* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Argentina Crisis

Survey

Document related concepts

Transcript

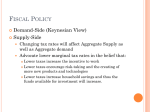

Argentina Crisis Econ 462 Presented by: Anthony Sierra Rossina Torres Li Xu Agenda Causes of the crisis: Rossina During the crisis: Li Post-Crisis: Anthony Political Instability 1989 – 1999: Carlos Menem - President 1999: Fernando De La Rua - President 2000: Vice-President Carlos Alvarez – Resigns Dec 20, 2001: Fernando De La Rua – Resigns Dec 21, 2001: Ramon Puerta – President Dec 23, 2001: Adolfo Rodriguez – President Dec 31, 2001: Eduardo Duhalde - President Currency Board - Convertibility Law 5 *Collapse of the currency board arrangement 4 Peso/$ = 1.00 January 17, 2002 3 2 1 0 1995 1996 1997 1998 1999 2000 2001 2002 Unemployment Real GDP Inflation Contagion Effect Tequila Crisis 1995 Asian Crisis 1997 Russia 1998 Brazil 1999 Fun Facts! Difference between wages and salaries paid by the federal government and the private sector. Powerful labor unions Inflexible wages and prices Real GDP Inflation Unemployment Weak Export Growth Mounting debt What went wrong? Factors? Lack of fiscal discipline Labor market inflexibility External environment and shocks Convertibility plan / Currency board Unsustainable debt Overvalued Peso The Scope of the Crisis Real GDP Unemployment Inflation Cash basis Public debts Real GDP 15 10 5 0 Real GDP 1990 -5 -10 -15 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Unemployment Rate 25 20 15 Unemployment 10 5 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 BANK: Problem faced Convertibility regime to “Pesoization” People seeking Private rather than public Monthly deposit withdrawal limit was to $250 pesos, (raised to $1500 in 2002) Dollar deposits would remain frozen until at least 2003 Congress also approved an emergency law that severely curtailed creditors’ rights Private over Public The government decrees the unification of the exchange rate regime and the asymmetric pesoization of bank balance sheets (assets at Arg$1/US$1, and liabilities at Arg$1.4/US$1). “pesoization” The existing stock of banks’ dollar-denominated assets and liabilities would be converted at the rate of Arg$1=US$1 for loans to the private sector and Arg$1.4=US$1 for loans to the public sector U.S. dollar deposits, which were also indexed to inflation. The measure was intended to protect firms and households with foreign-currency denominated debt, but it merely shifted the burden of the devaluation to the banking system—and ultimately to the taxpayer as banks would need to be issued compensation bonds.40 The main effect of the measure was to deepen financial disintermediation, curtailing the supply of fresh credit— including working capital—that banks were able to provide, and that would be critical in any eventual recovery. Response of Policy Maker to the Crisis Government was able to borrow amply both domestically and internationally The monetary policy was tighten After the Tequila Crisis (1995) Resulted : Y Put a direct constraint on Fiscal Policy To maintain the peg Dollarization Fiscal deterioration in 1999 Reduce over public deficit => IR Response of Policy Makers to the Crisis Revamped program Convergence factor Debt swap Zero Cash Deficit Lead to “pull the plug” Actions to fight the crisis Fiscal responsibility law Zero Deficit Law Deposit freeze Devaluation Fiscal policy The Role of the IMF Fiscal Responsibility Law September 1999 the Argentine Congress passed the Fiscal Responsibility Law, aiming to large reductions in federal and provincial government spending. Zero Deficit Law Zero-deficit law was implemented in an attempt to restore market confidence, attract foreign capital and ultimately get the Argentinean market back on track. Deposit Freeze In late 2001 the government set a number of financial restrictions to stop the massive run on the banks and to avoid a collapse of the whole banking system. Devaluation January 2002 the government was forced to announce the end of convertibility regime and the currency devaluation. The peso was first devalued by 29 percent from 1 to 1.4 pesos per US dollar for major foreign commercial transactions and then was allowed to float thereby quickly peaking to over 4 pesos per dollar Fiscal Policy The government announced an economic program that among other things included increases in the personal income and wealth taxes, a bill to strengthen tax enforcement, and a cut in non-interest expenditures. Debt Restructuring The Role of the IMF