* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Stable

Survey

Document related concepts

Transcript

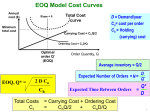

Dr. Ron Lembke Economic Order Quantity Assumptions Demand rate is known and constant No order lead time Shortages are not allowed Costs: S - setup cost per order H - holding cost per unit time EOQ Inventory Level Q* Optimal Order Quantity Decrease Due to Constant Demand Instantaneous Average Receipt of Optimal Inventory Q/2 Order Quantity Time Total Costs Average Inventory = Q/2 Annual Holding costs = H * Q/2 # Orders per year = D / Q Annual Ordering Costs = S * D/Q Annual Total Costs = Holding + Ordering Q D TC (Q) H * S * 2 Q How Much to Order? Total Cost Annual Cost = Holding + Ordering Ordering Cost = S * D/Q Holding Cost = H * Q/2 Optimal Q Order Quantity Optimal Quantity Total Costs = Q D H* S* 2 Q Take derivative with respect to Q = H D S* 2 0 2 Q Set equal to zero Solve for Q: H DS 2 2 Q 2 DS Q H 2 2 DS Q H EOQ Inventory Level Q* Reorder Point (R) Time Lead Time Adding Lead Time 2 DS Q H Order before inventory depleted Use same order size R dL Where: d = demand rate (per day) L = lead time (in days) both in same time period (wks, months, etc.) A Question: 2 DS Q H If the EOQ is based on so many horrible assumptions that are never really true, why is it the most commonly used ordering policy? Cost curve very flat around optimal Q, so a small change in Q means small increase in Total Costs If overestimate D by 10%, and S by 10%, and H by 20%, they pretty much cancel each other out Have to overestimate all in the wrong direction before Q affected Sensitivity Suppose we do not order optimal Q*, but order Q instead. Percentage profit loss given by: TC (Q) 1 Q * Q TC (Q*) 2 Q Q * Should order 100, order 150 (50% over): 0.5*(0.66 + 1.5) =1.08 an 8%cost increase Quantity Discounts- Price Break How does this all change if price changes depending on order size? Holding cost as function of cost: H=i*C Explicitly consider price: 2 DS Q i C Discount Example D = 10,000 S = $20 Price C = 5.00 4.50 3.90 Quantity Q < 500 500-999 Q >= 1000 Must Include Cost of Goods: 2 DS Q i C i = 20% EOQ 633 667 716 Q D TC (Q) iC S DC 2 Q Discount Pricing Total Cost Price 1 Price 2 Price 3 X 633 X 667 X 716 500 1,000 Order Size C=$5 C=$4.5 C=$3.9 Discount Example Order 667 at a time: Hold 667/2 * 4.50 * 0.2= $300.15 Order 10,000/667 * 20 = $299.85 Mat’l 10,000*4.50 = $45,000.00 45,600.00 Order 1,000 at a time: Hold 1,000/2 * 3.90 * 0.2= $390.00 Order 10,000/1,000 * 20 = $200.00 Mat’l 10,000*3.90 = $39,000.00 39,590.00 Discount Model 1. Compute EOQ for next cheapest price 2. Is EOQ feasible? (is EOQ in range?) If EOQ is too small, use lowest possible Q to get price. 3. Compute total cost for this quantity 4. Repeat until EOQ is feasible or too big. 5. Select quantity/price with lowest total cost. Summary Economic Order Quantity Perfectly balances ordering and holding costs Very robust, errors in input quantities have small impact on correctness of results Discount Model Start with EOQ calculations, using H= iC Compute EOQ for each price, Determine feasible quantity Compute Total Costs: Holding, Ordering, and Cost of Goods. Dr. Ron Lembke Random Demand Don’t know how many we will sell Sales will differ by period Average always remains the same Standard deviation remains constant How would our policies change? How would our order quantity change? EOQ balances ordering vs holding, and is unchanged How would our reorder point change? That’s a good question Constant Demand vs Random •Steady demand •Always buy Q •Reorder at R=dL •Sell dL during LT •Inv = Q after arrival •Random demand •Always buy Q •Reorder at R=dL + ? •Sell ? during LT •Inv = ? after arrival Inv Q R L Q Q Q R L Random Demand Reorder when on-hand inventory is equal to the amount you expect to sell during LT, plus an extra amount of safety stock Assume daily demand has a normal distribution If we want to satisfy all of the demand 95% of the time, how many standard deviations above the mean should the inventory level be? Just considers a probability of running out, not the number of units we’ll be short. Demand over the Lead Time R = Expected Demand over LT + Safety Stock R d L z L d = Average demand per day L = Lead Time in days L = st deviation of demand over Lead Time z from normal table, e.g. z.95 = 1.65 Random Example What should our reorder point be? Demand averages 50 units per day, L = 5 days Total demand over LT has standard deviation of 100 want to satisfy all demand 90% of the time To satisfy 90% of the demand, z = 1.28 R d L z L R 50 * 5 1.28 *100 R 250 128 378 Random Demand •Random demand •Always buy Q •Reorder at R=dL + SS Inv R •Sometimes use SS •Sometimes don’t •On average use 0 SS St Dev of Daily Demand What if we only know the average daily demand, and the standard deviation of daily demand? Lead time = 4 days, daily demand = 10, Daily demand has standard deviation = 5, What should our reorder point be, if z = 3? St Dev Over LT If the average each day is 10, and the lead time is 4 days, then the average demand over the lead time must be 40. d * L 10 * 4 40 What is the standard deviation of demand over the lead time? Std. Dev. ≠ 5 * 4 St Dev Over Lead Time We can add up variances, not standard deviations Standard deviation of demand over LT = L Ldays day 45 10 R d * L z L d * L z Ldays day Demand Per Day R d L z * L * D Or, same thing: L L * D R d L z L L = Lead time in days d = average demand per day D = st deviation of demand per day z from normal table, e.g. z.95 = 1.65 Random Demand Fixed Order Quantity Demand per day averages 40 with standard deviation 15, lead time is 5 days, service level of 90% L = 5 days d = 40 D = 15 z = 1.30, R d L z * L * D R 40 * 5 1.30 * 5 *15 R 200 43.6 243.6 Fixed-Time Period Model Place an order every, say, week. Time period is fixed, order quantity will vary Order enough so amount on hand plus on order gets up to a target amount Q = S – Inv Order “up to” policies S d L T z * L T * D Service Level Criteria Type I: specify probability that you do not run out during the lead time Chance that 100% of customers go home happy Type II: (Fill Rate) proportion of demands met from stock 100% chance that this many go home happy, on average Two Types of Service CycleDemand 1 180 2 75 3 235 4 140 5 180 6 200 7 150 8 90 9 160 10 40 Sum 1,450 Stock-Outs 0 0 45 0 0 10 0 0 0 0 55 Type I: 8 of 10 periods 80% service Type II: 1,395 / 1,450 = 96% Summary Fixed Order Quantity – always order same Random demand – reorder point needs to change Standard Deviation over the LT is given Standard Deviation per day is given Fixed Time Period Always order once a month, e.g. Amount on hand plus on order will add up to S Different service metrics