* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download AAE/IS 373 Class 4 Economic growth

Nouriel Roubini wikipedia , lookup

Balance of payments wikipedia , lookup

Global financial system wikipedia , lookup

Fear of floating wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Economic growth wikipedia , lookup

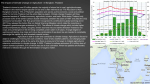

6a. SE Asian boom and bust 1986-99 0 Overview Global economic shocks and national responses, 1973-85 Global trade boom and Asian FDI Thailand’s manufacturing export boom Structure of production and the labor force Discussion: vulnerability? 1 Four defining events First oil price shock (1973-5). Recycling of “petrodollars” in global markets --> cheap credit for developing countries. Second oil price shock 1979-80. Global recession; high real interest rates on new and existing debt Global commodity price slump mid-1980s. Export revenues collapse for resource-dependent economies. Debt servicing crises and recessions (1985). Collapse of inwardoriented strategies. Plaza Accord 1985. Recovery in US and world economies (-> boom in global manuf. trade) and “hollowing-out” of Japanese economy (--> SE Asian FDI boom) 2 After the oil shocks: recession and recovery After 1973 oil price shock, period of “cheap and easy capital” for developing country borrowers Very low (or negative world real interest rates encouraged borrowing to maintain growth momentum After 1979 shock, world recession with high real int. rates Commodity price crash accompanied interest rate hike Gov’ts which accommodated these negative shocks through credit creation experienced high inflation or hyper-inflation “Lost decade” (1980s) for heavily indebted econs, e.g. Lat. Am Other gov’ts chose earlier adjustment, with lower growth but greater stability of prices and macro aggregates (debt, etc) Mid-1980s: recession everywhere, but varying severity E/SE Asian economies showed generally high growth 3 4 5 Governments vs markets in 1970s-80s During period of ‘cheap and easy credit’, many gov’ts attempted large- scale industization via public projects Philippines, “11 major industrial projects” (all failed) Indonesia: Pertamina (national oil company) borrowing spree for development, mid-1970s (ended in bankruptcy & default) Malaysia, HICOM heavy & chemical industry initiative 1982-85 (expensive flop) Malaysia,1982 attempt to corner world tin market (disaster) Speed with which K-intensive ‘showcase’ projects were abandoned helped determine adjustment and recovery Divergence once again: Philippines adjusts slowly, falls behind neighbors in growth 6 Elements of SE Asian adjustment & recovery Fiscal conservatism: low deficits, low public sector debt Thus relatively low inflation in most of SE Asia Gov’t debt used more for investment than for consumption Price and exchange rate stability Political aversion to high inflation in Indonesia, Thailand, … Conservative fiscal policies underpinned exch. rate stability ‘Fixed but adjustable’ exch. rate pegs Relatively friendly investment climate Few fears of nationalization/expropriation Exch. rate stability helped guarantee returns to FDI Outward-oriented industries promised sustained returns on K 7 Price stability 8 Stabilization efforts 9 The global trade and investment boom Global trade liberalization, lower transport costs, more open capital markets from mid-1980s 1985: World oil prices collapse to mid-1970s levels Recovery and boom in West; world trade grows by much more than income More open economies poised to capture gains Major realignment of JP Yen-US $ (Plaza Accord), Sept. 1985 Japanese manufacturers seek offshore bases SE Asian economies are close, relatively open, politically & economically stable, with cheap and ‘docile’ labor forces 10 11 Thailand’s policy shift, and its reward Since 1960s, strongly ISI-oriented 1971 ERPs ranged from -20 to 236 1982 ERPs ranged from -21 to 1693 Trade liberalization begins mid-1980s 1988 reform reduced tariffs and tariff dispersion on many products More reforms in 1990s Macro stability: Baht/US$ exch rate = 25 from 1984 to 1997 Openness & stability attracts FDI and domestic investment: ΔGDP = 8.60 + 1.43*L + 0.3*K – 0.15*FDI + 0.62*OPEN*FDI (data for 1970-99; source Kohpaiboon 2002) - Strong support for Bhagwati hypothesis 12 Foreign investment... and domestic too GFCF: Gross fixed capital formation (i.e. new investment before depreciation) 13 Turning Japanese Cumulative FDI ($m) FDI From Indonesia Malaysia Philippines Thailand To 1976 Japan USA 2,044 1,000 255 108 134 175 75 30 To 1980 Japan USA 3,372 575 226 80 299 752 77 28 To 1983 Japan USA 7,268 764 721 521 To 1993 Japan USA 13,366 4,585 1,904 5,476 Bowie and Unger Table 2.1 14 Effects of the investment boom Transformation of agricultural to industrial