* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Economic democracy wikipedia , lookup

Nominal rigidity wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Participatory economics wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Transcript

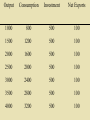

Chapter 8 Aggregate Demand 5/23/2017 © 2004 Claudia Garcia - Szekely 1 “Only suppliers can supply us with goods and services; the demand side can’t will a product or service into existence, no matter how hard it tries. Society therefore advances economically when it reduces tax and regulatory barriers to the creation of goods and services” Supply Side View 2 Old fashioned voodoo economics- the belief in tax cut magic- has been vanished from civilized discourse. The supplyside cult has shrunk to the point that it contains only cranks, charlatans and Republicans Paul Krugman New York Times 3 The Keynesian Model Developed within of the urgency to get the economy out of the Great Depression • Concern is finding a short term solution to unemployment • Concern is NOT inflation 4 The Keynesian Model Is a Short Run (Unemployment) model. Assumes that Aggregate Demand determines the level of production. Focuses on how variables that affect Aggregate Demand are interrelated. Develops tools for the government to manage the amount of spending in the economy 5 G Circular Flow Diagram to Interest Rent Profits Wages T S Rest of World G Households NX Firms C Goods and Services I=300 pay The Components of Aggregate Demand 8 National Income The sum of the incomes that all individuals in the economy earned in the forms of wages, interest, rents, and profits. – Excludes government transfer payments – Income before paying taxes 9 Disposable Income The sum of the incomes of all the individuals in the economy after all taxes have been deducted and all transfer payments have been added DI = GDP - Taxes + Transfers = Y - T 10 Time 11 Consumption Consumer Spending and Disposable Income Disposable Income 12 What determines the level of The effect of these As income components is Consumption? increases, Induced “bunched” together consumption increases Income Wealth Prices Expectations Real Interest Rate Add these two components component of C=bY consumption Autonomous Component C=a of consumption C = a + bY The Reaction of Consumption Spending to a Change in Income Real Consumer Spending 1900 1700 1500 1360 1300 MPC = 180/200=0.9 MPC = DC/DY This reaction is 1963 measured by the slope of the C function. B $180 billion 1180 A 1100 $200 900 0 1947 900 1100 billion 1300 1500 The slope is the Marginal Propensity to Consume MPC = DC/DY 1700 1900 Real Disposable Income 14 Copyright © 2006 South-Western/Thomson Learning. All rights reserved. When income drops, people use savings (their in income, own or borrowed) by 90 cents… MPC = 0.9 or 90% For each $1 increase consumption increases 90% of the increase in income will be consumed. For each $1 decrease in income, consumption decreases only by 90 cents… Only 90% of the decrease in income translates into a reduction in consumption. 15 The Consumption Function Autonomous Consumption: Value of Consumption when income is zero. Determines the height of the Consumption Function Induced Consumption: As income increase consumption increases. Income 0 100 150 200 250 300 350 400 450 Consumption ? 190 235 280 325 370 415 460 505 1. 2. 3. 4. 5. 6. 7. Calculate the MPC Calculate the Intercept Write down the formula for the Consumption function What is the value of Consumption when Income is 10,000 Calculate Savings At what value of Y is Consumption equal to Income? Write down the formula for the Savings function Disposable income Consumption 0 1000 2000 3000 1,400 2,200 4000 5000 6000 3,800 4,600 5,400 Saving The Consumption Function C=a+bY Value of C when Y is 0 MPC How Important is Consumption? Consumption is by far the largest component of aggregate demand. Expenditures in consumer goods are 70% of GDP. Understanding the determinants of consumption then, is critical. 19 Saving (S) We will assume that income not consumed is saved Y-C=S 20 Consumption (C) Mirror Saving (S) Recall: Y-C=S C=a+bY Value of C when Y = 0 C = a + (b x 0) C=a When Y = 0 S=Y–C S=0-a When income is zero, saving = - a Intercept of Saving Function is – a The Saving Function S S = -a + ? -a Intercept of Saving Function is – a 22 DS = DY – DC 20 = 200 - 180 Recall: S=Y-C C 3420 Causes a $180 Increase in C 3240 A $200 increase in income 3600 3800 The MPS= DS/DY = 20/200 = 0.1 or 10% 23 The Slope of the Savings Function: MPS Saving 380 360 Causes a $20 Increase in S A $200 increase in 3600 income 3800 The Marginal Propensity to Save Is the proportion of an increase in income that is used to increase saving.. Is the proportion of an decrease in income by which saving decrease Is a percentage or a number between o and 1. 