* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download A complete competitive full-information general equilibrium is efficient

Welfare capitalism wikipedia , lookup

Non-monetary economy wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Production for use wikipedia , lookup

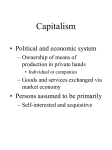

Participatory economics wikipedia , lookup

State capitalism wikipedia , lookup

Social market economy wikipedia , lookup

Economic democracy wikipedia , lookup

Market socialism wikipedia , lookup

Economic calculation problem wikipedia , lookup

History of capitalism wikipedia , lookup

Perspectives on capitalism by school of thought wikipedia , lookup

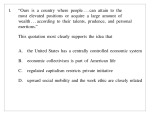

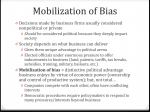

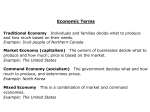

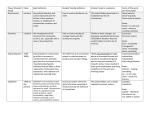

Overview of Comparative Economics Chapter II Market Capitalism 1 Market Capitalism Form of Ownership → Most of the time land and produced means of production (capital stock) are owned by private individuals or private firms Role of Planning → Market capitalism is usually planned by the market (with demand and supply) Material Incentives → In market capitalism material incentives exist in forms of rewards for entrepreneurship and capital investment as economic profits 2 Market Capitalism Income Redistribution → is usually done through social safety nets in market capitalism Role of politics and ideology → Are market capitalist countries mostly democratic? Social democrat parties exist in market capitalist countries supporting income redistribution, extensive social safety nets, nationalization and central planning 3 Why Market Capitalism Popular? End of communism → most former communist countries are concentrating on market capitalist economic systems Predominantly market capitalist economies are making efforts to move toward a purer version of this system 4 Advantages and Disadvantages of Market Capitalist Economies Experienced enormous technological advances and growth as they underwent the Industrial Revolution in the late 18th century “ability to revolutionize the means of production” Experienced large macroeconomic fluctuations with serious downturns in the 19th century (unequal distribution of income and increasing concentrations of industrial monopoly power) 5 Pure Version of Market Capitalist System Pure version of market capitalist system does not exist Closest to the ideal of pure laissez-faire market capitalism are: Hong Kong Singapore New Zealand 6 Efficiency Static efficiency → no one in society can be made better off without making someone else worse off resources are being utilized to their best potential given the existing technology Dynamic efficiency → allocation of resources over time to maximize long-run sustainable growth technological dynamism destabilizing process of “creative destruction” 7 Theoretical Efficiency of Market Capitalism Efficiency Theorem The general ability of markets to allocate goods and resources efficiently through the law of supply and demand A complete competitive full-information general equilibrium is efficient 8 Theoretical Efficiency of Market Capitalism Complete For any good or service that affects someone’s utility, there is a market Competition There are many buyers and sellers with free entry and exit There are well-defined homogenous goods and services No individual supplier has any control over the price in his or her market 9 Theoretical Efficiency of Market Capitalism Full information All agents in the economy know everything about consumer preferences, production technologies and prices General equilibrium Every single market is in equilibrium in the sense that the quantity supplied equals the quantity demanded of the good or service If that does not happen: Surplus Shortage Partial equilibrium with a few markets being in equilibrium 10 Theoretical Efficiency of Market Capitalism Efficiency Pareto optimality → no one in the economy can be made better off without making someone else worse off If someone can be made better off without making someone else worse off, then the economy is not producing as much as possible of what people want 11 Why is a complete, competitive, full-information, general equilibrium efficient? Adam Smith’s invocation of invisible hand of the market working across all sectors to allocate goods in a way that maximizes the “wealth of the nations” He founded classic laissez faire economics He argued that the government should get out of the economy (minimal government intervention) It is at the equilibrium price that the maximum amount will be both produced and sold and thus actually consumed by public 12 Invisible Hand In the free marketplace an “invisible hand” regulates and self-corrects the economy The market itself will regulate the economy Efficient producers will prosper and the inefficient producers will lose The public will get the best product for the lowest price Supply and demand will determine prices better than any government official can 13 Limits to The Efficiency of Laissez-Faire Market Capitalism Monopoly Power Externalities Collective Consumption Goods Imperfect Information 14 Source of Inefficiency: Monopoly Power Monopoly power prohibits competition Monopolist will maximize profits by setting marginal cost equal to marginal revenue Exceptions: Natural monopoly Characterizing an industry with economies of scale (declining LRAC) even at level of output equal to total market demand Technological dynamism More competitive industries will be more technologically progressive 15 Source of Inefficiency: Monopoly Power Intermediate market forms Monopolistic competition Many firms, each having some price setting power as a result of product differentiation Excess capacity theorem Oligopoly Small number of firms in industry with reaction to any action taken by others Perfect collusion Joint-maximizing cartel (OPEC in oil crisis) Longest surviving cartel? 