* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Macro_Module_30 deficits and debt

Survey

Document related concepts

Transcript

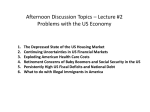

Module 30 Long-run Implications of Fiscal Policy: Deficits and the Public Debt KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson What you will learn in this Module: • Why governments calculate the cyclically adjusted budget balance • Why a large public debt may be a cause for concern • Why implicit liabilities of the government are also a cause for concern The Budget Balance • Deficits • Surpluses • Good? Bad? The Budget Balance as a Measure of Fiscal Policy •The Budget Balance is … •Savings by the government •Sgov = T – G – TR •T = value of tax revenues •G = government purchases of g/s •TR = value of government transfers •Budget Surplus = positive budget balance •Budget Deficit = negative budget balance The Budget Balance as a Measure of Fiscal Policy •How does this relate to fiscal policy? 1. Recessionary Gap 1. Expansionary Fiscal Policy 1. Cut taxes 2. Increase transfers 3. Increase government spending 2. AD increases and reverses the recession 1. Budget balance with decrease 1. Smaller surplus OR 2. Bigger deficit The Budget Balance as a Measure of Fiscal Policy •How does this relate to fiscal policy? 1. Inflationary Gap 1. Contractionary Fiscal Policy 1. Increase taxes 2. Decrease transfers 3. Decrease government spending 2. AD decreases and reverses the inflation 1. Budget balance will increase 1. Bigger surplus OR 2. Smaller deficit The Business Cycle and the Cyclically Adjusted Budget Balance 1. The Budget Deficit almost always … 1. Rises when U% rises 2. Falls when U% falls Is this due to changes in fiscal policy? Maybe, Maybe not! The Business Cycle and the Cyclically Adjusted Budget Balance 1. Automatic Stabilizers ( we talked about these before) 1. Heading into a recession ( budget balance happenings) 1. Tax revenue declines 1. Incomes and profits declining 2. Transfer Payments (like welfare) rise 1. Unemployment rises The Business Cycle and the Cyclically Adjusted Budget Balance 1. Automatic Stabilizers ( we talked about these before) 1. Heading into an inflationary period ( budget balance happenings) 1. Tax revenue rises 1. Incomes and profits rising 2. Transfer Payments (like welfare) fall 1. Unemployment decreasing The Business Cycle and the Cyclically Adjusted Budget Balance • Strong relationship between budget balance and business cycle The Business Cycle and the Cyclically Adjusted Budget Balance 1. We need a way to separate the two effects on the budget balance. 1. Effect One – impact due to changes in fiscal policy 2. Effect Two – impact due to current state of the business cycle The Business Cycle and the Cyclically Adjusted Budget Balance Cyclically Adjusted Budget Balance is … 1. An estimate of what the budget balance WOULD BE IF 1. No recessionary gap OR 2. Inflationary gap 2. CABB takes into account … 1. Extra tax revenue + transfer IF recessionary gap eliminated 2. Lost Revenue + extra transfers IF inflationary Gap eliminated Cyc The Business Cycle and the Cyclically Adjusted Budget Balance (Continued) Should the Budget Be Balanced? • Political motivation for running deficits or balancing the budget • Economists argue against balanced budget rule in favor of cyclically balanced budget • Limits on deficits as a compromise Deficits, Surpluses, and Debt When spending exceeds tax revenue, government borrows •National Debt = • accumulation of al past deficits – all past surpluses •Public Debt = government debt help by individuals and institutions outside the government Problems Posed by Rising Government Debt Two reasons to be concerned when a government runs persistent budget deficits 1. G borrows funds in financial markets 1. Competes with firm borrowing for investment 2. Crowding Out effect 3. Interest Rates Increase 4. Reducing economy long-run growth rate 2. Today’s deficits – increasing G debt 1. Financial pressure on future budgets 2. Interest paid in the future 3. $$$ goes here rather than 1. Education, military, space exploration, + others Problems Posed by Rising Government Debt How can a government pay off its debt? 1. Borrowing $$$$$ 1. Like getting a new credit card to pay off the old one. BANCKRUPTCY 2. Increase taxes or cut spending. POLICICALLY UNPOPULAR 3. Print Money FAST TRACK TO SERIOUS INFLATION Deficits and Debt in Practice •Debt-GDP Ratio = G debt as a % of GDP Implicit Liabilities Implicit Liabilities – spending promises made by the government (debt not included in the usual debt stats) Demographics – aging population = increase in • Social Security • Medicare • Medicaid