economy See earlier data on GDP shares by sector Thailand emerges as leading regional exporter in key product areas, e.g. motorcycles, automobiles These are primary areas of investment by E. Asian capital-complementary with the post-Plaza Accord “hollowing-out” Effects on total growth: Thailand Real GDP per capita growth, 1951-86 average: 3.9% 1987-96 average: 8.0% 15 16 17 Economy-wide impacts 18 Economy-wide impacts 19 Thailand: welfare effects of the boom Year 1969 1975 1981 1986 1988 1992 1994 1996 1998 2001 Source: Warr 2005 Poverty (%) Total Rural Urban 63.1 69.6 53.7 Inequality (Gini) 0.43 48.6 35.5 44.9 57.2 43.1 56.3 25.8 15.5 12.1 0.43 0.43 0.48 32.6 23.2 16.3 40.3 29.7 21.2 12.6 6.6 4.8 0.48 0.52 0.54 11.4 12.9 13.0 14.9 17.2 16.6 3.0 3.4 5.1 0.52 0.52 0.52 20 Consequences of post-Plaza growth Comparative advantage and EOI mean: Potential for sustained growth by exporting into world mkt Increasing integration with global capital markets Gains: rapid, labor-intensive growth Immediate impacts on wages, employment, poverty Costs Inequality? Rising returns to skilled L relative to unskilled L; pressure to maintain competitive labor costs Greater vulnerability to shocks from international economy Limits on domestic policies Foreign capital owners “vote” on domestic policy choices 21 Break time! 22 Overview Thailand’s boom Macroeconomics of a boom Sources of vulnerability: Thailand and Indonesia 24 Boom, bubble and bust Boom: “E. Asian Miracle” in early 1990s: Thailand, Singapore, Malaysia, Indonesia grow at record rates Based on rising exports of low-end manufactures Financed largely by foreign fixed capital investments Bubble: overoptimism about continued growth; speculative booms in property, construction, stocks Financed increasingly by short-term borrowing from foreign banks Bust: loss of export competitiveness, financial crisis Chinese competition; labor costs; human capital constraints Inability to earn enough to service foreign debts Recession and recovery: slow for some; permanent reduction in growth rate? 25 Thailand’s boom and bubble economy Double-digit growth 1989-91, concentrated in Bangkok Non-ag GDP growth rate 2–3 times faster than ag. See labor force transition data (class 14) Sources of rapid growth? Not TFP Total factor productivity (TFP) growth is supposed to be the biggest contributor to long-run growth (Solow; Radelet et al) But pre-boom growth in ‘new tiger’ economies due to factor accumulation, not productivity increases (Krugman: “Myth of Asia’s Miracle”, 1994) In Thailand. apparently large ‘Solow residual’ during boom years But: underinvestment in education TFP was due to foreign K inflows (Warr, “Boom, bubble, bust”) 26 Thailand’s boom and bubble economy A key point: domestic and foreign capital are not perfect substitutes in Thailand One consequence: FDI raises the productivity of domestic capital, stimulating dom. investment Another consequence: limited success of demand-constraining ‘sterilization’ attempts by central bank Mundell-Fleming: sale of bonds to raise interest rates, with fixed exch. rate and open capital account, stimulates short-term K inflow that drives int. rates down again; reserves rise but no domestic effects When dom. & for. K are imperfect substitutes, rate rise can persist, attracting additional foreign K inflows Foreign reserves will increase, raising investor confidence Inflows will also contribute to growth in dom. demand, and thus cause a real appreciation (rise in relative prices of nontraded goods) 27 Opening the capital account Hospitable environment for FDI Stable price level and baht-dollar exchange rate since 1984 Capital account liberalization 1993: Bangkok Int’l Banking Facility (BIBF) created to facilitate foreign borrowing for domestic investment Fixed exch. rate and Bank of Thailand guarantees on solvency of financial institutions reduce risks of borrowing by private sector Result: boom in K inflows, with short-term debt dominating Changing contributions (%) to total savings: Foreign investment Period H’holds Gov’t Total Long term Total Shor t term 1973-86 112.9 –16.7 3.8 5.1 2.1 100 1987-96 93.1 –11.4 18.2 4.1 22.8 100 28 Source: Warr 2005: Boom, bust and beyond. Note: discrepancy = decline in reserves Capital inflows and reserves BIBF 29 The confidence game Price and policy stability Interest rates above world benchmark Rising foreign reserves following liberalization “Implicit guarantee” of exch rate stability “East Asian Miracle” tag… future rapid growth seems assured “Investing in Thailand seemed both safe and profitable. Not to participate was to miss out.” (Warr, p.640) Result: accelerating capital inflows, increasingly in form of int’l borrowing by Thai banks to satisfy demand by domestic borrowers 30 Composition of short-term capital