* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter Thirty One

Nouriel Roubini wikipedia , lookup

Monetary policy wikipedia , lookup

Balance of payments wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Business cycle wikipedia , lookup

Great Recession in Russia wikipedia , lookup

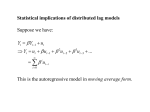

Non-monetary economy wikipedia , lookup

Chapter Thirty One Deficit Reduction, Fed Behavior, Stabilization, Stock Market Effects, and Macro Issues Abroad Gramm-Rudman-Hollings Bill A bill passed by the U.S. Congress and signed by President Reagan in 1986, this law set out to reduce the deficit by $36 billion per year, with a deficit of zero slated for 1991. Automatic Stabilizers Automatic stabilizers are those revenues and expenditure items in the federal budget that automatically change with the economy in such a way as to stabilize GDP. Deficit Targeting as an Automatic Destabilizer Positive boost to demand reduces the shock Negative Demand Shock Income Falls (automatic stabilizers) Tax revenues drop; transfers increase a. Without Deficit Targeting Deficit Increases Deficit Targeting as an Automatic Destabilizer b. With Deficit Targeting Negative Demand Shock Income Falls Second negative demand shock reinforces first shock and worsens the contraction (automatic destabilizers) Tax revenues drop; transfers increase Deficit Increases Tax rates raised or spending cut to reach deficit target Fed’s Response to Low Output/Low Inflation Price Level, P AS AD0 AD1 P1 P0 Y0 Y1 Aggregate Output, Y Fed’s Response to High Output/High Inflation Price Level, P AD0 AS AD1 P0 P1 Y1 Y0 Aggregate Output, Y Stabilization Policy Stabilization policy describes both monetary and fiscal policy, the goals of which are to smooth the fluctuations in output and employment and to keep prices as stable as possible. Two paths for GDP... B A Path A is less stable-it varies more over timethan path B. Time Lags in Stabilization Policies Time lags: Delays in the economy’s response to stabilization policies. Recognition lag Implementation lag Response lag Recognition Lag The recognition lag refers to the time it takes for policy makers to recognize the existence of a boom or a slump. Implementation Lag The implementation lag refers to the time it takes to put the desired policy into effect once economists and policy makers recognize that the economy is in a boom or a slump. Response Lag The response lag refers to the time that it takes for the economy to adjust to the new conditions after a new policy is implemented; the lag that occurs because of the operation of the economy itself. Two Major Recent Adjustments of the Stock Market to Economic Conditions The Crash of October 1987 The Stock Market Boom of 1995-1997 Review Terms & Concepts Automatic destabilizer Negative demand Automatic stabilizer shock Recognition lag Response lag Stabilization policy Time lag Deficit response index (DRI) Gramm-RudmanHollings Bill Implementation lag