16 Source of Inefficiency: Externalities These are either costs or benefits that are born by or accrue to an agent other than the agent generating them External costs negative externalities External benefits positive externalities 17 Source of Inefficiency: Externalities External costs are negative externalities, such as environmental pollution If the firm that generates pollution damages another industry but does not reduce that damage → the private marginal cost to the firm does not equal the social marginal cost and too much pollution is produced, resulting in inefficiency 18 Source of Inefficiency: Externalities External benefits are positive externalities, such as technological invention without patent protection for inventors If an inventor has no patent protection, then other firms can steal her invention and she may make no money even if her invention generates great social benefits Private marginal benefit to the inventor does not equal marginal social benefit of the invention and too little inventing will occur, resulting in inefficiency 19 Source of Inefficiency: Collective Consumption Goods Consumption goods = public goods → such as national defense Because of the nature of such goods, it is difficult for private markets to organize themselves to provide these goods in optimal quantities The characteristics of pure public good: Non-excludability of consumption: It is not possible to exclude this kind of consumption Non-depletability of consumption: Everyone consumes it simultaneously, and no individual’s consumption reduces any other individual’s consumption Free-rider problem 20 Source of Inefficiency: Imperfect Information Unrealistic to have perfect information When one party in a transaction knows more than another, special problems arise causing asymmetric information Akerlof “The market for Lemons” Principal agent problem Sub-optimizing behavior 21 The Role of Labor Unions Redistribute income to their members Deal with safety, job security, benefits, social functions and lobbying politically for broader social outcomes Offset the monopolistic power of big firms 22 Macroeconomic Instability of Market Capitalism The General picture The major market capitalist economies have been less than perfectly stable over time There was a general increase in unemployment rates after the early 1970s in many countries, associated with a general stagnation of economic growth, that appears to have been reduced recently The considerable variation in capital investment can be explained by factors Exogenous fluctuations in new technologies that can serve as the basis for the investment Fluctuations in government monetary policies affecting interest rates Psychological fluctuations due to the “animal spirits” of those making investments 23 Macroeconomic Instability of Market Capitalism QUESTION Why do these variables lead to fluctuations in the unemployment rate, since in a perfectly labor market, wage rates should fall when the demand for labor falls, thereby preventing the emergence of any involuntary unemployment? TWO DIFFERENT ANSWERS Keynesian School Classical School 24 Macroeconomic Instability of Market Capitalism Keynesian School Rigidities of various sorts exist in labor markets and that capital investment can collapse and stay down for extended periods of time, as in the Great Depression The implication is that government intervention through fiscal or monetary policies is advisable to stimulate the economy and to stabilize and smooth out business cycles 25 Macroeconomic Instability of Market Capitalism The Classical School Deriving from 19th century classical political economists such as David Ricardo Market capitalist economies are powerfully selfstabilizing Conscious government intervention merely generates inflation and intensifies fluctuations To minimize unemployment, unions should be broken up and a stable fiscal and monetary environment should be maintained within a laissez-faire environment 26 Laissez-faire Economic Policies Shift toward supporting more laissez-faire economic policies There is a tension between asserting the efficiency of competitive equilibria and recognizing the limits of the applicability of that theorem Chicago School’s (Milton Friedman) argument draws directly from the efficiency theorem and follows by asserting the irrelevance or unimportance of the various exceptions and limits 27 Chicago School Markets are almost always efficient, so government should keep its hands off The most externalities will be resolved by private markets if property rights are properly defined and enforced “free market” Many of the goods provided by the public sector are not really collective consumption goods and could be more efficiently provided privately Information costs are inevitable and cannot be avoided The Chicago School supports the Classical School approach in macroeconomics Friedman is the most prominent advocate of monetarism in the US With respect to distribution of income, people should be allowed to keep what they earn from the free market Inequalities are the necessary outcome of providing sufficient incentives for production, investment and growth 28 Public Choice Theory “Criticism of government intervention” The government agencies designated to carry out the market-correcting activities are self-interested agencies that became captured by special interests operating through their legislative connections Anne Krueger “rent-seeking” 29 Austrian School They reject equilibrium analysis and emphasize dynamic market processes Entrepreneurs are the most important agents in the economy They must be allowed to function freely, without government restriction, so that they can lead the market to evolve in conjunction with the evolution of consumer preferences through process of innovation Static efficiency is relatively unimportant It is the dynamic success of market capitalism that is its most important economic feature 30