitution and income effects yields Called Slutsky equation • Mathematically defines substitution and income effects Sum is total effect of a price change Total effect is a movement from bundle A to bundle C or a movement along demand curve for a change in p1 (Figure 4.9) Substitution effect defines a change in slope of budget line Would motivate a household to choose bundle B if choices had been confined to those on original indifference curve Income effect defines movement from B to C resulting from a change in purchasing power p1 decreases • Implies an increase in real income 43 Slutsky Equation If x1 is a normal good, a household will demand more of it in response to increase in purchasing power Own substitution effect always holds x1/p1|U=constant < 0 Normal good results in a negative income and negative substitution effect Total effect is sum of these two negative effects, so it also is negative • x1/p1 < 0, an ordinary good Known as Law of Demand Demand for a commodity will always decrease when its price increases If demand increases with an increase in income 44 Slutsky Equation Figure 4.10 represents income and substitution effects for a price increase in commodity x1 Results in an inward tilt of budget line with a new equilibrium tangency point C Substitution effect represents price increase holding level of utility constant Bundle B is a tangency of a budget line, given new increase in price, with initial indifference curve Movement from bundle A to bundle B is substitution effect Increase in price of p1 results in a decrease in purchasing power or real income Income effect measuring this decrease in real income is represented by a parallel leftward shift in budget line • Income effect is negative and reinforces negative substitution effect Total effect is sum of substitution and income effect representing a movement from A to C 45 Figure 4.10 Substitution and income effects for an increase in p1 46 Slutsky Equation Not all commodities are normal goods Some commodities are inferior Rise in income will yield a decrease in their consumption Income effect is positive • Will partially or completely offset substitution effect If income effect does not completely offset negative substitution effect Total effect will still be negative 47 Slutsky Equation Figure 4.11 illustrates these effects for inferior and ordinary goods Movement from A to B is substitution effect Decline in price results in an increase in consumption of x1 holding utility constant Illustrates negative substitution effect Income effect, movement from B to C, partially offsets negative substitution effect If this positive income effect does not completely offset negative substitution effect, total effect is still negative • Results in an ordinary but inferior good 48 Figure 4.11 Substitution and income effects for an inferior and ordinary good, x1 49 Giffen’s Paradox If x1 is an inferior good Sign of total effect can be either positive or negative • Substitution effect is negative and income effect is positive Positive income effect can be large enough to produce result illustrated in Figure 4.12 Demand curve has a positive slope • Increase in price results in an increase in quantity demanded English applied economist Robert Giffen claims to have observed effect in 19th-century Ireland An increase in price of potatoes resulted in an increase in consumption of potatoes 50 Figure 4.12 Giffen’s paradox 51 Giffen’s Paradox Potatoes were a large part of total expenditure in 19th-century Ireland An increase in I would lead to an increase in meat and a decrease in potato consumption An increase in price of potatoes resulted in a decrease in real income with an associated decrease in meat and an increase in potato consumption • Shown in Figure 4.12 Own substitution effect is still negative An increase in p1 reduces consumption of x1, holding utility constant, from A to B Income effect is positive Commodity x1 is an inferior commodity Offsets negative substitution effect • If it completely offsets substitution effect, total effect is positive Defining a Giffen good 52 Giffen’s Paradox Size of income effect depends on proportion of income spent on commodity More of a household’s income spent on a commodity, the larger will be the income effect Generally, commodities associated with a large proportion of a household’s income are normal goods rather than inferior goods • Very rare to encounter a Giffen good 53 Summary of Ordinary, Normal, Inferior, and Giffen Goods Relationships among an ordinary good, a normal good, an inferior good, and a Giffen good are illustrated in Figure 4.13 for an increase in p1 Initially a household is consuming commodity bundle A Price increase in p1 results in negative own substitution effect Movement from A to B If x1 is a normal good, income effect will reinforce negative substitution effect Further decrease consumption of x1 54 Figure 4.13 Summary of ordinary, normal, inferior, and Giffen goods 55 Summary of Ordinary, Normal, Inferior, and Giffen Goods If x1 is an inferior good, income effect will partially or completely offset negative own substitution effect If income effect completely offsets negative own substitution effect, a Giffen good results A necessary condition for a Giffen good is an inferior good If income effect does not completely offset negative own substitution effect, an ordinary good results Price increase in x1 yields a decline in consumption of x1 Giffen good must be an inferior good Ordinary good could be either an inferior or a normal good 56 Compensated Price Changes In very cold winters, price per therm for natural gas usually rises as a result of increased demand Especially hard on poor, who spend a larger proportion of their income on heating Government programs provide direct income compensation to poor to offset higher heating costs To determine how much compensation is required, we rewrite the Slutsky equation as Substitution Effect = Total Effect – Income Effect x1/p1|U=constant = x1/p1 + (x1/I)x1 Diminishing MRS Axiom assures own substitution effect will always be negative Substitution effect, also called a compensated price effect, is sum of two components that are observed (revealed) in markets Indicates effect from a pure price change • Level of consumption is adjusted for any beneficial or adverse effects from a change in real income, so utility remains unchanged 