* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Fiscal Policy - Mr. Catalano

Economic growth wikipedia , lookup

Economics of fascism wikipedia , lookup

Pensions crisis wikipedia , lookup

Economic democracy wikipedia , lookup

Business cycle wikipedia , lookup

Production for use wikipedia , lookup

Non-monetary economy wikipedia , lookup

Long Depression wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Participatory economics wikipedia , lookup

Economic calculation problem wikipedia , lookup

Transformation in economics wikipedia , lookup

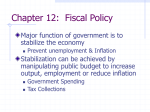

Fiscal Policy: Understanding Uncle Sam’s Tool Box How can policymakers influence the economy? FISCAL POLICY: The use of taxation and government spending to control the economy!!! Consider this situation: • Output (GDP) is down • Many people are getting laid off from their jobs • People have less discretionary income, so aggregate demand (spending) is down • Businesses continue to suffer and are forced to lay off more and more workers WHAT SHOULD THE GOVERNMENT DO? Encourage Economic Growth! Increase aggregate demand!!! Prices will rise Suppliers will want to produce more People will get hired back to their jobs People will feel comfortable spending money again The economy will expand We call this… EXPANSIONARY FISCAL POLICY Tool #1: Tool #2: INCREASE GOVERNMENT SPENDING CUT TAXES Government buys more goods & services Companies that sell goods to the government earn profits, which they use to pay their workers more & hire new workers When tax rates go down, individuals have more money to spend and businesses keep more of their profits Workers have more money & spend more in shops & restaurants Consumers now have more money to spend on goods and services Shops & restaurants buy more goods and hire more workers to meet their needs Businesses now have more money to spend on land, labor and capital These actions will increase demand, prices, and output In the short term, government spending leads to more jobs and more output Now, consider this situation: • Fast-growing demand is exceeding supply • Producers who cannot increase output levels are forced to increase their prices • Inflation occurs, cutting into consumers’ purchasing power & discouraging economic growth and stability WHAT SHOULD THE GOVERNMENT DO? Slow Down Economic Growth! Decrease demand!!! Keep prices low Suppliers will cut production/lay off workers Lower production will slow the rate of growth of the economy Inflation will not occur GDP may even decline We call this… CONTRACTIONARY FISCAL POLICY Tool #1: Tool #2: DECREASE GOVERNMENT SPENDING INCREASE TAXES Government buys less goods & services There is a decrease in aggregate demand because the government is buying less than before Individuals have less money to spend on goods & service, or to save for the future Businesses keep less of their profits and decrease their spending on land, labor, and capital As demand decreases, prices fall Suppliers produce less & possibly fire workers Lower production slows down the rate of growth of the economy Prices of goods and services drop Suppliers produce less & possibly fire workers Lower production slows down the rate of growth of the economy QUIZ: 1. What type of fiscal policy should be enacted when we are in an economic recession? EXPANSIONARY! (Increase Government Spending or Cut Taxes) 2. What type of fiscal policy should be enacted when high inflation is a problem? CONTRACTIONARY! (Decrease Government Spending or Increase Taxes) Multiplier Effects: Government interventions trigger a “domino” effect