* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Presentation File

Survey

Document related concepts

Transcript

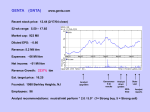

Executive Summary •Research Methods •S&P Reports •Site visits •Census report •Research Insight •Market Guide •Findings •Currently employing their best alternative Table of Contents Historical Performance New Marketing Strategy Concept Design Implementation Issues Expectations •Historical Performance New Marketing Strategy Concept Design Implementation Issues Expectations Home Improvement Market • Delivering value to customers –Low Price Sensitivity –Focus on • Specialized Know-How • Broader line of products • Greater depth of products Increase in Sales Sales Increase 30% 25% 20% 15% 10% 5% 0% -5% 5.7% -2.4% 1998 Home Depot 1999 Lowes Homebase % of Total Revenue Net Income 7% 6% 5% 4% 3% 2% 1% 0% 1997 Home Depot 1998 Lowes 1999 Homebase Operating Income % of Total Revenue 10% 8% 6% 4% 2.7% 2% 1.4% 0.3% 0% 1997 Lowes 1998 Home Depot 1999 Homebase % of Total Revenue Gross Profit Margin 30 25 20 15 10 5 0 Gross Profit SGA expense Home Depot Lowes Operating Income Home Base Sales per square foot $400 $384 in Dollars $300 $200 $279 $130 $100 $0 Home Base 1997 Home Depot 1998 1999 Lowes Revenue per Employee in Dollars (TTM) $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Home Depot Lowes HomeBase Industry Inventory Turnover Times (TTM) 6 5 4 3 2 1 0 Home Depot Lowes HomeBase Industry Alternatives •Closing HomeBase •Enter New Market Long-Term Leases • 65 Stores • Leases from 4 to 20 years with average of 13 • $530M noncancelable terms over one year In Millions (January 1998) $400 $300 PV $530M 340 Total Equity $395M $200 $100 $73 $0 2001 $72 $66 2002 2003 $64 2004 Operating Leases $62 2005 Thereafter Historical Performance •New Marketing Strategy Concept Design Implementation Issues Expectations Retail Industry 25 & Change 20 15 10 5 0 Specialty Department & Home Discount Improvement Sales (TTM) vs TTM 1 Yr. Ago Technology Retail Sales - 5 Yr. Growth Rate Specialty Retail • Home Furnishing – Large Market – Strong Growth – Low Entrance Barrier – Knowledge of the Market Home Furnishing Retail 35 % Change 30 25 20 15 10 5 0 Bed Bath & Beyond Linens & Things Sales (TTM) vs TTM 1 Yr. Ago Wlliams Sonoma Pier 1 Imports Sales - 5 Yr. Growth Rate Home Furnishing Market • Features – Highly Fragmented and Competitive – Strong Growth – Number of stores equals strength – Store size expanding – Importance of Women Home Furnishing Market • Key Local Factors – New housing growth in California of 13.7% vs. 7.4% in U.S. – Women’s population growth of 2.5% in California vs. 1.9% in the U.S. Historical Performance New Marketing Strategy •Concept Design Implementation Issues Expectations New Market Segment • Baby Boom – (35 to 52 years) – 70 Million • Women Buying Power Store Format • Broad but limited selection in each category – 10 Departments • High quality product/service – Designer brands Product Scope • Change product offering to home furnishing • Include outdoor home products – $33 Billion Product Mix Home Improvement Home Furnishing The Incredible Decorating Superstore Other Home Accessories Store Concept • Personalized Attention – 45% more store employees • Focus on Kids – Play Areas – Kid´s Products • Cafe Historical Performance New Marketing Strategy Concept Design •Implementation Issues Expectations % of Revenue . Test Stores 45 40 35 30 25 20 15 10 5 0 Bed Bath and Beyond Linens'n Things Gross Profit SGA WilliamSonoma, Inc House2Home Estimated Operating Income Sales per square foot $250 $214 $184 in Dollars $200 $166 $130 $150 $100 $50 $0 Bed Bath & Beyond Linens & Things House2Home HomeBase (Expected) Financial Analysis • Liquidity • Debt • Inventory management ratios Quick Ratio 0.35 0.34 0.3 0.25 0.22 0.2 0.2 0.13 0.15 0.11 0.1 0.05 0 House2Home Bed bath & Beyond Linens & Things Williams Sonoma Industry Current Ratio 2.5 2 1.5 1 0.5 0 House2Home Bed bath & Beyond Linens & Things Williams Sonoma Industry LT-Debt to Equity 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 House2Home Bed bath & Beyond Linens & Things Williams Sonoma Industry Other Issues • Hiring – Change from technical to service oriented – Fitting the service with the new target market Historical Performance New Marketing Strategy Concept Design Implementation Issues •Expectations Retail Industry • Key Factors – GDP Growth • Economy will slow with real GDP rising 2.5%, after 5.1% in 2000 – Disposable Personal Income • Estimated 5.3% in 2000, and • 5.1% in 2001 Beta 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 House2Home Bed bath & Beyond Linens & Things Williams Sonoma Industry Retail Industry 134 135 • Key Factors 130 (1985 = 100) – Consumer Confidence Index 128 125 120 114 115 110 105 100 November 00 December 00 January 01 Market Trends *$ Millions Company Bed Bath & Beyond Linens´n Things Williams Sonoma Revenue % Change SSS 1999* from 1998 % Change 1,878 34.4 9.2 1,300 22.0 6.4 1,384 25.4 6.4 Market Trends • Expected Rate of Growth of 10% for Home Furnishing Market Threats • Home Depot´s EXPO Centers • Competitor´s Expansion Rate • Ability to transform the organization toward service • Lack of support due to Analyst´s response to strategy We conclude that the strategy is an appropriate alternative to follow in this stage of life of HomeBase. The concept has a good format and has potential to become a growth driver. The Incredible Home Decorating Superstore Questions ? The Incredible Home Decorating Superstore