25 MPS = 1 - MPC If the MPC = 90%, you will consume 90% of any increase in income… If you consume 90% of any increase in income, you save the rest: 10% MPC + MPS = 100% MPC = 0.9 then MPS = 0.1 MPC + MPS = 1 26 The Saving Function S = -a + (1- b) Y 1 – MPC Value of Saving when Y(Income) is 0 27 1. 2. 3. 4. 5. 6. 7. Calculate the MPC Calculate the Intercept Write down the formula for the Consumption function What is the value of Consumption when Income is 10,000 Calculate Savings: S = Y - C Write down the formula for the Savings function At what value of Y is Consumption equal to Income? Disposable income Consumption 0 1000 2000 3000 1,400 2,200 4000 5000 6000 3,800 4,600 5,400 Saving 1. 2. 3. 4. 5. 6. 7. Calculate the MPC =800 /100 Calculate the Intercept = 600 Write down the formula for the Consumption function = 600 +0.8 Y What is the value of Consumption when Income is 10,000 = 600 + 0.8*10,000 Calculate Savings At what value of Y is Consumption equal to Income? At 3,000 Write down the formula for the Savings function = -600 + 0.2Y Disposable income Consumption Saving 0 1000 2000 3000 600 1,400 2,200 -600 -400 -200 0 4000 5000 6000 3,800 4,600 5,400 200 400 600 30 Events that cause a movement along the Consumption Function Changes in incomes ONLY! 5/23/2017 © 2004 Claudia Garcia - Szekely 31 Factors that shift the consumption function 1. Changes in wealth Example: value of stocks, bonds, consumer durables, homes. When stock prices go down, consumer wealth decreases in value. Consumers feel poorer and slow down purchases A downward shift in the Consumption Line 32 Factors that shift the consumption function 1. Changes in wealth When stock prices go UP, consumer wealth increases in value. Consumers feel richer and increase purchases An upward shift in the Consumption Line Factors that shift the consumption function 2. Changes in consumer expectation: Pessimistic expectations about future: employment, incomes, wealth. Consumers slow down purchases A downward shift in the Consumption Line 34 Factors that shift the consumption function 2. Changes in consumer expectation: Optimistic expectations about future: employment, incomes, wealth. Consumers increase purchases An upward shift in the Consumption Line 35 Factors that shift the consumption function 3. Prices When overall prices rise (an increase in the CPI) consumer’s wealth lose buying power. This drop in the purchasing power of saved dollars make consumers feel poorer and they slow down purchases. A downward shift in the Consumption Line 36 Factors that shift the consumption function 3. Prices When overall prices fall (a decrease in the CPI) consumer’s wealth gains buying power. This increase in the purchasing power of saved dollars make consumers feel richer and they increase purchases. An upward shift in the Consumption Line Factors that shift the consumption function Interest Rates Changes in wealth are NOT in the list! value of stocks, bonds, consumer durables, homes. Changes in consumer expectations Pessimistic expectations decrease autonomous consumption. Prices Shift Consumption line Affect the purchasing power of assets. Statistical studies: interest rates have no effect on Consumption We will assume that changes in interest rates do not shift C 39 Investment The acquisition of capital goods 40 Investment Includes… Residential Construction – consumer purchases of new houses and condominiums. Non-residential construction – Equipment, software, buildings, tools, etc. Changes in Inventories: unsold goods are included as investment. 41 Investment Includes… Residential Construction – consumer purchases of new houses and condominiums. Higher interest rates reduce home purchases. 42 Investment Includes… Non-residential construction Equipment, software, tools, etc. 43 Determinants of Investment Interest Rates: – Business borrow to finance investment. As interest rates drop, more investment projects become profitable and investment increases. Tax Incentives: – If directly tied to capital formation will increase investment. Technical Change: – New technology creates a boom in investment as firms rush to adopt the new technology (Microchip) – New technologies open new business opportunities: Firms build new factories, stores, offices and equipment to take advantage of these opportunities (Internet Cafes) Expectations about the strength of demand: – high sustained level of sales and expectations of growing economy boost investment Political Stability and the rule of law: – Business cannot be conducted without a guarantee that property rights and laws will be respected. (News communist take over will negatively affect investment) 44 Investment Also Includes Inventories Inventories are of two kinds: – Planned (desired) inventories. • Firms build up inventories to be able to fulfill future orders. – Unplanned (unwanted) inventories. • Firms end up with unsold inventories because sales decreased unexpectedly. 