57 Compensated Price Changes Income effect is removed from total effect, resulting in pure price effect As a result of higher price for natural gas, households’ real incomes have declined Reduces their satisfaction Compensating households for this loss in satisfaction by increasing their income results in compensated price effect Utility then returns to same level prior to price rise Compensated price effect is calculated from estimates of observed total effect and income effect 58 Hicks versus Slutsky Compensation Compensated price effect is called Hicks compensation Based on Pareto’s discussion of compensation • Holds utility constant Slutsky compensation is an alternative type of compensation • Instead of adjusting income to same level of utility prior to a price change Slutsky compensation adjusts income so a household can purchase original consumption bundle Keeps household’s purchasing power constant 59 Hicks versus Slutsky Compensation Figure 4.14 compares Hicks vs Slutsky compensation An increase in price of x1 results in Hicks compensation bundle B Budget line with new price ratio is tangent to original indifference curve Slutsky compensation adjusts income to where budget line intersects original commodity bundle (A) prior to price change Requires ability to just purchase this original bundle A Budget line cuts original indifference curve • By additional substitution a household can obtain bundle C Yields a higher level of utility than bundles A and B 60 Figure 4.14 Hicks and Slutsky compensation 61 Hicks versus Slutsky Compensation In the limit, as price change tends to zero, Hicks and Slutsky compensations are identical Will usually not matter which type of compensation is used • Provided price change is small Hicks compensation has desirable property for policy analysis Compensating a household to point where level of satisfaction is unaffected by a price change Such compensation is not directly revealed in market Slutsky compensation is revealed Can provide an approximation for Hicks compensation 62 Figure 4.15 Excise tax on gasoline with an income tax rebate 63 Laspeyres Index Used by United States and other countries to define Consumer Price Index (CPI) A Slutsky compensation index Computes change in quantity of commodities consumed using initial set of prices as weights CPI states, in percentage, amount of income required in current year to purchase same consumption bundle in some base year 64 Laspeyres Index Calculating CPI with Laspeyres index does not account for households adjusting to price changes by changing their consumption bundle Adjusting households’ income for any price increases with CPI may result in households increasing their utility Since Laspeyres index does not account for possibility of households substituting other commodities, it biases CPI upward For small relative price changes, bias should not be large • Given the good approximation of Slutsky compensation to Hicks compensation Congressional Budget Office estimates CPI has grown faster than cost of living by between 0.2 and 0.8 percentage points annually Has cost federal government $300 billion over past few decades • Social Security payments, civil service pensions, and earned income tax credits are all based on CPI 65 Changes in the Price of another Commodity When apples are harvested in the fall their price declines Likely to have an effect on amount of oranges a shopper purchases Can use Slutsky equation to express this change in x1 (oranges) when p2 (price of apples) changes x1/p2 = x1/p2|U=constant – (x1/I)x2 66 Changes in the Price of another Commodity Total effect = substitution effect + income effect Income effect represents x1/I times change in income as a result of changing p2 Sign of x1/p2|U=constant is generally indeterminate for three or more commodities In a two-commodity case, this cross substitution effect will be positive • Assuming diminishing MRS • When utility is held constant, a decrease in price of x2 will tend to cause purchases of x1 to decrease due to diminishing MRS Shown in Figure 4.16 67 Figure 4.16 Gross substitutes and complements 68 Changes in the Price of another Commodity Given strict convexity of indifference curves Impossible for this tangency to occur at the right of bundle A If p2 decreases, implying p1/p2 increasing, MRS also increases Only way for MRS to increase is for x1 to decrease and x2 to increase Decreasing p2, holding utility constant, results in decreasing consumption of x1 Cross substitution effect is always positive for a two-commodity case Implies x1/p2|dU=constant, given two commodities If x1 is a normal good, income effect is negative Total effect may be either positive or negative Depending on relative strengths of cross substitution and income effects 69 Substitutes and Complements Magnitude and signs of substitution and income effects will determine whether commodities are substitutes or complements Two commodities are substitutes if one commodity may, as a result of a price change, replace the other Examples are two brands of cola or gasoline Two commodities are complements if one commodity is consumed with another good Examples are pancakes and syrup, gasoline and automobiles 70 Substitutes and Complements Figure 4.16 illustrates gross substitute and gross complement relationship for a price decrease in x2 Because only two commodities are considered, for both cases, cross substitution effect is positive A decrease in price of x2 results in a decrease in consumption of x1 Income effect overwhelms positive cross substitution effect for gross complement case Two commodities are independent goods If a price change in one commodity does not affect consumption of another • Example: bottled water and laundry detergent 71 Substitutes and Complements Can use price consumption curve to determine whether commodities are gross substitutes or complements Negatively sloping price consumption curve indicates that commodity x2 is a gross substitute for x1 If price consumption curve has a positive slope a fall in price of x1 results in an increase in consumption of x2 x2 is a gross complement for x1 For independent goods Price consumption curve is horizontal for a change in price of x1 It is possible for xj to be a substitute for xi and at the same time for xi to be a complement of xj Presence of income effects can produce this paradoxical result 72