stocks BIBF Banks’ loan stock 31 Real appreciation Increasing demand for non-traded services and assets (housing, offices) fuels speculative investments The crane becomes Thailand’s national bird: construction sector employment increases from 6% – 10% of labor force btwn 1985 and 1995. Debt-fueled speculation in stock market, property development, and other non-tradable activities Extent of real appreciation: RER index = 100 in 1973; =70 in 1988, = 40 in 1997. Real appreciation also undermines profitability of traded goods industries They pay more for non-traded inputs, compete with speculative investors for capital 32 Wage growth = cost increases for L-intensive sectors 33 Signs of vulnerability Rising domestic inflation (see: real appreciation) In mid-90s, Thai inflation rose to 5-6%; US inflation fell to about 2% Indicators of excess supply in speculative mkts (property etc) Declining profitability and export revenues in ‘boom’ industries Implicit bank failures (actual failures prevented by official interventions) Non-objective appraisals of the above by regulators (Bank of Thailand “blustering” -- Siamwalla) 34 Loss of competitiveness in L-intensive inds As wages rose, exports from the most labor-intensive industries shrank fastest 35 When the anchor drags Foreign reserves of BoT: 36 Why does investor sentiment change, and why so quickly? Private sector failures: e.g. Bangkok Bank of Commerce 1994-96: Evidence of malpractice & politically motivated lending 1996: Run on BBC; BoT supports it with $US 7 billion injection Numerous other “failures” through 1996-97, all bailed out by BoT Government failure: democratization reduced influence of military and technocrats (fiscally conservative forces) Local money politics, esp. in provinces, busts national budget Reluctance to cut spending projects even as banking system began to collapse Politically-connected banks & companies receive GOT protection Institutional failure: decline of the technocrats In BOT, loss of independence and competence, esp. as private sector outbid public sector salaries for well-trained economists 37 Income growth forgone Thailand: Level and growth rate of GDP per capita 10000 15 9000 10 8000 7000 5 6000 0 5000 4000 -5 GDP per capita, PPP (current international $) GDP per capita growth (annual %) 3000 2000 -10 Source: WDI 20 02 20 01 20 00 19 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 19 89 -15 19 88 1000 38 Indonesia: a healthy economy? Indonesia’s economy seemed in good shape prior to 1997 Currency stable against US $; current account deficit relatively small and stable Open capital account since 1971 Financial liberalization since 1988 Budget broadly balanced; inflation low and stable Wages and other business costs fairly stable; no big export slowdowns in 1995-96 Speculative activity in property markets, but “bubble” small Signs of economic vulnerability -- pre crisis Bank collapses (1993) underline inst’l weaknesses in private sector Short-term debt very high in relation to international reserves; big private capital inflows raise short-term debt to about twice the value of international reserves 39 Constitutional weaknesses “Year of Living Dangerously” (1965): hyperinflation, civil war (1966): aversion to instability Under Suharto (1967-99), economic policy made under guidance of “technocrats” -- until 1993 After 1993, influence passed to “technologs” associated with Dr. Habibie (Minister for Science & Technology) Habibie: “you can’t build ships by selling fish”. Major industrial projects (aircraft, biotech, ship-building… ) launched. Decline of technocrats coincided with period of rapid capital inflows with liberalized capital market Pinnacle of power No institutional checks on presidency, or safeguards against failure Concentration of econ. power, poor governance (“KKN”) 40 Vulnerability: who/what to blame? Stiglitz, Globalization and its Discontents, p. 99: “I believe that capital account liberalization was the single most important factor leading to the crisis” in Asia … … It has become increasingly clear that all too often capital account liberalization represents risk without a reward… Probably no country could have withstood the sudden change in investor sentiment… inevitably, such reversals would precipitate a crisis, a recession, or worse. 41 Vulnerability: who/what to blame? Siamwalla, “Can a developing country manage its macroeconomy?” “Although the root cause for the crisis lies in excessive borrowing by the private sector, its effect has been multiplied by misguided policies, especially those emanating from the Bank of Thailand. “Since failure of technocracy could in principle be corrected by political leadership, it has to be explained why the Thai political system failed to deliver that leadership.” 42