45 Investment Firms control how much to spend in Investment goods Firms control how much they want to hold in inventories Firms control Planned Investment 46 Investment Spending Investment does not change with current income Total PLANNED Expenditures on Capital goods and desired inventories Investment Income / GDP 47 Investment Firms have NO control over how much ends up as inventories. These changes in inventories depend on actual demand: – If demand dropped below what firms expected, inventories rise – If demand was as expected, inventories do not change – If demand increases from expected inventories fall. Firms DO NOT control Actual Investment 48 Expenditures by federal, state and local governments. – Include final, intermediate and capital goods purchased by the government. – Exclude transfer payments (social security, unemployment benefits, etc) Government expenditures are determined by the budget process: The president, Congress and the Senate. Government expenditures are not a function of current income. 49 Government Spending Government Spending does not change with current income Total PLANNED Expenditures by all levels of government as dictated by the budget G Income / GDP Have two components: 1. Exports: Sales of US goods to other countries. Incomes abroad: as other countries grow, they increase purchases of U.S. goods. Relative prices: if prices in U.S. rise faster than prices abroad, U.S. goods become relatively more expensive for foreigners and purchases of U.S. goods drop. Exchange rates (see discussion next). Have two components: 2. Imports: Purchases of foreign goods by Americans. Incomes in the US: As the U.S. economy grows Americans purchase more goods from abroad. Relative prices: as prices in the U.S. fall relative to prices abroad, Americans find foreign goods cheaper and purchase more from abroad. Exchange rates (See discussion below). National Incomes: – When US incomes rise, imports increase and vice versa. GDP of other countries: – When GDP abroad increases, US exports rise as foreigners buy more American goods. Relative Prices: – When prices in the US rise, American goods become more expensive and exports drop as foreigners buy fewer American goods. – When prices in the US rise, foreign goods become cheaper and imports increase as Americans more foreign goods. Exchange Rates Net exports Net Exports do not change with current income NX Income / GDP 54 Weaker dollar One Dollar buys less DM’s 1DM U$1 0.5 DM U.S. Prices are lower to Germans U.S. Exports increase when the 55 dollar becomes weaker. Weaker dollar One DM buys more Dollars 1U$ 1DM 2 U$ Foreign Prices are higher to Americans U.S. Imports decrease when the dollar becomes weaker. 56 Stronger dollar One Dollar buys more DM’s 1DM U$1 2 DM U.S. Prices are higher to Foreigners U.S. Exports decrease when the dollar becomes stronger. 57 Stronger dollar One DM buys less Dollars 1U$ 1DM 0.5 U$ Foreign Prices are lower to Americans U.S. Imports increase when the dollar becomes stronger. 58 The Effect of Changes in Exchange Rates More on Strong Dollar 5/23/2017 © 2004 Claudia Garcia - Szekely 59 Questions to Prepare for Quiz 1. Determine the effect on Aggregate Demand. Identify the component of AD which is affected (C, I, G, X or M) and explain how it is affected. a) Prices in the US Increase (decrease) relative to prices abroad. b) The U.S. dollar becomes weaker (stronger) c) Home prices collapse (increase) d) Stock prices collapse (increase) e) Interest rates Increase (decrease) f) A zero-emissions engine is developed. g) Government announces an Increase (decrease) in the number of troops deployed abroad. h) As the economy recovers (enters into a recession) incomes increase (drop). 60 2. Use the table in the next slide to answer the following: a) Calculate the MPC and the intercept of the consumption line. b) Write the consumption function: C = intercept (a) + slope (MPC)* Y c) If Income is 5700 what is the value of consumption? How much is saved? d) If autonomous consumption increases by 300 what is the new consumption function? Does this increase represent a shift? Or a Movement along the Consumption line? Does this increase imply an increase or a decrease in saving? Output Consumption Investment Net Exports 1000 800 500 100 1500 1200 500 100 2000 1600 500 100 2500 2000 500 100 3000 2400 500 100 3500 2800 500 100 4000 3200 500 100 C = 100+0.9Y 22,600 17,200 9,100 4,600 5,000 10,000 19,000 25,000 63 I =1,000 G = 500 NX = 300 I+G+NX 1,800 5,000 10,000 19,000 25,000 64 AE = 100 + 0.9Y +1,800 AE = 1,900 + 0.9 Y 22,600 +1,800 = 24,400 17,200 +1,800= 19,000 9,100 +1,800 = 10,900 4,600 +1,800= 6,400 5,000 10,000 19,000 25,000 65 Sold AE = 100 + 0.9Y +1,800 AE = 1,900 + 0.9 Y Produced 5,000 Produced 10,000 Produced Produced 25,000 19,000 Sold 6,400 Sold10,900 Sold Sold19,000 24,400 Inventories fall Inventories fall Inventories Inventories do rise not change Firms increase Production Firms Production Firmsincrease decrease do not change Production Production 24,400 19,000 10,900 6,400 Produced 5,000 10,000 19,000 25,000